Illinois’ private sector jobs growth among worst in the nation since 2017 tax hike

Jobs growth in Illinois has gone from middle of the pack to back of the line.

As predicted, Illinois’ 2017 tax hike appears to be hurting the state’s economy already.

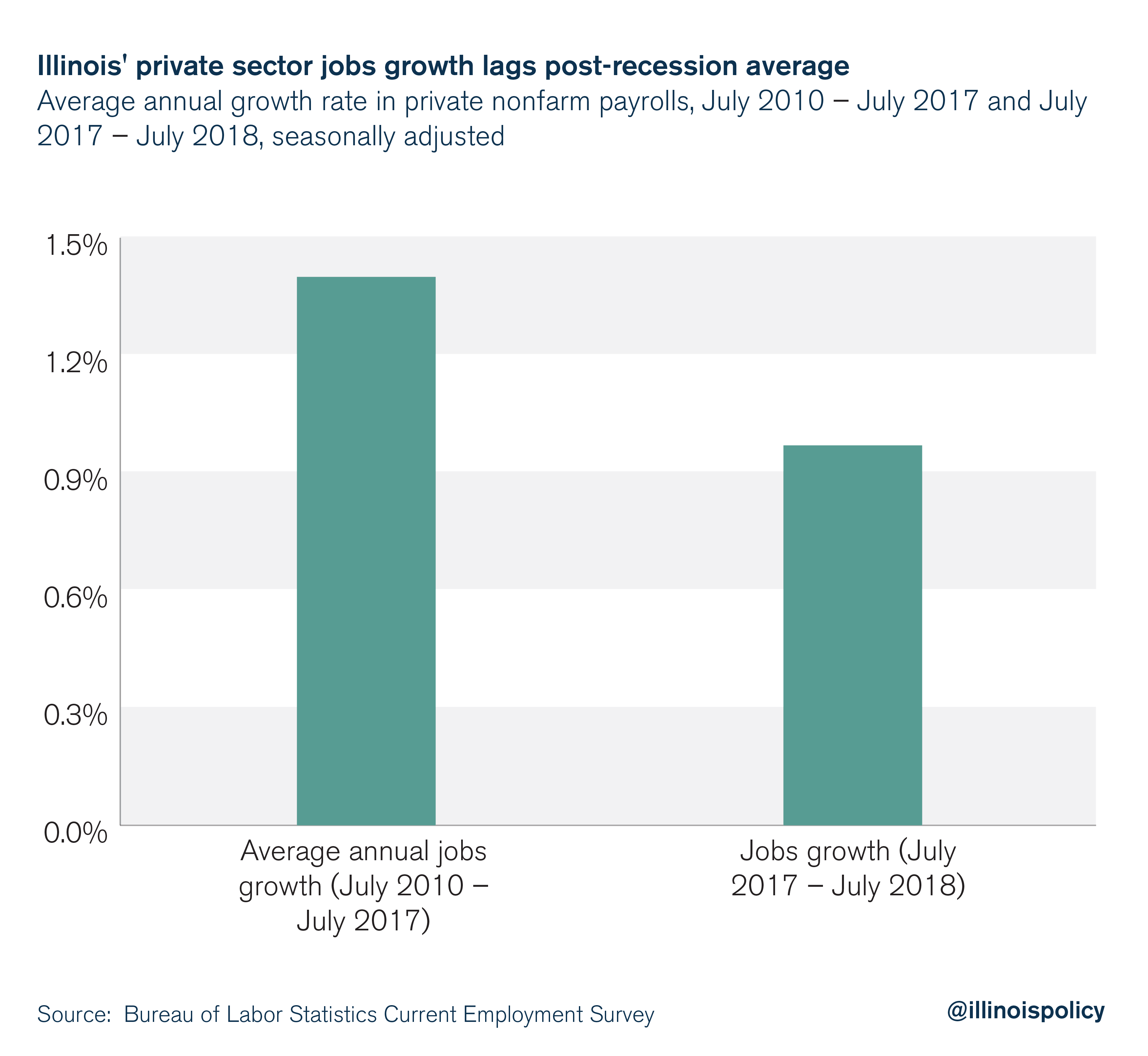

After the Great Recession and before the 2017 tax hike, Illinois ranked 27th in the nation for average annual private sector jobs growth, at 1.4 percent. That’s according to data from the Bureau of Labor Statistics.

But in the year after the tax hike, Illinois’ private sector jobs growth ranked 44th in the nation at 0.97 percent – a 30 percent decline.

