Illinois harbors hundreds of hidden pension crises

They might not make headlines, but Illinois is home to hundreds of government-worker pension systems in horrible shape.

Illinois’ severely underfunded pension liability for the five state-run pension funds has earned national media attention. But Illinois is home to many other pension crises that too often fly under the radar.

There are 675 public pension funds in Illinois. In addition to the five state-run funds, there are 359 suburban and downstate police pension funds, 301 suburban and downstate fire pension funds, a pension fund for suburban and downstate municipal workers, six pension funds in Chicago and three pension funds in Cook County, which overlaps with the city of Chicago.

These pension funds cover more than 1 million people, or 8 percent of the state’s total population, when active workers, retirees and other beneficiaries are accounted for.

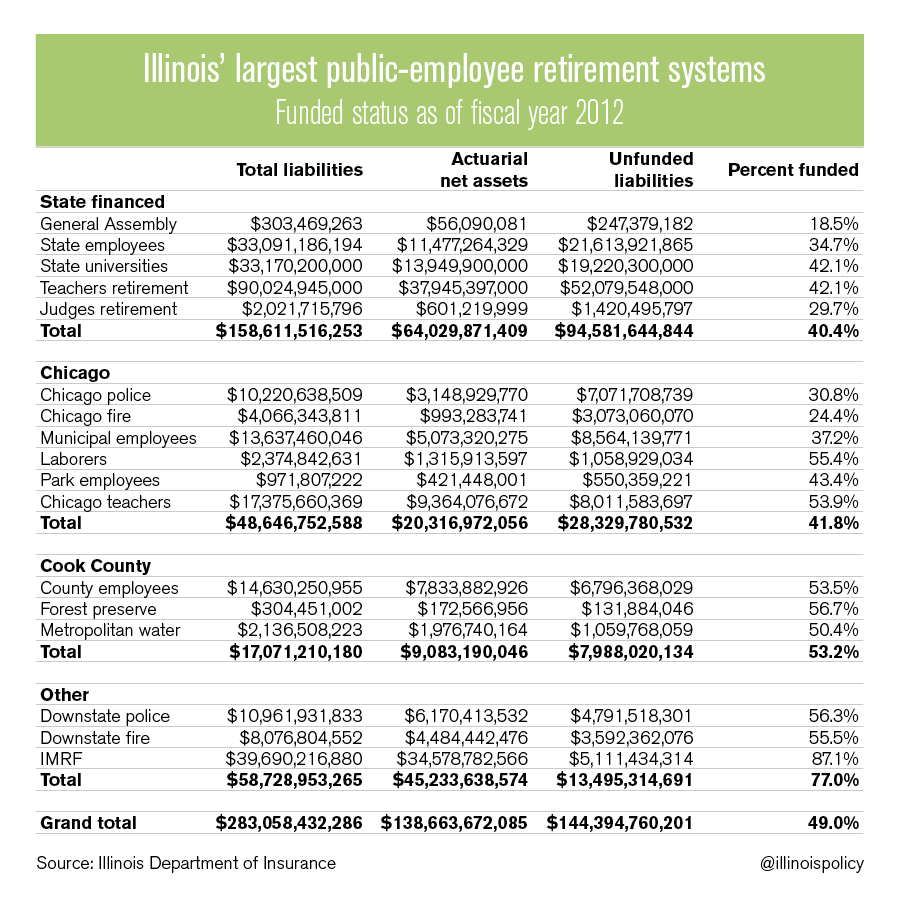

Collectively, pension funds in Illinois had an unfunded liability exceeding $144 billion and an aggregate funding ratio of less than 50 percent in 2012, according the biennial pension report published by the Department of Insurance, or DOI.

The DOI is slated to release an updated version of the biennial pension report later this year. And the numbers in that report will be even worse.

In all the discussion and debate about pension reform in Illinois, it’s important to understand the size and scope of the pension problem. The truth is state and local pension problems are often larger and worse off than what’s commonly reported.