Illinois’ workers’ compensation system costs taxpayers $1 billion per year, and employers repeatedly cite hefty workers’ compensation costs as a driving factor in fleeing the state for friendlier business climates. High workers’ compensation costs most directly affect labor-intensive blue-collar employment sectors – which have struggled to regain their footing in Illinois since the Great Recession.

Despite mounting evidence that workers’ compensation remains a costly problem for Illinois, many politicians claim reforms passed in 2011 ironed out the kinks that made the state’s system so expensive. New research further disproves that notion: While Illinois’ workers’ compensation costs have gone down since 2011, the state has a long way to go before joining the competitive ranks of other Midwestern and surrounding states.

Illinois’ costs per claim decreased 6.4 percent following the 2011 reforms, according to new research from the Workers Compensation Research Institute. Yet, despite this modest progress, Illinois still ranked as the most expensive among the 18 geographically diverse states studied.

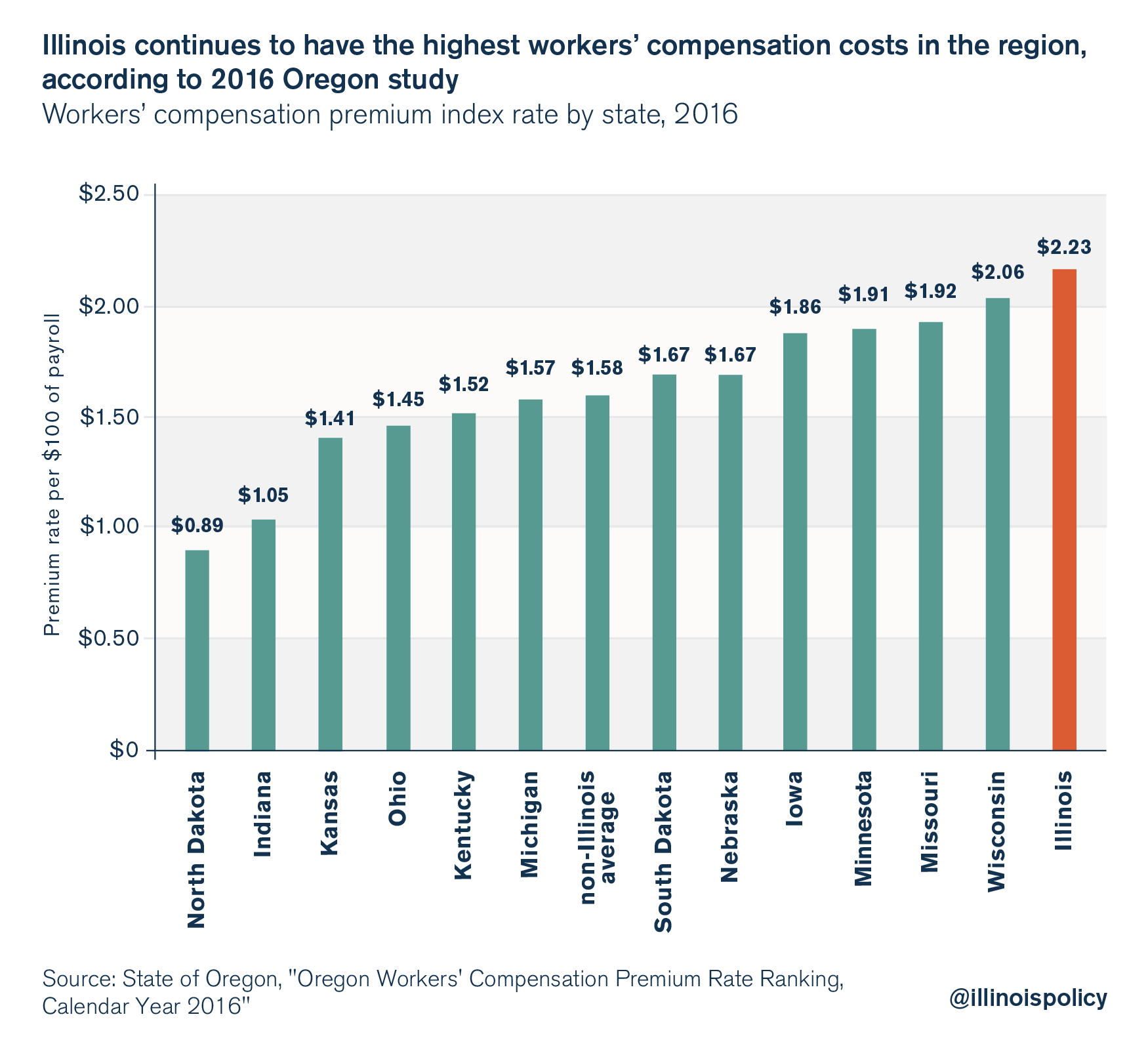

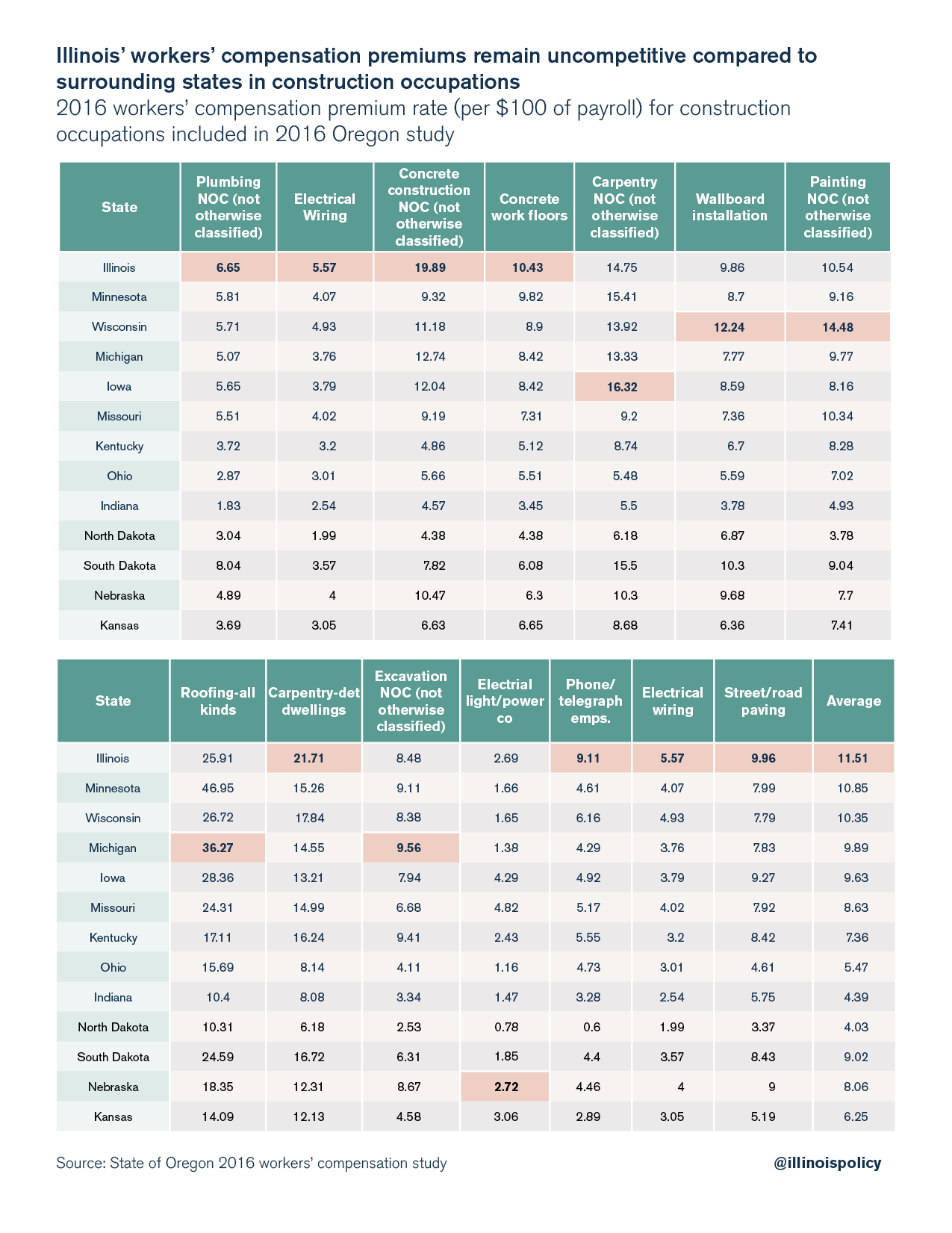

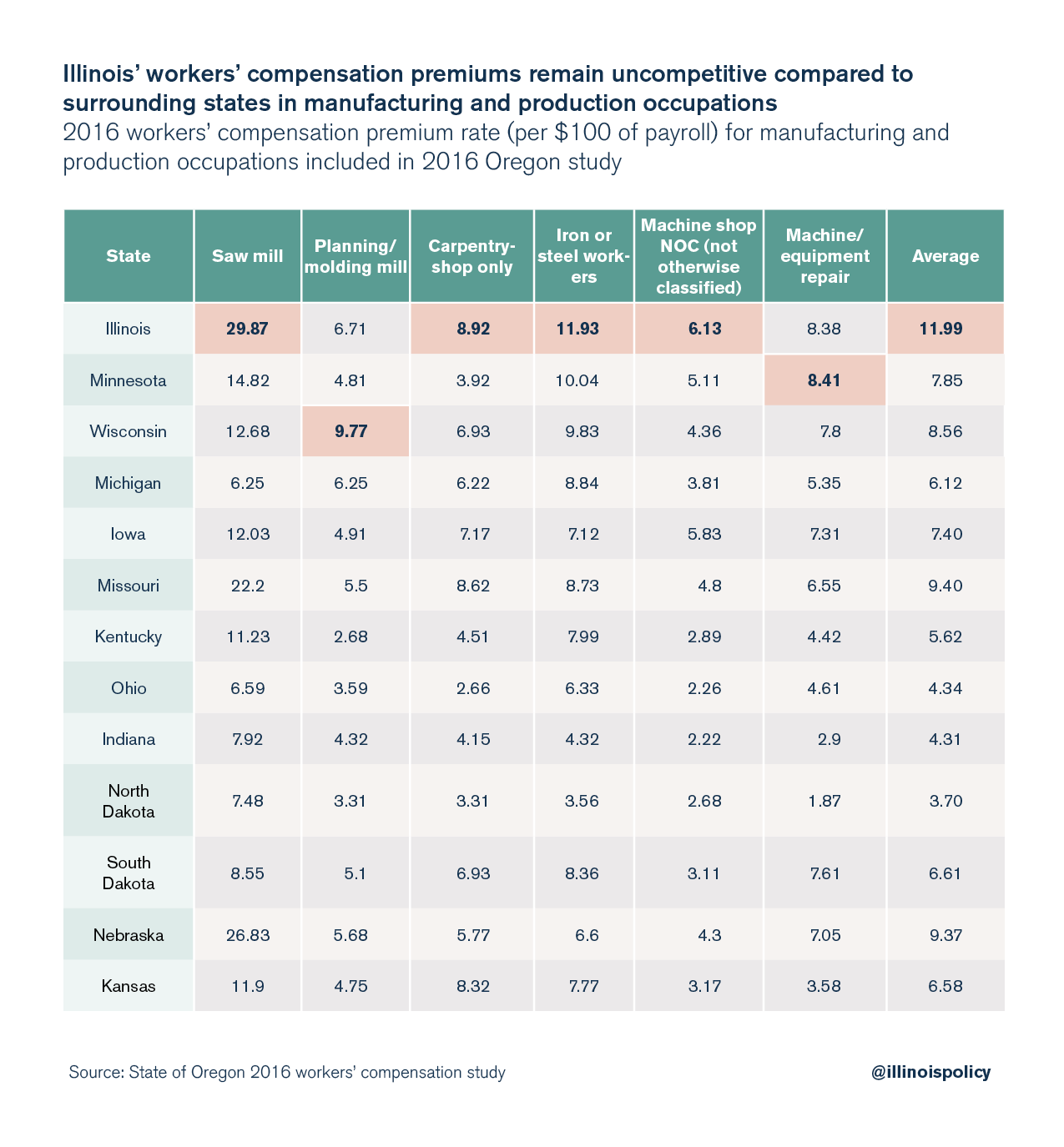

