Unpaid sick leave spikes Illinois teachers’ pension benefits

By Ted Dabrowski, John Klingner

Download Report

Unpaid sick leave spikes Illinois teachers’ pension benefits

By Ted Dabrowski, John Klingner

Download Report

Pension costs for state government workers reached an all-time high in 2016, consuming 25 percent of the state’s general budget.1 Today, more than $8 billion of the state’s yearly $32 billion budget goes to pay for pension costs, sapping tremendous amounts of money from social services for the developmentally disabled, grants for low-income college students, and aid to home health care workers.2

A large portion of those costs are driven by major factors that push up pension benefits: early retirements, generous cost-of-living adjustments, and limited employee contributions.3 But there are other pension perks that contribute to the unsustainable growth in pensions. Government workers’ ability to roll over and accumulate unpaid sick leave is one of those perks. Teachers and other members of the Teachers’ Retirement System, or TRS, are one group of workers in Illinois who benefit from unpaid sick-leave accumulation. Under current pension rules, teachers can accumulate up to two years of unpaid sick leave. Upon retirement, that sick leave is applied to teachers’ years of service, which in turn boosts their pension benefits.

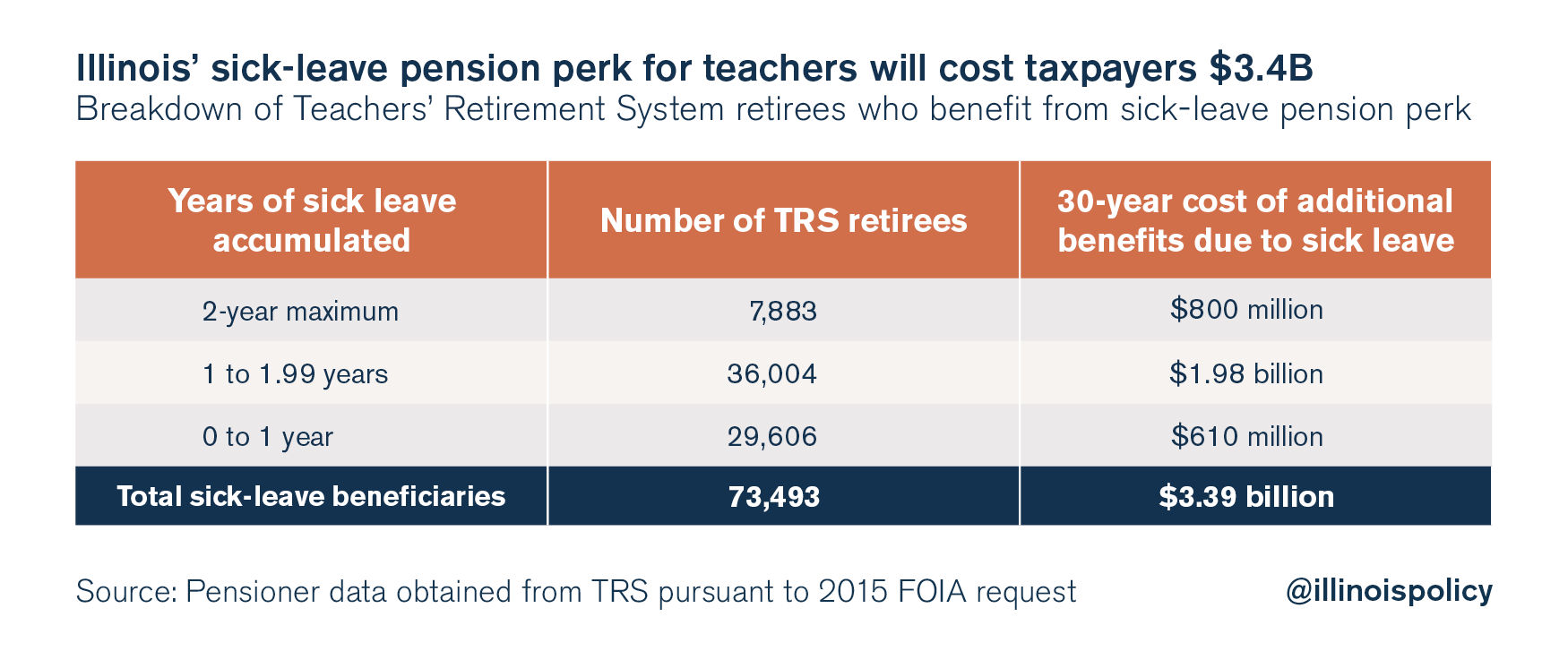

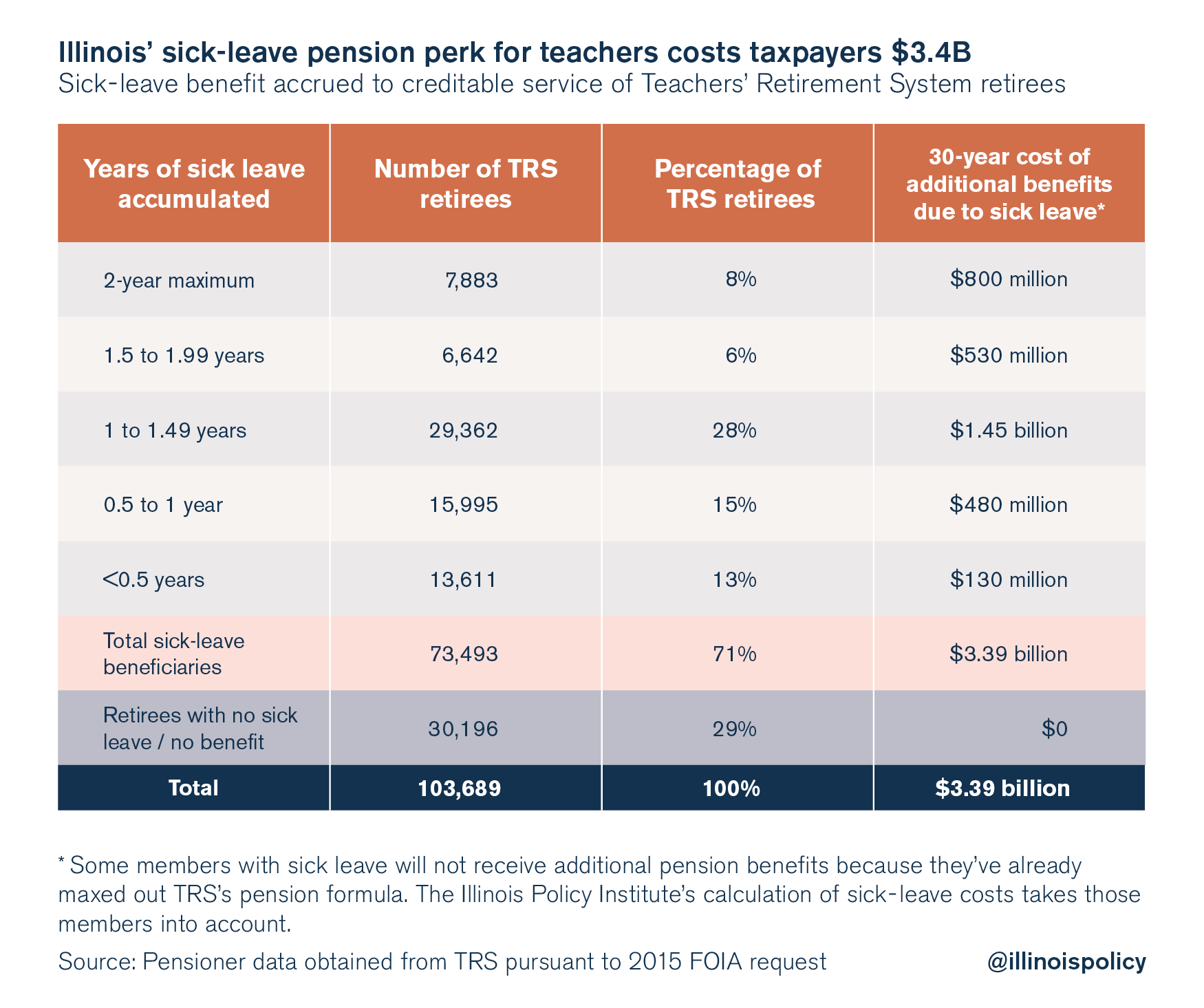

In total, over 73,000 retired teachers and other school workers are taking advantage of this perk, which will cost taxpayers nearly $3.4 billion over the next three decades.