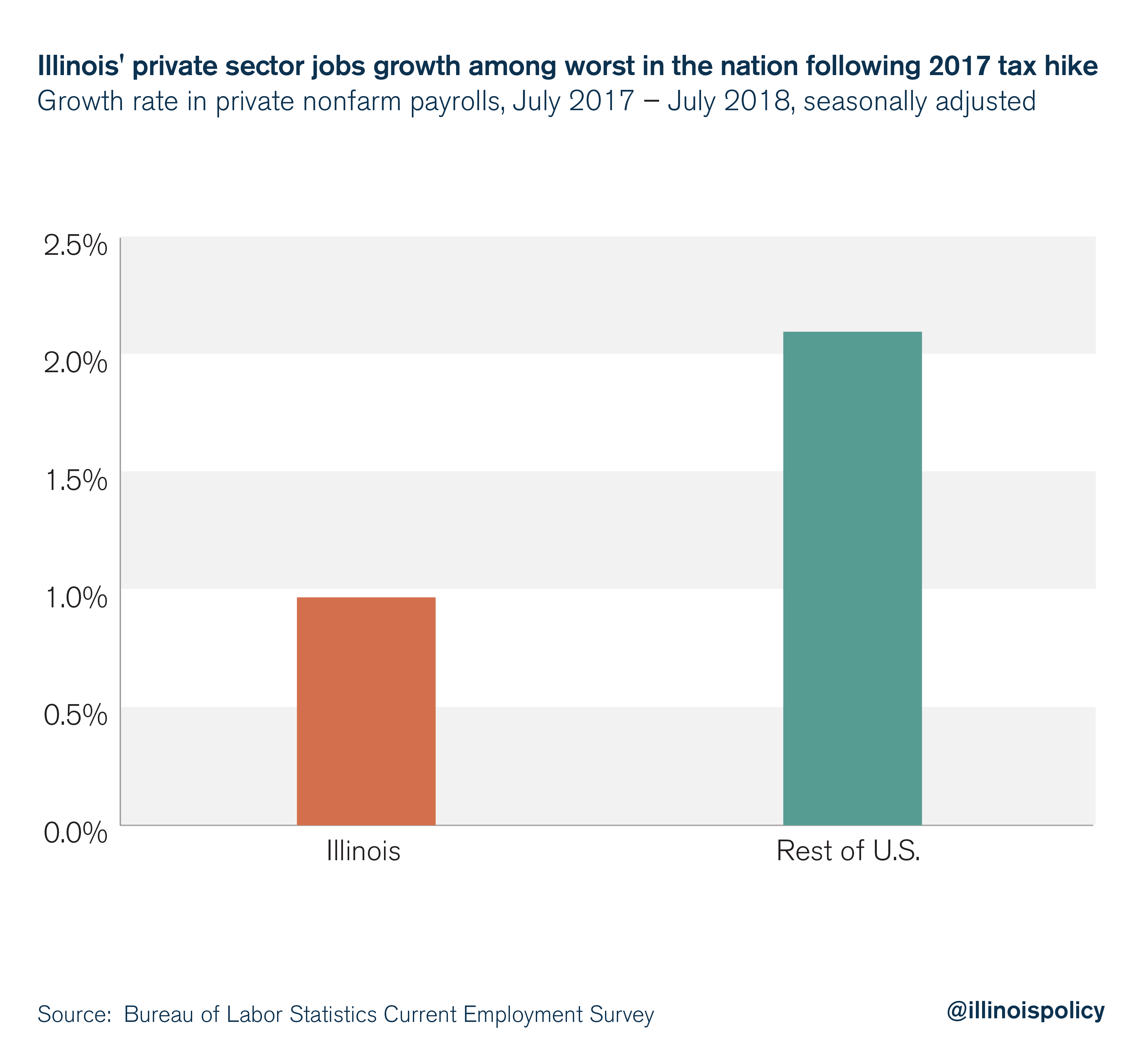

In the year following the 2017 tax hike, Illinois’ jobs growth outside of government was less than half the rate of the rest of the nation, further widening the divide between Illinois and other states.