A 2016 study by the state of Oregon produced similar results. Its findings show Illinois has the most expensive workers’ compensation costs in 12 of 22 industries, including construction, manufacturing and production, and transportation, and the highest average insurance premium in the Midwest and among surrounding states.

Illinois’ out-of-step workers’ compensation costs render Illinois regionally uncompetitive for blue-collar jobs – which the state has been bleeding since the Great Recession. Illinois policymakers took the first steps toward fixing the state’s awed workers’ compensation system in 2011, but the reforms’ minimal impact on cost savings failed to advance Illinois’ competitive standing.

Productive reform that brings Illinois’ workers’ compensation costs in line with those in surrounding states will require fixing cost drivers in Illinois’ current system, including: indemnity payments, wage replacement ratios, the medical fee schedule and physician dispensing of dangerous opioids. Lowering workers’ compensation costs serves the interests of employers, workers and the state, all of which would benefit from increased investment and opportunity in a more competitive Illinois.

Introduction

Illinois’ workers’ compensation system drives away rewarding blue-collar jobs in sectors such as manufacturing and transportation.1 And not only that, Illinois’ broken workers’ compensation law drives up taxpayer costs by increasing the cost of government payrolls and government construction projects. Workers’ compensation costs taxpayers an estimated $1 billion per year in Illinois.2

