Pension crisis hits home: Morton Grove

Morton Grove's police pension fund has just 54 cents of every dollar it needs in the bank today to meet future pension payments.

Illinois’ $111 billion unfunded pension liability for its state-run pension funds has earned national media attention. But Illinois is home to another pension crisis that all too often flies under the radar. Rapidly rising pension costs are also suffocating hundreds of municipalities across the state.

There are nearly 650 downstate municipal pension funds for police and fire departments in Illinois. Compared to the state-run pension plans, many of these funds are faring just as poorly. Often times, they’re even worse off. The Commission on Government Forecasting and Accountability recently rereleased a detailed analysis of police and fire pension systems in Illinois municipalities, including the village of Morton Grove, a northern suburb of Chicago with a population of 23,500.

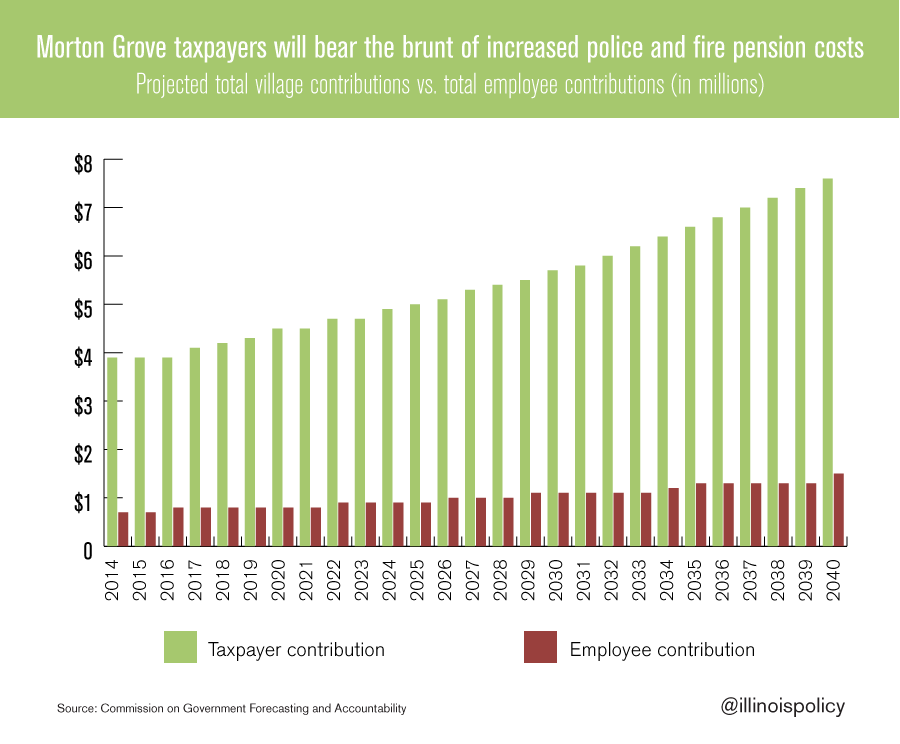

Whether they realize it or not, taxpayers in Morton Grove have a lot of experience with the impact of rising pension costs. Taxpayers contributed $1.4 million to the police pension fund and $1.6 million to the fire fund in 2009. Although Morton Grove’s pension costs haven’t increased as dramatically as some municipalities in Illinois, the taxpayer contributions have still grown by 9 percent since 2009.

