St. Clair County property taxes nearly doubled over last 20 years

Property taxpayers in St. Clair County have seen home values swamped by property taxes over the past 20 years.

When property tax bills hit mailboxes in May, taxpayers in St. Clair County received a rude reminder of their home state’s punishing property tax burden. What many property taxpayers don’t realize, however, is that an ever-increasing share of those bills are going toward pension benefits for local government workers far more generous than they’re likely to see in their own retirements.

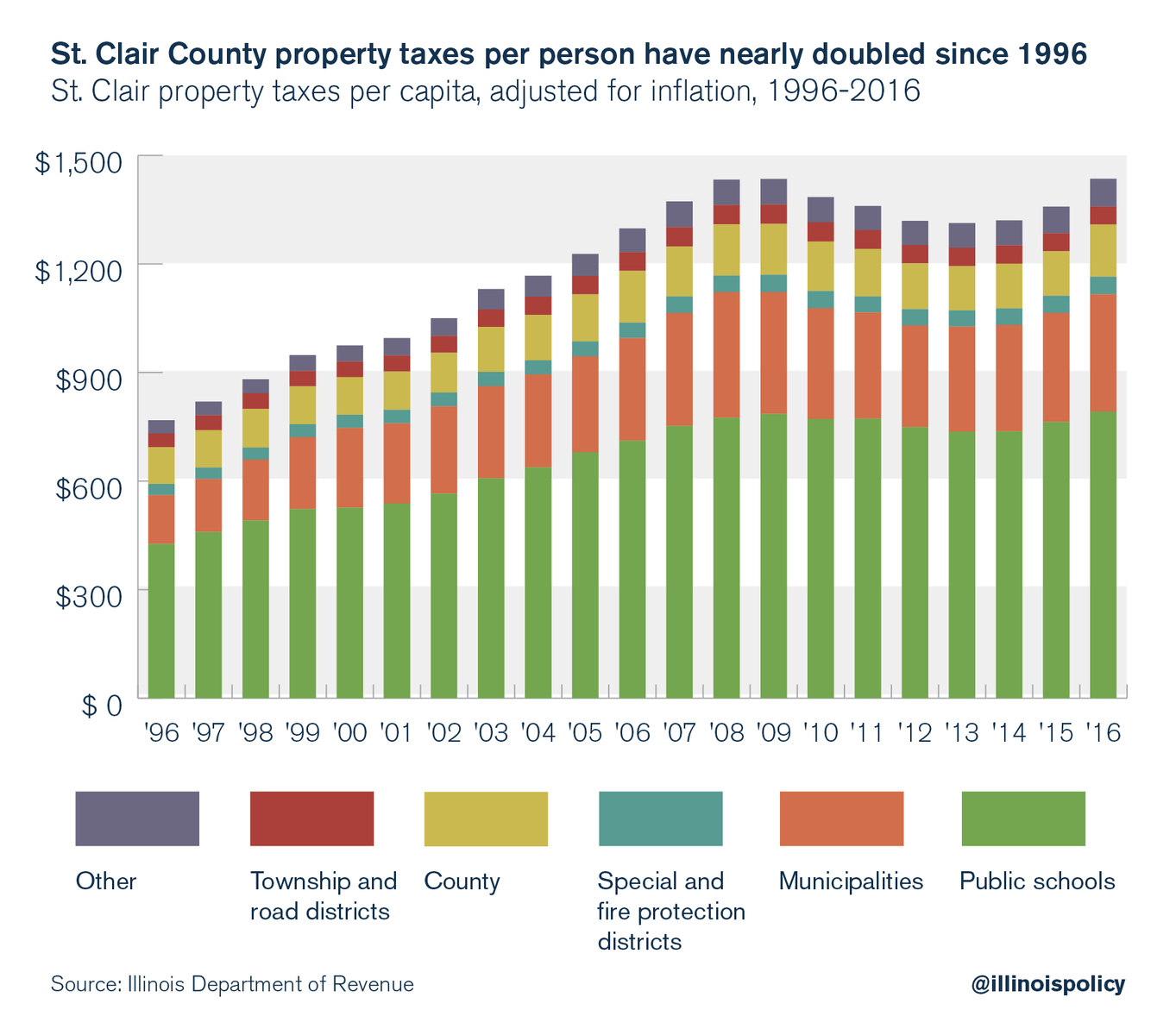

In St. Clair County, property taxes have nearly doubled since 1996, amounting to an increase of nearly $665 per person.