Illinois’ workers’ compensation system needs structural reform. However, one of the main objections3 to reforming Illinois’ system is the false but often repeated claim that workers’ compensation legislation enacted in 2011 fixed the system. Illinois Senate President John Cullerton has voiced support for this myth, while House Speaker Mike Madigan has inaccurately insisted that workers’ compensation isn’t a budgetary issue.4

The savings from Illinois’ 2011 reforms have already been priced into Illinois’ system. The result: Illinois is still uncompetitive with Midwestern and surrounding states.

Two new reports counter the myth that Illinois’ 2011 workers’ compensation changes fixed the workers’ compensation system and made Illinois competitive again.

First, new research from the Workers Compensation Research Institute, or WCRI, shows that Illinois’ 2011 workers’ compensation reform law had a small impact on reducing costs per workers’ compensation claim.5 In addition, data released by the state of Oregon reveal that Illinois’ workers’ compensation insurance costs remain uncompetitive as of 2016, five years after the reforms were passed.6

Illinois still the highest-cost state after 2011 workers' comp reform savings

New research from WCRI7 shows that total costs per claim fell by 6.4 percent as a result of Illinois’ 2011 workers’ compensation law, while the median state studied saw costs increase by 8.7 percent over the same time period. However, Illinois still has the highest cost per claim of all states considered in WCRI’s study.

WCRI researcher Evelina Radeva attributes the 6.4 percent cost-per-claim reduction to a 30 percent reduction in the state’s medical fee schedule. Radeva points out that Illinois’ cost-per-claim savings on medical fees was somewhat offset by rising delivery expenses per claim. Delivery expenses include medical cost-containment expenses and litigation expenses.

The WCRI study compares 18 states that are geographically diverse and represent a range of different system features. WCRI’s research study is extremely rich and considers a wide variety of factors that affect changing costs in each state.

Major findings that should inform the Illinois discussion on total costs, cost drivers and the state’s changing economy include:

Total cost

- Illinois had the largest decrease in total costs per claim of all study states after its 2011 reforms.

- However, Illinois still has the highest cost per claim of all study states.

- Indemnity benefits are the largest component of total cost in Illinois. (Note: Illinois increased indemnity benefits in 2005.)

