Pension costs push Metro East property taxes up, as population shrinks

Residents in Illinois’ Metro East area are fleeing a growing property tax burden, fueling regional population loss.

Illinois’ Metro East area is no exception to the state’s people problem, as rising property taxes driven by growing pension costs encourage residents to plant roots elsewhere.

Take the area’s two biggest counties: Madison and St. Clair, both of which have seen their populations shrink – while their property tax burdens grow.

Property tax pain

In Madison County, homeowners pay an average effective property tax rate – or taxes paid as a percentage of home value – of 2.12%, according to ATTOM Data Solutions. That’s nearly double the national average of 1.16%. St. Clair County homeowners pay an even higher effective rate at 2.49%, over twice the national average.

Despite declining home values in St. Clair County, the percentage of those values homeowners pay in property taxes is growing. The price of the average home in St. Clair fell by nearly $11,000 between 2016 and 2018, and trails that of Madison by nearly $16,200. Meanwhile, average effective property tax rates spiked by nearly 16% during that time.

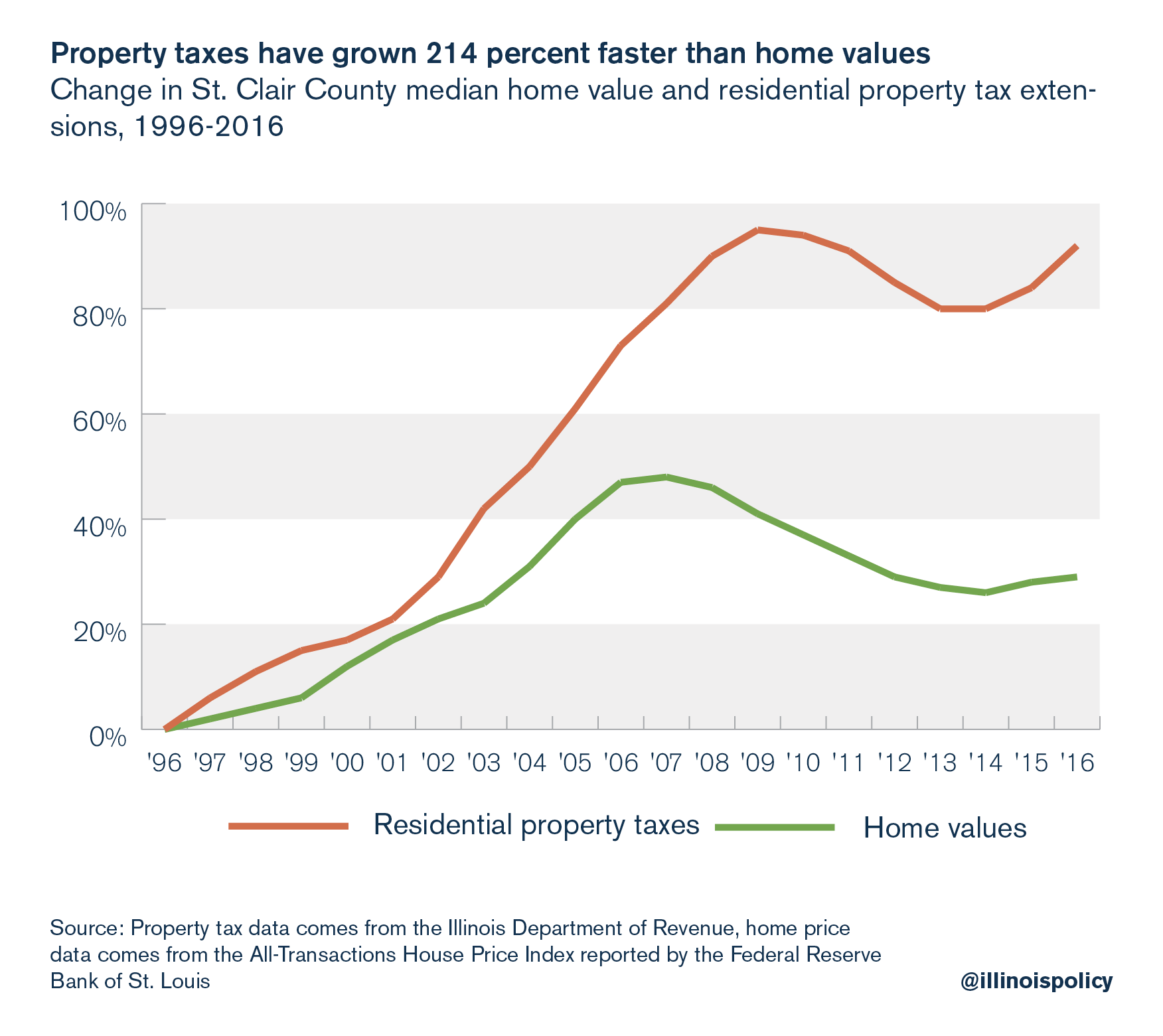

Unfortunately, this is not a new problem for St. Clair County: Since 1996, property taxes have nearly doubled, and have risen 214% faster than home values, which have struggled to recover since the Great Recession.

