May jobs report: Illinois loses 2,500 payroll jobs, workforce shrinks by 9,100

Weak jobs numbers across the Midwest reflect the possibility of an oncoming economic slowdown. In fact, it would not be surprising to face a recession in the upcoming months, given that U.S. jobs growth has been weakening, and it has been seven years since the previous recession ended – a long period of expansion by historical norms.

Illinois’ need for economic reforms and a more friendly jobs environment is clear given the state’s long-running trend of weak job creation and lost opportunities. Illinois’ May jobs report is in line with Illinois’ longer-term trend, showing month-over-month job losses and workforce dropout.

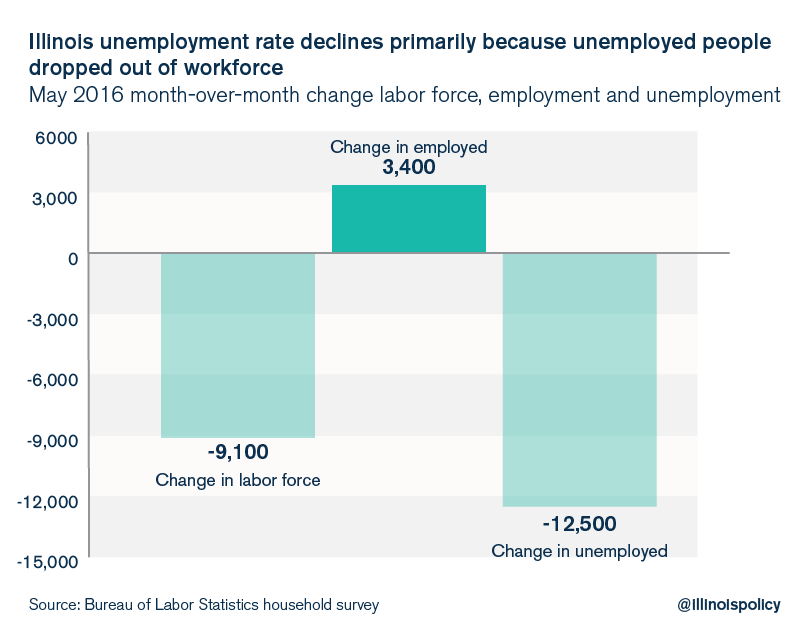

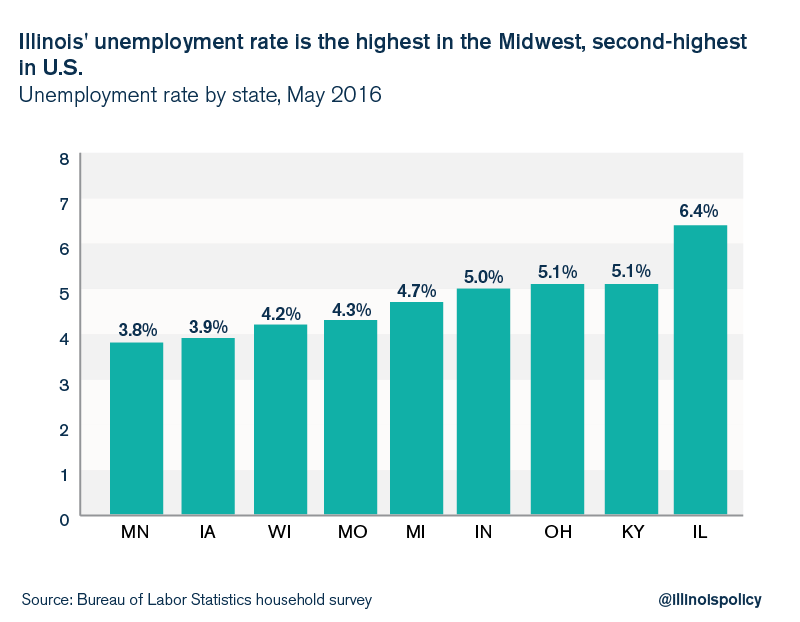

Illinois lost 2,500 payroll jobs in May, and the unemployment rate fell to 6.4 percent from 6.6 percent in April, according to data from the Illinois Department of Employment Security, or IDES. However, the drop in the state unemployment is a mixed indicator. The primary reason the unemployment rate fell in May was because a net of 9,100 unemployed Illinoisans dropped out of the workforce. Illinois now has the second-highest unemployment rate in the country, better than only Alaska’s 6.7 percent rate.

