Illinois fiscal collapse began long before the 2-year budget impasse

Illinois’ budgetary mess preceded Gov. Bruce Rauner’s tenure, with years of gimmicks, borrowing and broken promises.

Illinoisans are being told that Illinois’ dysfunction is the fault of the state’s two-year budget impasse. The narrative follows that Illinois hasn’t had a full budget for two years due to the stalemate between Gov. Bruce Rauner and House Speaker Mike Madigan.

But Illinois’ fiscal crisis began long before the current impasse.

In a tweet May 29th, Capitol Fax’s Rich Miller noted that Illinois lawmakers “didn’t pass a full budget in 2014…” Even when Democrats had full control – a Democratic supermajority in both chambers and a Democratic governor – they couldn’t pass a complete budget for fiscal year 2015.

In other words, Illinois was already embroiled in a budget crisis before Rauner even took office.

When the Illinois General Assembly passed its fiscal year 2015 budget, it ignored that the state’s temporary tax hike was set to expire in the middle of that fiscal year. The General Assembly deliberately sent then-Gov. Pat Quinn a budget that was clearly out of balance.

“The General Assembly didn’t get the job done on the budget,” Quinn said at the time, according to the Chicago Tribune. “The General Assembly sent me an incomplete budget that does not pay down the bills but instead postpones the tough decisions.”

Some state agencies expected to run out of money halfway through that year as unfunded spending built up a $1 billion year-end deficit.

The budget didn’t “balance” until Rauner, then newly elected, and Madigan approved $1.3 billion in fund sweeps and $300 million in cuts to education and other programs.

The fiscal year 2015 crisis was small enough that lawmakers could paper over it.

That playbook hasn’t worked over the past two years, however.

Illinois broken budgets

The fiscal year 2015 budget failures were not a new phenomenon in Illinois.

Earlier budgets under Quinn only “balanced” because of billions in borrowing, taxing and other budgetary maneuvers.

In 2008 and 2009, Illinois’ pension contributions began to spike. Rather than reform pensions, Quinn resorted to taking out more debt to make the state’s 2010 and 2011 budget balance.

Quinn took a page out of former Gov. Rod Blagojevich’s playbook and borrowed $3.5 billion to make the state’s required pension payment in 2010. He did the same next year, borrowing another $3.7 billion.

In both cases, the borrowing exposed a fundamental flaw in Illinois’ balanced budget requirement: Proceeds from borrowing can count as budgetary revenue.

Billions in debt let Illinois politicians present a balanced budget. But the reality is Quinn’s borrowing shifted the state’s current-year obligations from the pension system to long-term bond repayments, spreading the burden to future taxpayers.

A year later the General Assembly passed, and Quinn signed, a fiscal year 2011 budget they claimed was balanced.

But the Illinois Policy Institute uncovered over $1 billion in additional, unfunded spending in the budget relating to Medicaid and other health care payments. Lawmakers extended the payment period of health care bills into the next fiscal year, then appropriated less funding to pay the remaining bills. That move allowed lawmakers to declare the 2011 budget “balanced.”

Lawmakers called that reduction in funding a “cut.” In reality, as the media and policy makers finally realized, it was really an increase in the state’s unpaid bills.

Tax hikes only made Illinois’ crises worse

Even politicians’ go-to solution to Illinois financial crises – tax hikes – only succeeded in making the state’s problems worse.

In 2011, Illinois politicians enacted a record 67 percent income tax hike on individuals and a 46 percent corporate income tax hike. Springfield politicians promised the additional revenue would stabilize the pension crisis, pay down the state’s unpaid bills and help the economy.

The tax hike took an additional $32 billion from taxpayers’ wallets from 2011 through 2014. Yet none of politicians’ promises came true.

The state didn’t pay off its unpaid bills. Instead, they were reduced by less than $2 billion. The state still had $6.6 billion in unpaid bills to go when the tax hike expired.

Illinois also suffered one of the weakest economic recoveries in the nation. The state’s manufacturing base collapsed and never recovered like in neighboring states. In fact, Illinois still has fewer jobs now than it did in the year 2000.

And Illinois’ pensions didn’t get any better. The debt taxpayers owe worsened by more than $20 billion over the four-year tax hike period.

New money didn’t solve Illinois’ finances. Instead, it relieved Illinois lawmakers from pressure to enact necessary spending reforms.

Lawmakers simply spent the money and left Illinois on a budgetary cliff when the tax hike expired.