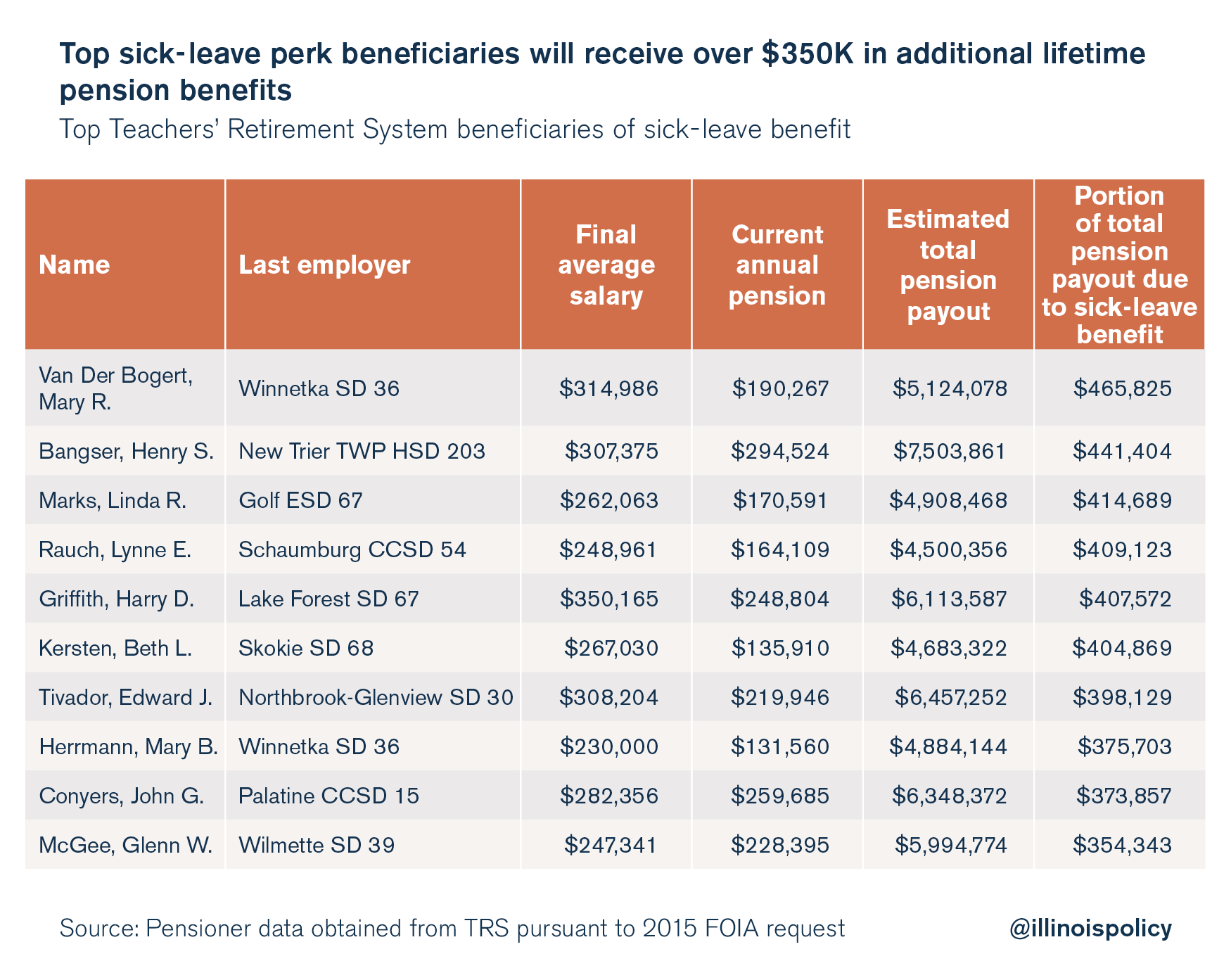

The sick-leave perk can boost retirees’ pension benefits significantly. Over 6,800 TRS retirees will receive over $100,000 in additional pension benefits, and the top 10 beneficiaries of the sick-leave perk will see their lifetime pension benefits boosted by $350,000 or more.

While sick leave is necessary for working teachers, letting unpaid sick leave accumulate for the purpose of boosting pensions is an expensive perk that taxpayers cannot afford.

Accumulating sick days

In Illinois, public school teachers and other members of TRS can accumulate unpaid sick days throughout their careers, rolling over unused days from year to year to amass up to two years’ worth of sick days. At retirement, teachers can use these accumulated sick days as credit toward their starting pension benefit, with each unused sick day treated as an additional day spent in the classroom.

According to Illinois’ Pension Code:4

“For … any days of unused and uncompensated accumulated sick leave earned by a teacher … [t]he service credit granted under this paragraph shall be the ratio of the number of unused and uncompensated accumulated sick leave days to 170 days, subject to a maximum of 2 years of service credit. … A member is not required to make contributions in order to obtain service credit for unused sick leave.”

Through this benefit, a teacher can apply the equivalent of two years of service credit toward his or her annual pension benefit.

According to member data received directly from TRS, nearly 90 percent of the state’s currently retired TRS members received some service credit for unpaid sick days.5

However, sick-leave service credit does not always result in additional pension benefits. TRS members who work long enough to receive 34 years or more of regular service credit receive the maximum starting benefit under the pension formula (75 percent of final annual salary). Additional service credit from the sick-leave perk cannot boost those members’ starting pension benefit any further.

Regardless, over 70 percent of current TRS retirees receive some pension benefits from the sick-leave perk.

Of the 103,700 currently retired TRS members, over 73,000 receive additional pension benefits due to unpaid sick leave.

The nearly 7,900 retirees who benefit from the maximum two years of sick leave will cost taxpayers $800 million over the next 30 years. Retirees who benefit from one to 1.5 years of sick leave will cost over $1.45 billion.

