Illinois metro areas gain 800 jobs in September

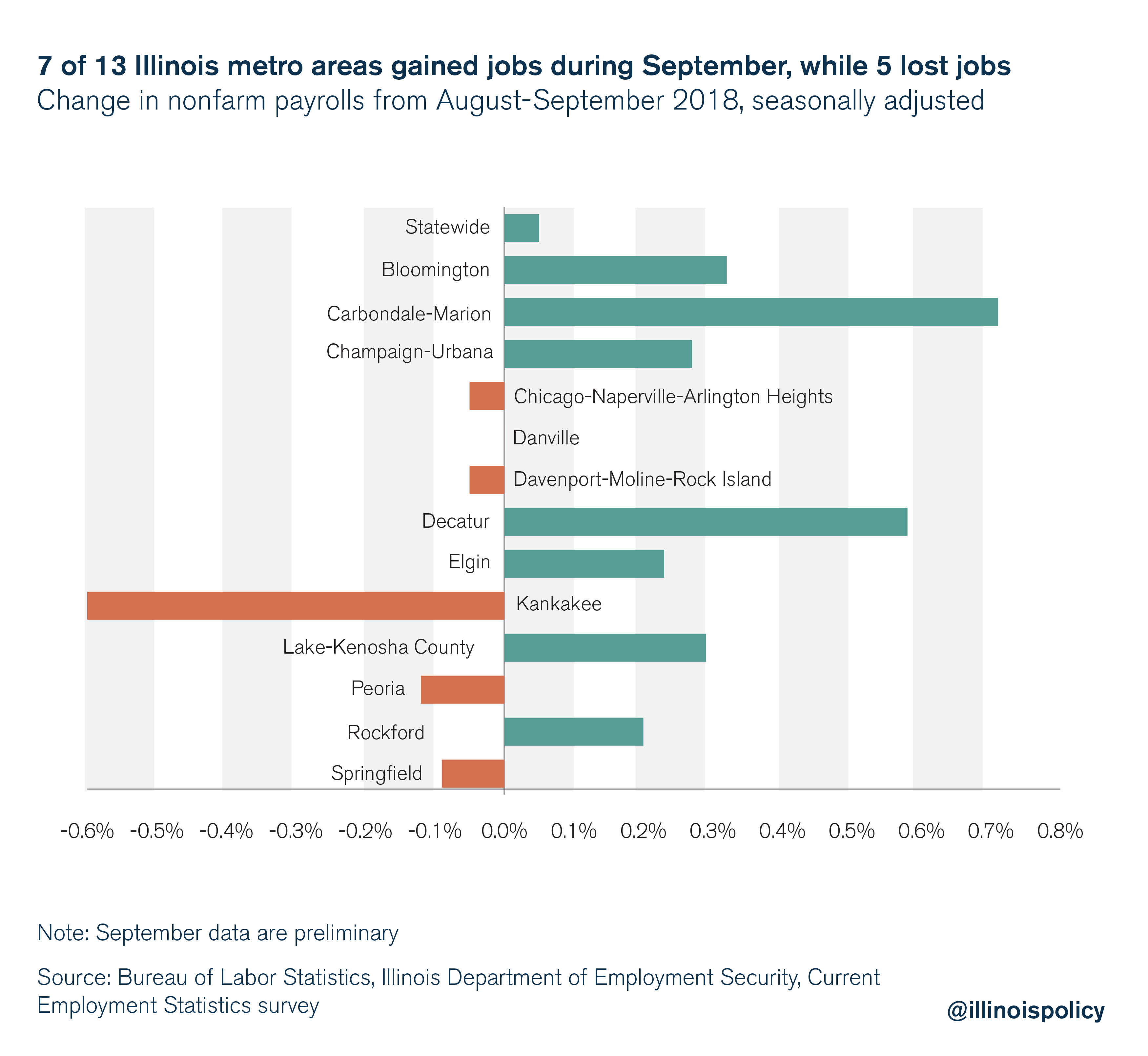

While a majority of Illinois’ metro areas experienced expanding payrolls in September, metro areas only gained 800 jobs on net.

