Illinois first to rely on ‘lender of last resort’ borrowing from Federal Reserve

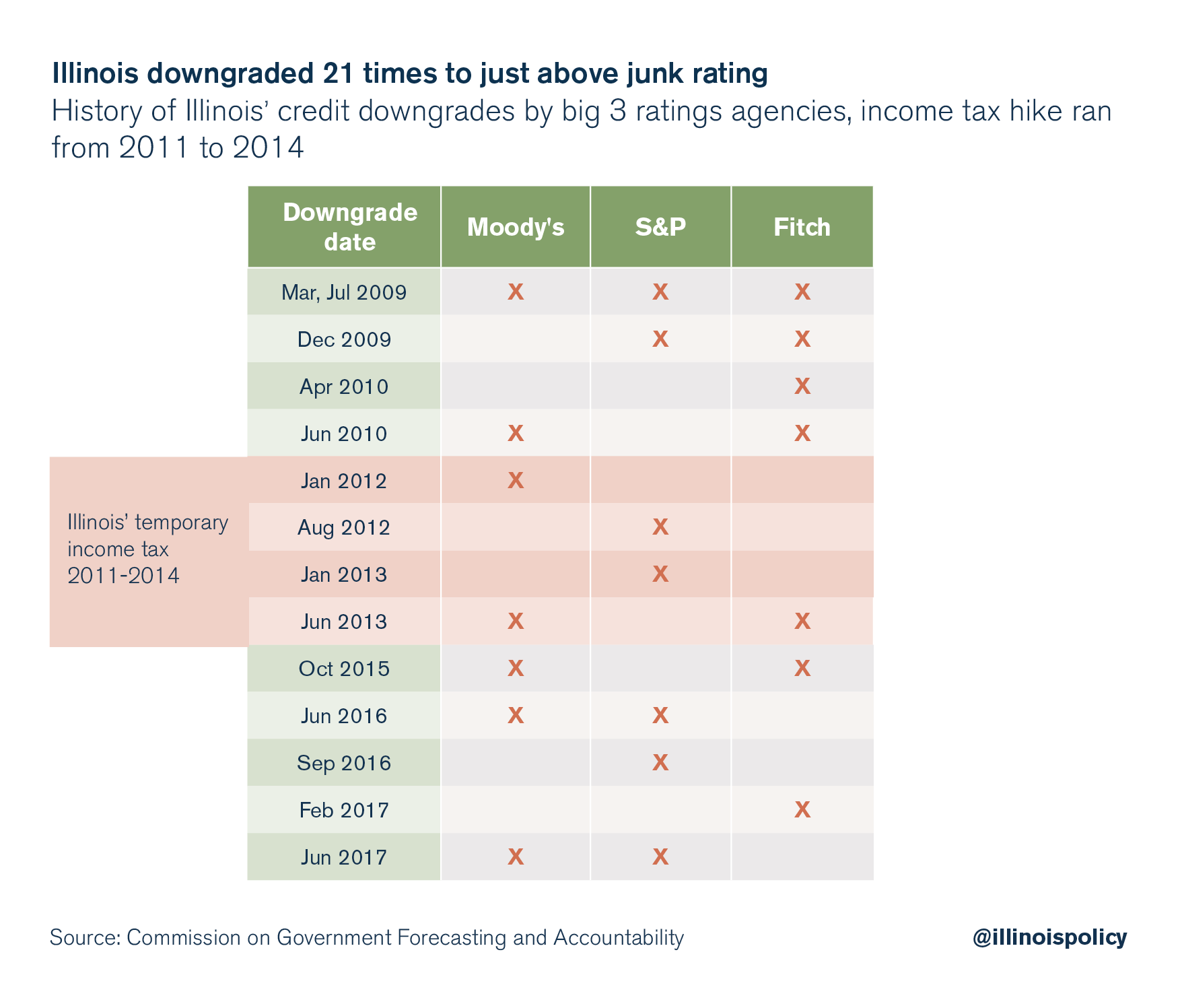

Illinois' credit rating is just one notch above junk, the lowest of any U.S. state.

