Illinois taxpayers on the hook for pension failures

More realistic investment return assumptions by the Teachers’ Retirement System mean Illinois taxpayer contributions to the fund could rise by hundreds of millions of dollars. Ending teacher pension pickups would alleviate the burden on Illinois taxpayers.

Every time you turn around, there’s a new mess in Illinois pensions that ends up costing taxpayers billions. Sometimes it’s corrupt double-dipping that lets government workers tap into multiple pensions. Other times, it’s salary spiking that boosts the multimillion-dollar pensions of superintendents and administrators. Most of the time, it’s politicians treating the pension systems as their own political slush funds. And as pensioners are retiring earlier and living longer, they are soaking up the pension funds even faster than experts had expected. These factors combined have created a $111 billion pension hole – and taxpayers are on the hook for it.

The latest mess involves the state’s largest pension fund, the Teachers’ Retirement System, or TRS. TRS is admitting it can’t reach the lofty investment return targets it has set for itself. Moody’s Investors Service, the Illinois Policy Institute and other groups have criticized the overly optimistic goals for some time. Under more realistic investment assumptions for TRS and the state’s other government-worker pension funds, Illinois’ total pension debt actually amounts to more than $200 billion.

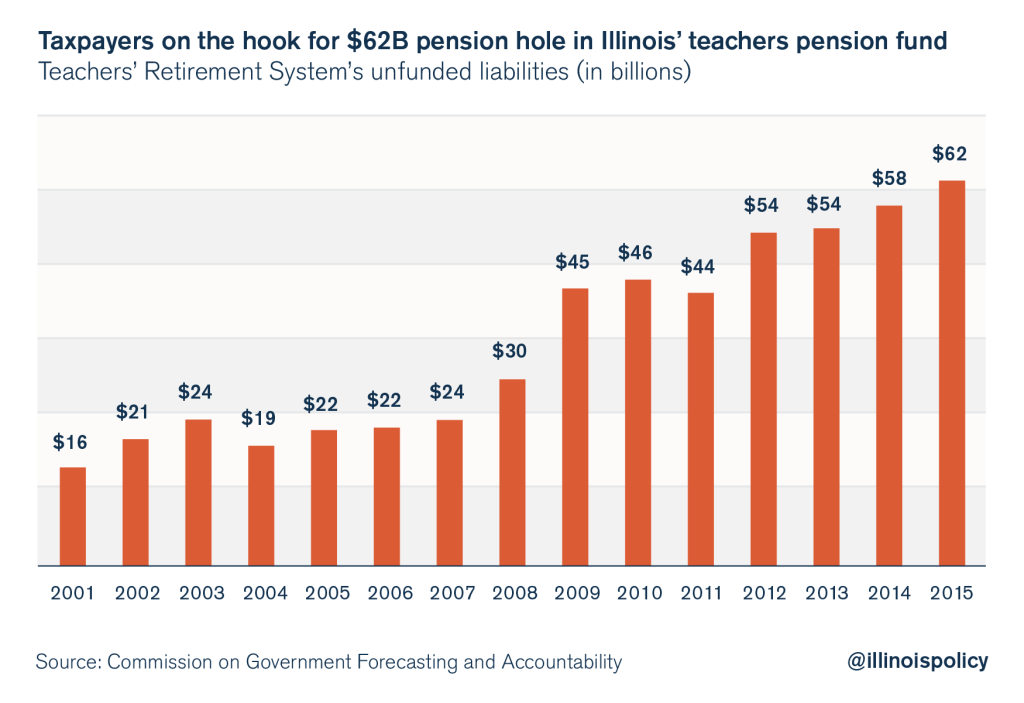

In recent years, TRS has counted on achieving 7.5 percent annual investment returns. But the fund will be undergoing an internal investment review and expects to lower its investment return projections after the study is completed. Because the pension fund offers guaranteed pensions to its retirees, lower assumed investment income going forward means the TRS shortfall, currently at $62 billion, will grow. If expected investment returns are cut to 7 percent, the shortfall will rise by approximately $6 billion.