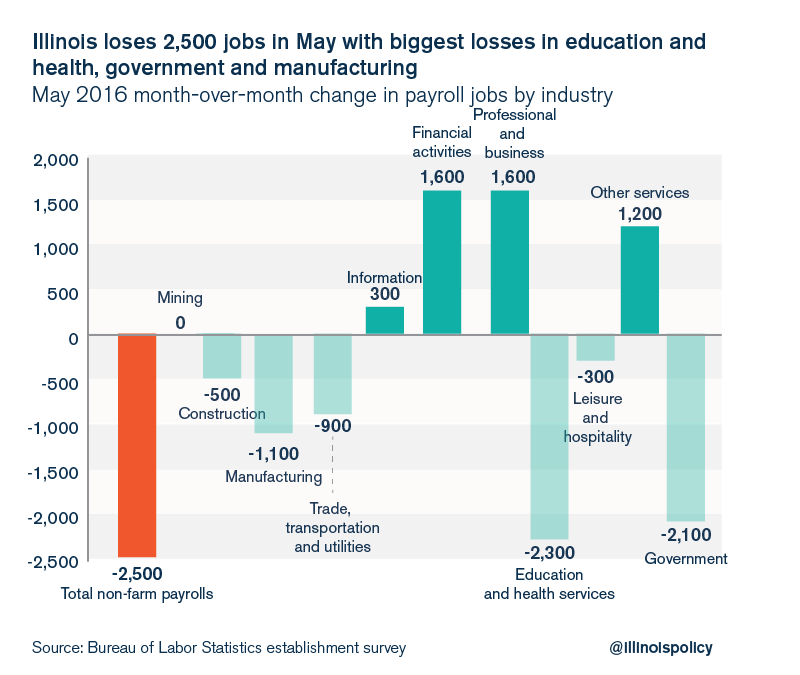

The net loss of 2,500 payroll jobs in May was driven by larger losses in education & health services (-2,300); government (-2,100) and manufacturing (-1,100). Jobs sectors that showed gains in May included financial activities (+1,600), and professional and business services (+1,600). However, sectors with job losses outweighed sectors with job gains, which resulted in Illinois’ net loss of 2,500 jobs on the month.

The state’s unemployment rate dropped to 6.4 percent because the number of jobless Illinoisans decreased by 12,500 in May. Of the 12,500 fewer people counted as unemployed, 9,100 can be attributed to workforce dropout while only 3,400 can be attributed to finding employment.

Regional comparisons

Illinois’ 6.4 percent unemployment rate is by far the highest of surrounding states, and much higher than the national average of 4.7 percent. Unemployment rates for surrounding states range from 3.8 percent in Minnesota to 5.1 percent in Ohio and Kentucky.

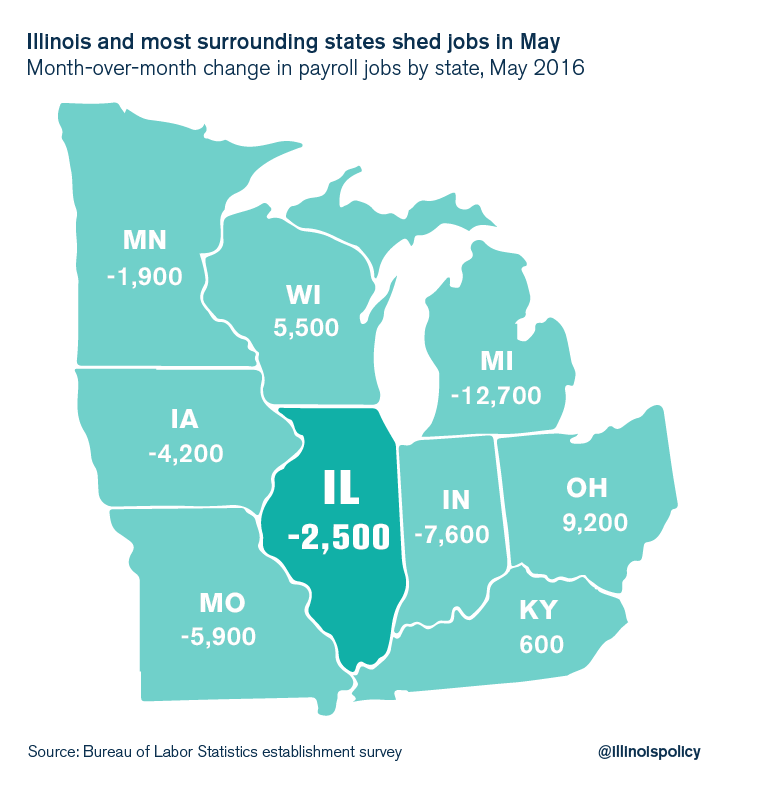

Most surrounding states lost jobs in May, marking a negative sign for regional strength. Michigan and Indiana, which have been job-creation leaders for several years, lost 12,700 and 7,600 jobs, respectively. Only Ohio (+9,200) and Wisconsin (+5,500) showed modest jobs strength in May.

