Rock Island County taxpayers can’t keep up with the rate of state spending

As the state continuously spends more than residents can afford, taxpayers in Rock Island County have seen little income growth.

Despite asking for more out of state taxpayers, Illinois hasn’t passed a truly balanced budget in 17 years.

That’s because even as the state collects more revenue, it’s spending at an even faster rate – much faster than taxpayers can keep up with. And in certain areas of the state, taxpayers are falling especially far behind.

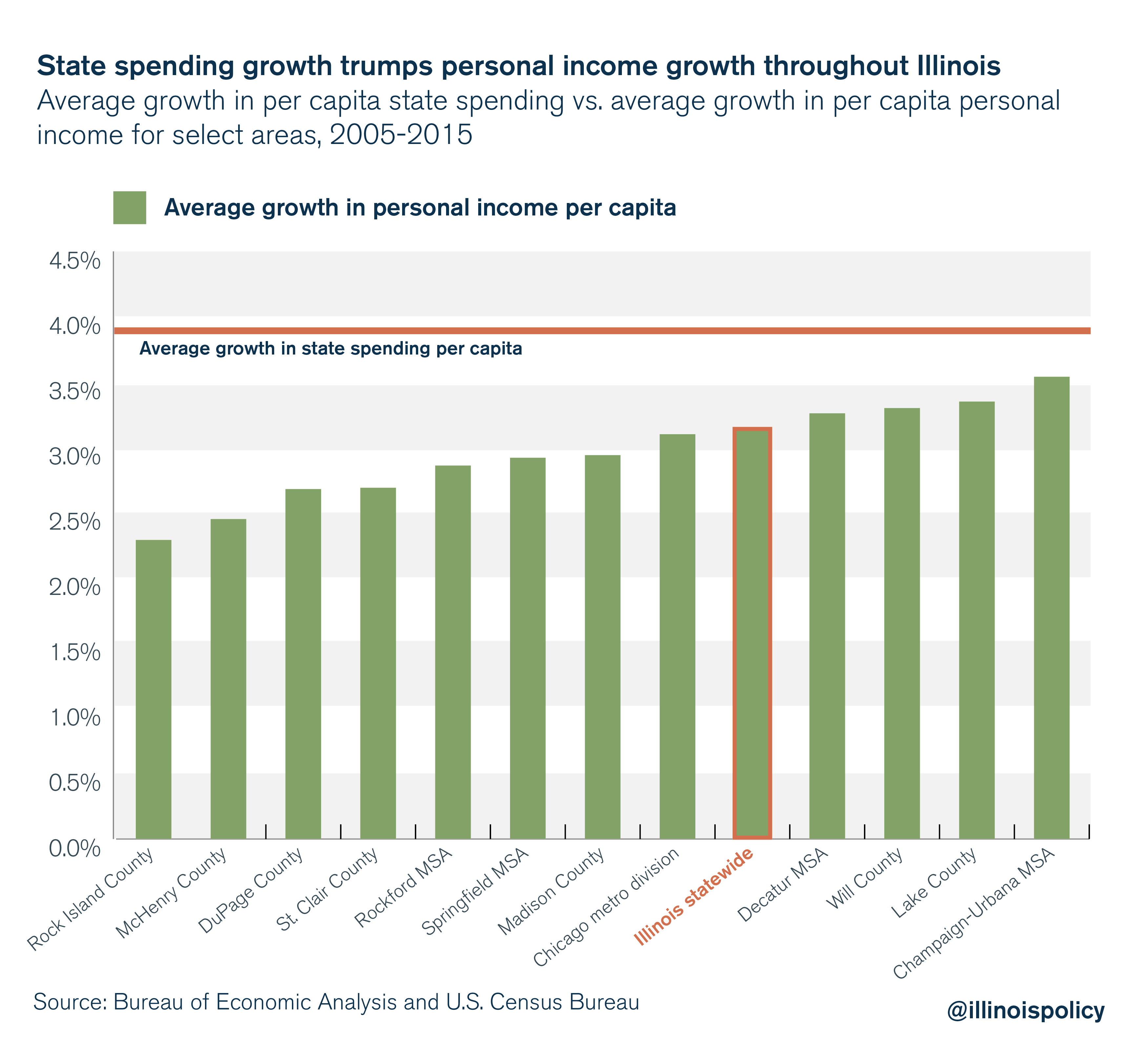

State spending per capita outpaced per capita personal income growth by 70 percent in Rock Island County from 2005-2015.

Personal income per capita in Rock Island County grew by less than 2.3 percent per year, on average. But state government spending per capita grew by an average of 3.9 percent per year, far outpacing residents’ ability to pay.

This unrestrained growth in state spending causes uncertainty for Rock Island County residents and Illinoisans across the state. As the state spends recklessly, it’s left with two options: raise taxes or borrow money, both of which place burdens on struggling taxpayers.

In 2017, even as lawmakers passed the largest permanent income tax hike in state history, the General Assembly could still not produce a balanced budget. That budget still resulted in a deficit of over $1 billion.

Given their track record, lawmakers should have seen how fruitless a new income tax hike would be. The 2011 temporary income tax, though raising $31 billion in revenue, cost the state $24.8 billion in gross output and decreased employment by 9,300 jobs between 2012 and 2016.

Rock Island County taxpayers, seeing meager income growth as the state spends beyond its means, can’t afford tax hikes as a solution to Illinois’ budgetary woes. Many in Rock Island County have already said as much with their feet: From 2010-2016, the county’s population shrank by nearly 2,800 people due to outmigration.

Instead of new tax hikes, lawmakers should pass a spending cap to get state spending under control with what taxpayers can afford. A spending cap would tie growth in government spending to growth in Illinois’ economy, meaning Rock Island taxpayers – who are seeing their incomes grow far slower than the state spends – could then rest assured they’re getting a state government they can afford.

It’s not fair for politicians to ask for more out of taxpayers while they won’t rein in their own spending. Adopting a spending cap instead of new tax hikes can provide certainty Rock Island taxpayers need, and lead to better budgetary decisions that could eventually help incomes grow.