People problem

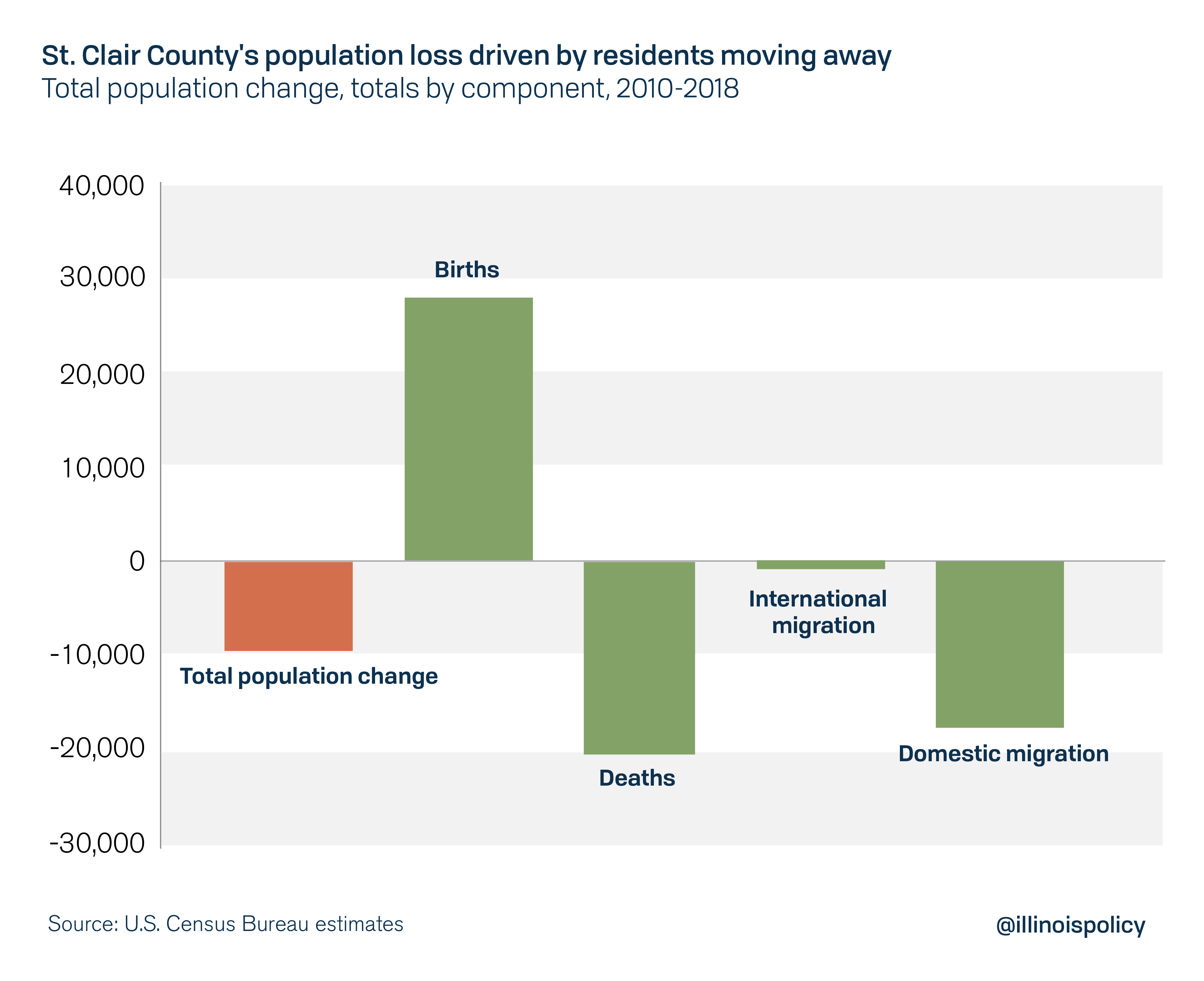

St. Clair County ranks fifth nationally for population loss, among counties of 250,000 residents or more. Since 2010, the county has lost 9,300 residents, or 3.4% of its population.

Despite experiencing natural population growth – or births outpacing deaths – the number of residents lost due to both domestic and international migration more than offset those gains.

Madison County has also seen its share of residents leave for greener pastures. The county has lost nearly 5,000 over the last decade, which places them 15th in the nation for population loss.

With effective property tax rates around double the national average, it’s no wonder the Metro East has seen among the most severe population loss in the nation. And as more taxpayers disappear, those who stay must endure an even larger property tax burden.

Across the river in Missouri, nearby St. Charles and Jefferson counties have seen their populations grow. Metro East residents have easy access to a more affordable life in Missouri.

Pension pressure

What’s causing Metro East property taxes to skyrocket? Growth in pension costs for government workers is the main culprit. Most residents expect their property tax dollars to go toward funding core services, but rising pension costs are crowding services out of local budgets.

In St. Clair County, for example, pension costs captured 92% of property tax dollars reserved for police departments in 2016. That leaves only 8% of those funds for protective services. Although police department spending has grown overall, funds flowing to police pensions have grown 18 times faster those devoted to public safety services.

Fire departments in St. Clair County face a similar problem, with 71% of property tax dollars in 2016 going to pensions rather than public safety services.

Illinois’ pension crisis has left residents paying more in property taxes and receiving less in services, as funds increasingly go toward shoring up an unsustainable pension system. St. Clair County is just one more example of how rising pension costs put pressure on local communities, and drive residents away.

Without constitutional pension reform pursued at the state level, high property taxes will continue to drive Illinoisans in the Metro East and elsewhere to resettle in more temperate tax climates.