Illinois state reps sponsor bills to fix business fees, tax code

Reforms to LLC fees and the corporate franchise tax would be a great start for building a better business environment in Illinois, especially for small businesses and entrepreneurs.

Illinois state Reps. Carol Sente, D-Lincolnshire, and David Harris, R-Mount Prospect, have filed separate legislation to fix the way Illinois charges fees and levies taxes on corporate and noncorporate businesses in Illinois.

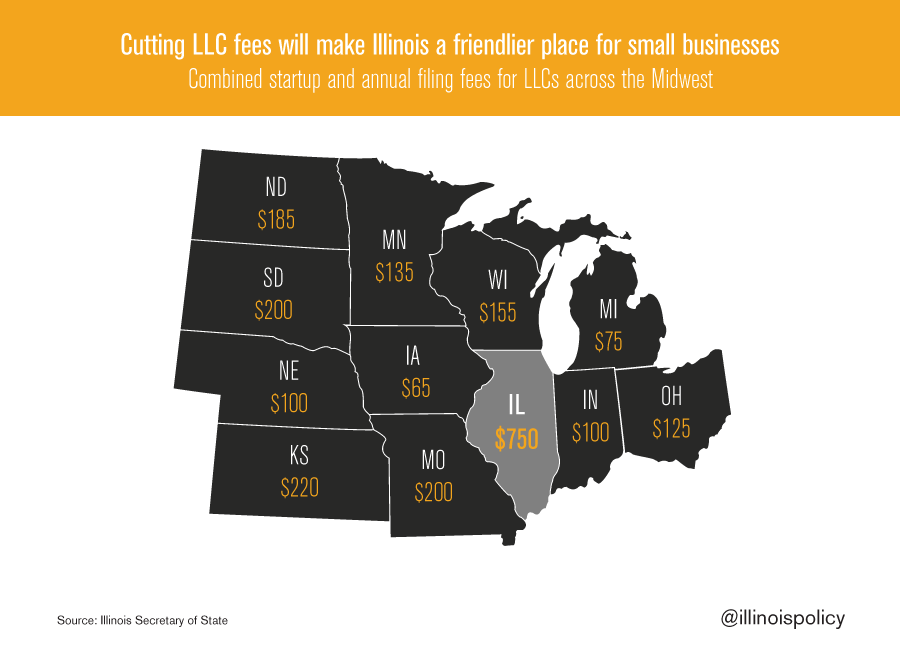

Sente’s bill would reduce startup and annual filing fees for Limited Liability Companies by 70 percent. Currently, Illinois’ combined fee schedule of $500 to start up and $250 to file an annual report is by far the least competitive in the Midwest, and the second-highest nationally.

Sente’s bill would reduce those fees to $150 and $75, respectively, to put them in line with the same fees for Illinois corporations. Reducing the cost to start up would be a tremendous first step for turning around Illinois’ business climate. The bill already has more than 30 co-sponsors, an encouraging sign.

Meanwhile, Harris filed a bill to repeal Illinois’ corporate franchise tax, an anachronistic form of taxation that is being eliminated across the country. The franchise tax is a holdover from the 19th century, before income taxation began. It is levied on the “paid-in capital” of Illinois corporations.

