Pritzker to decide COLA increase for Chicago firefighter pensions, with $850M price tag

Over the objections of Chicago Mayor Lori Lightfoot, who called the legislation “irresponsible,” state lawmakers passed a bill to increase the cost-of-living adjustment for 2,200 Chicago firefighter pensions to 3% from 1.5%. Gov. J.B. Pritzker should veto it.

Illinois Gov. J.B. Pritzker will soon see House Bill 2451, which intends to enhance cost-of-living adjustments, or COLAs, for Chicago firefighter pensions. Chicago Mayor Lori Lightfoot opposed the bill and called it “irresponsible,” according to the Chicago Sun-Times. The city estimates it will cost an average of $30 million per year and $850 million over 35 years.

“Mayor Lightfoot believes strongly that we must work toward a comprehensive pension solution which keeps the promises made to retirees and which sets pension funds across the state on a path to solvency,” according to a statement from the mayor’s office.

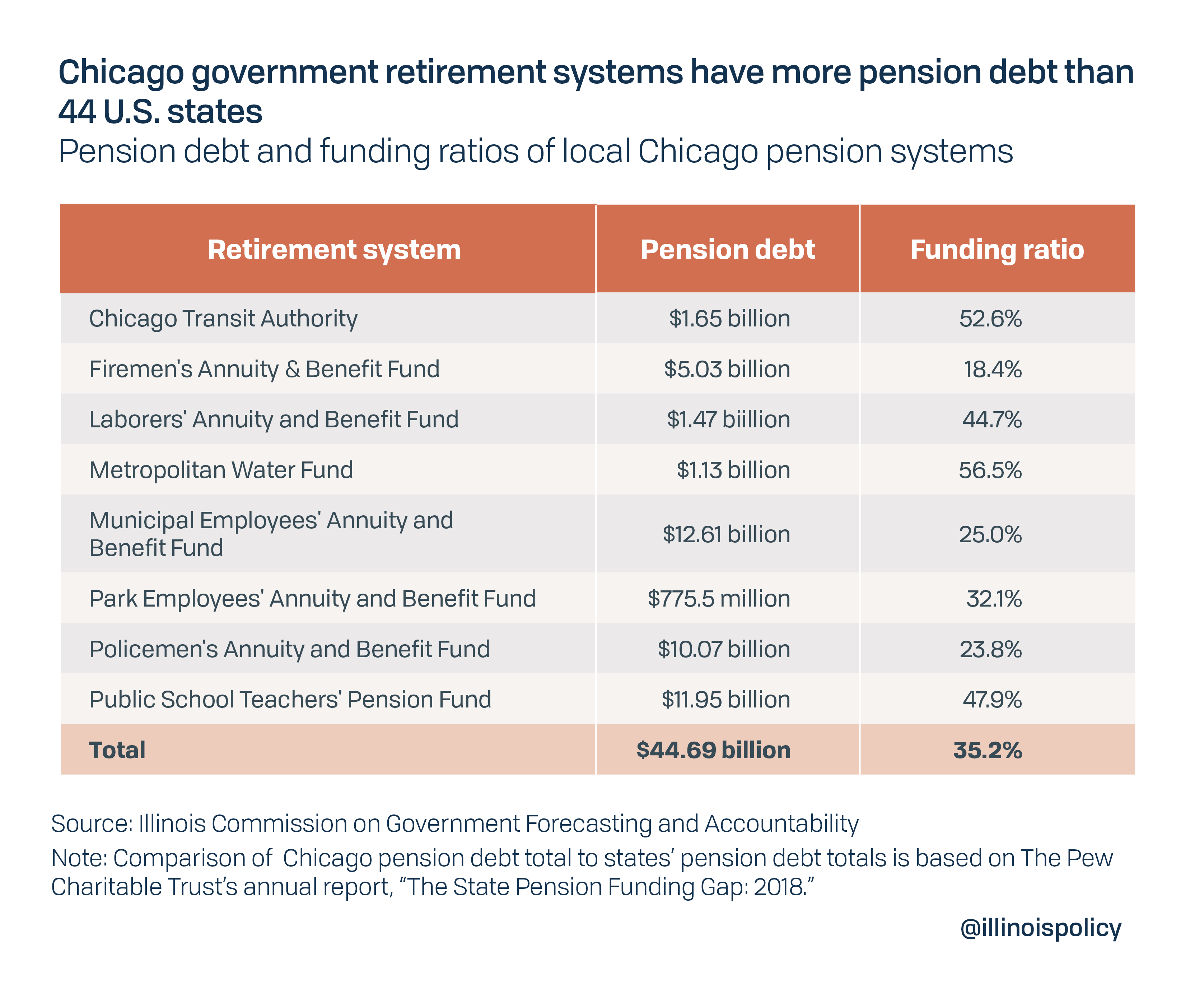

Chicago residents are on the hook for nearly $45 billion in pension debt, which is more than the total pension debt held by 44 U.S states. The firefighter pension fund is in the worst shape, with only 18% of the money on hand needed to pay promised future benefits.

