Official Illinois progressive tax explainer ranges from misleading to wrong

Progressive income tax proponents put factually inaccurate and misleading claims into a constitutionally required pamphlet intended to inform voters about a proposed amendment.

On Nov. 3, Illinois voters will have their first opportunity in 50 years to directly vote on a tax increase and on how much power state lawmakers deserve over who to tax. The legally required pamphlet intended to help voters make an informed decision about the progressive tax amendment is hitting Illinois mailboxes now, but it contains claims that are misleading or false.

Some of the misleading pamphlet arguments are repeated on the actual ballots in what is supposed to be a neutral description of the amendment. That potentially violates the “free and equal elections” clause of the state constitution.

The ballot description inaccurately states the amendment grants lawmakers the power to “impose higher income tax rates on higher income levels.” In fact, the amendment simply gives lawmakers the ability to charge different rates to different income groups, not merely for those with “higher income levels.”

If voters approve the “fair tax” amendment, lawmakers would have the legal authority to charge any income tax rate to any taxpayer. The Illinois General Assembly could, under the progressive tax amendment, choose to charge higher rates to lower income taxpayers.

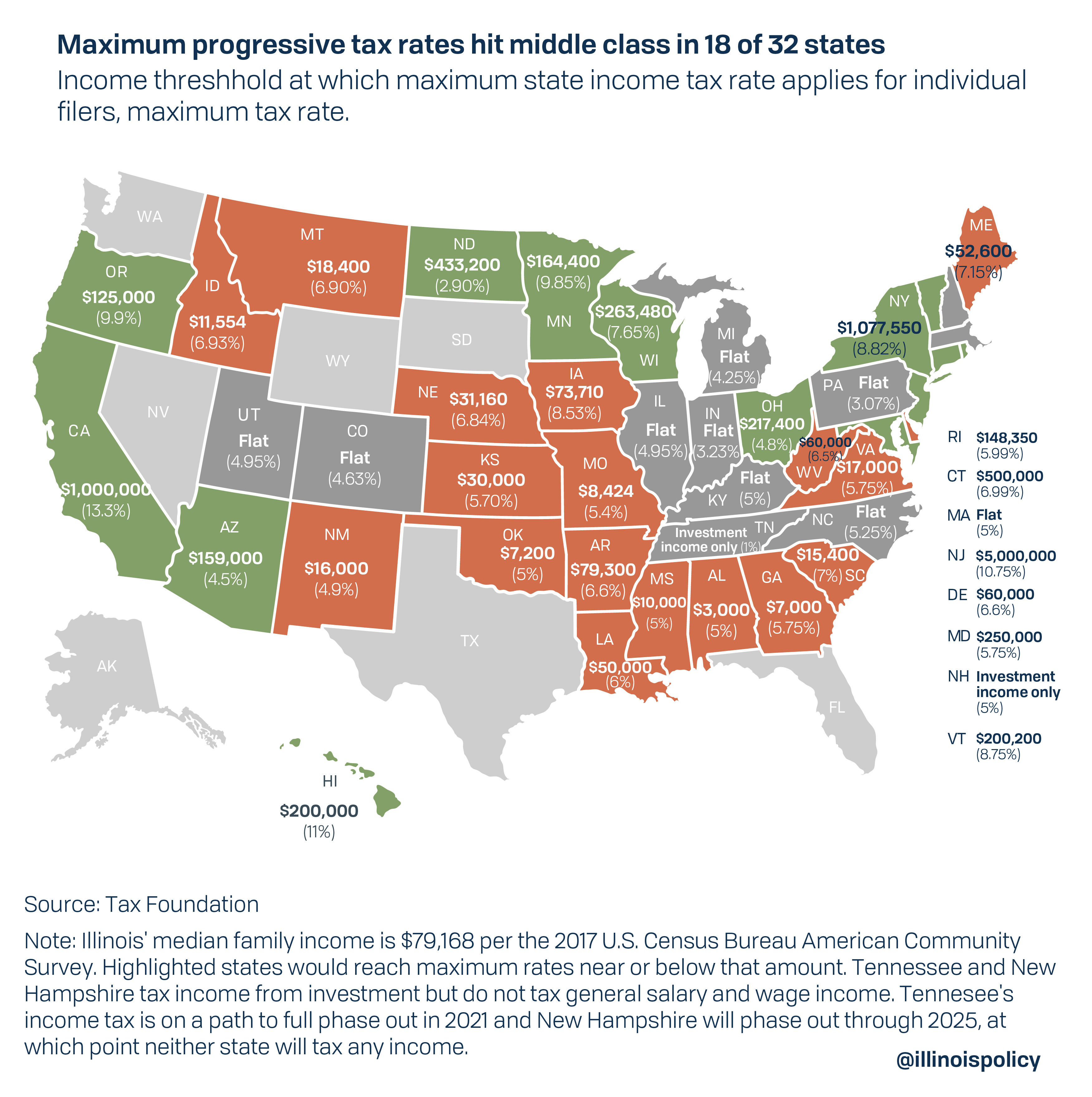

In fact, in 18 of the 32 states with progressive income taxes, the middle class is hit with the highest income tax rate.

Amendments to the constitution initiated by the General Assembly must be approved by either a majority of all voters in the next general election or by 60% of those voting on the question. The state constitution requires that such amendments “be published with explanations, as provided by law, at least one month preceding the vote thereon by the electors.”

Adding further detail, The Illinois Constitutional Amendment Act requires pamphlets containing explanations of proposed amendments be mailed to every registered voter in the state with arguments “for and against” the proposal. Language included in those explanatory pamphlets for the progressive income tax, as well as the specific text voters will see on the ballot, was approved in May 2020 on a party-line vote with only Democrats in favor.

What follows are the eight most problematic claims in the progressive tax guide, with corrections or needed context that is missing from the pamphlet.

1. “This amendment would make Illinois’ tax system fair”