In total, unpaid sick-leave benefits will cost Illinois taxpayers nearly $3.4 billion over the next three decades in additional pension expenses. In 2015 alone, the perk cost taxpayers $100 million.

Sick leave and school districts

The total amount of sick leave teachers can accumulate is determined district by district and is negotiated between individual school boards and the local teachers unions.

School districts have an incentive to offer sick leave as a benefit to teachers and other district workers because it costs the districts nothing. Districts don’t bear the cost of pensions. Instead, the state of Illinois – and therefore taxpayers across the state – pays the cost of teachers’ pensions.

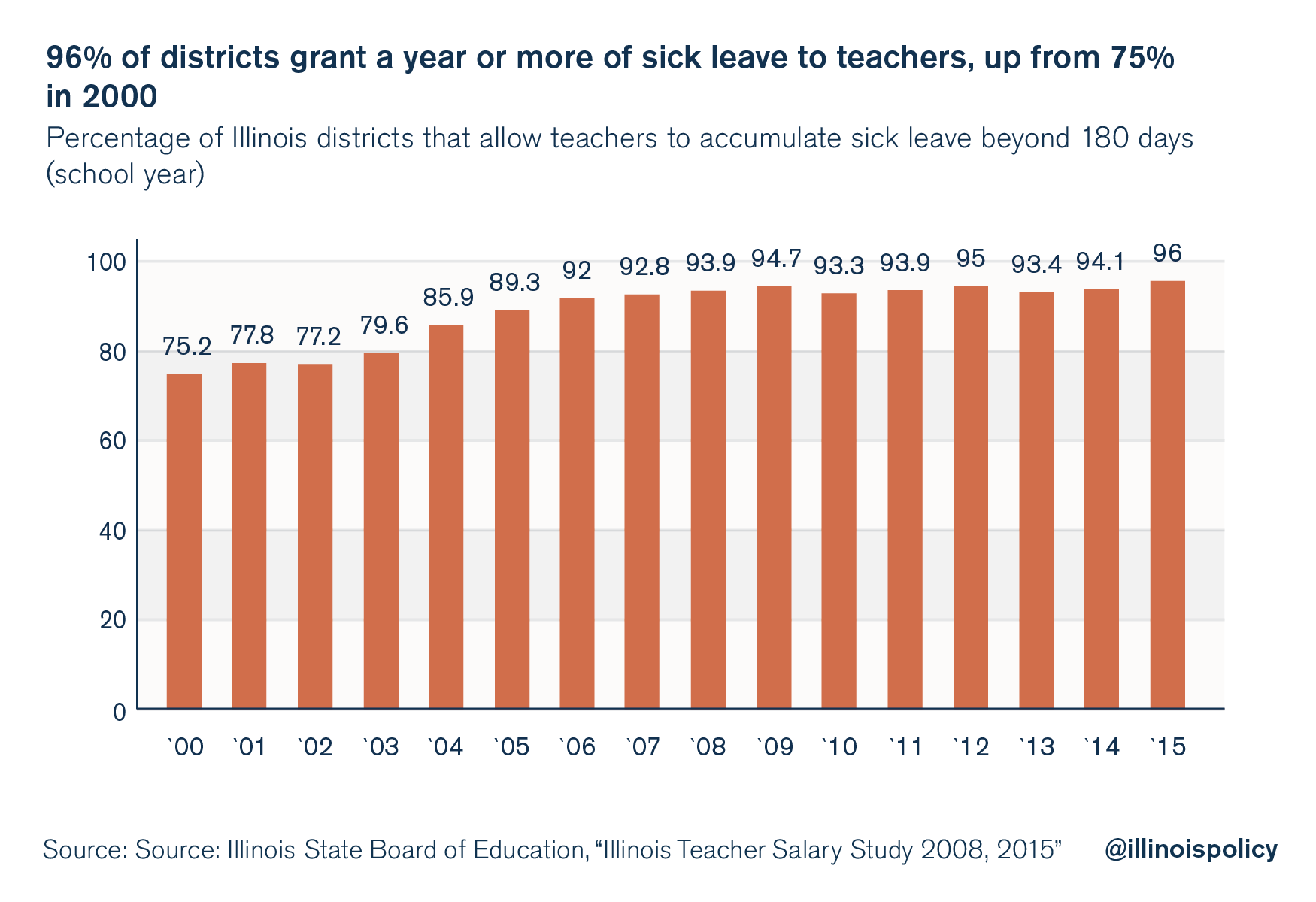

As a result, the number of districts that allow teachers to accumulate a year or more of sick leave has been growing steadily, according to the Illinois State Board of Education’s “Illinois Teacher Salary Study, 2014- 2015.” Today, a full 96 percent of school districts across the state allow teachers to accumulate a year or more of sick leave. In 2000, just 75 percent of school districts granted that perk.6