On June 2, Illinois became the first state to borrow from the Federal Reserve’s new and historically unprecedented Municipal Liquidity Facility. The $1.2 billion bond issuance comes with a 3.83% interest rate and must be repaid in one year, according to The Bond Buyer.

The state’s credit rating is just one notch above junk according to two major ratings agencies, the lowest of any U.S. state. Illinois Gov. J.B. Pritzker had previously tried to sell the $1.2 billion in debt through private markets in May, but pulled the bond issuance after failing to secure a favorable offer. Being forced to rely on “lender of last resort” borrowing from the Fed underscores just how weak Illinois’ finances truly are.

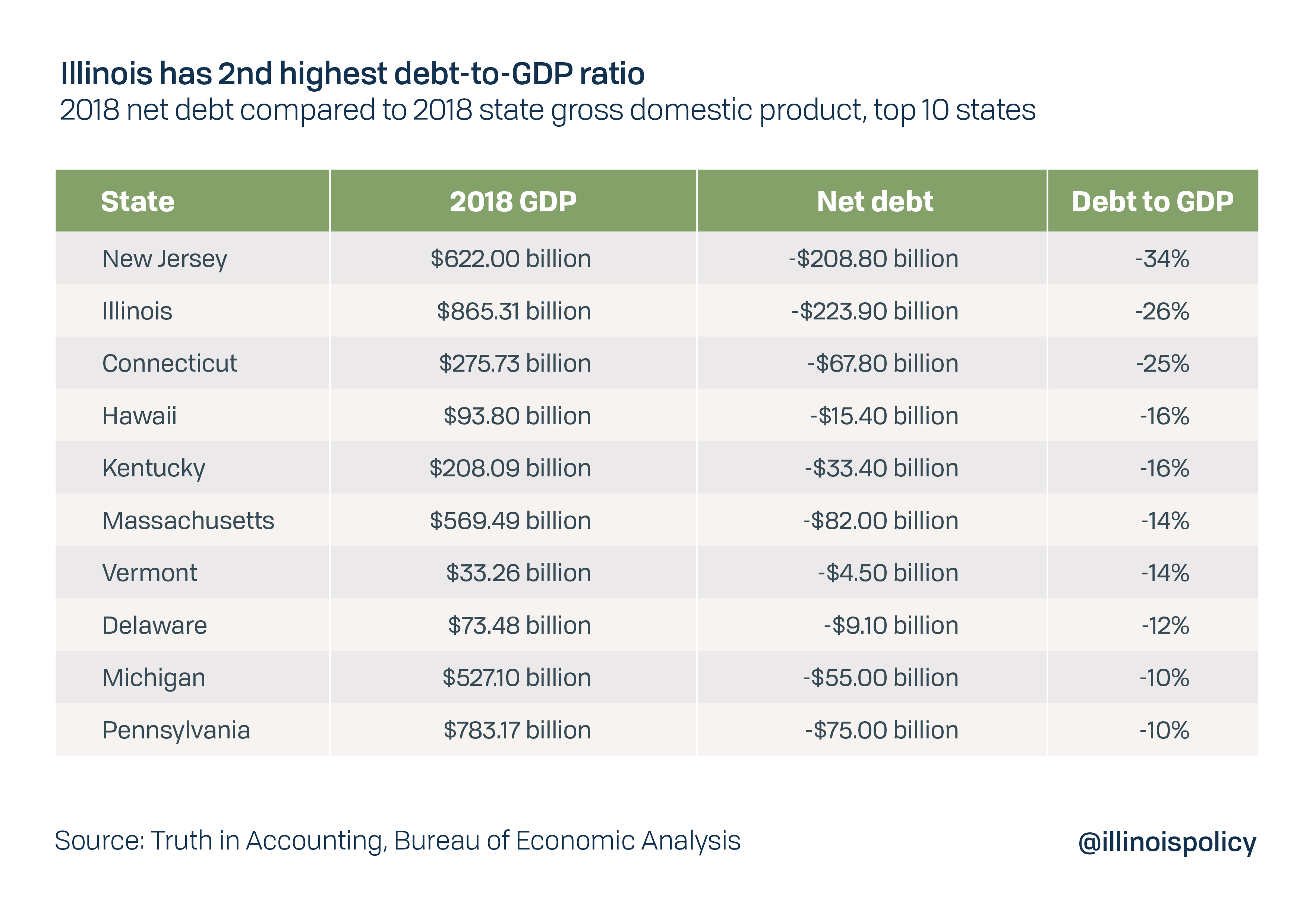

Without major financial reforms, particularly to the state’s deeply indebted pension system, residents of Illinois will be forced to endure a continued deterioration of state finances. Illinoisans have already been subjected to the combination of multiple significant tax hikes and cuts to core government services during the past decade as the state struggles to keep up with rising debt burdens. The Prairie State’s ratio of total debt compared to the size of its economy was the second highest in the nation at the end of 2018. More debt risks further crowding out spending on services and provides some Springfield politicians with an excuse to push for even higher taxes.

The last one-year Illinois bond maturity sold privately came with a 4.875% interest rate, 4.33 percentage points higher than states with the top AAA credit rating must pay. The lower price demanded by the Fed, while still based on states’ relative credit ratings, means Illinois is almost certainly receiving a better deal than it could get through a competitive market sale but is still much higher than it would pay were its finances not a wreck.

The Fed announced the new state and local lending program on April 9 amid concerns that volatility in private bond markets, where governments typically sell their debt, would prevent state and local governments from accessing needed cash during the COVID-19 pandemic. Economic fallout from government shutdowns to fight coronavirus has caused massive disruptions in revenue collections, with Moody’s Analytics projecting total state revenue losses of between $130 billion and $172 billion. Those losses are hitting just as demand for government spending on public health and disaster relief is increasing, causing many elected officials to look to short term borrowing to bridge the gap.