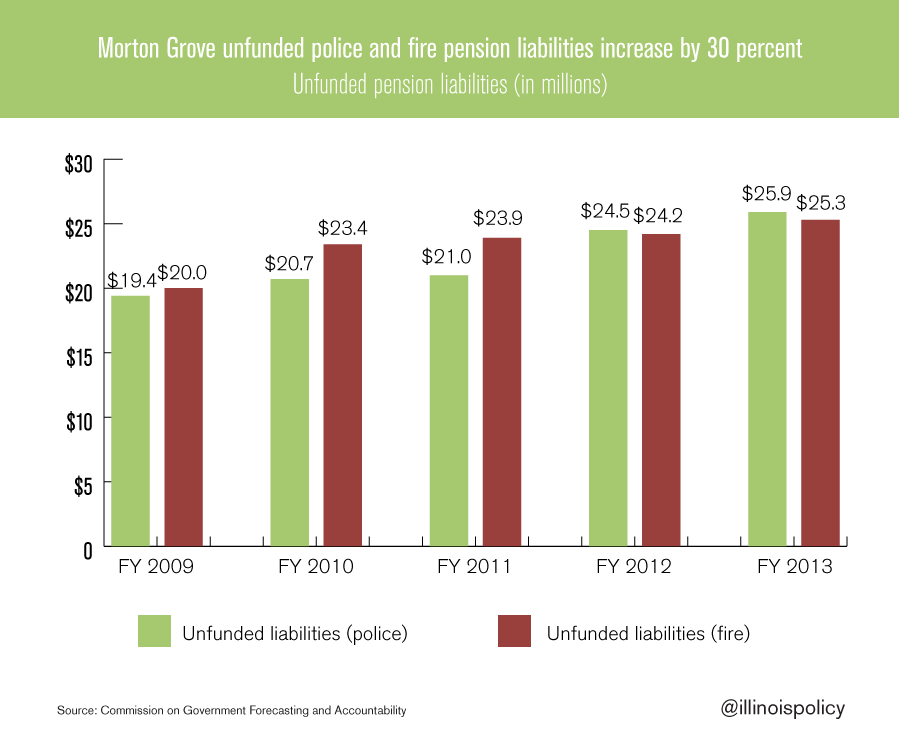

Despite making those increased pension payments, the village’s unfunded pension debt for its police and fire pension funds increased by 30 percent since 2009 – to $51 million from $39 million. The increased unfunded liability is largely due to missed investment returns, underfunding and changes in actuarial assumptions, according to the Commission on Government Forecasting and Accountability.

The Morton Grove police pension fund has just 54 cents of every dollar it needs in the bank today to meet future pension payments. The Morton Grove fire fund, just 52 cents.

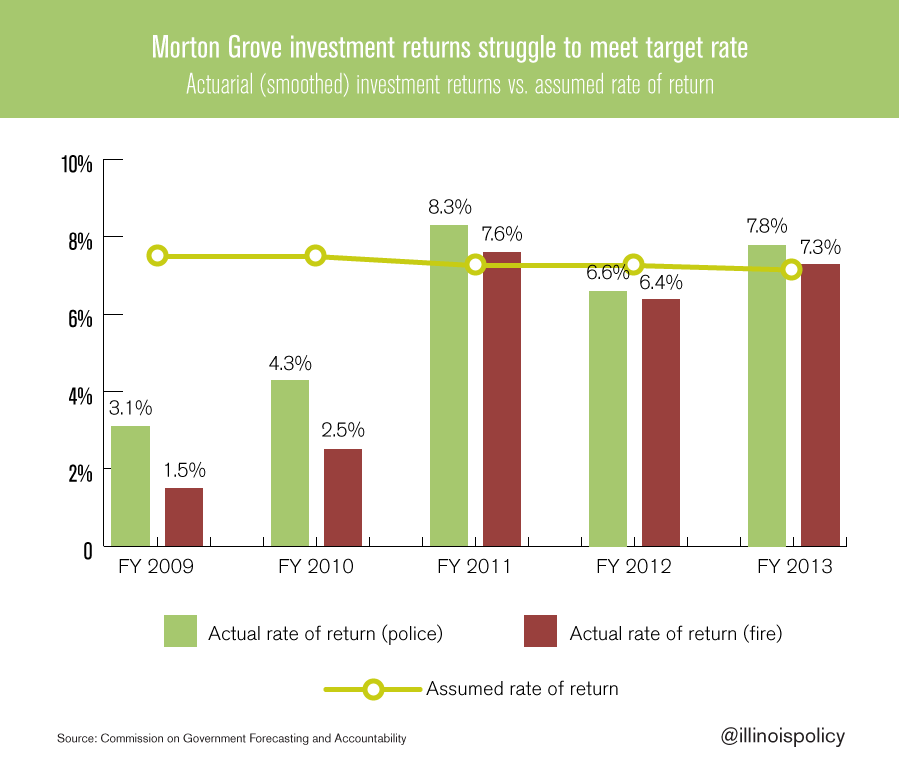

To the village’s credit, Morton Grove made a financially responsible decision and began ratcheting down the assumed rate of return for its pension funds beginning in fiscal year 2011. Pension funds are often criticized, and rightly so, for using rosy investment assumptions to make their funding look better on paper.

Decreasing the return assumption to 7.125 percent from 7.5 percent was a step in the right direction for Morton Grove. Unfortunately, the village has struggled to meet its investment mark many times during the last five years. The village did exceed its expected rate of return in 2011 and 2013, but missed the mark in 2009, 2010 and 2012.

Increasing pension payments will continue to strain the Morton Grove budget and its taxpayers. Taxpayers will have to contribute approximately $5 into the police and fire pension systems each year for every dollar police and fire employees contribute.

Local officials across Illinois are struggling to keep up with their quickly growing pension costs. Some communities are hiking taxes and fees to help balance their budgets, while others are cutting services.

The problem is local governments like Morton Grove have their hands tied when it comes to pension reform. The Illinois state legislature sets municipal pension laws – retirement ages, cost-of-living adjustments and benefit formulas – with no regard to whether the local budget or taxpayers can afford them.

It’s time to give local governments more control over their own retirement systems. Local governments should have the option to restructure their local retirement systems in a way that best meets the needs of their budget, taxpayers and public employees. Local pension control would help communities like Morton Grove prevent quickly growing pension costs from consuming an ever-growing chunk of local resources.