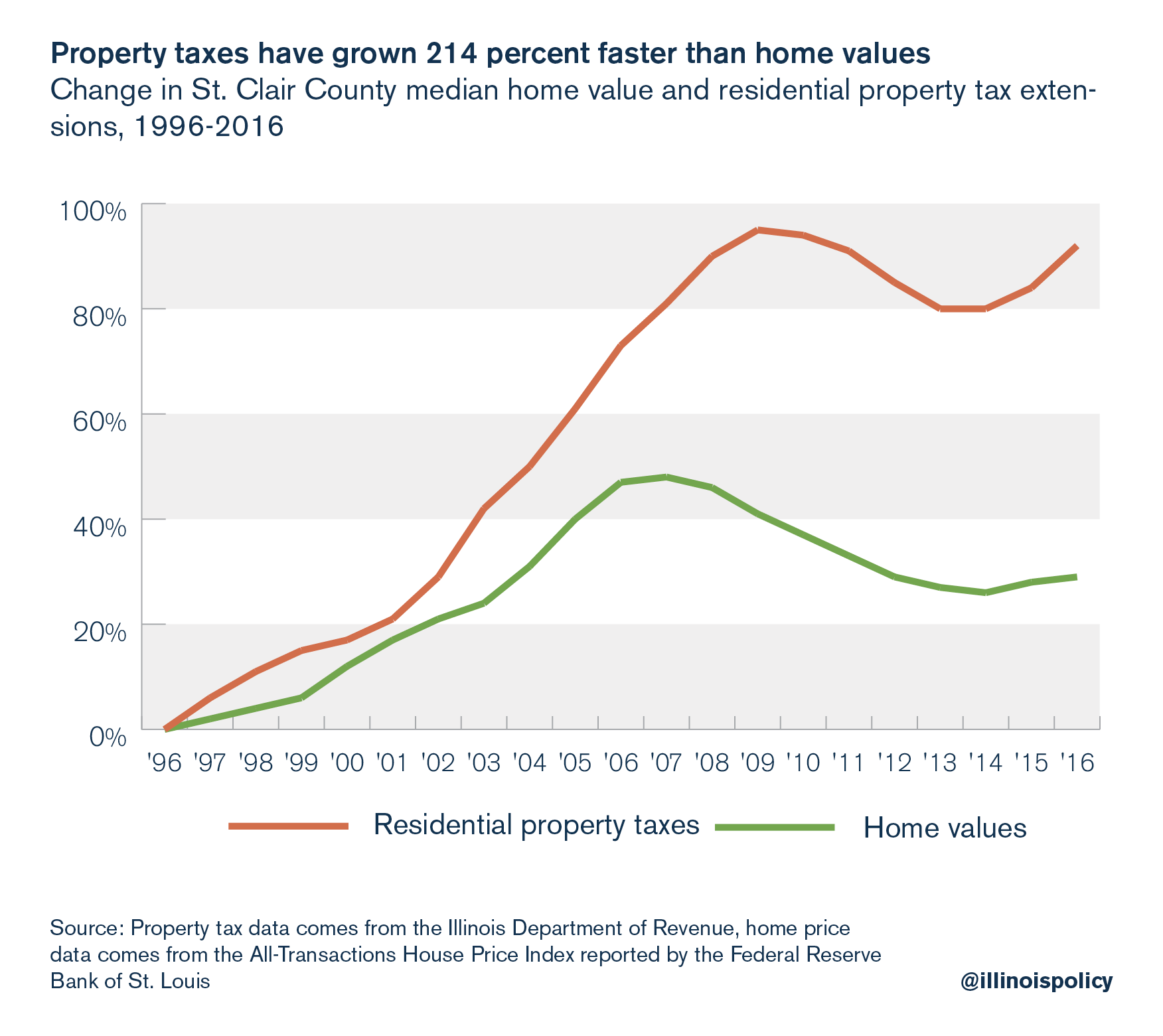

It’s true that property tax increases aren’t automatically indications of crises. Increases in property taxes might even benefit home values, provided new funds are directed toward better government services. But that’s not the case in Illinois, where less than 50 cents of every new property tax dollar raised since 1996 has gone toward public services. Instead, most of those levy increases have been driven by ballooning pension costs.

In St. Clair County, it’s clear taxpayers aren’t getting a bang for their property tax buck. Residential property taxes in the county have outgrown median home values by more than 200 percent over the last 20 years.

Records from the Illinois Municipal Retirement Fund, or IMRF, show several St. Clair County local government pensioners collecting annual benefits near $100,000 – with at least two former officials having already accumulated more than $1 million over the course of their retirements.

