How Trump’s tax proposals would affect Illinois

The corporate tax reforms under President Donald Trump’s proposed tax plan could strengthen Illinois’ position as a home for businesses, but the state’s uncompetitive income, property and death tax policies would put its residents at an even greater disadvantage with respect to other states if the president’s plan passes.

President Donald Trump unveiled his tax reform plan on April 26, laying out general principles that largely mirror the tax plan on which he campaigned. The Trump proposals, if enacted, would have a deep impact on the Illinois economy and on Illinois’ relative competitiveness.

Some parts of the proposal would be unambiguously good for Illinois, and in particular for the greater Chicago area. Other proposals would force Illinois into more significant tax competition with other states, and reveal how uncompetitive Illinois’ tax system is relative to states such as neighboring Indiana. Finally, one proposal in particular, though it is sound tax policy, could have an ugly effect on Illinois’ housing market.

Below is a summary of the good, the bad and the ugly from Trump’s tax policy, along with steps Illinois can take to keep its head above water as changes come from the federal government.

The good

Trump’s proposed corporate tax cuts would undoubtedly enhance the Chicago area’s ability to attract global headquarters and high-paying corporate jobs.

Chicago is already well-positioned as the unofficial capital of the Midwest, and as an international transportation hub with cultural diversity, world-class universities and a busy downtown business district with entertainment attractions.

Trump’s tax proposals would benefit Illinois by fixing two major problems in the U.S. corporate tax code, thereby enhancing Illinois’ attractiveness for corporate investments and relocations:

- The U.S. corporate tax rate would be cut to 15 percent from 35 percent, moving America from the highest corporate tax rate of all Organization for Economic Cooperation and Development countries to the second-lowest, behind only Ireland.

- The U.S. would stop double-taxing the overseas profits of U.S.-based corporations by changing from an international to a territorial tax system. This reform is something of a no-brainer in tax policy and would finally put U.S. tax policy in line with almost every other developed country in the world. Both of these changes would make the U.S. more attractive for corporate investments, and should disproportionately benefit Illinois and Chicago because the Chicago area is a global hub for corporate headquarters and so stands to benefit more than other areas of the Midwest. Illinois would also benefit as the trillions of dollars in profits held overseas by U.S. corporations would flow back into the U.S., and into Illinois.There are 36 Fortune 500 companies with headquarters in Illinois, significantly more than what’s proportionate to Illinois’ population, showing that Illinois would likely be one of the winners as American corporations became more competitive and brought money home. If the number of headquarters were proportionate to the state’s population, Illinois would have just 20 headquarters.

If Trump’s plan attracts corporate investment, which is likely, Illinois should be a winner relative to other s and other countries.

- Trump’s general plan of simplifying the federal rate structure, reducing deductions and loopholes, cutting tax rates and reversing the rising tide of taxes on capital would improve overall economic growth, increase wages and boost job creation according to an analysis by the Tax Foundation. Illinois, like all states, would benefit from enhanced growth.

The bad (for Illinois)

Trump’s tax plan would improve America’s overall economic competitiveness.

It would also put states into more direct competition with each other by increasing the “felt cost” of high state and local taxes. Illinois’ relatively high taxes and financial weakness would undercut the attractiveness of the state, especially with the prospect of still more taxes on the way.

Trump’s plan would remove the federal deductibility of state and local taxes, which would mean that tax filers in high-tax states could no longer deduct their high state and local taxes from their federal income tax returns. Trump would also end the federal death tax, making states like Illinois stick out like a sore thumb for retaining a death tax.

These federal changes would expose how bad Illinois’ tax system has become relative to competitive states such as Indiana, Florida, Texas and Tennessee.

Illinois would be forced to either get its house in order, or watch more people leave the state.