For example, the contract between the Wilmette Education Association and Wilmette Public Schools District 39 allows teachers to amass more than two (school) years’ worth of sick days after 20 years of teaching.7

“Each Bargaining Unit Member shall be entitled to a total of sixteen (16) days of sick leave with full pay per school term during the first ten (10) years of District service. Beginning with the eleventh (11th) year of District service each member shall be entitled to seventeen (17) days per year of sick leave. Beginning with the twentieth (20th) year of District service each member shall be entitled to eighteen (18) days per year of sick leave. Unused sick leave shall accumulate up to three hundred seventy-six (376) days. Sick leave shall be interpreted to mean illness, quarantine at home, or serious illness in the immediate family for which purposes of this section shall include: spouse, domestic partners, brothers, sisters, children, step-children, grandparents, grandchildren, parents-in-law, brothers-in-law, sisters-in-law, legal guardians, parents or others residing in the household.”

School district employees should have sick-leave benefits in case of their own or their family members’ illnesses, but current TRS pension rules go beyond serving that purpose.

The accumulation of sick leave for the purpose of boosting pensions, as the Wilmette teachers’ contract allows, creates a perk that taxpayers cannot afford.

How sick-leave benefits boost teachers’ pensions

The TRS pension benefit formula grants teachers 2.2 percent of their final average salary for each year of service, to a maximum of 75 percent, to determine their starting pensions.8

So, in addition to years actually worked, a teacher with one year of accumulated sick leave will receive an additional year of credited service, or 2.2 percent of his or her final average salary during retirement. A teacher with two years of accumulated sick leave will receive an additional two years of service, or 4.4 percent of his or her final average salary during retirement.

