Illinois metro areas add 3,300 jobs in April

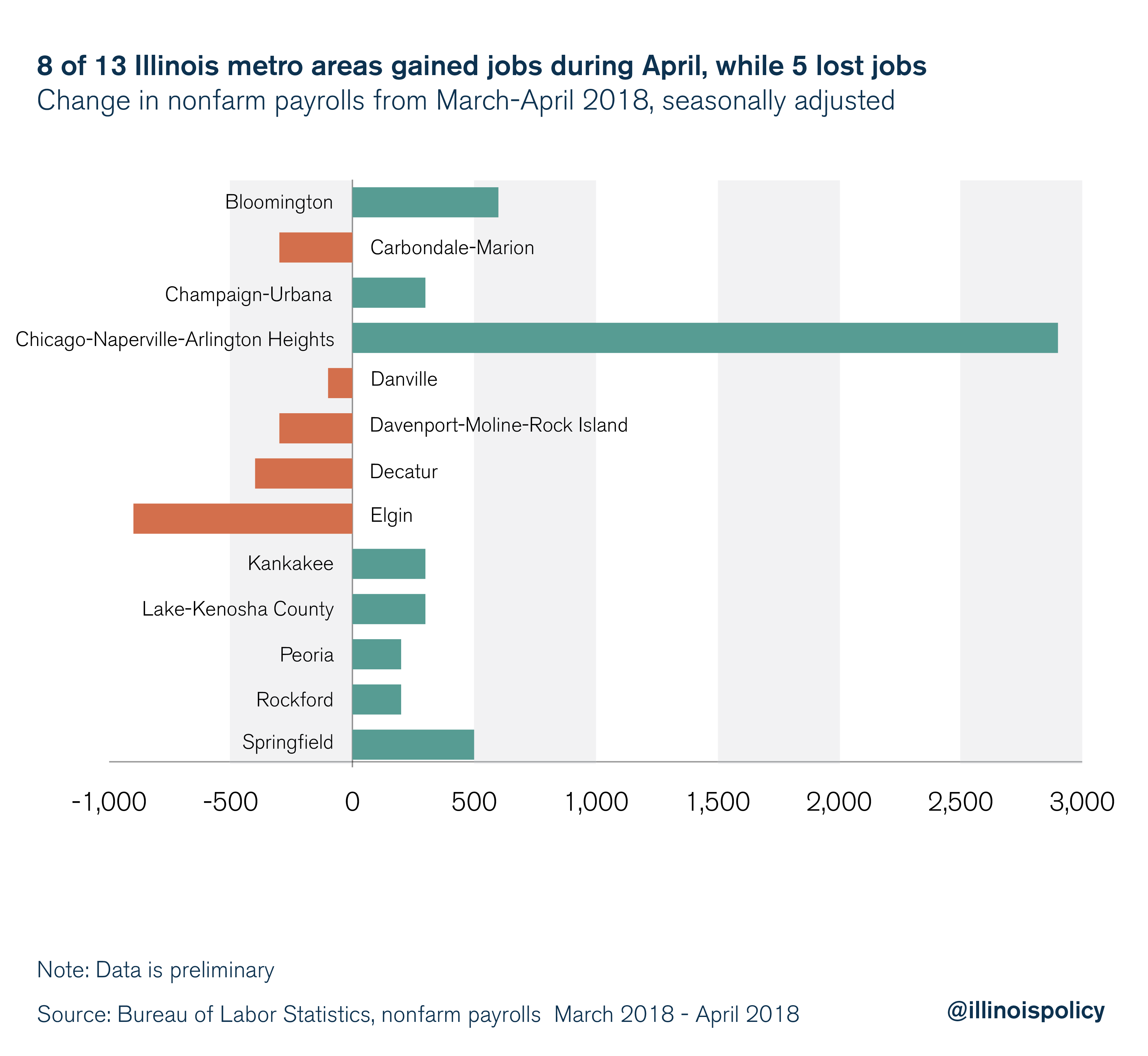

New data from the Bureau of Labor Statistics show eight of Illinois’ 13 metro areas gained jobs over the month.

A majority of Illinois’ metropolitan areas showed net jobs growth in April, according to new data from the Bureau of Labor Statistics. Total net job gains during the month amounted to 3,300, with the Chicago area’s 2,900 net additional jobs accounting for the vast majority of the gains.

Following Chicago, Bloomington picked up 600 jobs (+0.64 percent); Springfield expanded payrolls by 500 jobs (+0.45 percent); Champaign-Urbana added 300 jobs (+0.27 percent); Lake-Kenosha County created an additional 300 jobs (+0.07 percent); Rockford added 200 jobs (+0.13 percent); and Peoria gained 200 jobs (+0.12 percent).

Unfortunately, some places across the Land of Lincoln experienced a net decline in payrolls in April. Elgin lost the greatest number of jobs, down 900 (-0.34 percent); Decatur shed 400 jobs (-0.78 percent); Carbondale-Marion payrolls shrank by 300 (-0.53 percent); Davenport-Moline-Rock Island payrolls declined by 300 (-0.16 percent); and Danville shed 100 jobs on net (-0.36 percent).

