Illinois lost more than 30,000 millennials on net in 2014

Illinois’ out-migration of younger workers should concern lawmakers and urge them to pass pro-growth reforms.

Millennials are refreshingly optimistic about their futures – but unfortunately for Illinois, few young people are building those futures in the Land of Lincoln.

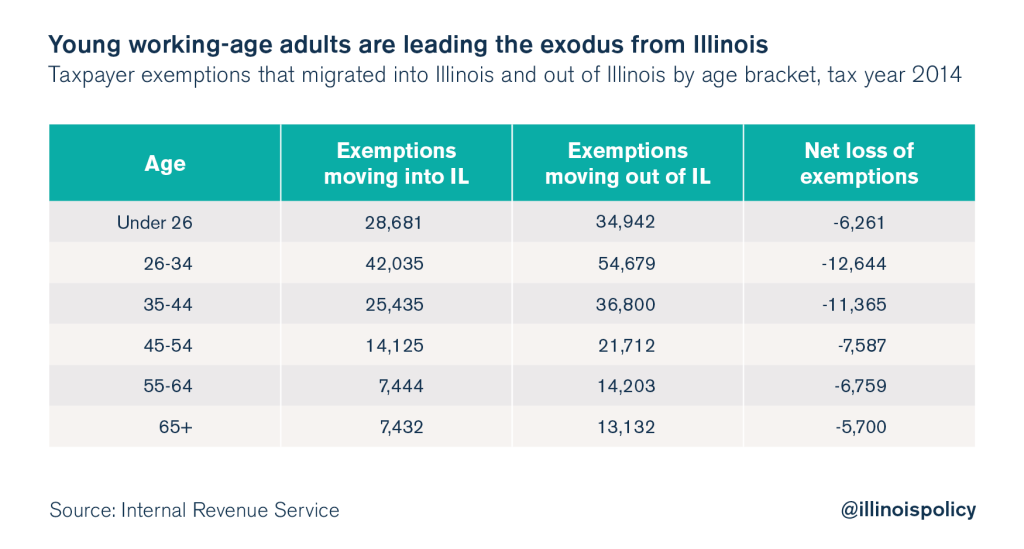

According to Internal Revenue Service, or IRS, data, in 2014, Illinois lost 50,000 more taxpayers – and their dependents – than it gained through migration. Millennials led the exodus. While more than 70,700 taxpayers under the age of 34 moved into Illinois, more than 89,600 moved out. This amounts to a net loss of almost 19,000 millennials in 2014, and more than one-third of the state’s 50,000 net loss to migration across all age groups.

Not only are young taxpayers leaving Illinois, but students are leaving in droves, too. Department of Education, or DOE, data compiled by The New York Times confirm that in 2014, only about 2,100 students came to Illinois from out of state to attend a public university, while more than 16,400 students left Illinois for public universities in other states. This amounts to a net loss of more than 14,300 students to other states. Illinois sends the most college students to neighboring Midwestern states, including Missouri, Iowa, Indiana, Wisconsin and Michigan.

Out of all 50 states, only California had more students leave than Illinois, at more than 17,100. But Illinois had a greater net loss. California also gained more than 4,600 students for a net loss of more than 12,500, while Illinois’ net loss was more than 14,300.

The combined net loss of millennial taxpayers and students to other states in 2014 amounts to more than 33,000 young Illinoisans. And that’s just for one year.

To be sure, this number is not exact. For example, young people entering the workforce straight out of high school who have never paid taxes could move states, and this migration would not be accounted for in the IRS data due to lack of prior tax data. Further, some fleeing millennial students are likely also taxpayers, so they may be counted in both DOE and IRS data, inflating the actual number. The DOE data also only measured public universities, so it does not account for student migration for private universities.

Nevertheless, the trend is clear: Young people are leaving Illinois, and policymakers need to ask themselves why the state is so unattractive to these young people.

The IRS and DOE data are consistent with a recent Paul Simon Public Policy Institute poll, which found that 57 percent of Millennials in Illinois want to leave the state, compared with 47 percent of the general state population.

Illinois needs millennials. According to a Forbes survey, a majority of U.S. entrepreneurs under the age of 30 still believe in the American Dream. In addition, the millennial generation is now front and center in American enterprise. In 2015, it surpassed Generation X to become the largest share of the American workforce. Combined, these factors make the millennial generation particularly fit to fuel current job creation and to cover the state’s tax bill over the long term. Fewer millennials means fewer working-age adults – or fewer taxpayers – to cover the state’s soaring pension burden, which will be a growing problem as more of Illinois’ population reaches retirement age.

If young people are our future, Illinois is in trouble. State policymakers need to correct the policies that could be contributing to this mass millennial departure. Illinois’ anti-jobs policies, crushing tax burden and looming pension crisis make the state uncompetitive and unattractive. Illinois policymakers should heed the grave consequences of a shrinking youth population, and enact job-creating reforms so millennials can not only afford to, but also be proud to build futures in Illinois.