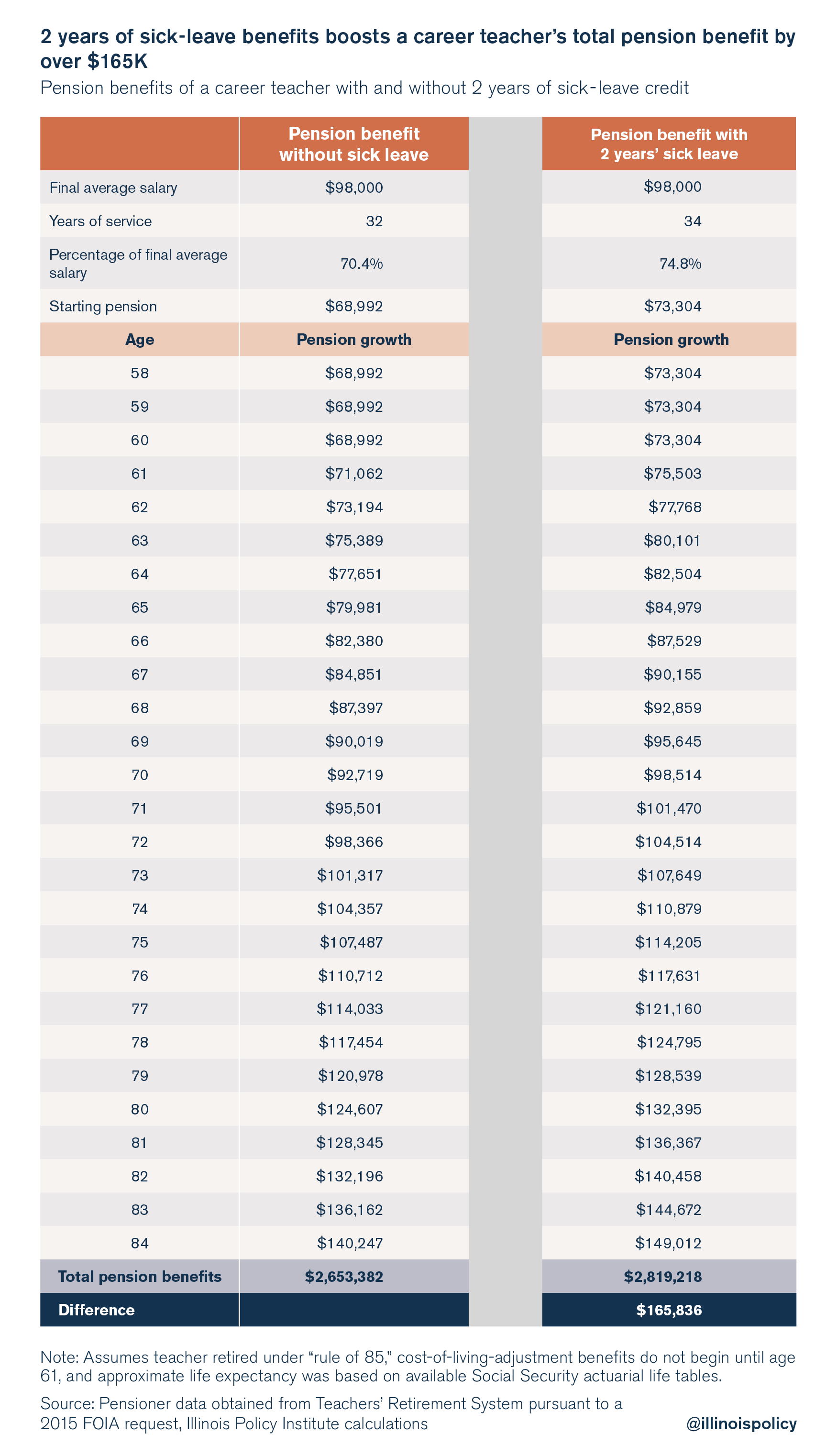

While an additional 4.4 percent of final average salary may seem like a minor perk, it ends up granting career teachers $165,000 or more in additional pension benefits in retirement.

For example, take a hypothetical career teacher who recently retired at the age of 58 with 32 years of service and a final average salary of $98,000.

Those 32 years of service will give that teacher a starting pension of $68,992 (32 years of service, multiplied by 2.2 percent per year = 70.4 percent of final average salary). Assuming that teacher lives to her approximate life expectancy of 84, she’ll receive $2.65 million in pension benefits over the course of her retirement.

But if that same teacher has two years of accumulated sick leave in addition to her 32 years of regular service, she’ll receive $2.82 million in total pension benefits.

The two years of unpaid sick leave will give her two extra years of service credit, boosting her starting pension to $73,304 (34 years of service, multiplied by 2.2 percent per year = 74.8 percent of final average salary). Overall, those two years of sick leave will give that teacher over $165,000 in additional pension benefits over the course of her retirement.

Top sick-leave beneficiaries

Over 6,800 TRS retirees will each receive over $100,000 in additional pension benefits due to accumulated sick leave. The top 10 beneficiaries of the pension perk will each receive $350,000 or more in additional benefits during retirement.

For example, look at Henry Bangser, a former superintendent of New Trier Township District 203 who retired in 2006 with a starting pension of $230,000. In all, Bangser can expect to receive $7.5 million in benefits over the course of retirement if he lives to his approximate life expectancy.

The retired superintendent’s massive pension is due to a number of factors: Bangser began collecting a pension at age 57, salary spiking boosted his final average salary by over 50 percent, and a generous pension formula allowed him to collect 75 percent of his final average salary as his starting pension.

But the sick-leave perk also contributed to Bangser’s benefits. He, like thousands of other school workers, cashed in two years of accumulated sick days to boost his starting pension. In all, the perk will increase Bangser’s lifetime pension benefit by over $440,000.

The total cost of sick leave and other pension benefits

In total, 73,000 retired teachers benefit from sick-leave boosts to their pension benefits.

