Illinois pension funds need 19 percent annual investment returns to make ends meet

Illinois reports that it owes $83 billion to its five public pension funds. Worse yet, under new reporting requirements by the Governmental Accounting Standards Board and Moody’s Investment Services, the state’s pension debt will more than double. There are a lot of numbers being thrown around in the fight over pension reform. But these are the...

Illinois reports that it owes $83 billion to its five public pension funds. Worse yet, under new reporting requirements by the Governmental Accounting Standards Board and Moody’s Investment Services, the state’s pension debt will more than double.

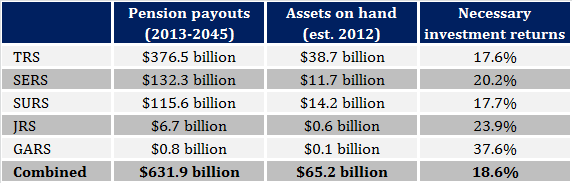

There are a lot of numbers being thrown around in the fight over pension reform. But these are the two numbers that matter most: $632 billion and $65 billion. $632 billion is the total amount the state’s pension plans will pay out for pension benefits between now and 2045. $65 billion is the total amount of money the state’s pension plans have on hand.

The state should have already set aside enough money so that the funds’ assets can grow over time to cover the required payouts. But the state has only set aside $65 billion to pay for these future benefits. In order to cover future payouts, the pension plans would need to see average investment returns of nearly 19 percent per year.

Without real reform, pensions will continue to crowd out funding for core government services, like education. And the longer lawmakers delay action, the worse our pension debt crisis will become.

The state is already half-way to certified junk-bond status and both Moody’s and Standard & Poor’s have warned that failure to enact comprehensive pension reform could lead to another downgrade. Legislators can’t ignore the math any longer. Only major reforms, like those heavily-centered on a defined-contribution plans, can get the problem under control. If Democrat-controlled Rhode Island can do it, why can’t we?