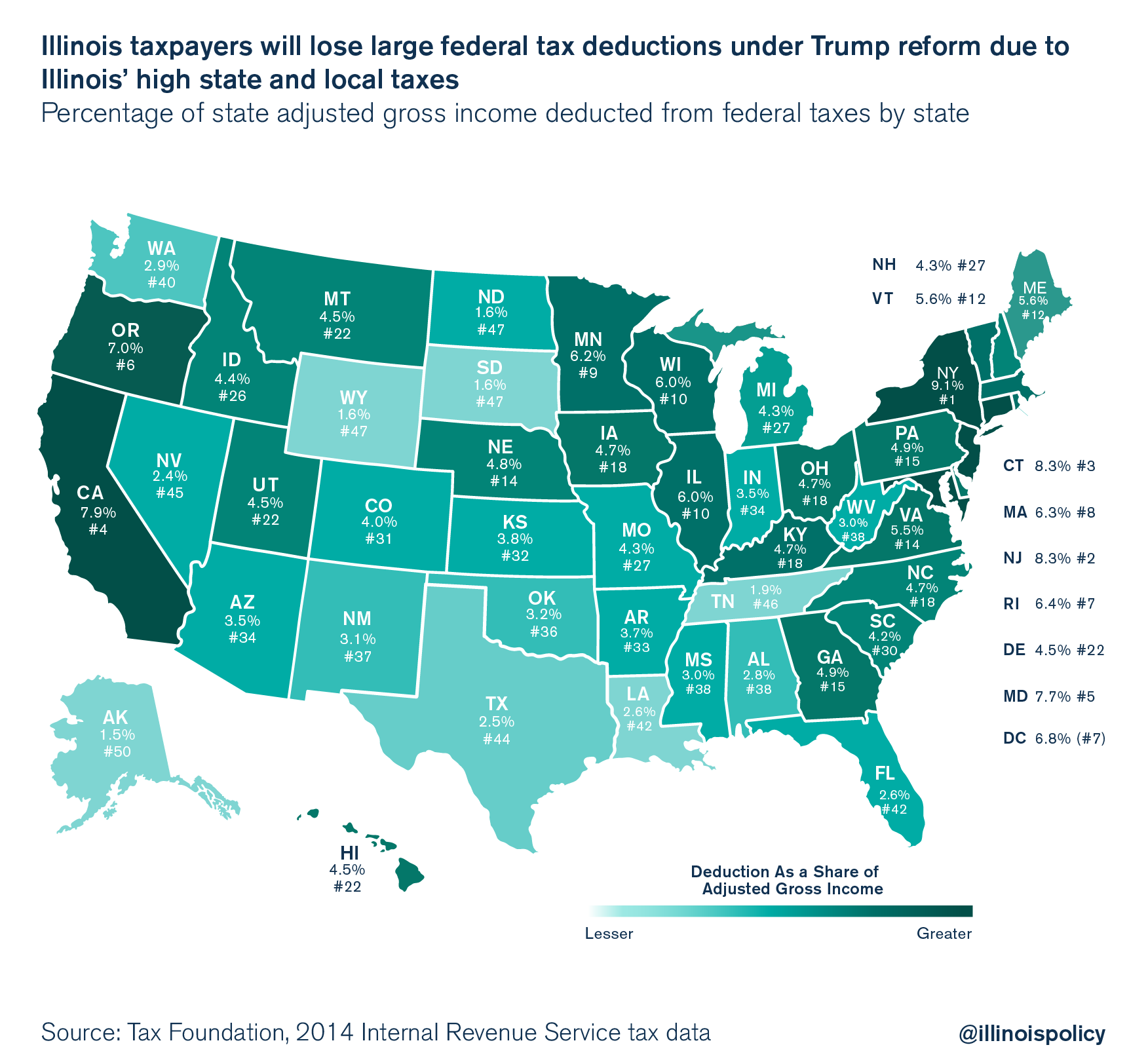

- Trump’s plan would remove the deductibility of state and local taxes. This would essentially increase the cost to Illinoisans of having high state and local taxes. Deductibility of state and local taxes subsidizes high-tax, high-income states like Illinois by allowing those high taxes to be deducted from federal taxes. Removing the deductibility would remove a tax subsidy that benefits states such as Illinois, California, New York and New Jersey.Illinois would see its relative competitiveness decline with the end of state and local tax deductibility.According to a Tax Foundation analysis, 32.4 percent of Illinois federal tax filers deduct state and local taxes. Illinois has the 14th-highest adjusted gross income, or AGI, per tax filer and the 10th-highest state and local tax deduction as a percentage of total state AGI.