A majority of Illinois metropolitan areas showed net jobs growth in September, according to preliminary data from the Bureau of Labor Statistics in conjunction with the Illinois Department of Employment Security. Total net statewide job gains during the month amounted to 2,800; Illinois’ metro areas contributed 800 of those net gains.

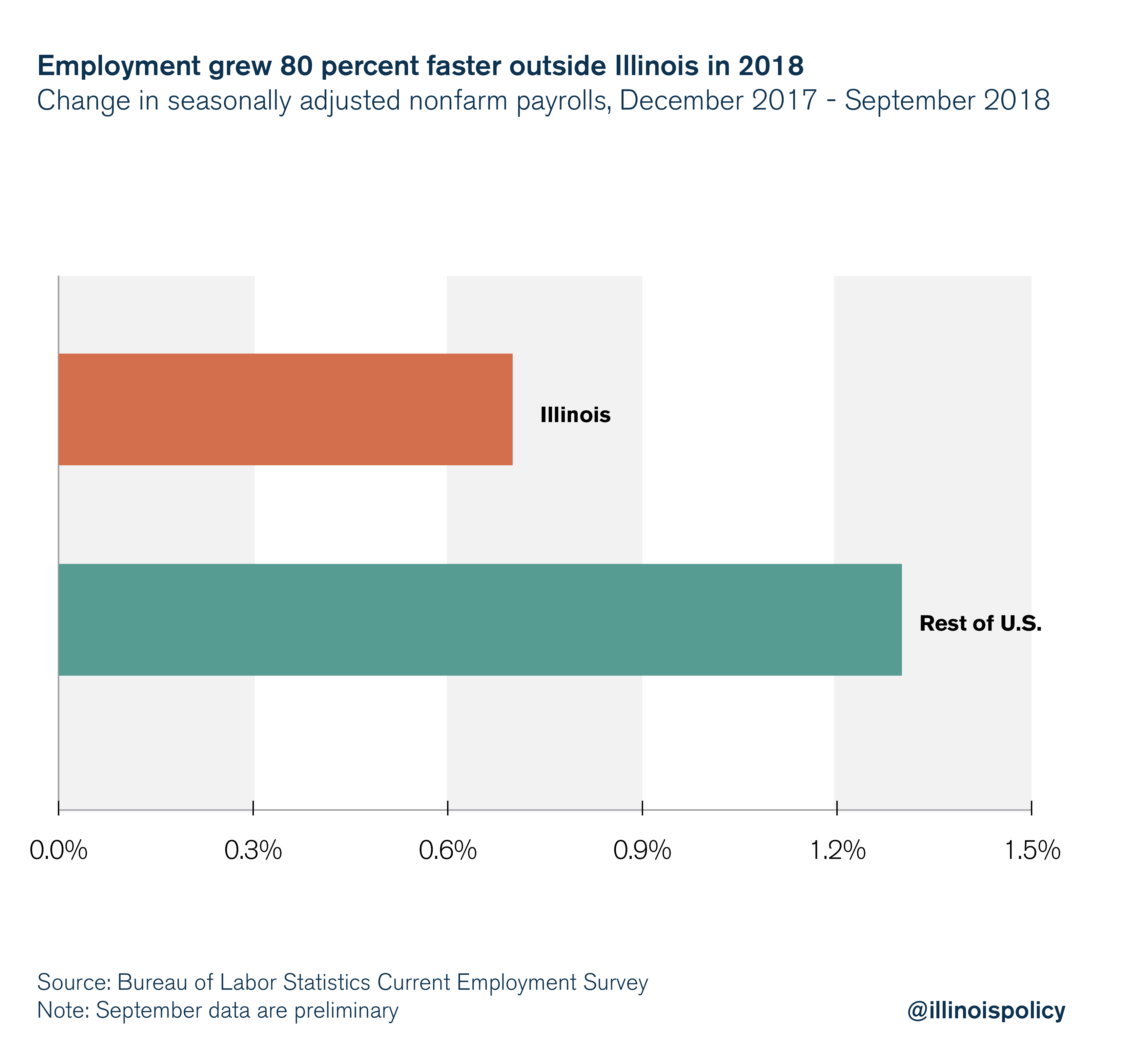

Illinois’ September job gains are a welcome bounce back from the payroll decline the state experienced in August, which was the first month in 2018 to show job losses. However, the Land of Lincoln still lags the rest of the U.S. in jobs growth for 2018, and September saw that trend continue.