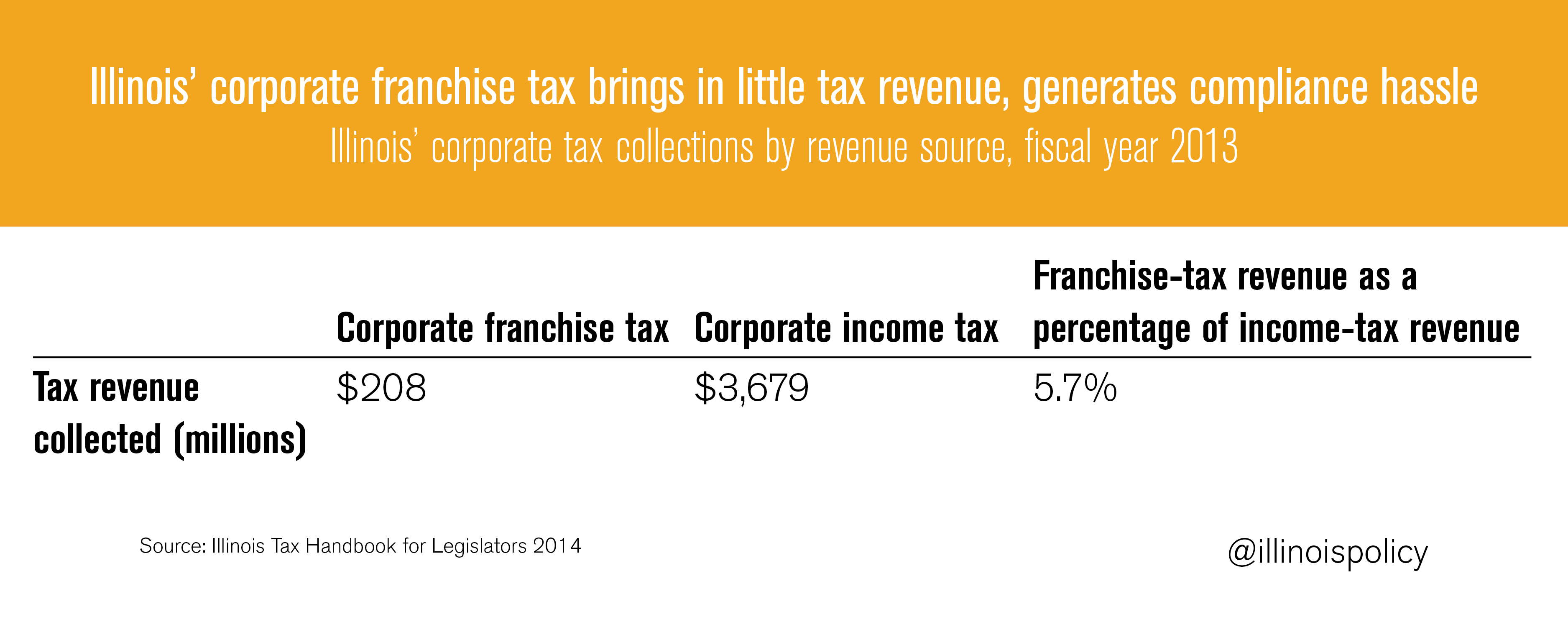

The concept of “paid-in capital” is a cloudy one, which is exactly why this tax needs to be repealed. The franchise tax complicates the corporate code with a formula that is completely different from that of the corporate income tax. This significantly increases the cost of tax compliance, and generates very little revenue for the hassle. In fact, corporate franchise tax revenue amounted to a mere 5.7 percent of corporate income tax revenue in Illinois, as of fiscal year 2013.

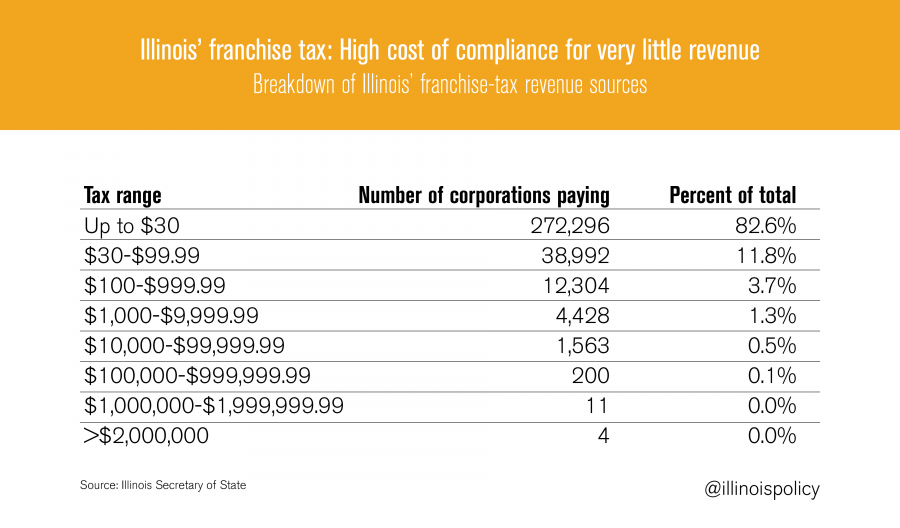

Looking at the breakdown of who pays the franchise tax makes clear what a cost-of-compliance mess this tax is. Out of 330,000 corporations in Illinois, more than 82 percent pay less than $30 per year in franchise taxes, 94 percent of Illinois corporations pay less than $100 per year in franchise taxes, and 98 percent pay less than $1,000 per year. But the tax requires businesses to calculate nonsensical tax formulae and fill out compliance forms, often with the help of accountants and lawyers. The franchise tax is certainly costing these businesses more in compliance than it is raising for the state in revenue.

These reforms to LLC fees and the corporate franchise tax would be a great start for building a better business environment in Illinois, especially for small businesses and entrepreneurs.

These two pieces of legislation, combined with Sente’s bill to bring crowdfunding to Illinois and a bill introduced by State Rep. Ed Sullivan, R-Mundelein, to repeal the death tax constitute the core of a strong agenda for Illinois entrepreneurs for this legislative session.

Image credit: Eric Allix Rogers