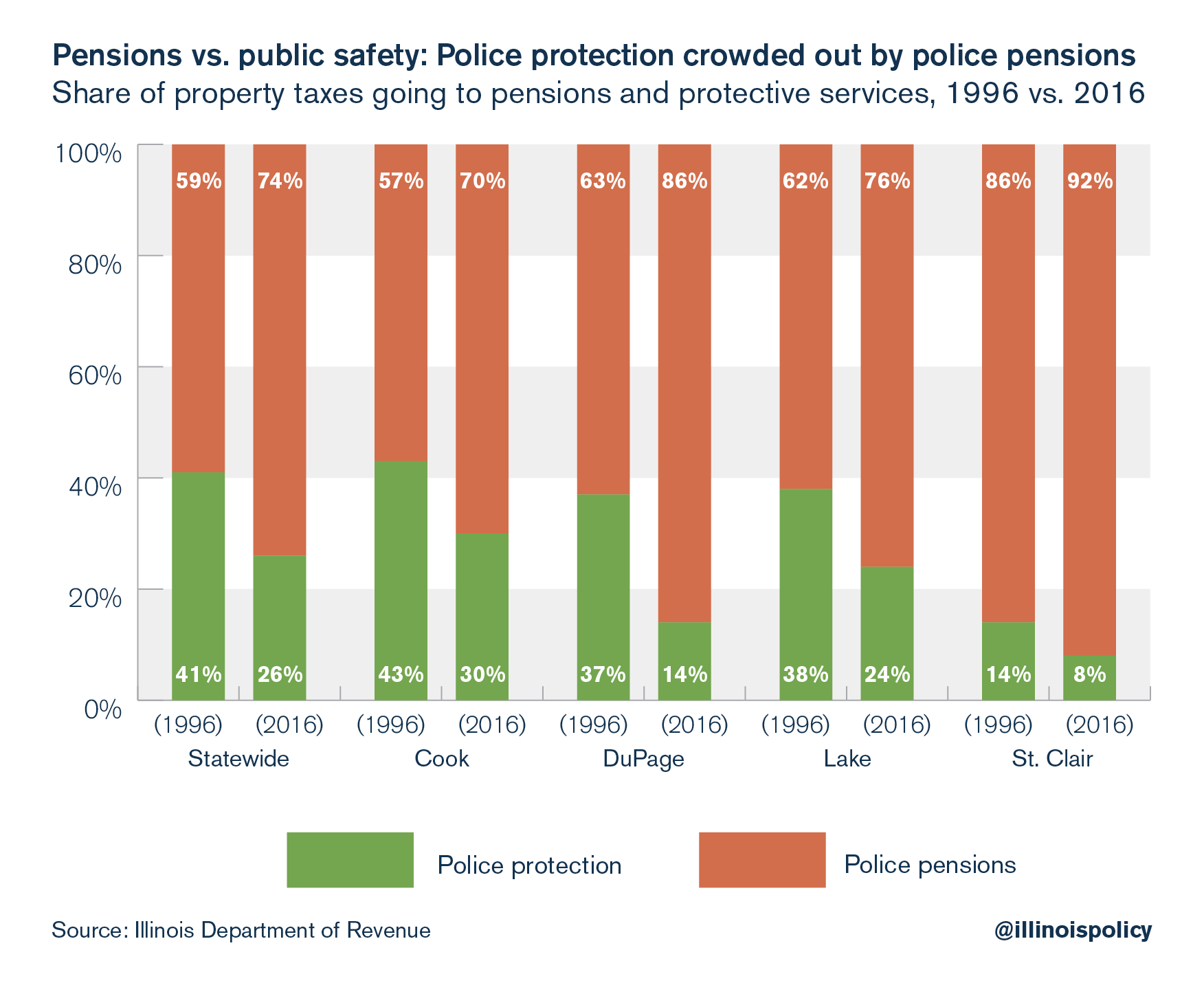

In line with the statewide trend, rising property tax bills in St. Clair County are being diverted from core services to keep pace with pension costs. This isn’t a new development: In 1996, 85 cents of every property tax dollar for municipal police departments in St. Clair County went toward police pensions rather than police protection. Since then, municipal police departments in the county have increased their property tax levies by more than $5.5 million, with 95 percent of that growth attributable to pension costs. As of 2016, 92 cents on every property tax dollar flowing to municipal police departments in St. Clair County is going to pensions.