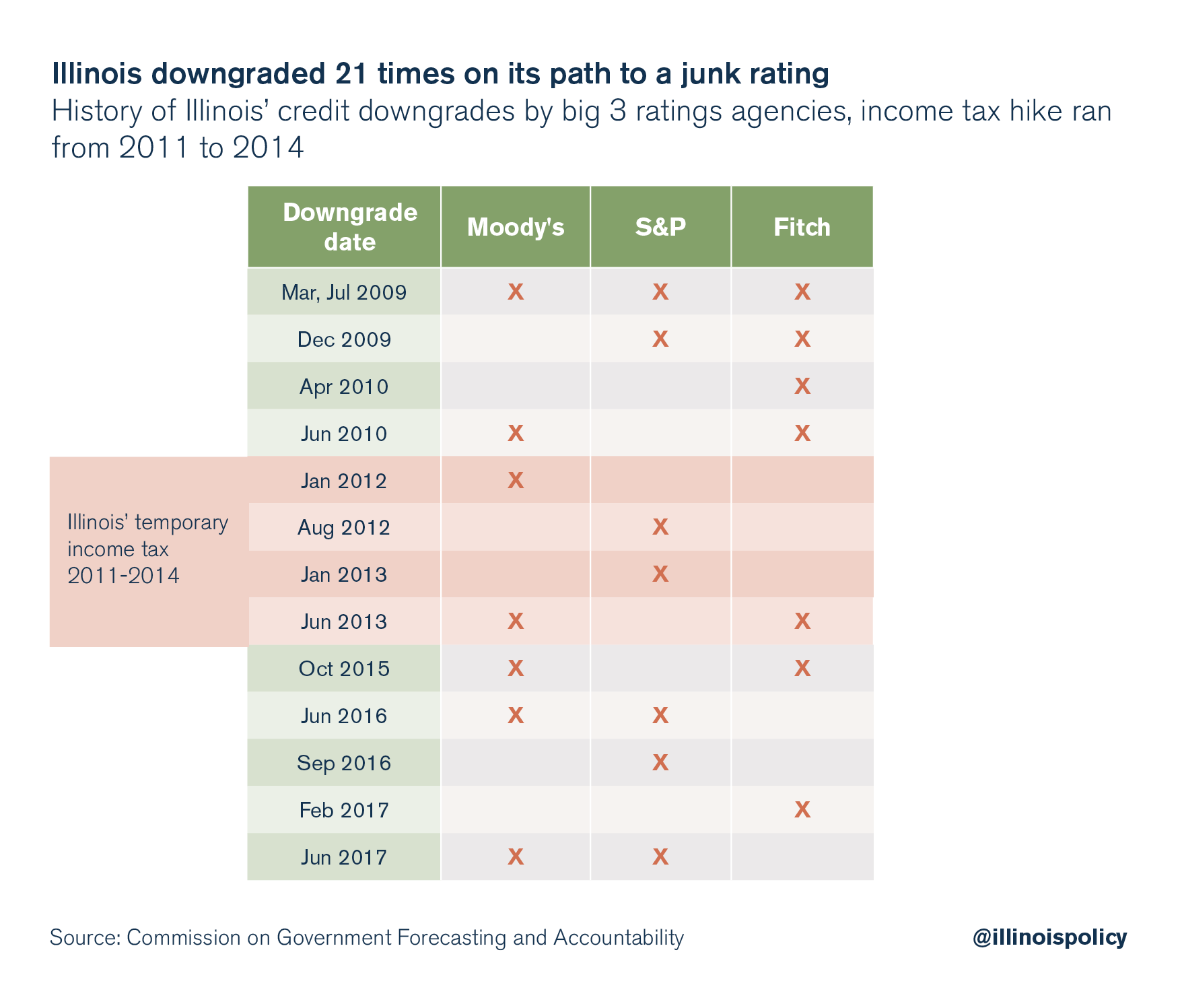

That’s why the state’s credit rating suffered. Illinois was downgraded five times from 2011 through 2014, meaning rating agencies wanted to see structural changes, not just more revenues.

Structural reforms are the only solution to Illinois’ crisis

The state’s problems came to a head in 2015, when lawmakers’ usual toolset of budgetary gimmicks, debt and more taxes failed to paper over Illinois’ problems.

Illinois was left with an incomplete budget – and the state’s current meltdown began.

Illinois can’t afford to put off structural reforms any longer.

Illinoisans needs comprehensive reforms that balance the budget without tax hikes. The state can’t leave real fixes for later – certainly not if it means higher taxes and more gimmicks.