PRESS RELEASE from the

ILLINOIS POLICY INSTITUTEMEDIA CONTACT: Rachel Wittel (312) 607-4977

Illinois mortgage delinquency rate could double this year

Up to 130,000 Illinois homeowners could fall behind on mortgage payments following economic fallout from the COVID-19 pandemic

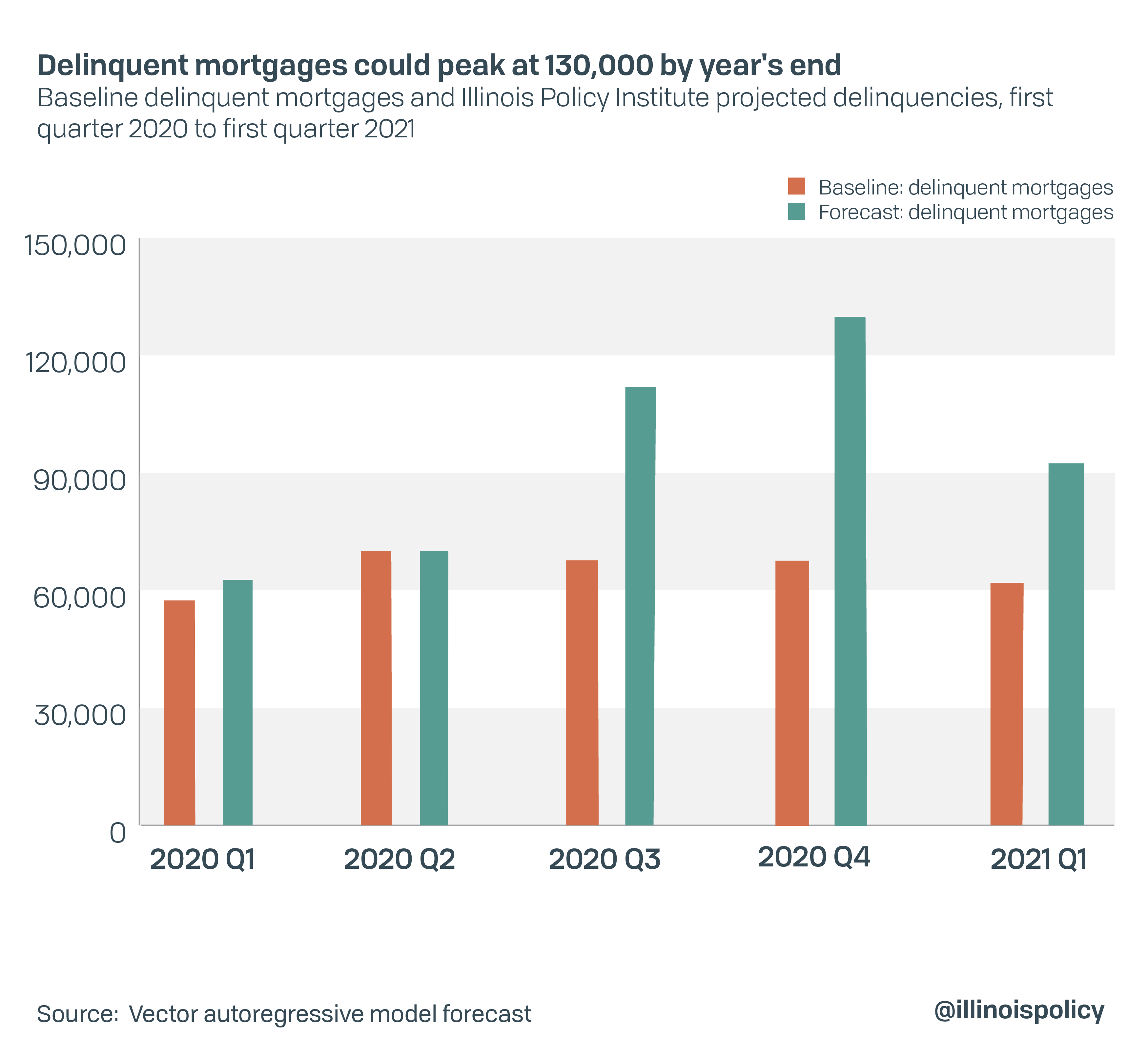

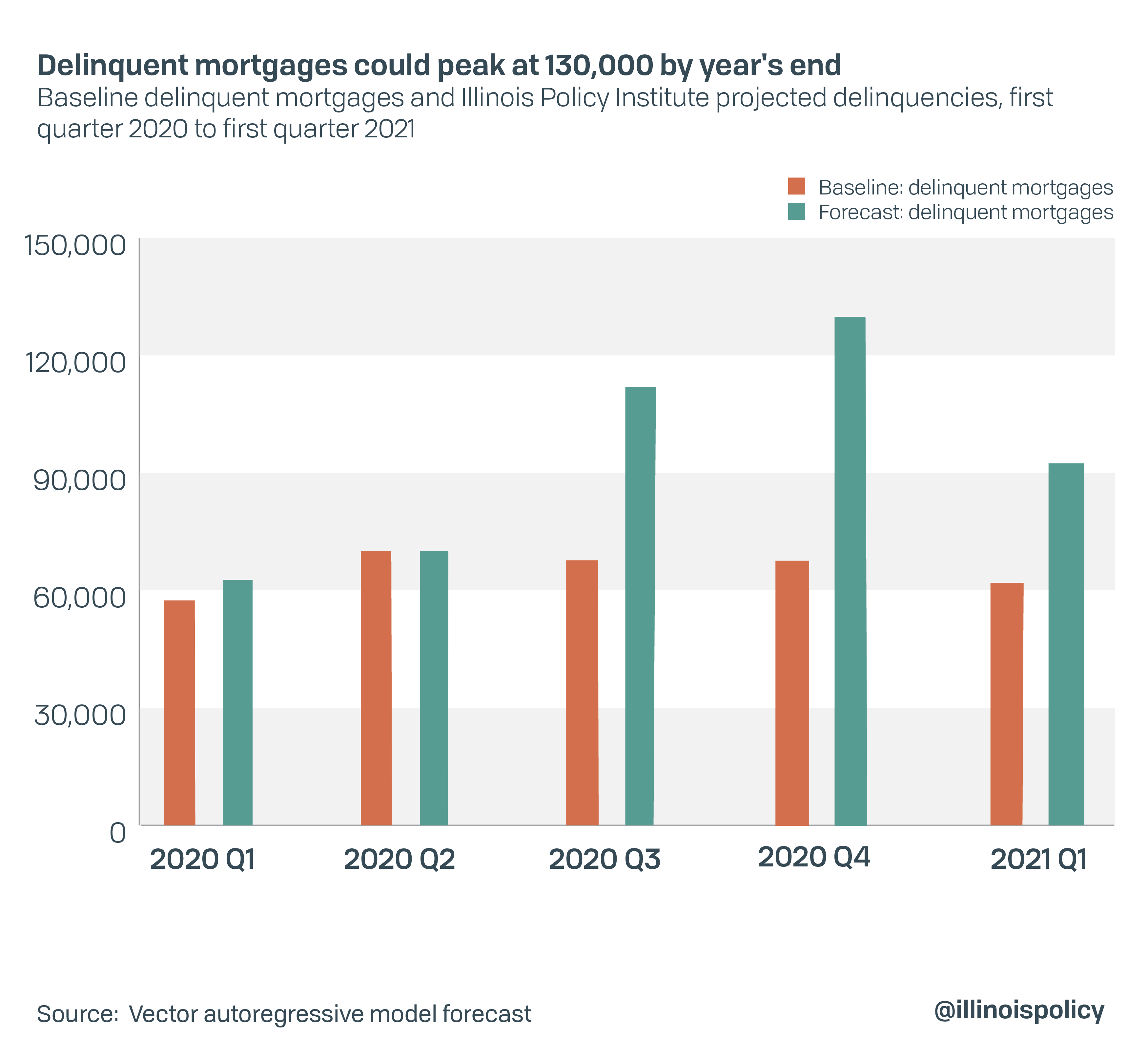

CHICAGO (June 17, 2020) – Illinois is at risk of facing its worst housing crisis since the Great Recession following the economic fallout from the COVID-19 pandemic. According to new analysis by the nonpartisan Illinois Policy Institute, up to 130,000 homeowners in the state could fall behind on their mortgage payments this year, doubling Illinois’ mortgage delinquency rate to nearly 9%.

Illinois’ housing markets were among the weakest in the nation prior to 2020 and the most vulnerable to the COVID-19 shock. This is because Illinois already had a large number of underwater homes as well as the second-highest foreclosure rate in the country as of February 2020.

With 1.5 million Illinoisans out of work and many property tax payment deadlines approaching across the state, Institute experts suggest property tax relief as a way to reduce homeowners’ costs and to stave off delinquency. Kane, McHenry, DuPage, Sangamon and St. Clair counties have all provided extensions without penalties on property tax due dates.

Illinois housing market highlights:

- Among the 50 states most vulnerable to the COVID-19 economic shock, Illinois is the only state in the Midwest with housing markets most at risk of default.

- Illinoisans who have recently purchased their home likely pay annual property tax bills equal to nearly seven months’ worth of their mortgage costs.

