Ep. 38: The hidden tax: Why inflation is (still) soaring

Inflation is hitting record highs across the nation and higher prices are affecting everyone, everywhere in the country. In Illinois, we face unique challenges, such as multiple layers of taxation that already makes gas costlier than neighboring states. The result of a more expensive cost of living is that many Illinoisans have essentially experienced a pay cut. Bryce explains what Illinoisans need to know about rising prices and what to do about it.

This edition of The Policy Shop comes to you from Senior Research Analyst Bryce Hill.

Whether you’re thinking about gas prices, grocery bills or the cost of an airplane ticket, we all know there’s an inflation problem. Inflation is hitting everyone, everywhere in the U.S. In Illinois, we face unique challenges, such as multiple layers of taxation that make gas costlier than neighboring states, for example.

Shave and a pay cut. Inflation has plateaued at 8.3% after a record government stimulus, supply chain disruptions, and rising stock and housing markets. Costs have jumped. Have our incomes?

Short answer: No.

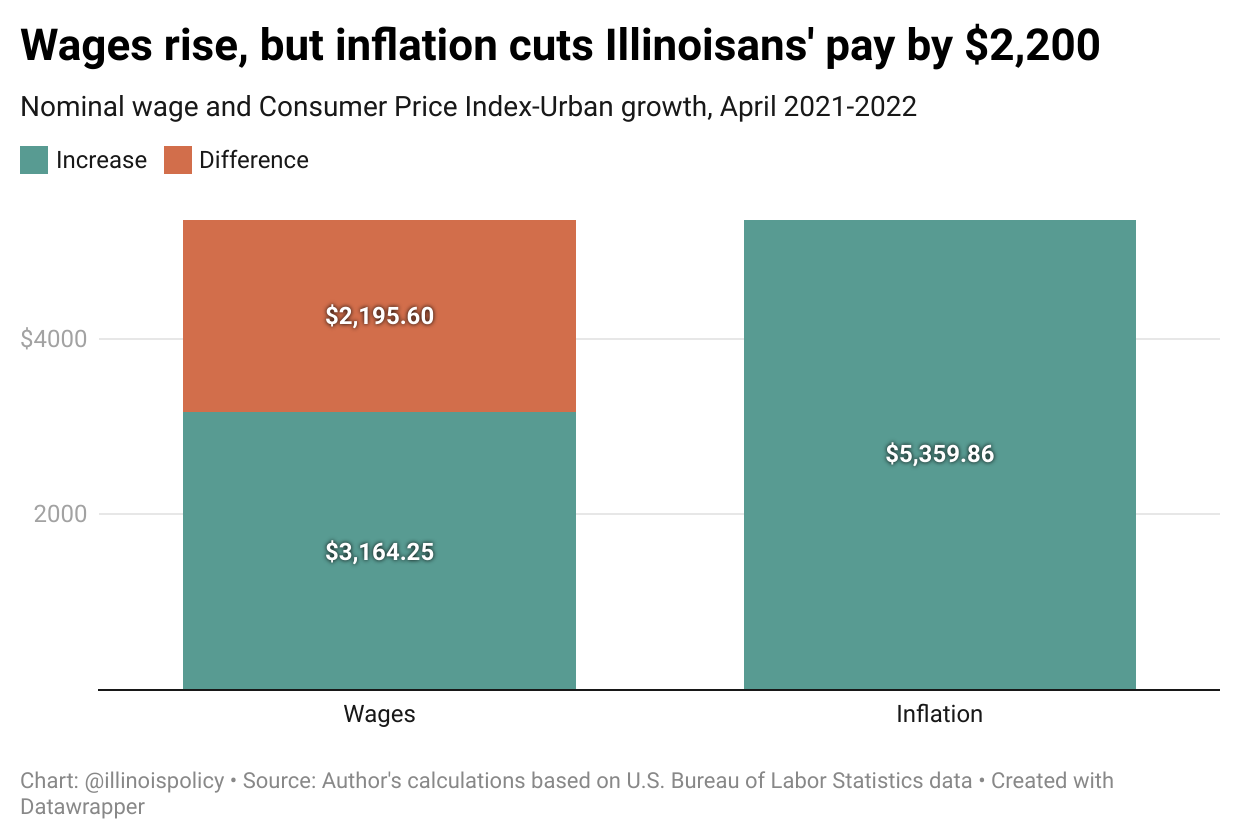

While the average private-sector worker in Illinois saw a pay bump of more than $3,164 during the past 12 months, prices have been rising far faster. To keep up with inflation, the average worker in Illinois would have needed their wages to rise by $5,360. Thanks to inflation, Illinoisans’ $3,164 pay bump was actually equivalent to a $2,196 pay cut as the rise in pay failed to keep up with the cost of living.

The property problem: To add insult to injury, Illinois has not benefited from the wealth effect most American homeowners have gotten from their home values increasing. Instead, home appreciation rates in Illinois were the third-lowest in the nation – our homes appreciated about 16% from 2019-2021 versus 25% nationally. Now that the federal reserve has begun to raise interest rates to combat inflation, market experts expect home prices to fall. While some buyers might be relieved to hear that, it is particularly bad news for Illinoisans who have already largely missed out on home price appreciation because the Illinois housing market will be more susceptible to the downturn.

And it’s not just homeowners feeling that pain. Renters have been made even worse off as demand for rental units has increased. Rents are up 21% in Illinois, the most in the Midwest and more than most other states, from 2019-2021.

This is my stop: Property taxes and other local factors have contributed to lower home price appreciation and population decline. Illinois’ population has been in accelerating decline for eight consecutive years. Homeownership rates have dropped while new residential construction has continued, meaning the supply of homes is increasing more than demand. This is likely one reason for slower home price appreciation in Illinois. It also raises the risk of more severe home price declines in Illinois.

Call in a repair: Public leaders have tools at their disposal to improve the situation for Illinois’ housing and rental markets. On the demand side, Illinois needs to make the state an attractive place to live and conduct business. The major reasons Illinoisans are choosing to leave the state are for better housing and employment opportunities, both of which have been made worse by poor public policy decisions. Illinois’ second highest property taxes in the nation are now equivalent to nearly seven additional mortgage payments annually for new homeowners. Renters are also affected by property taxes as they are passed on in the form of higher rent. Nearly half of Illinoisans have thought about moving away, and they said taxes was their No. 1 reason.

On the supply side, easing regulatory requirements can make the new homes that are being built more affordable, making homeownership more accessible to current and future Illinoisans. The National Association of Home Builders estimates regulations imposed by all levels of government account for about 24% of the current average sales price of a new single-family home. The burden of regulation is up 44% when compared to a decade ago.

Without reforms that make Illinois a more attractive place for businesses and families, the state’s housing and rental markets will continue to produce lackluster results and leave residents with no choice but to leave the state.