The bulk of the metro area gains were driven by the addition of 1,200 jobs in Lake-Kenosha County (+0.29 percent).

Following Lake-Kenosha County, Elgin picked up 600 jobs (+0.23 percent); Carbondale-Marion added 400 jobs (+0.71 percent); Decatur gained 300 jobs (+0.58 percent); Bloomington picked up 300 jobs (+0.32 percent); Champaign-Urbana payrolls expanded by 300 jobs (+0.27 percent); while Rockford also added 300 jobs (+0.20 percent). Danville’s labor market saw no change in payrolls over the month.

Meanwhile, other communities across the Prairie State experienced a net decline in payrolls in September. The largest decline came in Chicago-Naperville-Arlington Heights which lost 1,900 jobs (-0.05 percent); Kankakee payrolls shrank by 300 jobs (-0.60 percent); Peoria payrolls shed 200 jobs (-0.12 percent); Springfield lost 100 jobs (-0.09 percent); Davenport-Moline-Rock Island payrolls also contracted by 100 jobs (-0.05 percent).

The gap between Illinois and the rest of the nation continues to widen

While total Illinois payrolls recouped nearly all of the losses from August’s decline, the rest of the nation continued to add jobs at a faster rate, as has been the case for most of the year. Since December 2017, the rest of the U.S. has expanded payrolls 80 percent faster than Illinois, according to data from the Bureau of Labor Statistics.

Closing the gap between Illinois and the rest of the country

Persistent underperformance relative to the rest of the nation has meant a sharpening contrast between Illinois’ employment situation and worker opportunities available elsewhere.

Illinois’ economic future is uncertain. And when businesses perceive more volatility in the economy (whatever the source), they tend to err on the side of higher prices, which result in more inflation, higher markups and less economic activity.

Worse, Illinois’ comparatively weak jobs growth could slow down in the event of future tax hikes to support increased government spending. Gubernatorial candidate J.B. Pritzker’s campaign promises, for example, come with a $13 billion to $18 billion tab.

The revenue increases necessary to finance this level of spending could require doubling the state’s current individual income tax and could cost the state up to 132,000 jobs and $31.3 billion in economic activity.

A better approach – one that Pritzker and all candidates and policymakers should embrace – is to halt the growth in income and property taxes by reining in the growth of government spending.

A spending cap, for example, could prevent the need for future tax hikes. In spring 2018, state lawmakers lent bipartisan support to a constitutional amendment to impose a spending cap on the state budget. Although the spending cap amendment never made it to a vote, members of the Illinois House of Representatives and Senate have pledged to re-introduce the legislation next year. The spending cap would have tied the growth in state spending to the long-run average growth in the economy, avoiding the need for economically damaging tax hikes.

In addition to a spending cap, reforming Illinois’ broken pension system would allow governments to maintain core services while avoiding continual property and income tax increases. Pensions for government workers significantly burden both state and local government budgets, and the systems’ solvency continues to worsen even as taxpayers funnel billions of dollars into them each year. But tax hikes to pay for pensions do nothing to improve the delivery of current services and can depress home price appreciation. Lower home values have also been associated with lower job creation. A larger tax burden has made housing in Illinois less affordable than in the past, and a worse investment relative to other states.

Taxpayers must reject calls for a progressive income tax if Illinois is to prioritize its economic growth. State lawmakers have called for an end to Illinois’ constitutionally protected flat income tax in favor of a progressive income tax, with differing rates set according to income levels. Although often sold as a tax “on the rich,” other states’ progressive income tax models Pritzker has indicated he would look to for inspiration would all hike taxes on the typical Illinois family, and wouldn’t even come close to raising the revenue he needs to finance his spending plan.

The state’s economy cannot afford a progressive income tax hike – or any tax hike – if it is to ever to close the economic growth gap with the rest of the nation. Policymakers must opt for pro-growth reforms instead.