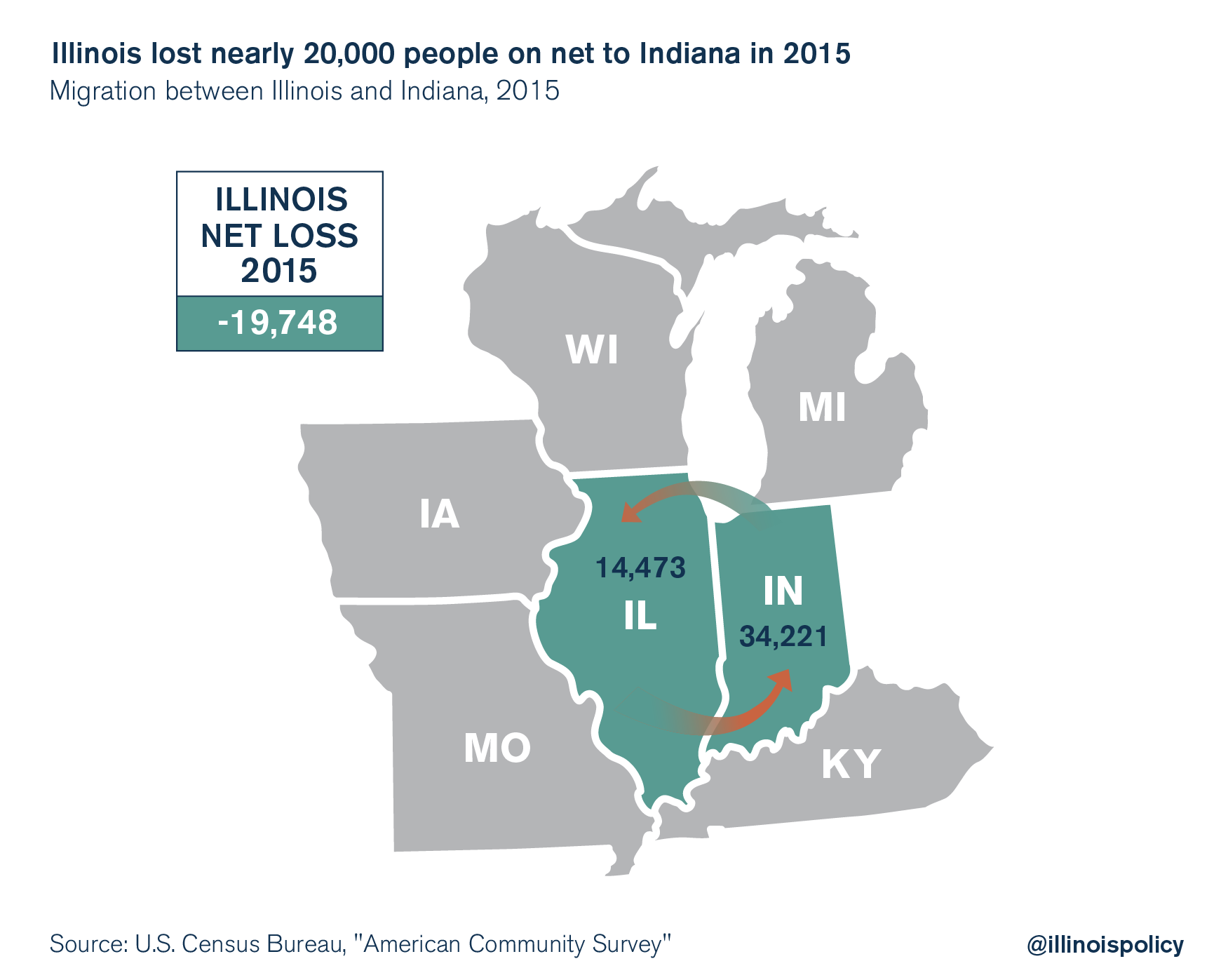

Illinois is already seeing accelerating out-migration to Indiana, which has much lower overall taxes and a 1 percent property tax cap.Indiana plans to improve the South Shore train line so that Chicagoans can live along the Indiana lakeshore, have lower taxes and a lower cost of living, and quickly commute to a job in downtown Chicago.Illinois lags when it comes to tax competitiveness, especially property taxes. All else being equal, Illinois would likely see accelerated out-migration of both people who are leaving Illinois altogether and also of people who plan to keep a job in Chicago but live in Indiana.Illinois has set itself up to lose residents who will move to the Indiana lakeshore instead of the Illinois suburbs. Illinois lost 20,000 people to Indiana, on net, in 2015, the most recent year of migration data.

Illinois is already seeing accelerating out-migration to Indiana, which has much lower overall taxes and a 1 percent property tax cap.Indiana plans to improve the South Shore train line so that Chicagoans can live along the Indiana lakeshore, have lower taxes and a lower cost of living, and quickly commute to a job in downtown Chicago.Illinois lags when it comes to tax competitiveness, especially property taxes. All else being equal, Illinois would likely see accelerated out-migration of both people who are leaving Illinois altogether and also of people who plan to keep a job in Chicago but live in Indiana.Illinois has set itself up to lose residents who will move to the Indiana lakeshore instead of the Illinois suburbs. Illinois lost 20,000 people to Indiana, on net, in 2015, the most recent year of migration data.

