Report: Absent reform, retirement benefits will eat over half of Illinois’ taxes

More than 25% of state revenue already goes to pensions and retiree health care, but Illinois would need to double that to fully fund promised benefits at current levels.

A new report shows again pension reform is the only responsible option to fix Illinois’ failing finances.

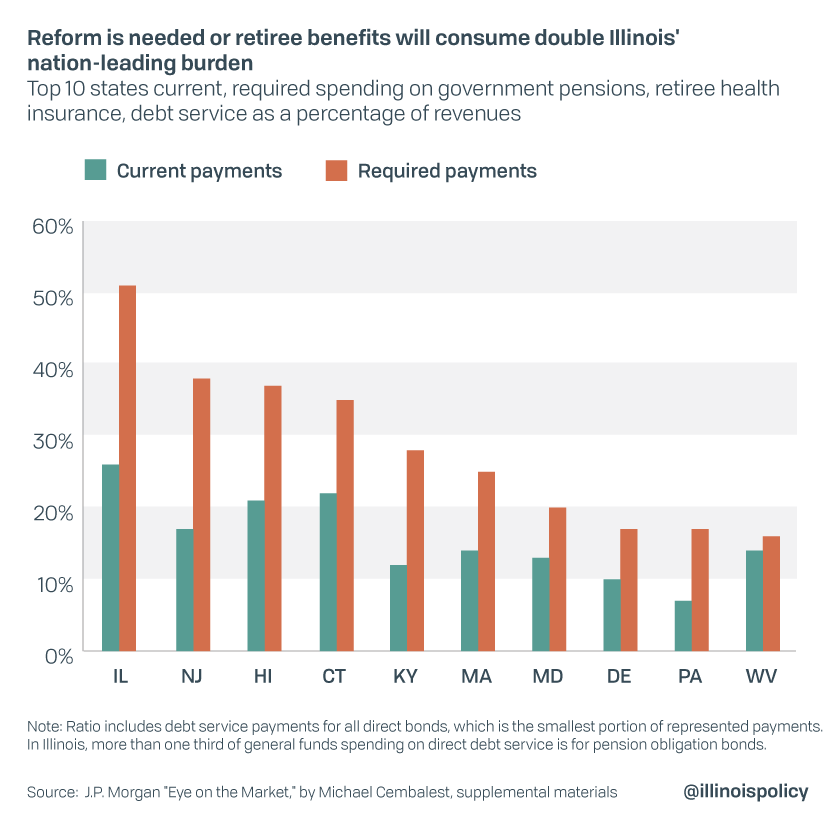

Spending would need to nearly double to more than half of all state revenue in order to fully fund Illinois government worker retirement benefits at current levels, according to a report from Michael Cembalest, a researcher for J.P. Morgan. Illinois state and local governments already spend a greater percentage of revenue on pension benefits and retiree health care than any other state in the nation.

Cembalest calculated that spending on pensions, retiree health care, and interest on debt would need to consume 51% of all state revenue in Illinois to fully pay off current obligations over 30 years, assuming a 6% return on pension fund investments.

Cembalest’s calculations rank the Prairie State as the top spender on these three items at 26% of its revenue. But even that high ratio has left Illinois’ pensions underfunded because the state calculates its contributions on overly optimistic expectations that investments will earn between 6.75 and 7.25 percent and on a weak target of pensions being 90% funded by 2045.

So Illinois already spends the most of any state. Yet it has the nation’s largest gap between what it pays and what it needs to pay into its public pensions.

The report goes on to state that in Illinois and New Jersey pension debt is so bad it is “practically irreversible.”

What lesson should Illinois residents and elected officials take away from this report? Simply put, opponents of pension reform in Illinois – those who defend the status quo of overly generous benefits combined with chronic underfunding and unrealistic accounting assumptions – are simultaneously endangering the futures of both taxpayers and public sector employees.

There are only three mathematically possible ways to pay down the debt without reform, according to Cembalest. None are practical.

1: Increase taxes by 25% and dedicate all of the new revenue only to increased pension payments.

To put this in context, Gov. J.B. Pritzker’s proposed $4.5 billion in tax hikes would represent only an 11.9 percent increase in general revenue fund taxes. But Pritzker has proposed using this money to close the existing budget deficit and finance new spending, while actually reducing pension contributions by over $1 billion in the first year.