- Even after reducing its medical fee schedule, Illinois has higher than normal medical payments per claim. Medical prices paid in Illinois are higher than in other states, except for evaluation and management services.

- Litigation expenses per claim are growing faster in Illinois than in all other study states. In particular, the cost of medical-legal expenses and defense attorney payments per claim had the highest growth rates of all states in the study.

- Defense attorneys were involved in 42 percent of claims that included more than seven days of lost time, a higher percentage than in other study states.

- Illinois has a high proportion of claims with more than seven days of lost time, compared with other study states.

- Injured Illinois workers with permanent partial disability benefits stayed off work for 19 weeks on average, compared with 13 weeks in the median state.

- The study notes Illinois’ loss of well-paying jobs in manufacturing and growth of low-paying service jobs as a factor that could be bringing down the state’s overall costs.

- The study notes slow jobs growth and weak income growth as other factors that could be affecting cost. The weak income growth is likely related to the rapid out-migration of Illinois workers.

In summary, Illinois costs have come down by 6.4 percent as a result of the 2011 changes, but Illinois costs per claim remain the highest of all states considered.

Illinois remains uncompetitive for blue-collar jobs

Illinois’ 6.4 percent reduction in costs per claim is a first step. However, Illinois’ 2011 reforms leave Illinois with the highest average cost per claim of all states studied by WCRI and leave Illinois with the highest average insurance premium among Midwestern and surrounding states. According to 2016 data from the state of Oregon, Illinois remains the most expensive state in the Midwest and among Illinois’ surrounding states for workers’ compensation.8

A previous Illinois Policy Institute report9 looked at workers’ compensation costs in key industries by examining insurance prices for different job occupations, using 2014 data from the state of Oregon’s workers’ compensation study.