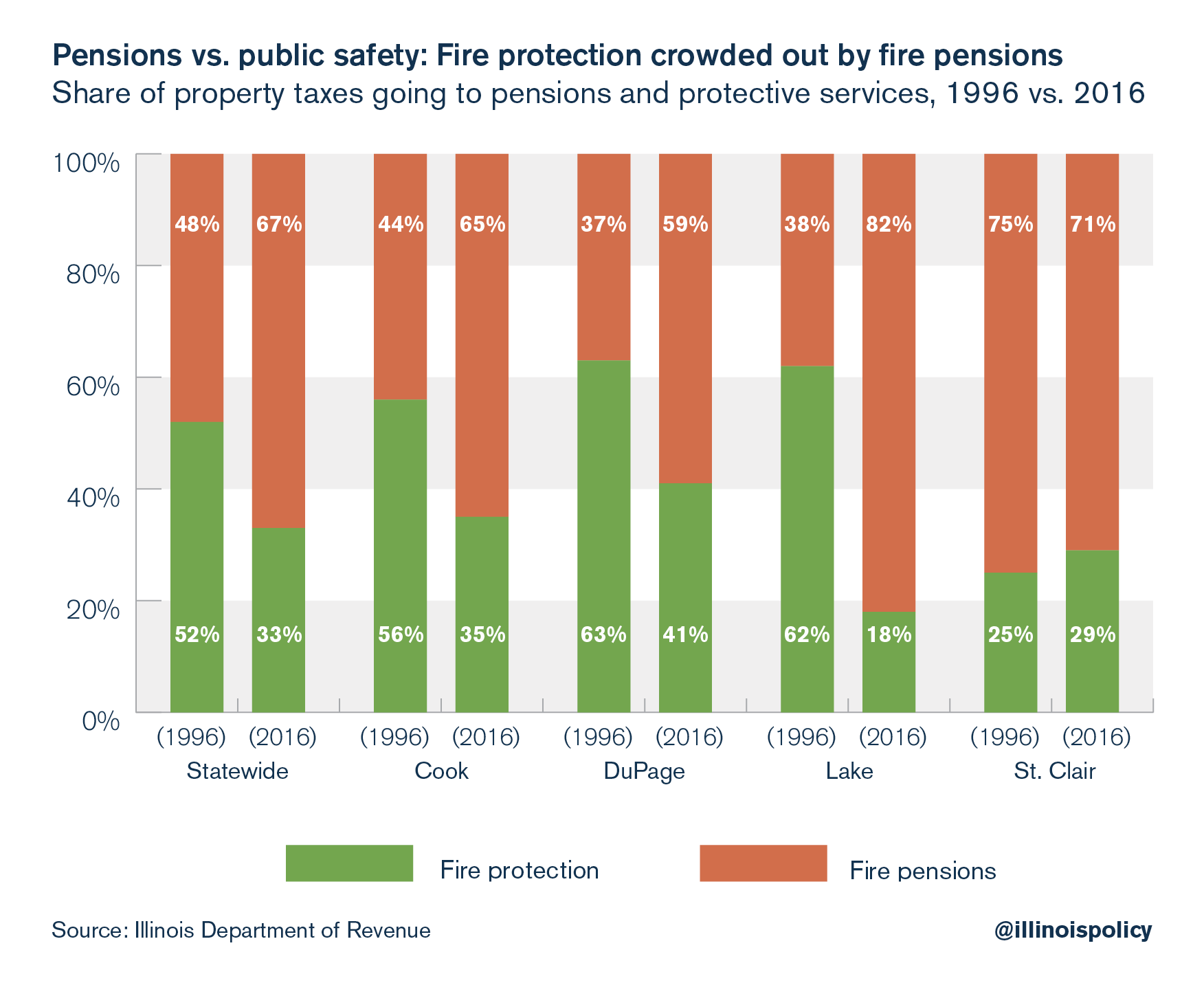

As with local police departments, fire pension costs have also crowded out funding for fire protection services. More than 70 cents on every property tax dollar for municipal fire departments is going to pension costs.

Pension liabilities have grown well beyond taxpayers’ ability to pay. And not only are these costs saddling Illinoisans with some of the highest property taxes in the state – they’re also imperiling the retirement security of government workers.

Ultimately, lawmakers must find the political will to amend the Illinois Constitution to allow changes in future, not-yet-earned pension benefits. In the short term, however, local governments should enroll all new government workers into affordable 401(k)-style defined-contribution plans.

Absent serious reform, rising tax bills will continue to find their way to Metro East home addresses – or residents will continue finding their way to home addresses outside Illinois.