Even larger tax hikes that cannot be used for better services should be a non-starter in a state which already has one of the highest state and local tax burdens. High taxes are the No. 1 reason people say they want to leave Illinois, and given the state’s five straight years of population loss, it cannot afford to alienate more residents.

With an economy already suffering under large tax hikes during the past eight years and a population already seeing service cuts to pay for pensions, paying more to get less is not an option.

2: Increase employee contributions by 689%

Most employees in state pension systems currently contribute between 8% and 9% of their salary to their pension fund. Those amounts would need to increase to between 63% and 71%, amounting to an absurdly large burden for state workers that is both politically unlikely and inadvisable as a matter of policy. Increasing contributions for current employees would also almost certainly be prohibited under Illinois’ restrictive pension clause.

3: Achieve a consistent 11.5% return on investments

In a healthy pension system, investment returns on assets owned by the pension funds, such as stocks and real estate, account for a large portion of total revenues. According to the National Association of Retirement Security Administrators, investment earnings have generated 61% of all public pension revenue in the U.S. since 1987.

But when pension funds fail to achieve their expected rate of return on investment, pension debt grows or taxpayers are forced to make up the difference through higher contributions.

Illinois pension funds have historically underperformed expectations. While the funds assume a rate of return between 6.75% and 7.25%, actual 10-year rates of return are between 4.6% and 5.4%.

Simply put, an average return of 11.5% is unattainable for even the best investment managers at a time when investment returns are slowing globally.

Despite the severity of the pension crisis, thoughtful reform can fix it

By the most important measures – those that account for ability to repay debt – Illinois’ pension crisis is the worst of any state in U.S. history. The crisis is so bad that Cembalest argues in favor of allowing states to declare bankruptcy, using Puerto Rico’s recent bankruptcy as an example. Bankruptcy is a useful option for companies, individuals and even local governments to manage the inevitable chaos of debt burdens that have become too large to be repaid.

As Cembalest’s repayment options make clear, Illinois’ pension debt is far too large to ever be repaid at current benefit levels. Yet states are currently not allowed to declare bankruptcy and the concept would likely face serious legal challenges in federal court, making it an unlikely solution.

So how can Illinois reduce its pension debt and prevent the ever-rising cost of annual pension contributions from crowding out core government services at both the state and local level?

As credit rating agency S&P Global Ratings put it, Illinois needs a “practical reduction in liabilities,” which means a reduction in the value of expected future pension benefits.

