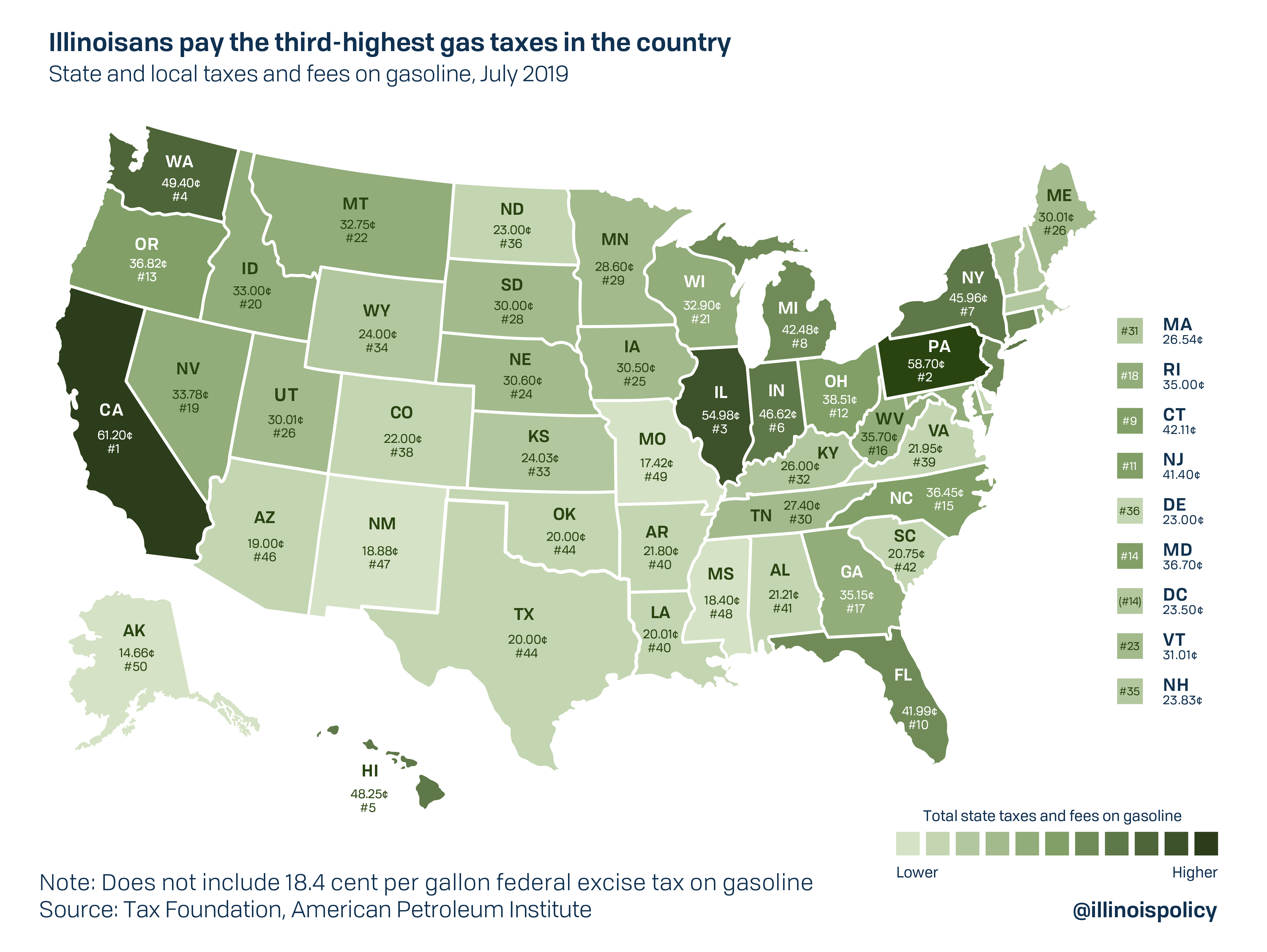

Gas tax hike moves Illinois’ pain at the pump to No. 3 in U.S.

Data from the American Petroleum Institute confirms doubling Illinois’ motor fuel tax will bring total taxes paid at the pump to third highest in the nation, up from 10th highest a year earlier.