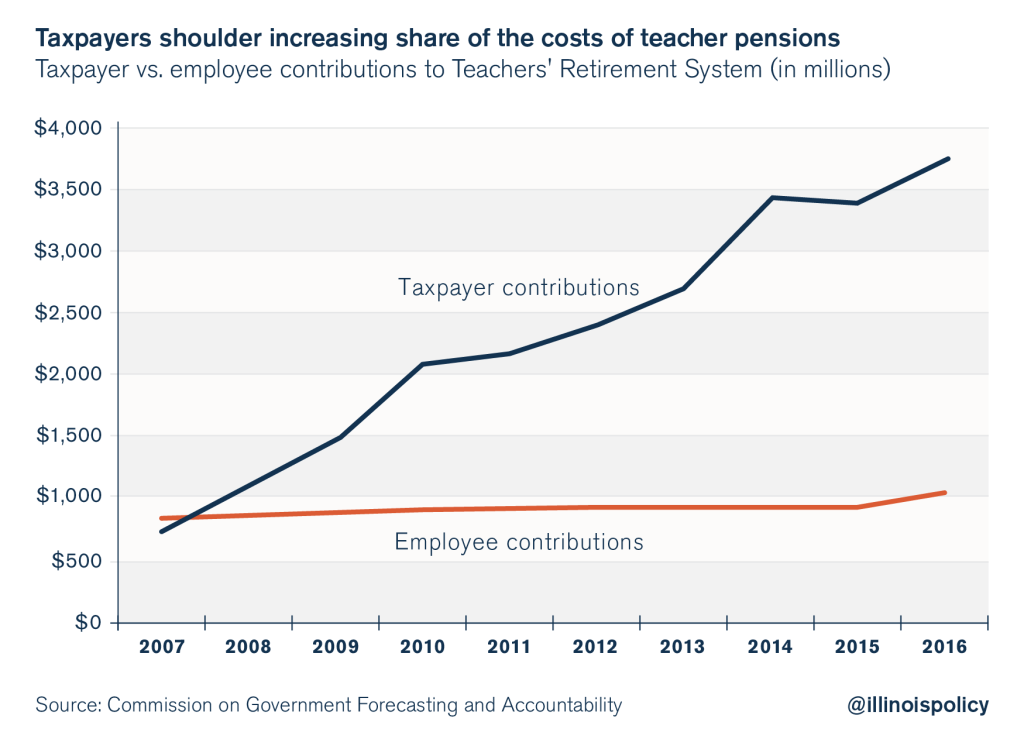

And as usual, politicians won’t want to address the real problem – the failures of defined-benefit plans. Nor will state workers share in the consequences. Instead, politicians will ask taxpayers to prop up pensions through ever-higher income and property taxes. The TRS changes alone mean taxpayer contributions could rise by as much as $500 million, depending on how much the investment return rate is reduced. When TRS lowered the investment return rate by half a percentage point in 2015, state taxpayer contributions increased by $200 million.

But there is a way for teachers to share in that cost – a way that is fair and that complies with the Illinois Constitution’s pension-protection clause: Teachers should pay their fair share toward their own pensions.

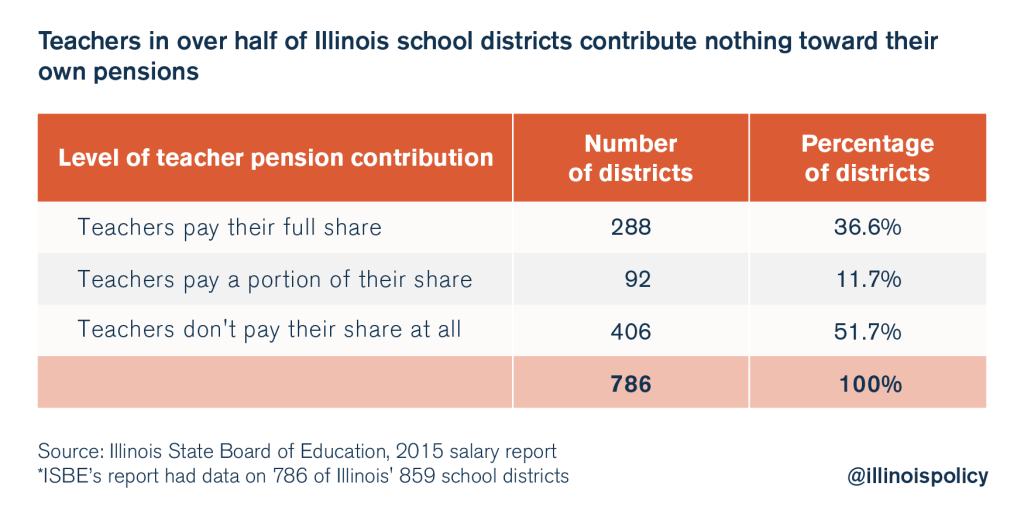

Today, teachers in half of Illinois’ school districts don’t contribute toward their own pensions at all – school districts, meaning taxpayers, pick up that entire cost as an added benefit for teachers.

Teachers in another 12 percent of school districts pay only a small portion toward their pensions.

This practice, referred to as pension “pickups,” cost downstate taxpayers at least $380 million in 2015. (Nearly 100 school districts did not report whether or not they pick up their teacher pensions in the Illinois State Board of Education’s annual salary report, meaning the costs of pickups may be even higher.) In Chicago, which has its own teachers pension fund, the school district’s teacher pickups cost city residents a separate $134 million a year.

The end result is that many teachers pay little to nothing toward their pensions while taxpayers are getting hit by pension failures on three sides. First, taxpayers pay the state’s employer pension contribution through income taxes. Second, many pick up their teachers’ required contributions through local property taxes. And finally, taxpayers have been solely responsible for bailing out the billions in pension failures.

Ending teacher pickups across the state – by requiring teachers to pay their full 9.4 percent of their salaries – will go a long way toward offsetting the cost of the TRS investment return reductions.

The only real solution to the pension crisis is to move away from the broken pension funds entirely. New teachers should be given 401(k)-style retirement plans and optional 401(k)-style plans should be offered to current workers.

Illinois needs these structural pension reforms. In the meantime, the state should stop placing the entire pension burden on the backs of taxpayers.