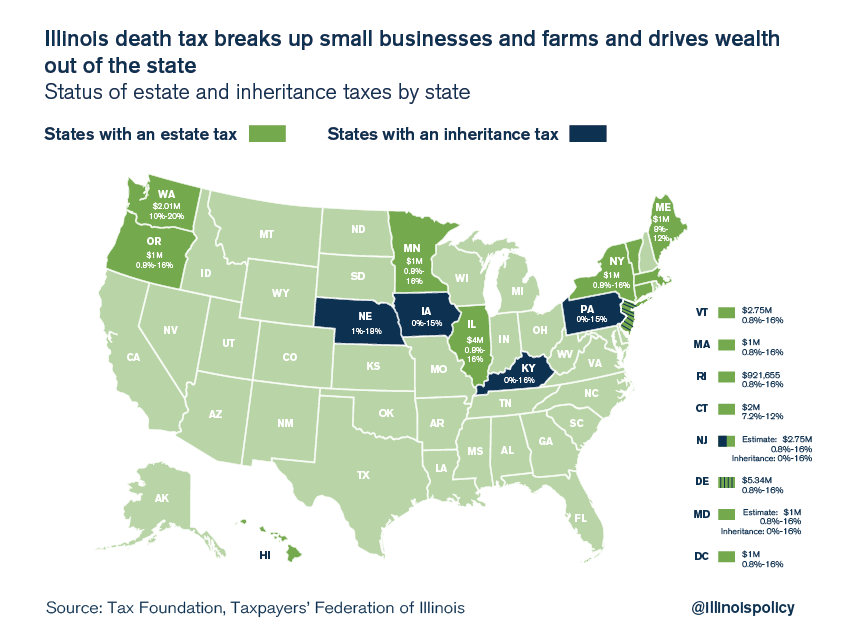

- Trump’s tax plan would eliminate the federal death tax. If the federal death tax is eliminated, Illinois will stand out as one of the few remaining states with a death tax.Currently, estates subject to a death tax already deal with the compliance costs at the federal level, so a state death tax is relatively less burdensome because the federal death tax is already inescapable.Repeal of the federal death tax would likely lead to increased out-migration of wealthy estates from Illinois, as Illinois would be one of the few remaining states to impose a death tax. This would deprive Illinois of vast amounts of capital and expertise, and likely increase the outflow of successful family businesses.