On June 28, Gov. J.B. Pritzker signed into law a $45 billion infrastructure plan financed by numerous tax and fee hikes. One of the largest increases was doubling Illinois’ motor fuel tax from 19 cents to 38 cents per gallon, which is expected to take as much as $1.3 billion more from taxpayers per year.

Data from the American Petroleum Institute, or API, confirms predictions that the increase will bring Illinois’ total state and local tax burden on gasoline purchases to the third highest in the nation, up from 10th highest one year earlier. California’s total gas tax burden per gallon is 6.22 cents higher than the Prairie State’s and Pennsylvania’s is 3.72 cents higher.

The tax hike means the average Illinois driver pays $100 more per year, according to an Illinois Policy Institute analysis.

Proponents of raising Illinois’ gas tax made repeated use of misleading claims that implied Illinois’ motor fuel tax was too low prior to lawmakers voting for the increase. For example, a draft capital plan from the Pritzker administration claimed “Illinois currently has one of the lowest motor fuel taxes in the nation.” While it is true that the motor fuel excise tax had not been increased since 1990, this is just one on a long list of taxes and fees Illinois residents pay when purchasing gasoline.

When all taxes and fees are included, the effective tax rate on gasoline is nearly 42%.

Illinois is one of just seven states that levies a general sales tax on gasoline, on top of a motor fuel tax. As of July 1, the sales tax added about 15 cents per gallon to total taxes paid at the pump. Because sales tax is percentage based, Illinois gas taxes are variable, meaning tax collections increase proportionately with economic growth and changes in the wholesale price of gasoline. Drivers also pay underground storage and environmental fees of a little over a penny per gallon along with various local sales and excise taxes on gasoline that vary by locality but add to the statewide average as reported by API.

The law signed by Pritzker has other features that could drive Illinois gas taxes higher over time, potentially moving the Prairie State up even higher in the rankings.

First, the law allows Chicago to increase its motor fuel tax by 3 cents per gallon and each of the collar counties to levy a motor fuel tax of up to 8 cents per gallon. DuPage, Kane and McHenry counties currently charge drivers 4 cents per gallon, meaning their rates could double. Lake and Will counties currently do not have a county-level motor fuel tax but now have the ability to add 8 cents per gallon. With nearly two-thirds of the state’s population residing in those six counties, further gas tax hikes by their county governments could well push up Illinois’ national ranking.

Second, the law provides for automatic increases through “inflation indexing” of up to 1 cent per year, which lawmakers do not have to vote on and thus cannot be held accountable for in the future. Based on expected rates of inflation, automatic increases could drive up Illinois’ motor fuel tax to 43.5 cents per gallon by 2025.

While doubling the motor fuel tax and other tax hikes were sold by the Pritzker administration as “necessary” to repair “crumbling roads and bridges,” an Illinois Policy Institute analysis found at least $1.4 billion of waste and pork spending in the enacted plan. Some of the questionable projects include funding for pickleball courts, swimming pools, and vague grants to be handed out by politicians and well-connected insiders.

To ensure a good return on investment for future infrastructure spending and guard against waste, lawmakers should establish a data-driven project selection process similar to the cost benefit analysis required by state law in Virginia. Overburdened taxpayers should also demand an end to automatic state gas tax increases before they begin. As long as Springfield is set to receive more transportation revenue automatically with no legislative action, lawmakers will lack any meaningful incentive to find ways to be more efficient with existing funds.

Springfield’s refusal to reform infrastructure spending or respect taxpayers with a no-tax-hike capital plan could also impact Pritzker’s push to scrap the constitutional flat tax protection and replace it with a progressive income tax, which charges higher rates the higher the income. Already, vehicle registration fee hikes and the gas tax increase will raise taxes on the average Illinois family by $300 per year, more than wiping out any promised progressive income tax relief for the poor and middle class.

Given that nearly half of Illinois voters already view the progressive income tax amendment as a “blank check” for state lawmakers, and 74% of Illinois residents were opposed to any tax or fee increase to pay for infrastructure, doubling the gas tax and misusing capital spending may just add to the already long list of reasons voters may give the amendment a very cool reception in November 2020.