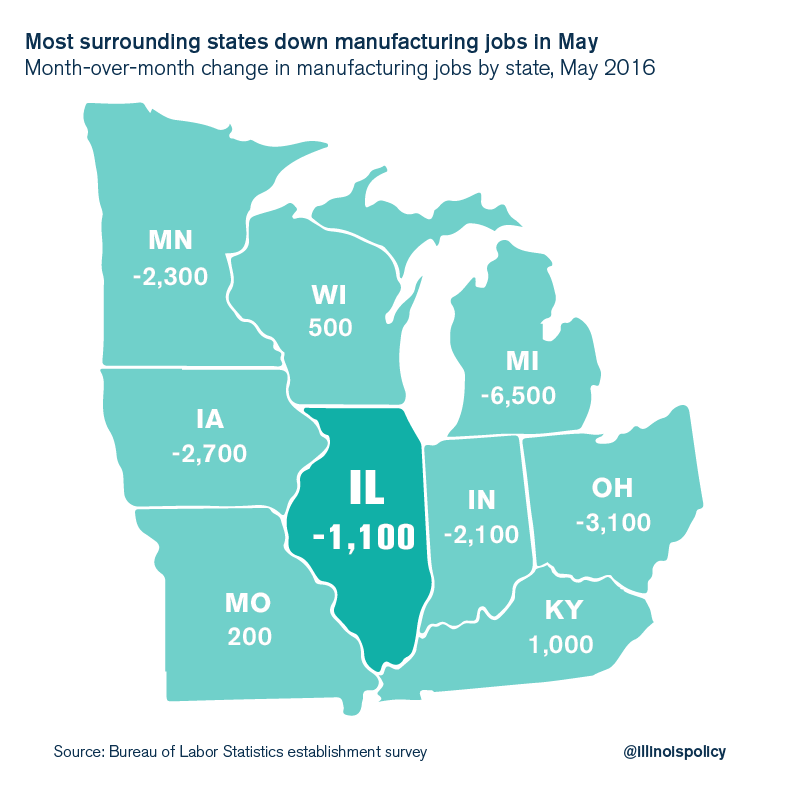

On the manufacturing front, Illinois lost 1,100 jobs on the month, putting the state down 2,200 factory jobs on the year. Most surrounding states shed thousands of manufacturing jobs in May, with Michigan losing 6,500, Ohio losing 3,100 and Iowa losing 2,700. Kentucky (+1,000) and Wisconsin (+500) showed modest gains for the month. These manufacturing payroll numbers reflect other surveys that have recently shown a generally weakening industrial economy in the Midwest.

These weak numbers across the Midwest reflect the possibility of an oncoming economic slowdown. In fact, it would not be surprising to face a recession in the upcoming months, given that U.S. jobs growth has been weakening, and it has been seven years since the previous recession ended – a long period of expansion by historical norms.

Since the Great Recession ended, the states around Illinois have proved much more adept at changing economic policies and encouraging jobs growth, especially to attract industrial jobs. For example, since the last recession ended, Illinois’ manufacturing job count is up only 3.7 percent, while surrounding states have done multiples of that growth rate.

Broad structural reforms are needed to strengthen Illinois’ economy and reverse Illinois’ cycle of the region’s worst jobs growth. Illinois families deserve the opportunity to rise and be rewarded for their hard work. Generating strong jobs growth takes time, economic policy reform, and stability of governance and taxes. The better long-term jobs growth and lower unemployment rates in surrounding states indicates that most of Illinois’ neighbors have gotten their houses in order, while Illinois hasn’t.

Two policy levers to pull to improve economic outcomes are tax reform and regulatory reform.

Tax reform should start with Illinois’ property-tax system to relieve overburdened industrial property owners and homeowners. In addition, Illinois’ overall tax burden is too high and needs to be brought down over time through spending reforms. Furthermore, a taxpayer bill of rights, as has been achieved in Colorado, would give taxpayers a say in whether their taxes go up.

Regulatory reform of the state’s workers’ compensation system, occupational-licensing requirements, lawsuit environment and labor markets would dramatically improve employment opportunities, especially in blue-collar industries that are more affected by Illinois’ heavy regulatory burden.

Illinois would do well to prepare for the possibility of an upcoming recession and position itself to thrive in future periods of economic growth.