Inconsistent growth

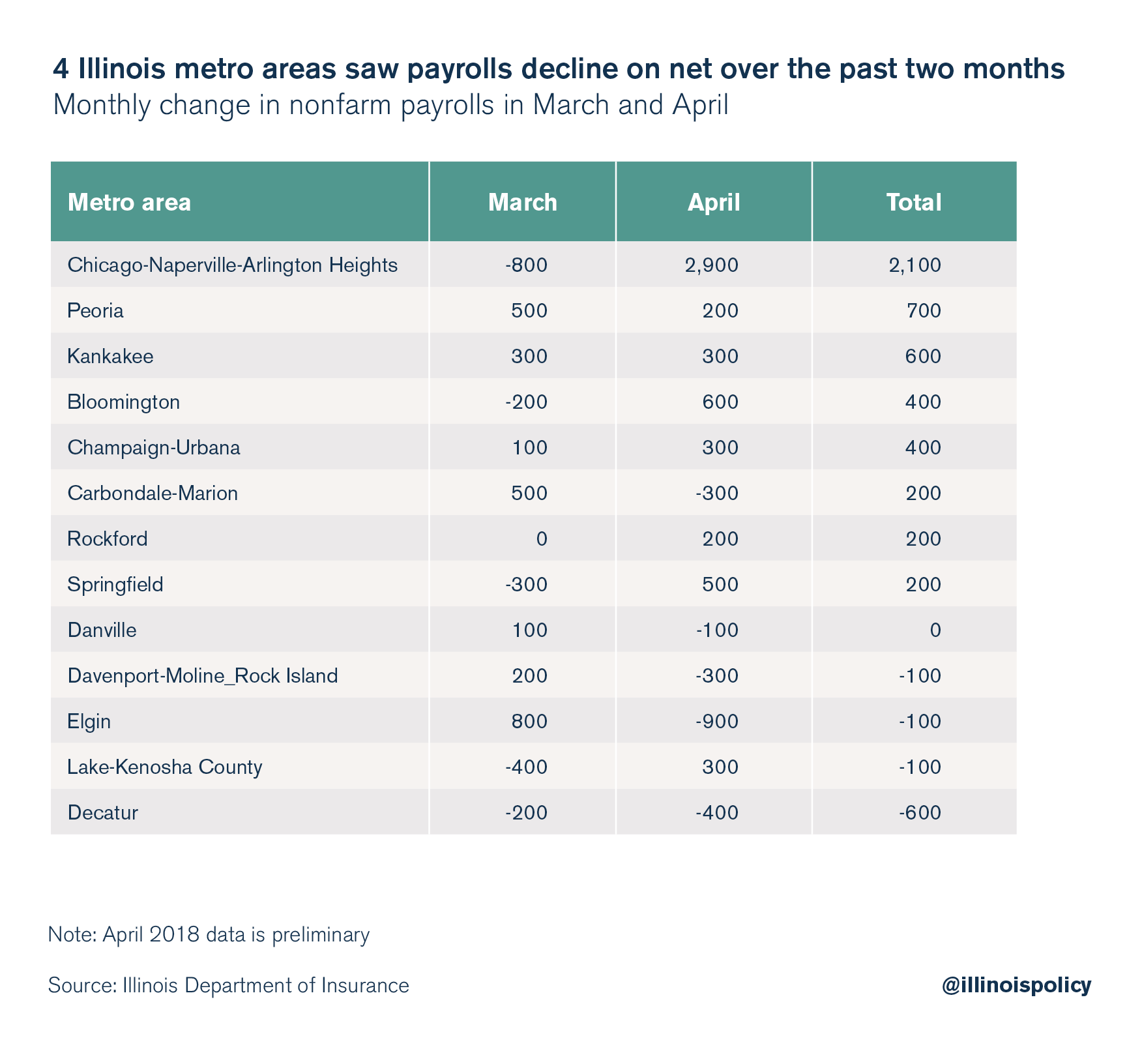

Although many areas experienced growth in April, and revisions were made to show that Illinois’ metro areas actually gained jobs in March, some metro areas find payrolls have actually declined on net over the past two months.

There has been little consistency in payroll growth from month-to-month. Many areas experience growth one month only to shrink payrolls the next month. In the worst case, Decatur experienced net job decline in both March and April.

Improving Illinois’ labor market

Illinois families need consistently growing employment opportunities. However, Illinoisans have been given an economy that is failing to keep up with the rest of the nation, and poor public policy is largely to blame.

For the last decade, Illinois state government spending per capita has grown 25 percent faster than Illinoisans’ per capita personal income. To finance the massive increases in spending, in the wake of the Great Recession, Illinois lawmakers passed two of the largest income taxes in state history. The tax hikes immediately stunted the Illinois recovery, but effects of the tax hikes are still being felt, having cost the economy thousands of jobs and billions of dollars.

Instead of continuously hiking taxes, state lawmakers need to free Illinoisans from their enormous tax burden.

In addition to providing a path toward tax relief, a spending cap would be a strong signal to creditors that Illinois wants to get its finances in order, thus potentially improving the state’s worst-in-the-nation credit rating. If state lawmakers could only do what many households manage every day – to spend within their means – they would soon see more investment flowing into the state to spur job creation and economic growth.

Hopefully, lawmakers will buck recent trends and pass a responsible budget this year.