Income of out-migrants from Illinois jumped by $8,000 in first year of 2011 income-tax hike

Illinois’ tax hikes and anti-growth regulatory environment drive away taxpayers and businesses

Illinois needs to reverse its financially ruinous out-migration trend. Here’s how it works: As a result of Illinois’ tax increases and anti-growth regulations, people and businesses flee the state, which leads to a reduced tax base. To make up for the loss in revenue, politicians impose even higher taxes on the remaining taxpayers. Those who can get out, leave; those who can’t must remain to shoulder the increased tax burden.

New data from the IRS show that for the first year of the 2011 tax hike, the average income of people leaving Illinois jumped by $8,000 compared to the year before. If Illinois continues losing higher-income workers and business owners, the tax base will shrink still further, leaving fewer and fewer Illinoisans to pay the state’s mounting expenses.

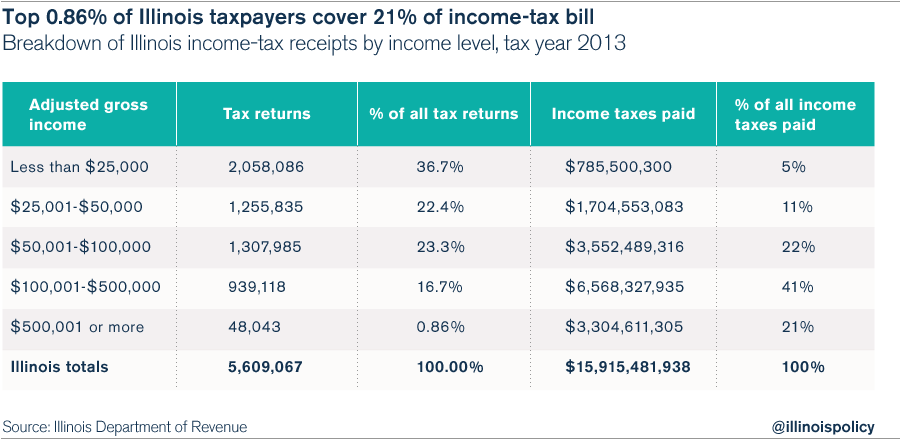

Less than 1 percent of all taxpayers cover 21 percent of all income taxes paid. That’s $3.3 billion of income taxes paid by the 48,000 taxpayers who earn more than $500,000 per year. In addition, 62 percent of the total income tax bill is paid by those who earn more than $100,000 per year, less than 18 percent of all taxpayers.

At the current pace, Illinois loses, on net, 48,000 taxpayers every two years. At the top end of Illinois’ income tax distribution, 48,000 taxpayers pay 21 percent of all income taxes in the state. If Illinois loses too many taxpayers, especially those at higher incomes, there will be no solution to the state’s fiscal problems.

Addressing this issue requires regulatory reform and a long-term, pro-growth tax plan.

With workers’-compensation and tort-liability costs driving manufacturers out of the state, Illinois is losing blue-collar opportunities and exporting its middle-class tax base. Enacting workers’-compensation reform and tort reform would help stem the tide of outbound businesses and jobs.

Illinois also must stop relying on the same income- and property-tax hikes that impel higher-income earners to leave the state. An immediate property-tax freeze would be a helpful first step. Over the long run, Illinois needs to control major costs such as pensions and Medicaid, which are major drivers of the income-tax hikes.

Gov. Bruce Rauner has legislative proposals pending that would address these issues. The General Assembly should enact these reforms. Until it does, Illinois residents will continue to see neighbors packing up for other states, leaving the Land of Lincoln less vibrant and wealthy.