Pritzker wrongly claims an Illinois budget surplus ‘if not for coronavirus’

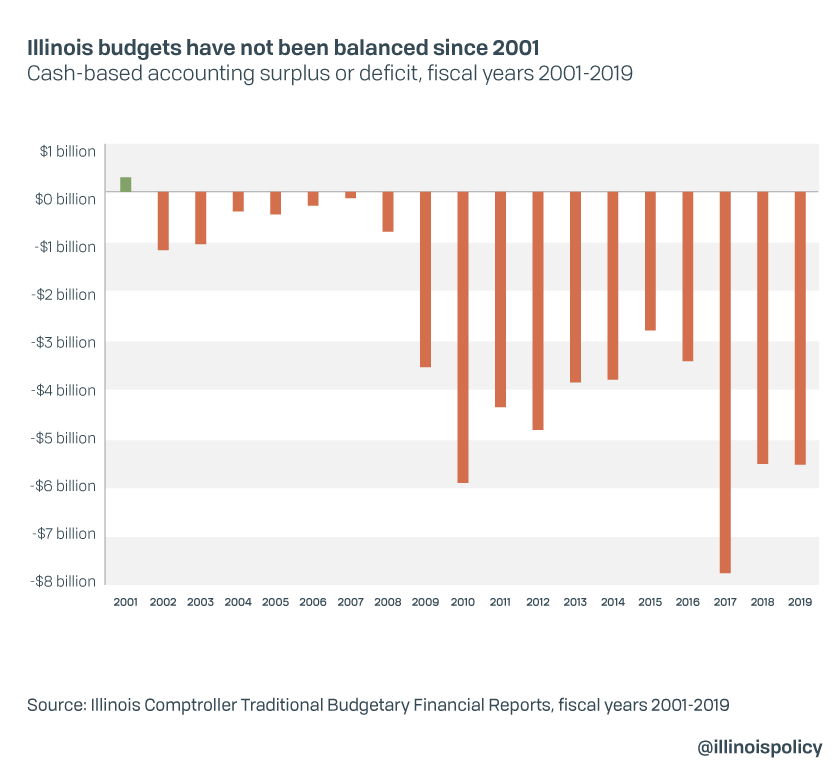

The budget was not balanced, and Illinois has not balanced a budget for nearly two decades. Pretending Illinois had no issues before COVID-19 won’t help it recover.

At his daily press conference April 28, Gov. J.B. Pritzker traded shots with President Donald Trump over the fiscal health of Illinois, which led to Pritzker incorrectly claiming the state budget would have been balanced were it not for the coronavirus.

Trump tweeted early that day, “Why should the people and taxpayers of America be bailing out poorly run states (like Illinois, as example) and cities, in all cases Democrat run and managed, when most of the other states are not looking for bailout help? I am open to discussing anything, but just asking?”

When asked about it at his press conference, Pritzker shot back: “Unlike Donald Trump, we proposed and passed and have effectuated a balanced budget for the year that we’re in,” Pritzker argued. “Had it not been for coronavirus, we would have had a (budget) surplus.”

That is wrong. Illinois would not have had a balanced budget for fiscal year 2020, let alone a budget surplus, before COVID-19 became a financial issue. In fact, Illinois hasn’t balanced a budget since 2001.

Last June, the General Assembly passed a 1,581-page budget that lawmakers shoved through in a matter of hours. An Illinois Policy Institute analysis found the budget was as much as $1.3 billion out of balance. Even granting optimistic revenue assumptions, the state would have ended the year $574 million in the red.

Making matters worse, the budget was unbalanced even with 20 new or higher taxes and fees on Illinoisans. Those taxes and fees, including doubling the state gas tax, designated more than $1 billion for the operating budget and financed a $45 billion infrastructure plan.

Lawmakers and the governor claimed the budget was balanced on paper, using their projections for spending and tax collections. That is where Illinois runs into trouble.

The Illinois Constitution requires a balanced budget, but the requirement is toothless. The constitution reads: “Appropriations for a fiscal year shall not exceed funds estimated by the General Assembly to be available during that year.”

The word “estimated” is the issue. The requirement is that lawmakers plan to spend only what they receive but does not require the budget to actually balance at the end of the year. This allows for numerous budget gimmicks, including overestimating revenue and underestimating expenditures.

Worse, Illinois actually carries what is essentially a perpetual operating deficit through its backlog of unpaid bills. As of April 30, Illinois owes more than $6.9 billion to various vendors for services already rendered. Under state law, the unpaid bills carry high interest penalties ranging from 9% to 12%. The state’s weak and ineffective balanced budget requirement allows the backlog deficit to be carried from year to year.

Illinois also has virtually nothing set aside for a recession or other emergency, what is commonly known as a “rainy day” fund. The state had only about 15 minutes worth of cash in the rainy day fund when the pandemic hit in mid-March.

And there was budget trouble projected even before COVID-19 wrecked state finances. The state in October projected it was facing a $1.77 billion structural deficit for fiscal year 2021, which starts in July.

Pritzker now wants help from the federal government to resurrect Illinois’ state finances.

In mid-April, Illinois Senate President Don Harmon wrote a letter to Congress asking for $44.2 billion from the federal government. Among these funds would be $10 billion to pay the state’s pensions next year. Pritzker has publicly rejected the idea, but still called on Congress to approve more aid for states. In Illinois, this means the money would inevitably go to the state’s broken pension system.

U.S. Rep. Adam Kinzinger, R-Channahon, rejected the idea of using federal funds to bail out Illinois from problems it created through mismanagement well before the pandemic. He said the state will get help based on the damage done by the virus.

Illinois could lose up to $6.6 billion in personal income tax revenue resulting from people laid off or having income reduced by the pandemic. Lawmakers will now be tasked with difficult decisions about how to cut spending and try to balance the fiscal year 2021 budget – a task at which they have failed since 2001, on a budget that was already projected to be in the red and that now faces billions less in revenue.

That is going to be quite a task. Pretending Illinois had no pre-existing conditions will do nothing to help the state budget recover from COVID-19.