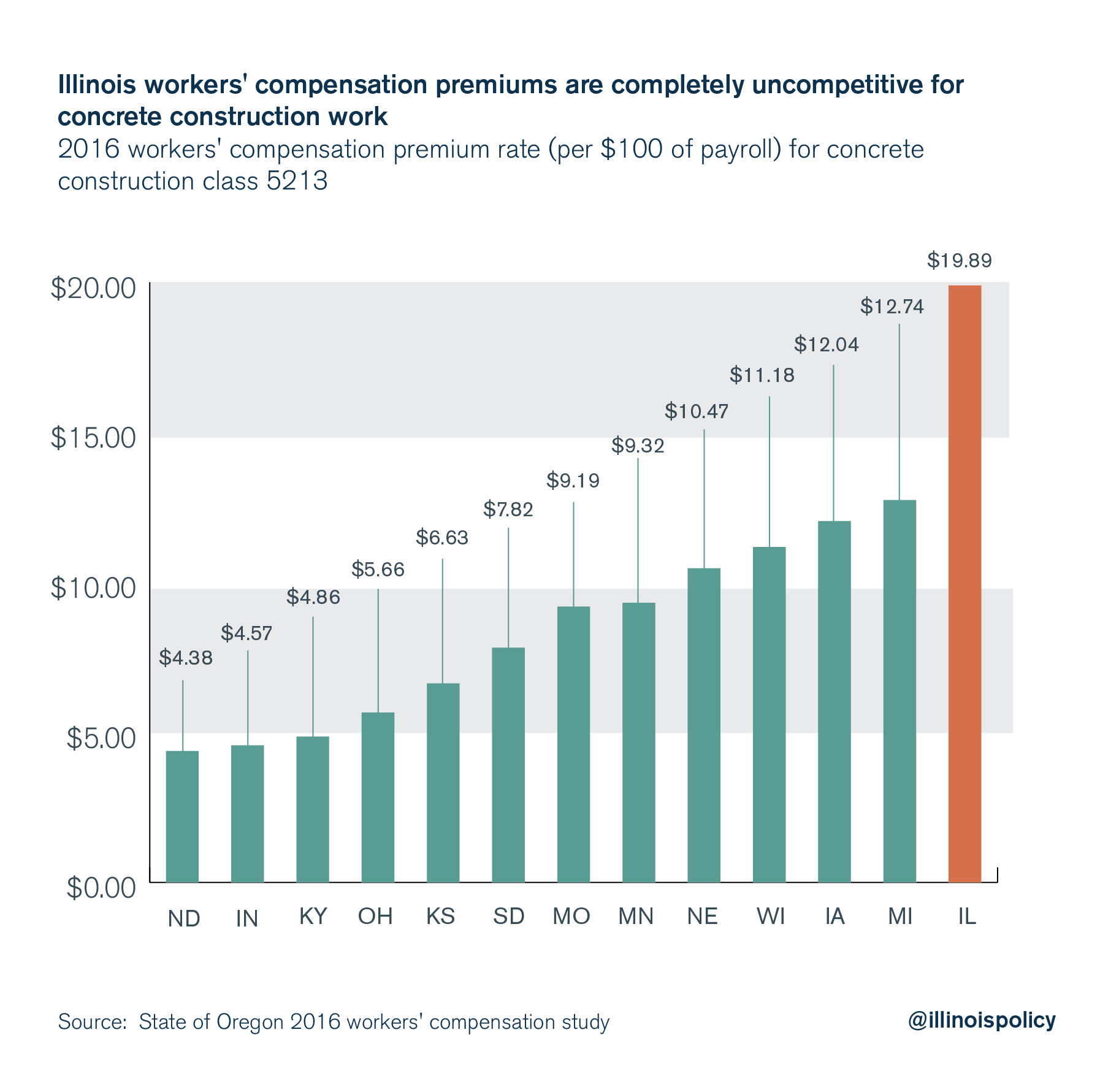

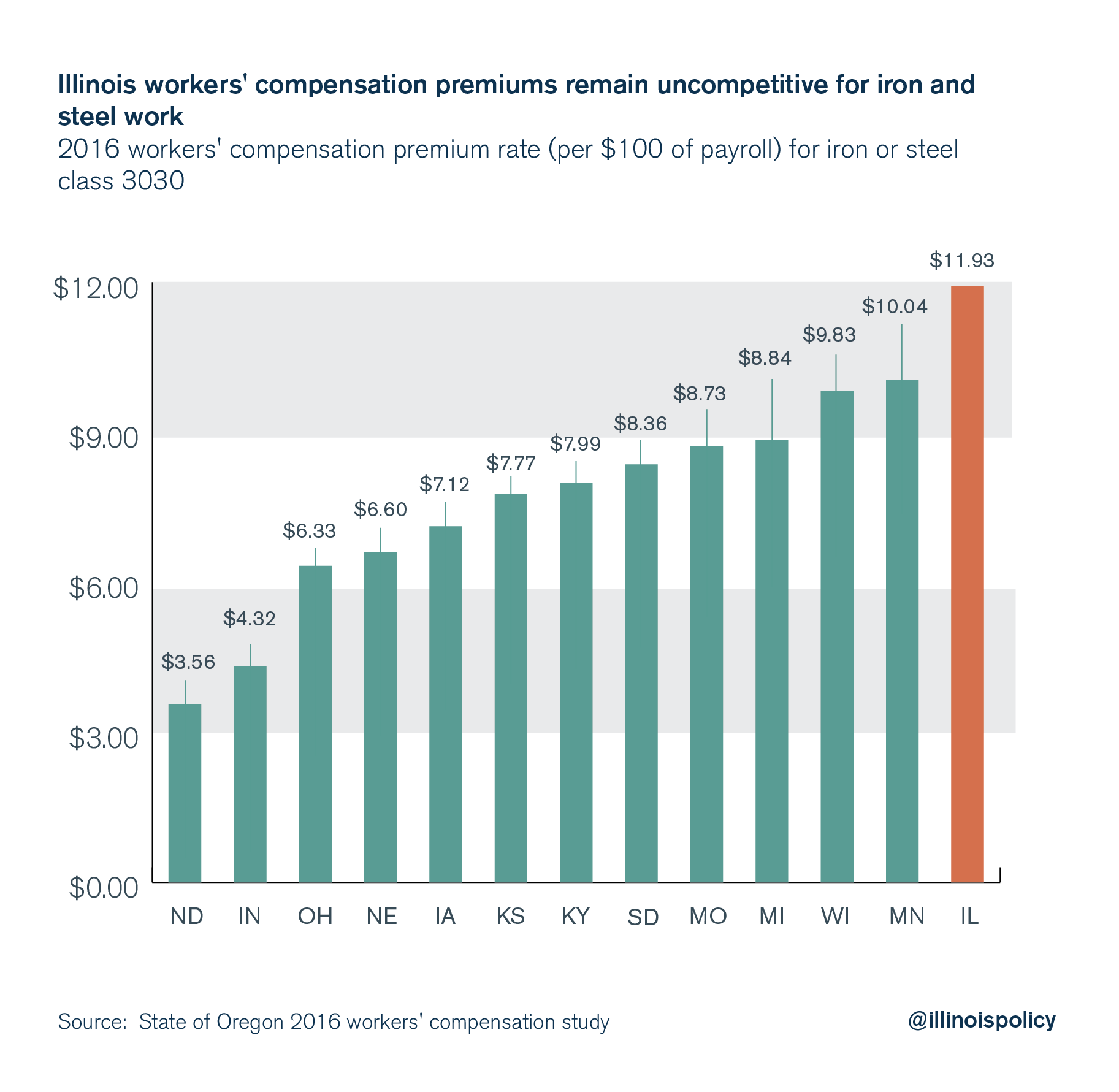

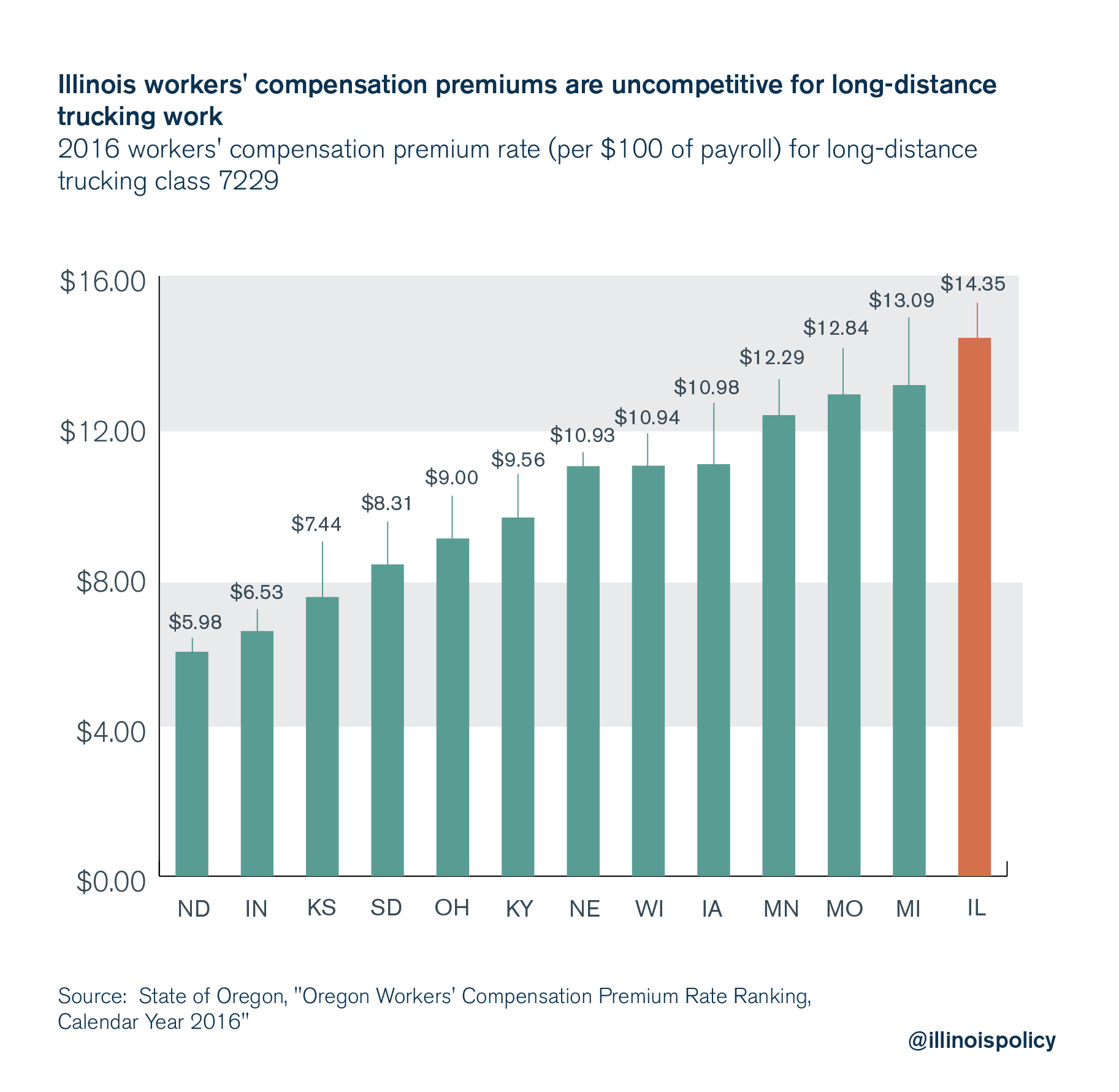

The state of Oregon has since published 2016 industry-specific data10 that show that Illinois still remains completely uncompetitive for workers’ compensation in blue-collar industries. The Oregon report included premium rate comparisons for 14 construction occupations, six manufacturing and production occupations and two transportation occupations. (These comparisons are included in the appendix of this paper.)

Among Midwestern and surrounding states, Illinois was the highest-cost state for 12 of the 22 blue-collar occupations considered, and had the second-highest costs for five of the 22 blue-collar occupations considered.

Illinois’ average premium for these 22 occupations is $11.82 per $100 of payroll. The average of Midwestern and surrounding states for these 22 occupations is $7.62 per $100 of payroll. Indiana’s average for these 22 occupations is $4.48 per $100 of payroll.

