Income report shows Illinois staggering along with nation’s worst income growth

Illinois’ 32 percent income tax hike will steal nearly an entire year’s worth of income growth from Illinoisans.

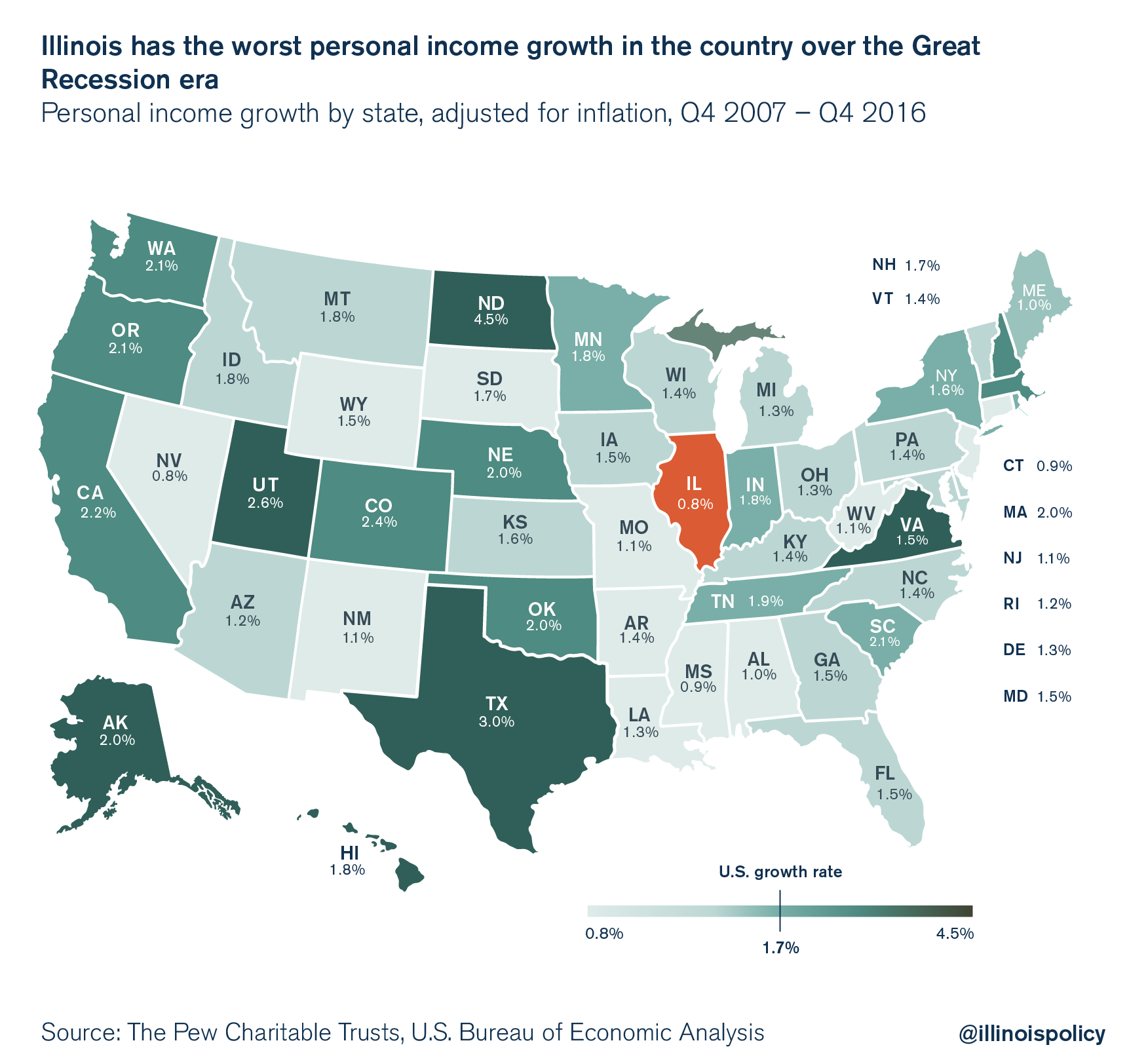

Illinois has seen the nation’s worst personal income growth over the Great Recession era. And the Land of Lincoln isn’t experiencing any improvement, according to new data from the U.S. Bureau of Economic Analysis.

Illinois’ income growth is so weak because jobs growth is lagging, paycheck growth is small and too many wage earners are leaving the state – and taking their earning power with them.

