Typical 30-year career workers in state retirement systems put just 5% toward the cost of their benefits and receive payouts significantly higher than the private sector

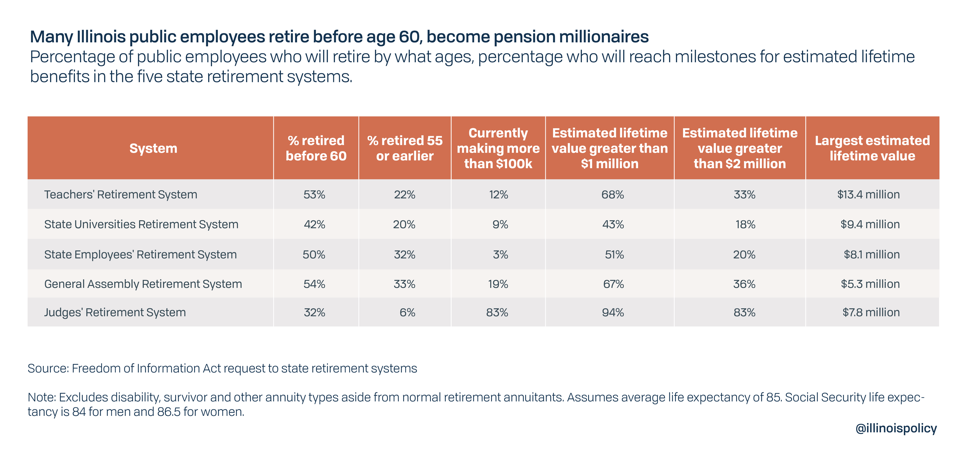

According to the original report, “Illinois pensions 101: Paltry contributions yield million-dollar payouts,” between 43% and 94% of retired teachers, state workers, university employees, lawmakers and judges will become pension millionaires, depending on their respective state pension system.

Researchers also found public employees typically pay very little toward their own retirement, assume none of the economic risk for investment and retire relatively young compared to the private sector.

By contrast, the typical private sector worker would to need to have saved $1.6 million in a personal retirement account by age 60 to receive similar benefits as a career worker in Illinois.

Highlights from the report:

- The typical career worker in the Teachers’ Retirement System, State Universities Retirement System and State Employees’ Retirement System contributed about 4% to 5% towards their lifetime expected payout before retiring. That is approximately $113,000 for teachers, $121,000 for university employees and $54,000 for state workers.

- In return, these contributions legally guarantee a pension worth an average of roughly $2.5 million. Employees in SERS receive slightly lower benefits because they also receive Social Security benefits.

- The largest lifetime pensions can be worth more than $10 million.

- About half of all state workers retire before age 60, with nearly one-third retiring before age 55.

- The average Social Security benefit for 2019 is just $17,532 per year. The minimum age to receive a full benefit is 67. Similarly, the average 401(k) balance for people aged 60 to 69 is just $195,500.

Adam Schuster, director of budget and tax research for the nonpartisan Illinois Policy Institute, offered the following statement:

“The disparity between how much Illinois pensioners pay in and take out of the retirement system illustrates how unsustainable and unaffordable the benefits are. Illinois politicians designed a system with generous payouts, early retirement ages, no risk sharing and insufficient employee contributions. When investment returns come in lower than expected or benefits grow faster than expected, taxpayers bear the entire financial burden.

“We should never blame retirees for the way politicians designed the pension system. In reality, their retirement security faces the same risk as the rest of the state: insolvency.

“We must come together to fix Illinois’ pension systems in a way that protects all the stakeholders — taxpayers, retirees and Illinoisans in need of government services. A constitutional amendment would allow for modest reductions in future benefit growth, while still protecting every dollar a worker or retiree has earned to date.”

To read the full report, visit illin.is/millionaires.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.