S&P: Illinois faces junk rating, large budget deficit even with progressive tax revenue

A credit rating agency found Gov. J.B. Pritzker’s ‘fair tax’ would fail to close the state’s deficit or adequately fund essential services.

Proponents of the progressive tax amendment to the Illinois Constitution have publicly sold the “fair tax” hike as a way to raise more revenue to close Illinois’ infamous budget deficits and fund essential government services. But a new report from credit rating agency S&P Global Ratings found it would do neither.

“The fair tax will bring in billions of dollars of additional revenue that we can use to balance our budget, fund our schools, human services, and critical programs that many Illinoisans rely on,” Pritzker said in August while attending a Democratic Party fundraiser.

But S&P found Illinois faces at least a 5% budget gap for the current fiscal year 2021, even if the progressive tax is approved. The rating agency also warned because of rising debt and continued unbalanced budgets, “Illinois could exhibit further characteristics of a non-investment-grade issuer.” In other words, the state of Illinois is at risk of becoming the first “junk”-rated state in U.S. history. All three major ratings agencies currently put Illinois just one notch above junk status with a negative outlook, indicating further downgrades could come soon.

This latest warning from S&P supports findings from the nonpartisan Illinois Policy Institute that only structural spending reform to the largest cost drivers of the state budget can fix the state’s decades-long fiscal crisis.

Illinois is not lacking money. State residents already pay among the highest combined state and local tax burdens in the country, with Illinois consistently ranking among the top 10 highest taxed states. Research from the Institute of Government & Public Affairs at the University of Illinois shows from 1998 to 2018 revenues grew in real terms by 47%, but were outpaced by a 57% increase in spending.

