Property tax bills en route for Rock Island County residents

Homeowners’ 2017 property tax bills (payable in 2018) outpace the state and national average, when measured as a share of home value.

A sinking feeling may wash over Rock Island County homeowners as they check their mailboxes in the coming week, with property tax bills set to arrive. The county treasurer’s office announced it sent out nearly 63,000 property tax bills to residents May 4. Taxpayers’ first installment is due June 7.

Local homeowners are paying higher property taxes than the state average and more than double the national average, when measured as a share of home value.

The average property tax bill for a single-family homeowner in Rock Island County was $2,855 in 2017, according to data released in April by ATTOM Data Solutions, a housing data company. With the average home value estimated at just under $111,700, that bill brings the average effective property tax rate up to 2.56 percent.

That’s more than double the national average of 1.17 percent. It’s also higher than the state average of 2.22 percent, according to ATTOM.

Just like the state as a whole, Rock Island County has had difficulties attracting and retaining residents in recent years. Might a heavy property tax burden be putting up red flags?

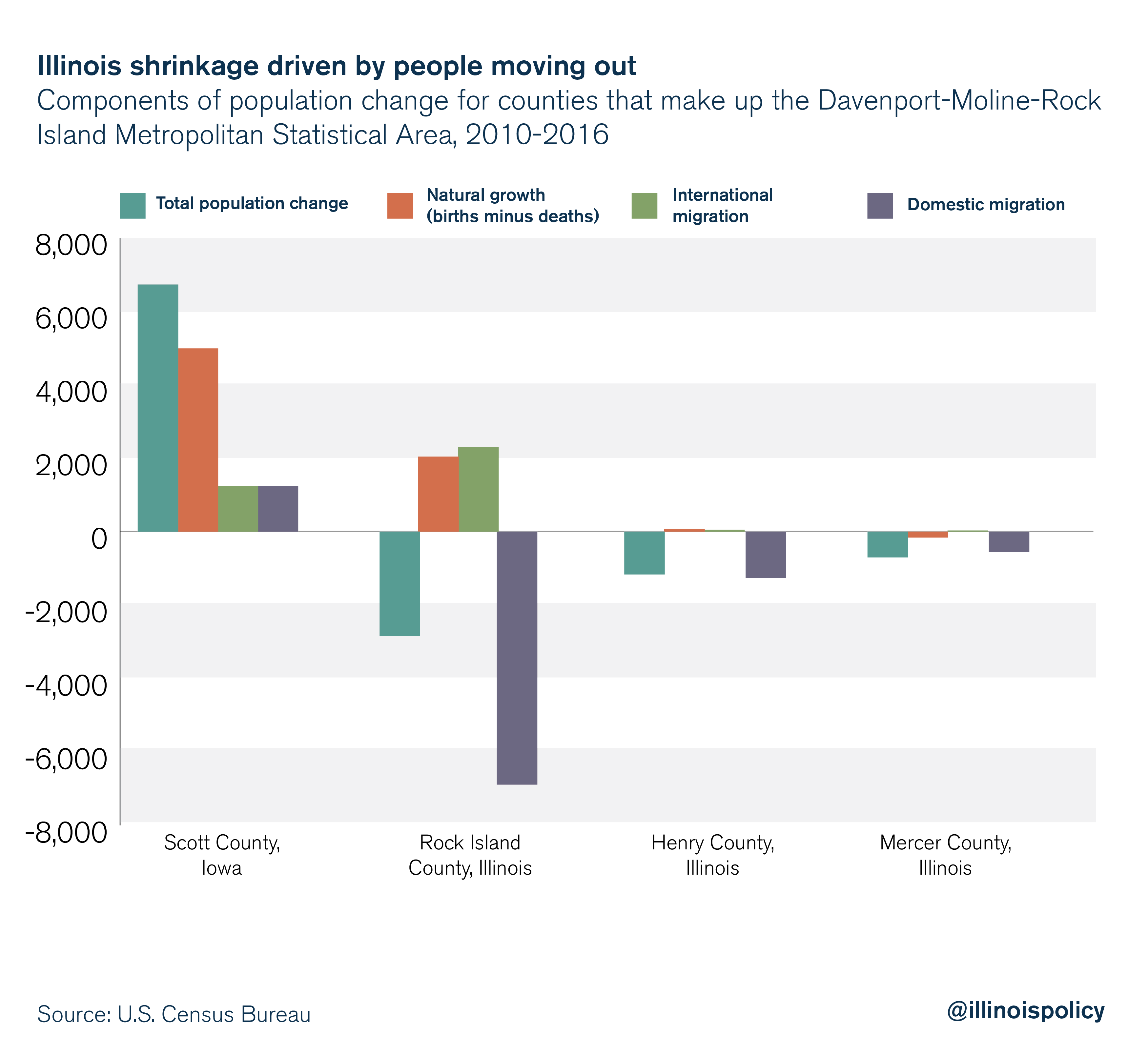

In the Quad Cities region, the Illinois side of the border is shrinking while the Iowa side is growing. This divergence is driven mainly by Rock Island County’s heavy net loss of residents to other counties. Meanwhile, Iowa’s Scott County has seen a net gain of residents from other counties.

The average effective property tax rate in Scott County is 1.64 percent, according to ATTOM – more than 35 percent lower than Rock Island County. This disparity in the effective property tax rate echoes earlier data from the U.S. Census Bureau.

Beyond just property taxes, consumer finance website WalletHub found in a 2018 report that when adjusting for cost of living, the median household in Iowa faced a lower total state and local tax burden than the median household in Illinois.

Unfortunately for those hoping to draw investment to the Illinois side of the Mississippi River, that gap could soon be widening.

The Hawkeye State changed its rules for government union collective bargaining in 2017, which will help control taxpayer costs.

And members of the Iowa legislature are considering what state Republicans claim are the largest tax cuts in Iowa history, which will save Iowans an average of $300 on their income tax bill, according to the Iowa Department of Revenue. The tax reform plan would also expand the state sales tax to things like online video streaming services and ridesharing.

In Illinois, efforts to address the cost-drivers of tax bills have often been “hijacked” by those opposed to reform. In Henry County, for example, calls to study cost-saving measures among dozens of local governments have been muzzled repeatedly. Members of the Illinois General Assembly, meanwhile, have been unwilling to tackle a number of substantial reforms at the state level to reduce property tax bills.

Until Springfield takes smart steps toward making the Land of Lincoln more competitive and attractive for families and businesses, Quad Cities homeowners will continue to see lighter property tax burdens on the Iowa side of the Mississippi River.