Madigan tax proposal would hit small businesses

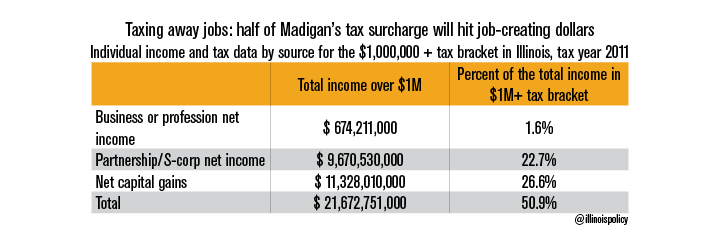

One-quarter of the revenue generated by Madigan's surcharge comes directly from small businesses.

Internal Revenue Service data from 2011 shows that $42.7 billion of adjusted gross income would be subject to House Speaker Mike Madigan’s proposed 3 percent “millionaire’s” surcharge. One-quarter of that amount comes directly from small businesses that create jobs. Another quarter of that amount is from investment returns that create jobs.

Small business growth and investments are two things the state desperately needs – after all, they are the engine and fuel of state job creation.

People and businesses in Illinois’ top income bracket have the resources and the motivation to relocate to states with more hospitable business and tax environments.

Illinois workers should fear what more of Madigan’s plans will mean for the state’s anemic economy. Many Illinoisans will be forced to join the 1.25 million people the state has lost during the Madigan net out-migration. And those who must stay should prepare to shoulder the growing bill for Illinois’ debt and pension liabilities.