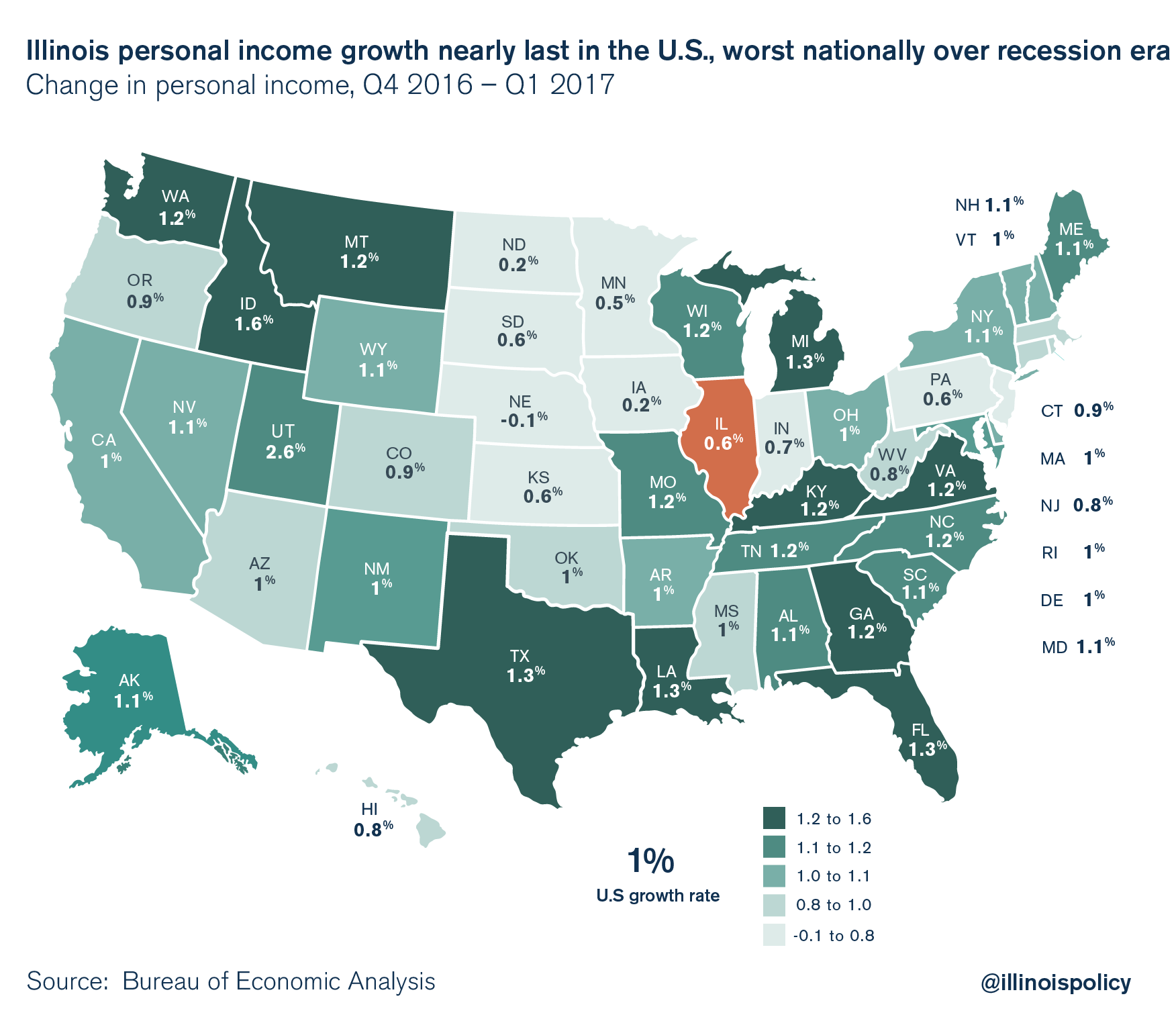

Illinois’ personal income growth for the first quarter of 2017 was only 0.6 percent, placing Illinois 45th out of 50 states for income growth in the first quarter.

Illinois’ personal income growth does not translate directly into gains in real buying power. That’s because inflation reduces the buying power of a dollar over time. Inflation is running at 1.9 percent per year, or just under 0.5 percent per quarter.

Therefore, personal income grew by 0.6 percent in Illinois, while at the same time inflation is running nearly 0.5 percent per quarter. In other words, Illinois experienced almost no real personal income growth in the first quarter of 2017.

Furthermore, Illinois was previously tied with Nevada for the worst personal income growth over the Great Recession era, from the fourth quarter of 2007 through the fourth quarter of 2016. But in the first quarter of 2017, Illinois’ income grew by 0.6 percent while Nevada’s grew by 1.1 percent. As a result, the tie is likely broken and it is only a matter of time before Illinois is left clearly standing alone with the worst personal income growth in the U.S. over the recession era.

Illinois experienced a real personal income growth of only 0.8 percent per year from the fourth quarter of 2007 through the fourth quarter of 2016.

Economic growth and income growth are incredibly weak in Illinois, which is one of the primary reasons Illinois experiences repeated budget crises.

In fact, Moody’s Investors Service pointed to Illinois’ weak income growth as one of the reasons why Illinois might be downgraded regardless of whether a budget and tax hike are enacted. Weak income growth means weak tax revenue growth. In the words of Moody’s analysis:

“The state’s baseline tax collections declined in fiscal 2017, suggesting that any tax increase may yield less revenue than anticipated in coming months.”

Indeed, data from Illinois’ Commission on Government Forecasting and Accountability estimate that tax revenues are down year over year. This should be extremely concerning to policymakers and lawmakers, and it speaks to Illinois’ extraordinary financial vulnerability that will be exposed in the next recession.

Given that Illinoisans have seen the worst income growth over the recession era it is ironic that lawmakers have chosen to repeatedly raise income taxes. Illinois’ 32 percent income tax hike will steal nearly an entire year’s worth of income growth from Illinoisans. And the 32 percent income tax hike comes on top of high local burdens in the form of property taxes and sales taxes, which have also gone up in many parts of the state.

In short, don’t expect much new spending or economic growth in a state where incomes are barely growing, and where the little growth that does occur is being skimmed off the top by government. Illinoisans need a government that is far more affordable, and one far less determined to raid residents’ income growth and economic growth.