The 2015 fiscal year marks a long-awaited milestone for Illinoisans: taxpayers are less than one year away from tax relief. The record 2011 income tax increase is slated to partially sunset during the 2015 fiscal year.

But politicians are already crying poor as Illinois approaches the tax-hike sunset. The solutions they’ve offered up involve making the tax hike permanent, or worse: increasing taxes again with a progressive income tax.

The Illinois General Assembly has already had more than three full years of higher revenues from the 2011 tax hike. And by the end of fiscal year 2015, the 2011 tax hike will have raised more than $31 billion in higher taxes. Lawmakers used the new money to avoid making real reform and are now in a position that will require real spending reform and tough decisions.

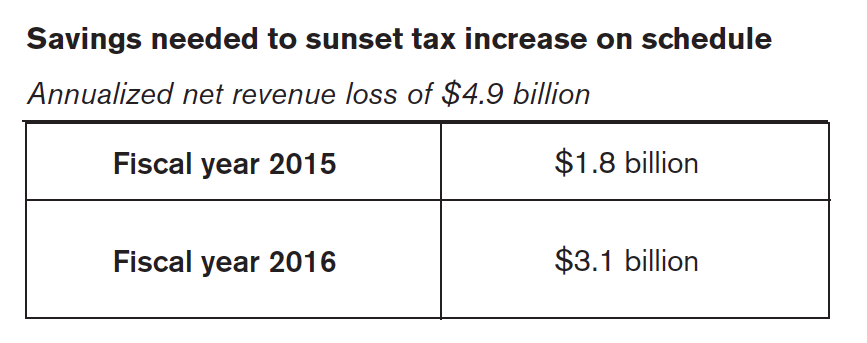

General Fund revenues are expected to drop by 4.9 percent ($1.8 billion) in FY 2015 and another 9 percent ($3.1 billion) in FY 2016. That’s an annualized net revenue loss of $4.9 billion during 2016, the first full fiscal year of the sunset. But revenue begins growing again by approximately 3 percent a year after the sunset, reaching nearly $35 billion in fiscal year 2019. Making up these revenue losses is more than possible – it’s necessary to get Illinois’ economy growing again.

Illinois’ general fund is projected to bring in $34.9 billion in total revenue in fiscal year 2015. That means under no circumstances should Illinois spend more than $34.9 billion during the 2015 fiscal year.

The purpose of Budget Solutions 2015 is to offer a menu of reforms that can be used to not only allow the tax hike to sunset, but also to begin paying down Illinois’ bill backlog. Tax relief is in the immediate future and Illinois needs bold leadership that will make sure it happens. Sunsetting the tax hike is more than a promise – it’s the law. And it can be achieved.

Menu of reform proposals

Balanced budget | Illinois hasn’t had a balanced budget since 2001. Illinois needs a more stringent and enforceable balanced budget requirement that will force lawmakers to rein in spending.

Spending limit | Illinois government is spending more money than it takes in and must learn to live within its means. State spending would total $24 billion, or $10 billion less than the $34 billion in 2012 if the state would have limited spending to the rate of inflation and population growth since 1979. Illinois needs to enact a spending limit tied to the growth of population and inflation.

Spending cuts | Across-the-board spending cuts of 4.9 percent would save the state $1.8 billion in fiscal year 2015, and cuts of 9 percent would save the state $3.1 billion in fiscal year 2016.

Education | More than $870 million of Illinois’ general fund for education subsidizes funding that’s not based on district need. Eliminating inappropriate subsidies and returning the General State Aid to its original intent – paying school districts based on need – would save more than $870 million.

Medicaid | Access to high-quality care for Medicaid enrollees has collapsed, even as record amounts of taxpayer dollars are spent on this program, which covers one-fourth of the state’s

population. Giving patients meaningful choices improves health outcomes and increases satisfaction. In addition to reinstating a private contractor to scrub Illinois’ Medicaid eligibility rolls, these reforms can save as much as $2 billion.

Retiree health insurance | State government retirees contribute little to nothing toward their health-insurance plans. Requiring retirees to pay at least half of their health-insurance premiums and eliminating this benefit for new workers going forward would save as much as $800 million.

State payroll | Illinois is broke and skyrocketing employee compensation costs are at the center of the crisis. Reducing the cost of government by reducing payroll costs 10 percent would save as much as $300 million.

Revenue sharing | Eliminating ineffective revenue-sharing programs between state and local governments would save up to $1.7 billion.

401(k)-style retirements | Defined benefit systems are inherently unpredictable and unmanageable, and are the root of Illinois’ pension crisis. Ending defined benefit pension systems, protecting already-earned benefits and moving workers to 401(k)-style plans going forward is the only way to protect government workers and taxpayers. Comprehensive pension reform would save the state as much as $2 billion, compared

with the current official pension payment.

Means-test COLAs | More than 8,000 government retirees receive cost-of-living adjustment, or COLA, benefits on top of annual pensions that exceed $100,000. Doling out COLAs to some of the state’s wealthiest retirees threatens the benefits of the state workers who need them most. Pension reform must means-test the COLAs of career state workers.

Retirement age | More than 63 percent of Illinois’ 200,000 government pensioners retired at or before the age of 60. Pension reform must align the retirement age with the Social Security retirement age while protecting workers currently nearing retirement.

Cost-shift | Teachers and university employees are not state employees, but the state pays the employer’s share of their pensions. One unit of government hands out benefits while another pays for them, eliminating spending accountability. This practice must end.