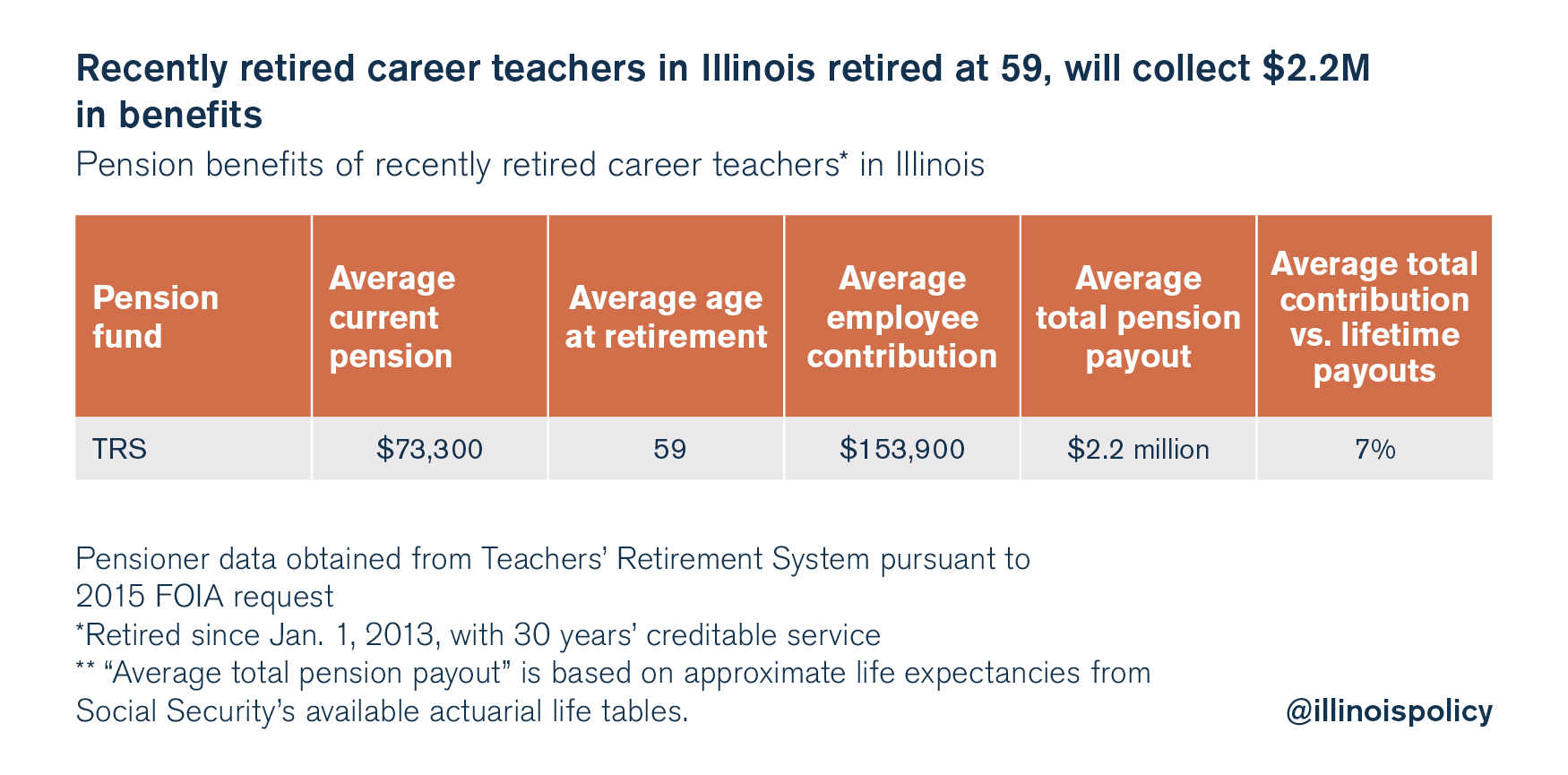

But TRS’s sick-leave benefit is only one small part of a large number of overly generous retirement rules from which Illinois teachers benefit. Nearly 70 percent of teachers retire in their 50s, all receive 3 percent compounded cost-of-living adjustments annually in retirement, and employee contributions remain out of sync with the $2.2 million an average career teacher receives in retirement benefits.9