- Delinquency often leads to foreclosures. The economic fallout from the pandemic could push Illinois close to Great Recession levels when mortgage delinquency rates peaked at 11%.

- Illinois has had the third-lowest housing price appreciation in the nation on average since the end of the Great Recession.

- Illinoisans pay $4,900 in property taxes on the state median $203,400 home – the second-highest rate in the nation.

|

|

Orphe Divounguy, chief economist at the nonpartisan Illinois Policy Institute, offered the following statement:

“So many families are struggling to make ends meet during this crisis. State lawmakers need to provide homeowners with property tax relief to save the state from mass mortgage delinquencies and a historic housing market downturn. Providing extensions on paying property taxes, without penalties, would lower Illinois homeowners’ monthly costs to support consumer spending, such as housing payments. Long-term, Illinois must tackle foundational pension reform, as pensions are the core cost-driver behind high property tax bills across the state.

“At the same time, we have to get Illinois safely back to work. The state needs to foster a strong economic recovery, and that requires alleviating more lockdown restrictions and rejecting a progressive income tax hike that would directly hurt 100,000 small businesses as they’re beginning to bounce back from the most severe economic downturn since the Great Recession.

To read the full report, “Illinois mortgage delinquency could double in 2020,” visit: illin.is/delinquency.

For bookings or interviews, contact media@illinoispolicy.org or (312) 607-4977.