For example, Illinois’ premium cost for concrete construction workers is $19.89 per $100 of payroll, which works out to be 141 percent above the average premium rate of nearby states, and 335 percent above Indiana’s rate.

Workers’ compensation remains a sore spot for Illinois manufacturers. For example, Illinois’ premium cost for steel and iron workers is $11.93 per $100 of payroll, which works out to be 60 percent above the average premium rate of Midwestern and surrounding states, and 176 percent above Indiana’s rate.

Workers’ compensation is a key factor that makes transportation work uncompetitive in Illinois. For example, Illinois’ premium cost for long-distance truck drivers is $14.35 per $100 of payroll, which works out to be 46 percent above the average premium rate of Midwestern and surrounding states, and 120 percent above Indiana’s rate.

Conclusion

Illinois’ workers’ compensation law keeps Illinois uncompetitive in blue-collar industries. The 2011 reform effort resulted in marginal cost reductions, but Illinois remains the most expensive state in WCRI’s study on a cost-per-claim basis, and is the most expensive state in the Midwest and among surrounding states, according to state of Oregon data.

The overwhelming body of evidence suggests that Illinois has only taken the first steps in fixing its workers’ compensation law, and much more needs to be done.

Fixing the cost equation will require lawmakers to address the cost drivers in Illinois’ system, including indemnity payments, wage replacement ratios, the medical fee schedule and physician dispensing of dangerous opioids. The Illinois Policy Institute’s research and recommendations on these topics,11 if enacted into law, would be a significant step in prioritizing the long-term best interests of workers and businesses while also bringing Illinois’ costs in line with those in other Midwestern and surrounding states.

Appendix

Endnotes

- Austin Berg, “Heavy Metals.”

- Radeva, CompScopeTM Benchmarks for Illinois.

- Ibid.

- Oregon Department of Consumer and Business Services, Oregon Workers’ Compensation Premium Rate Ranking.

- Lucci, “Illinois Remains Most Expensive State in Midwest for Workers’ Compensation.”