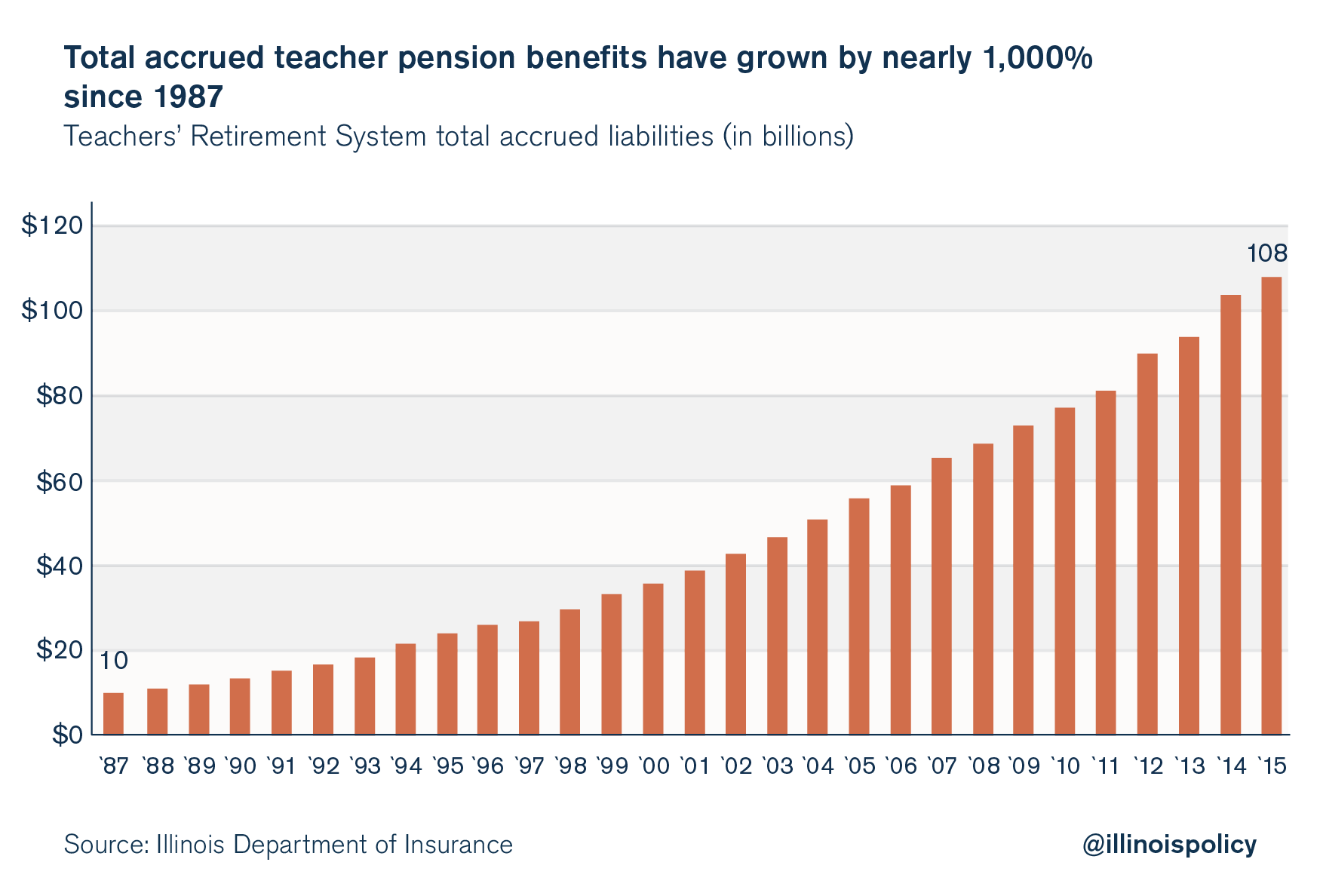

As a result, the total pension benefits accrued by Illinois teachers have increased nearly 1,000 percent between 1987 and 2015, growing at an annual rate of 9 percent a year. That growth rate far surpasses the growth rates of state revenues, inflation and taxpayers’ ability to pay for those benefits during that same period.

Illinoisans now owe teachers over $108 billion in accrued pension benefits, at least $3.4 billion of which is due to the sick-leave benefits of retired teachers.10

The way forward

Illinois taxpayers are paying for pension perks, including sick-leave benefits, at the expense of funding services for Illinoisans most in need.

That’s not to say that teachers themselves have done anything wrong. Government workers who earn generous pension benefits have benefited from labor negotiations that have led to lucrative compensation packages.

However, Illinois taxpayers can no longer afford to offer such benefits going forward. There are three solutions to this problem.

First, Illinois lawmakers should pass legislation that ends unpaid sick leave as a subject of collective bargaining. The accumulation of sick leave is an extravagant practice that does not exist in the private sector. Unpaid sick leave has become just another way to spike pensions and pass teacher compensation costs on to state taxpayers.

To be clear, the rules regarding paid annual sick leave – as opposed to pension-creditable accumulated sick leave – should remain unchanged (the costs of which are borne by districts, and not state taxpayers).

Going forward, sick leave should be granted on an annual use-it-or-lose-it basis – as it is in the private sector.

Second, the state should stop paying the yearly costs of teacher pensions. Teachers are employees of school districts, not the state. Going forward, school districts should pay for the yearly pension costs of their teachers.

School district officials would be more likely to exercise fiscal restraint and bargain harder against perks such as the sick-leave benefit if they had to bear the full cost of their employees’ compensation, including teachers’ salaries, benefits and pension costs.11

Third, Illinois must follow the lead of the private sector and other states and move away from its broken pension system. Nearly 85 percent of private-sector companies now have defined-contribution plans, and states ranging from Oklahoma to Rhode Island have initiated 401(k)-style reforms over the past few years.12

New teachers should be given self-managed retirement plans, and current workers should have the option to participate in self-managed plans.13 Both can be done without a change to the Illinois Constitution.

By enacting these reforms, Illinois can make important progress in fixing its pension crisis.

Endnotes

- Ted Dabrowski, “Pension Costs Eat Up Funding Meant for Students,” Illinois Policy Institute, February 27, 2016.

- Ted Dabrowski, “Why Illinois Shortchanges People Dependent on Government Services,” Illinois Policy Institute, June 9, 2016.

- Ted Dabrowski, John Klingner, “What’s Driving Illinois’ $111 Billion Pension Crisis,” Illinois Policy Institute, April 2016.

- 40 ILCS 5, Article 16, Illinois Pension Code.

- Member data received pursuant to a 2015 Freedom of Information Act request to TRS.

- Illinois State Board of Education, Illinois Teacher Salary Study 2014-2015, (April 2015).

- Contract between District 39 Board of Education and Wilmette Education Association, 2013-2016.

- Commission on Government Forecasting and Accountability, Financial Condition of the Illinois State Retirement Systems as of June 30, 2015, (March 2016).

- Member data received pursuant to a 2015 FOIA request to TRS.

- Commission on Government Forecasting and Accountability, Financial Condition of the Illinois State Retirement Systems as of June 30, 2015, (March 2016).

- Collin Hitt, “Playing Favorites: Education Pension Spending Favors Wealthy, Suburban Schools,” Illinois Policy Institute, May 2012.

- Ted Dabrowski, “7 Pension Reforms that Illinois Can Still Enact Despite the SB1 Ruling,” Illinois Policy Institute, November 6, 2015.

- Ibid.