Lawmakers granted Pritzker an additional $5 billion of borrowing authority to partially cover holes in the recently enacted state budget. The new budget marks Illinois’ 20th consecutive unbalanced spending plan and increased by $2.4 billion, even though state leaders knew the coronavirus was seriously cutting revenues.

Illinois’ high cost of debt and limited access to bond markets have been caused by two decades of fiscal mismanagement by Springfield politicians, primarily driven by unsustainable pension systems. According to Moody’s Investors Service, Illinois’ $241 billion in pension debt at the end of fiscal year 2018 equaled more than 500% of state revenues, making it the worst pension crisis in the nation.

In 2019, S&P Global Ratings warned that without a “practical reduction in liabilities” of the state pension systems the state’s credit could slip to junk status. Similarly, Moody’s has said Illinois’ rating reflects “extremely large net pension liabilities and a long history of unbalanced financial operations.”

To date, Pritzker has opposed any attempt to reform state pensions.

Pritzker and many Democratic lawmakers have publicly stated they hope to be able to repay recent and planned borrowing with a bailout from the federal government, which Congress has not passed. Pritzker has repeatedly called for potential federal aid to be “unencumbered,” meaning he wants a blank-check bailout with no strings attached.

Congress should reject those requests.

The Illinois Policy Institute has proposed a plan under which any additional financial assistance provided to state governments by Congress would be made contingent on certain taxpayer protections. Those conditions would ensure federal aid supports essential government services rather than being squandered through waste and mismanagement. States would have to demonstrate they have sound pensions, truly balanced budgets and sufficient rules for emergency savings or else enact significant reforms to meet those conditions. States that fail to meet the conditions would have to repay federal monies with interest.

By conditioning any further financial assistance on good stewardship of taxpayer dollars, Congress could encourage the structural reforms needed to fix Illinois’ credit rating and offer relief to state residents overburdened by public debt. Lower debt burdens and more efficient state spending would help ensure a strong recovery from the COVID-19 recession and provide Illinoisans with a path to the tax relief they need to prosper.