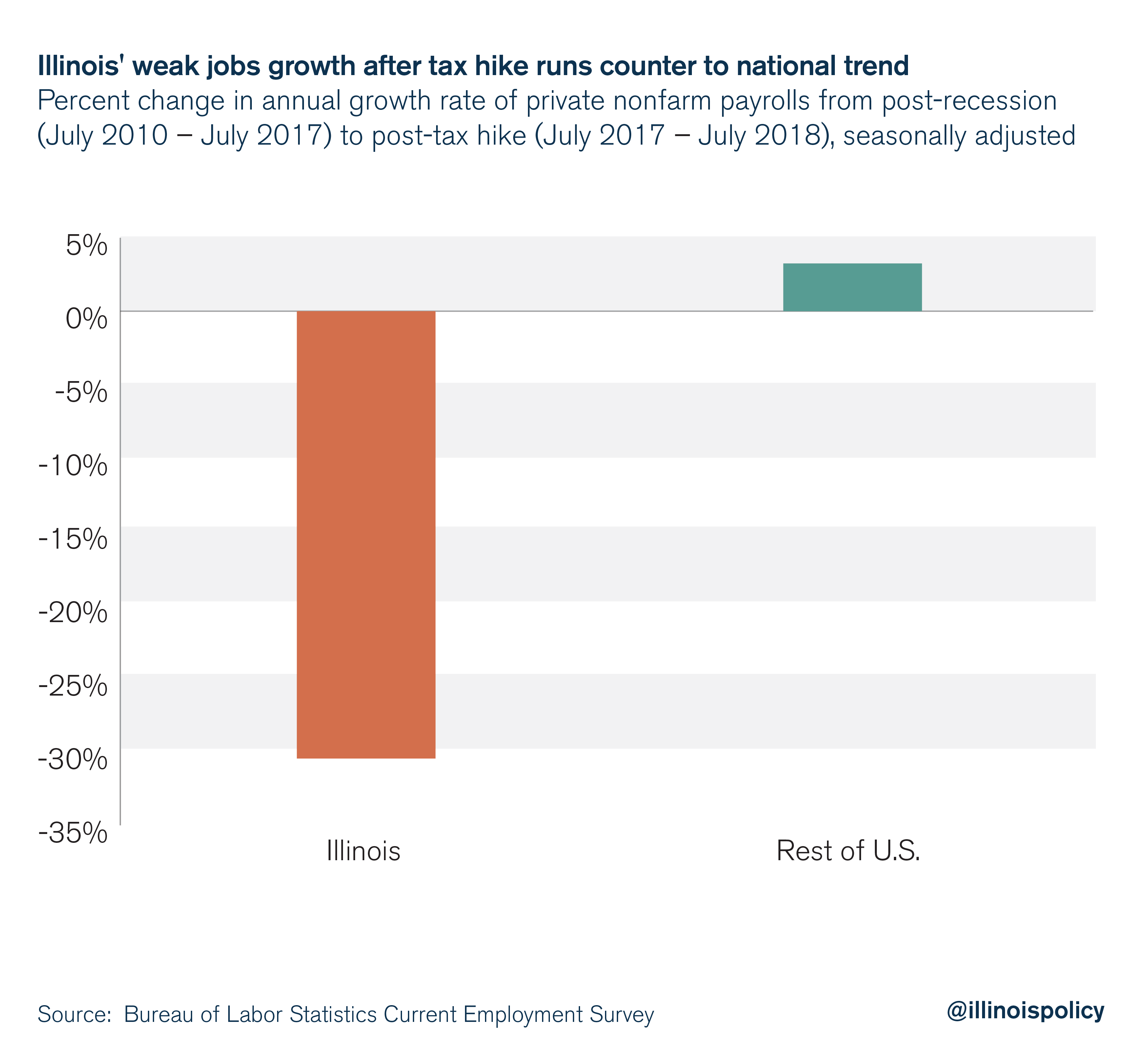

The Land of Lincoln’s decrease in private sector jobs growth relative to the state’s post-recession trend was one of the most extreme in the nation. The rest of the country actually experienced an acceleration in private sector jobs growth, compared with its post-recession trend.

Illinois’ budget impasse may have also been a drag on employment growth, perhaps even more than the tax increase, but passing a budget with the largest permanent income tax hike in state history didn’t improve Illinois’ economic climate.

That’s because state lawmakers made no significant reforms to shore up the state’s fiscal condition, meaning Illinois’ economic future remains uncertain. When businesses perceive more volatility in the economy (whatever the source), they tend to err on the side of higher prices, which result in more inflation, higher markups and less economic activity.

How tax hikes hurt growth

While it’s still too early to estimate the impact of the 2017 tax hike empirically, the employment slowdown is consistent with what experts predicted.

Although tax hikes may initially cause tax revenues to increase, the negative economic effects of the 2017 tax hike will overshadow any benefits of additional revenue in the long run. Higher taxes discourage investment, which results in a decline in worker productivity. Slowing production results in decreased labor demand, wages and employment in the state. It also encourages the tax base to leave, leading to an overall weakening of the Illinois economy.

Politicians often ignore this important tradeoff and fail to account for individuals’ response to changes in tax policy, resulting in further budget shortfalls. By failing to recognize It’s not surprising that Illinois continues to face budget woes while lagging in employment growth, income growth and labor productivity growth.

The 2017 tax hike did not fix Illinois’ financial problems. The state continues to pass unbalanced budgets, digging itself deeper into debt. Meanwhile, higher taxes scare away investment, slowing job growth in Illinois’ private sector.

As long as Illinois continues to brashly spend and requires taxpayers to finance its poor decisions, the state will be unappealing to private sector businesses.

A spending cap could curb Illinois’ irresponsible spending by tying spending growth to Illinois’ long-run economic growth. Instead of outpacing taxpayer incomes, spending would rise proportionally with the state economy, reducing the need for frequent tax hikes.

By providing a barrier against careless spending and its accompany tax hikes, the spending cap could bring stability to Illinois and make the state more inviting for workers and businesses.