The ugly

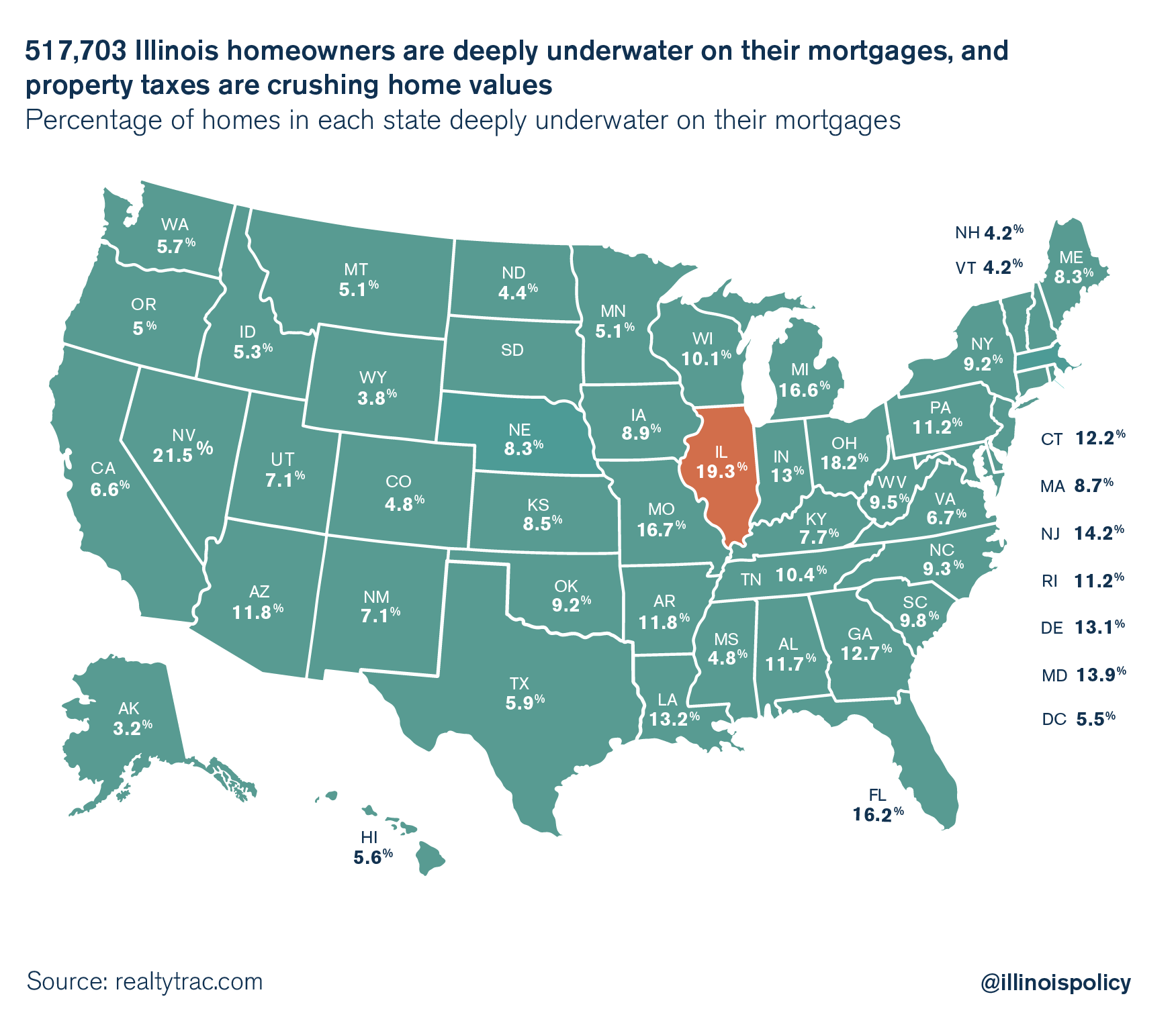

Trump’s tax plan would end the deduction of local property taxes against federal income taxes. In effect, this would increase some Illinoisans’ real property tax burdens by the amount of the total property tax owed multiplied by the person’s top marginal income tax rate.

In other words, some homeowners with high property taxes would see a large effective property tax increase.

Illinois government, through its own incompetence and mismanagement, has done a great deal to set Illinoisans up for a broad housing crisis. It has already hit some areas of the state, such as southern Cook County and McHenry County, where out-migration and high property taxes are crushing home values, leaving homeowners deeply underwater on their mortgages.

In fact, a RealtyTrac study shows that nearly 20 percent of homes in Illinois are deeply underwater on their mortgages. “Deeply underwater” means the home value is more than 25 percent below the amount of mortgage debt still owed. So if these 517,703 deeply underwater Illinois homeowners were to sell at market prices, they would still owe a huge chunk of money on their mortgages even after their home sales. They’re stuck in houses that have become debt traps.

Only Nevada has a higher portion of homes that are deeply underwater on their mortgages.

Illinois’ formula for a housing crisis has been twofold:

- Reduce demand for homes by driving away population through failed governance and weak job creation.

- Increase the liability of owning a home by allowing property taxes to reach crisis levels.

Ending the deductibility of state and local taxes, though a sensible reform, could precipitate even lower home values in Illinois and put more homeowners deeply underwater.

Illinois has the makings of a state-government-created housing crisis, and Trump’s tax reform would make it worse.

Solutions for Illinois

The only long-term solution for Illinois is to fix its state government, reduce its debts, and foster better economic growth.

Trump’s reforms would help attract corporate investment to Illinois and would set up the U.S. for better economic growth, which would pull Illinois along.

However, Illinois needs to get its fiscal house in order. Trump’s tax plan deserves consideration at the state level, as it would affect different states in different ways. Here are three must-dos for Illinois lawmakers to adapt to Trump’s proposed tax reform:

- Acknowledge tax competition and start to compete. Indiana and Southern states with no income tax are setting themselves up to eat Illinois’ lunch. Illinois needs to reduce its overall tax burden, especially for communities near the Indiana border.

- End the death tax. Illinois will lose talent, capital and family businesses if the federal death tax is repealed and Illinois’ remains. The death tax brings in around $300 million annually. Find a way to eliminate it.

- Save Illinois homeowners. Illinois is setting itself up for a housing crisis. Property taxes need to be frozen and then cut. If Illinois homeowners can no longer deduct local property taxes from their federal tax returns, they are going to need property tax relief even more than they do now.

Trump’s tax reform proposals will likely evolve, but the core components would have a significant impact on Illinois. These effects should be considered, and Illinois should prepare to adapt to a new tax landscape.