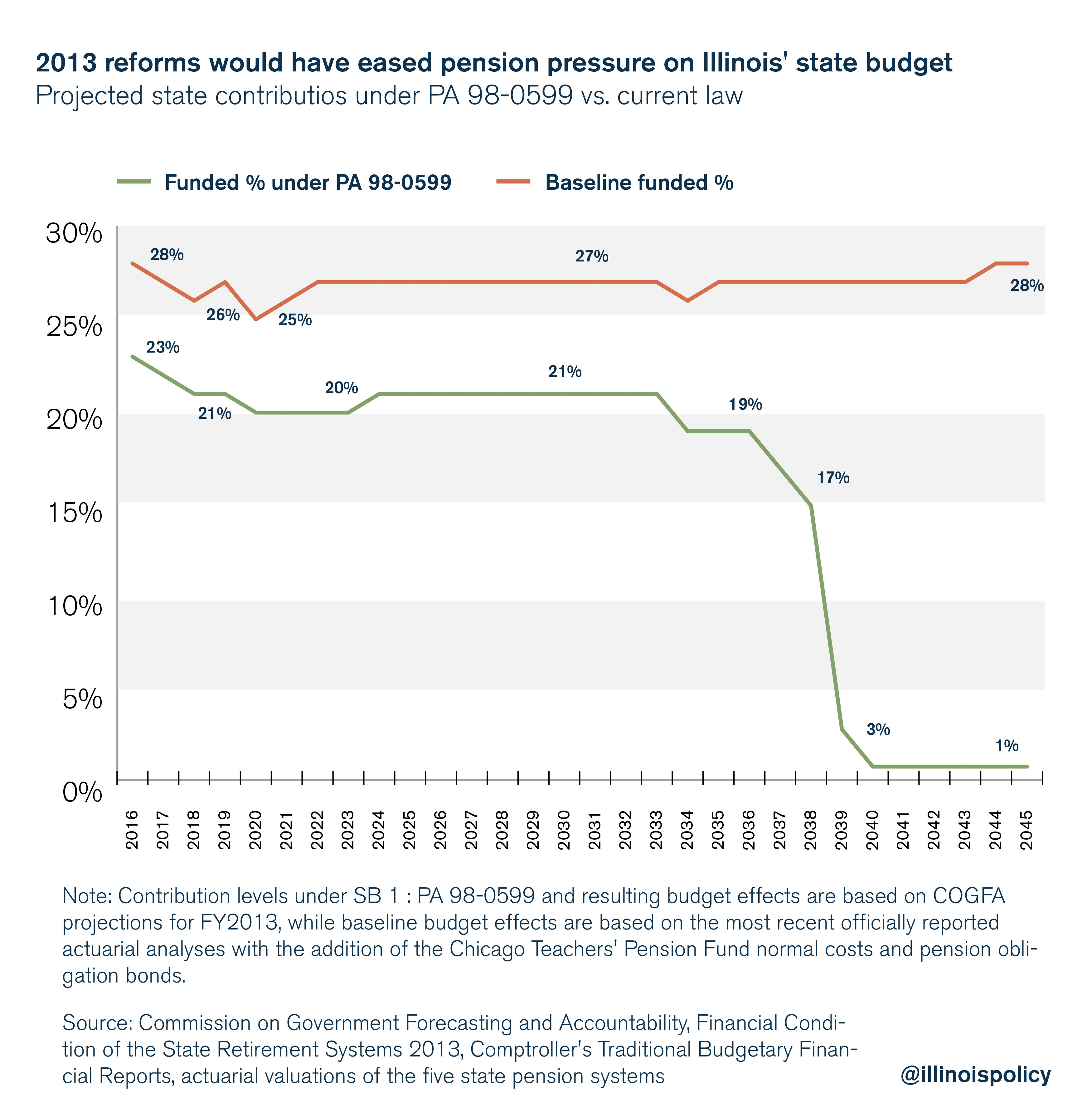

Reducing pension liabilities does not require cutting a dime from pensions that people have already earned. In 2013, Illinois lawmakers passed a pension reform package that would have preserved earned pension benefits while reducing the future growth rate of benefit increases. According to actuarial projections at the time, even this modest reform effort would have reduced annual pension contributions by more than $1 billion, significantly reducing the percentage of the state budget going to pensions while also paying off remaining pension debt more quickly than planned under current law.

Unfortunately, the Illinois Supreme Court struck down the 2013 reforms, pointing to the state’s restrictive pension clause.

Now Illinois must follow the lead of Arizona by amending its state constitution to allow pension reform. A proposed constitutional amendment filed in the General Assembly, HJRCA 21, would clarify the state’s pension clause by creating a distinction between already earned benefits, which would be protected, and the future growth rate in pension benefits, which should be open to change to give lawmakers the flexibility needed to make pensions affordable and sustainable.

Subsequent pension reform can follow the 2013 roadmap by focusing on the following concepts:

- Increasing the retirement age for younger workers but not those already close to retirement, to more closely match Social Security and the private sector

- Capping maximum pensionable salaries to prevent more costly six-figure pensions

- Replacing permanent 3% compounding benefit increases with true cost-of-living adjustments, or COLAs, tied to inflation

- Implementing COLA holidays to allow inflation to catch up to past benefit increases for some retirees

- Enrolling all newly hired employees in a sustainable and affordable retirement system going forward

Without pension reform, Illinois residents and businesses will continue to be asked to pay more in taxes while getting less in services. For that reason, investment expert Warren Buffet recently recommended that companies avoid moving into states with large pension debt. Undoubtedly, many companies realized the danger of massive pension liabilities long ago, helping to explain why Illinois continues to lag the nation in jobs growth.

Illinois has a myriad of economic and fiscal problems and pension reform is a necessary first step to fixing nearly all of them. Fair and reasonable changes to future benefit growth can fix the pension crisis, help stabilize state and local government finances, protect taxpayers, and strengthen the economy.

But first, elected leaders in Illinois need to give voters the opportunity to amend the pension clause in the constitution.