As Lightfoot stated, reform is needed if pension promises are to be kept and the funds made solvent. A constitutional amendment allowing lawmakers to lower the growth rate of future pension benefits is the only way to achieve those goals. Further sweetening pension benefits without creating reforms would aggravate the problem that is wrecking the city’s finances.

If Pritzker were to sign the bill, it would increase COLA benefits for 2,200 active Chicago firefighters to 3% non-compounding. It passed 72-40-1 in the House in 2019 and 37-14-1 in the Senate on Jan. 11 during the lame duck session. Until the bill is signed, firefighters born after Jan. 1, 1966, were entitled only to a 1.5% simple post-retirement annual benefit increase.

State Sen. Rob. Martwick, who sponsored HB 2451, promoted it as a transparency measure. He claimed in a press release that it “shines a light on the true financial condition” of the Chicago firefighter pension fund and would prevent the city from further “kicking the can down the road.”

In reality, the legislation adds millions in costs that are likely to be passed on to Chicago property taxpayers, who are already overburdened. The city has few other options to raise taxes and fees. It grapples with consistent, growing deficits.

Residents were hit with $864 million in annual tax hikes during former Mayor Rahm Emanuel’s administration, including $543 million in property tax increases, primarily to cover rising pension contributions in the city budget. Lightfoot’s latest budget includes a $94 million property tax increase and $38 million in fine and fee increases. Some of that revenue comes from an aggressive new ticketing policy, which uses automated cameras to catch drivers going just 6 mph over the posted speed limit.

Martwick’s claim about transparency stems from the fact that the birthdate restriction – used to determine which pensioners receive 1.5% COLAs and which receive 3% – had been previously moved to include more retirees. Originally, only those born before 1930 were eligible for the higher COLA, but that was moved three times before landing at 1966 in 2016. The city continued to calculate its annual costs based on the lower COLA, meaning it was not contributing toward the benefit increases it was paying out, growing the debt.

But rather than expanding pension benefit increases, Chicago should commit to setting pension benefits at a sustainable and affordable level. Lightfoot’s office pointed out that raising benefits now passes on a “massive, unfunded mandate to the taxpayers of Chicago at a time when there are no extra funds to cover this new obligation.”

Pension costs will consume $1.82 billion of Chicago’s $12.76 billion budget in fiscal year 2021, or more than 14%. Annual contributions to city pension funds were already projected to rise by $1 billion during the course of Lightfoot’s first term in office. The effect of COVID-19 on pension fund investments will likely drive pension costs higher and faster than projected, plus city revenues are taking a hit from the pandemic.

If Pritzker approves this firefighter COLA increase, it will add further to pension expenses.

Despite all the tax and fee hikes, Chicago’s budget has not been balanced since 2003. The fiscal year 2020 budget ended $800 million in the red and Lightfoot faced a $1.2 billion deficit for fiscal year 2021. It is virtually impossible to close Chicago’s long-term structural budget deficit without changing the Illinois Constitution to allow pension reform that slows the growth in future benefit increases.

Lightfoot has sent mixed messages on pension reform, often acknowledging the depth of the problem and calling for change while failing to provide specifics. She has criticized 3% compounded post-retirement annual raises as “unsustainable,” but has not publicly endorsed a constitutional amendment, which is the only way to change them. Those compounded increases are available to members of the municipal and laborer’s pension funds, while public safety COLAs are non-compounding.

Emanuel went farther than Lightfoot toward the end of his term, calling on Springfield to send a pension reform amendment to the ballot for voter approval. This endorsement likely carried less weight because it was issued after Emanuel decided not to run again. The General Assembly tried in 2013 to fix government pensions, but the Illinois Supreme Court ruled changes cannot happen unless the Illinois Constitution is amended.

Voters in Chicago and throughout Illinois deserve the opportunity to vote on a pension amendment, which would help to lower property taxes while freeing up revenue for critical services needed by the state’s most vulnerable residents. It’s the only realistic option to dig out of the financial hole caused by unsustainable pensions.

At the very least, lawmakers should stop digging the hole deeper and Pritzker should take away this shovel.