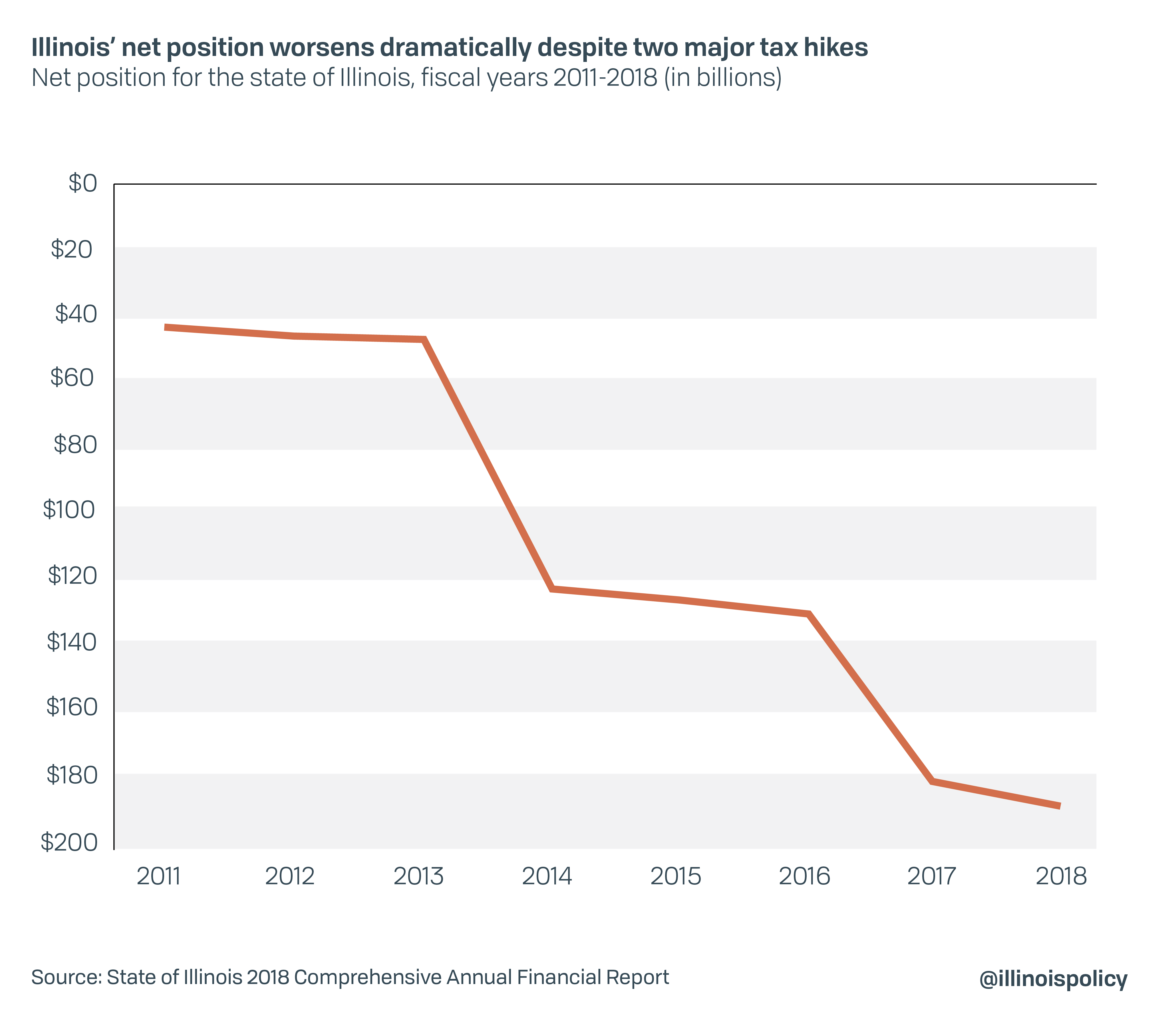

Tax hikes have already failed as a strategy to fix Illinois’ finances. Since Illinois first attempted to solve its problems with a “temporary” income tax hike in 2011, the negative net position of the state – which is similar to an individual’s net worth – has worsened by a factor of four to $189.1 billion from $43.6 billion. That’s despite a second income tax hike in 2017 making higher rates permanent and a record economic expansion during the past decade.

Accounting for the economic harm of COVID-19, the initial rates attached to Pritzker’s progressive tax proposal are expected to raise about $3 billion. That amount won’t come close to covering Illinois’ $224 billion debt burden, $6 billion current-year budget deficit and more than $8 billion in unpaid bills from prior unbalanced budgets. Pensions alone will eat just under $11 billion of the fiscal year 2022 budget.

Because the initial rates do not raise enough revenue, the progressive tax is likely to be a “bait and switch” for higher taxes on the middle class. Illinois Policy Institute research found that to close budget holes and fully finance the cost of Pritzker’s campaign spending promises, a typical middle class family could end up paying up to $3,500 more in income taxes.

Progressive tax powers make it inherently easier to raise taxes on everyone, because lawmakers do not have to worry about facing backlash from all taxpayers at once. Eliminating the flat tax protection from the Illinois Constitution would allow lawmakers to “divide and conquer” taxpayers by targeting smaller groups of taxpayers at a time.

In fact, in 18 of the 32 states with progressive income taxes, the middle class is hit with the highest income tax rate. The last state to adopt a progressive income tax, Connecticut in 1996, saw middle class income taxes jump 13% in the years that followed.

It also makes it easier to start taxing retirement income. All 32 progressive tax states tax some form of retirement income, and two members of Pritzker’s administration have publicly supported looking at retirement taxes.

Granting lawmakers permanent new progressive tax powers virtually guarantees higher taxes on the middle class – and new taxes on retirement income – but would not solve the state’s fiscal problems, as S&P warned. If voters instead reject the amendment, they’ll be sending lawmakers a clear message that it’s time to stop putting off structural spending reform.

A recent report from the Illinois Policy Institute, “Illinois Forward,” shows how commonsense reforms can fully fund public pensions, balance budgets, reduce debt and lower everyone’s taxes over time. Those reforms won’t come if lawmakers get progressive tax powers so they can try to tax their way out of their spending problems.