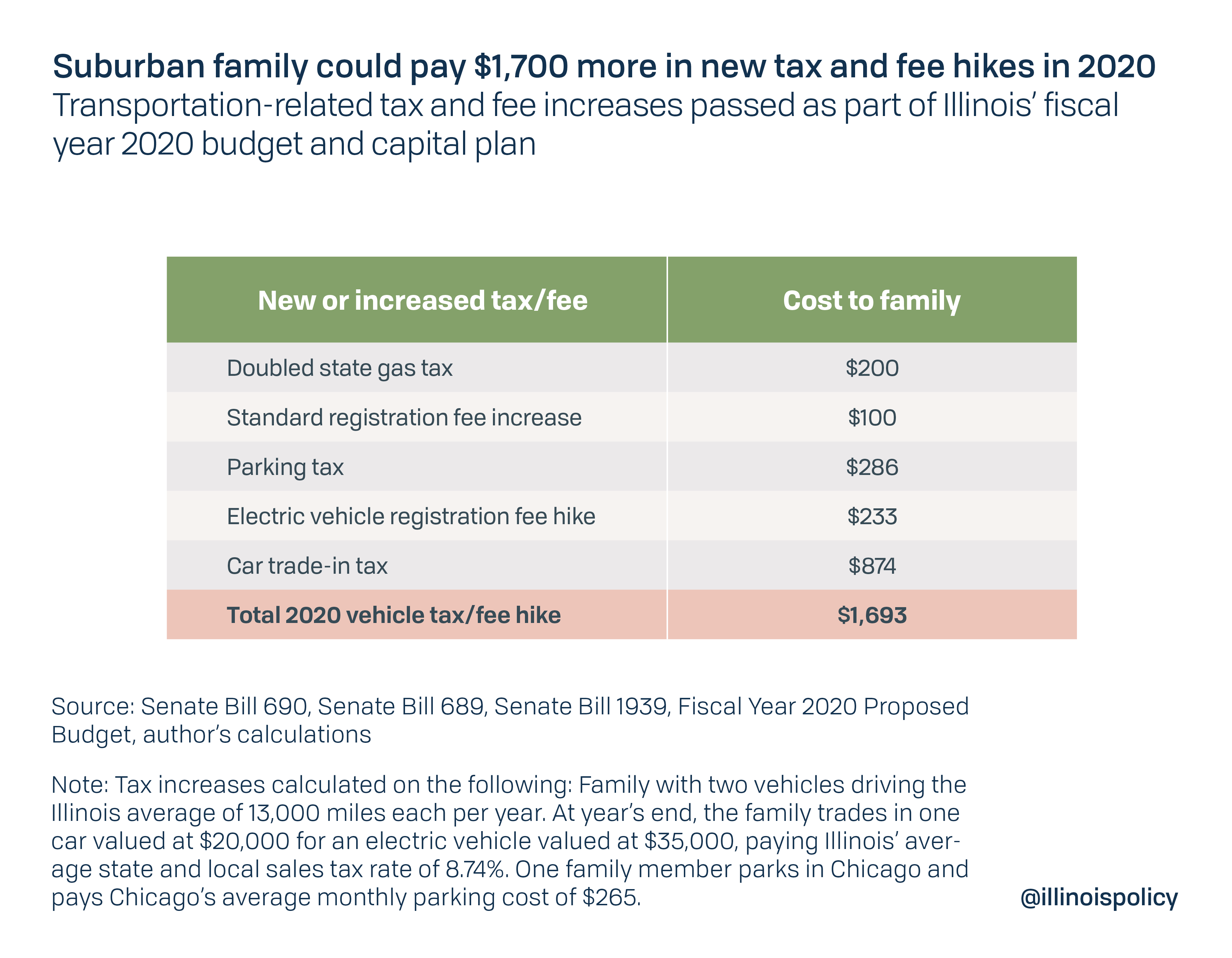

The amendment does nothing to lower Illinois’ second-highest in the nation property taxes and would leave the poorest Illinoisans paying the third-highest overall tax burden in the nation. In his first year, Gov. J.B. Pritzker signed off on 20 new or higher taxes and fees, including doubling the gas tax and hiking vehicle registration fees.

Many of those tax and fee increases were regressive, meaning they will disproportionately hurt the poor and middle class. Altogether, a typical suburban family could end up paying $1,700 more in vehicle-related taxes after Pritzker’s first-year tax hikes.

If lawmakers want to make the tax code fairer, they should focus on reducing property taxes and repealing new tax hikes that overburden working families.

2. “This amendment does not tax retirement income”

Every state with a progressive income tax also taxes retirement income.

In June, progressive tax backer and Democratic Treasurer Michael Frerichs admitted the progressive tax amendment is Step 1 to taxing retirement income in Illinois for the first time. “One thing a progressive tax would do is make clear you can have graduated rates when you are taxing retirement income,” he said while speaking at an event hosted by the Des Plaines Chamber of Commerce. “And, I think that’s something that’s worth discussion.”

Frerichs is the most recent “fair tax” backer to admit it paves the way to taxing retirement income, but not the first.

The Chicago Sun-Times’ editorial board wrote, “Pritzker’s progressive income tax plan can set the stage for far greater tax fairness. Next, that tax should be expanded to include the highest retirement incomes.”

Daniel Biss, a former Illinois state senator, Democratic candidate for governor and progressive tax advocate, said: “I would only consider taxing retirement income once we’ve amended the Illinois Constitution to allow for a progressive income tax …”

Progressive tax powers make it inherently easier to raise taxes, because lawmakers do not have to worry about facing backlash from all taxpayers at once. This amendment would enable Springfield to begin taxing retirement income above a certain level, but then gradually lower the exemption threshold to raise additional revenue, slowly adding more Social Security and pension income to the tax base.

Attempts to deny this fact likely stem from widespread public opposition. A 2019 poll from the Paul Simon Public Policy Institute found 73% of Illinoisans somewhat or strongly opposed eliminating the retirement exemption, while only 23% somewhat or strongly supported the change.

3. “This amendment will help small business owners”

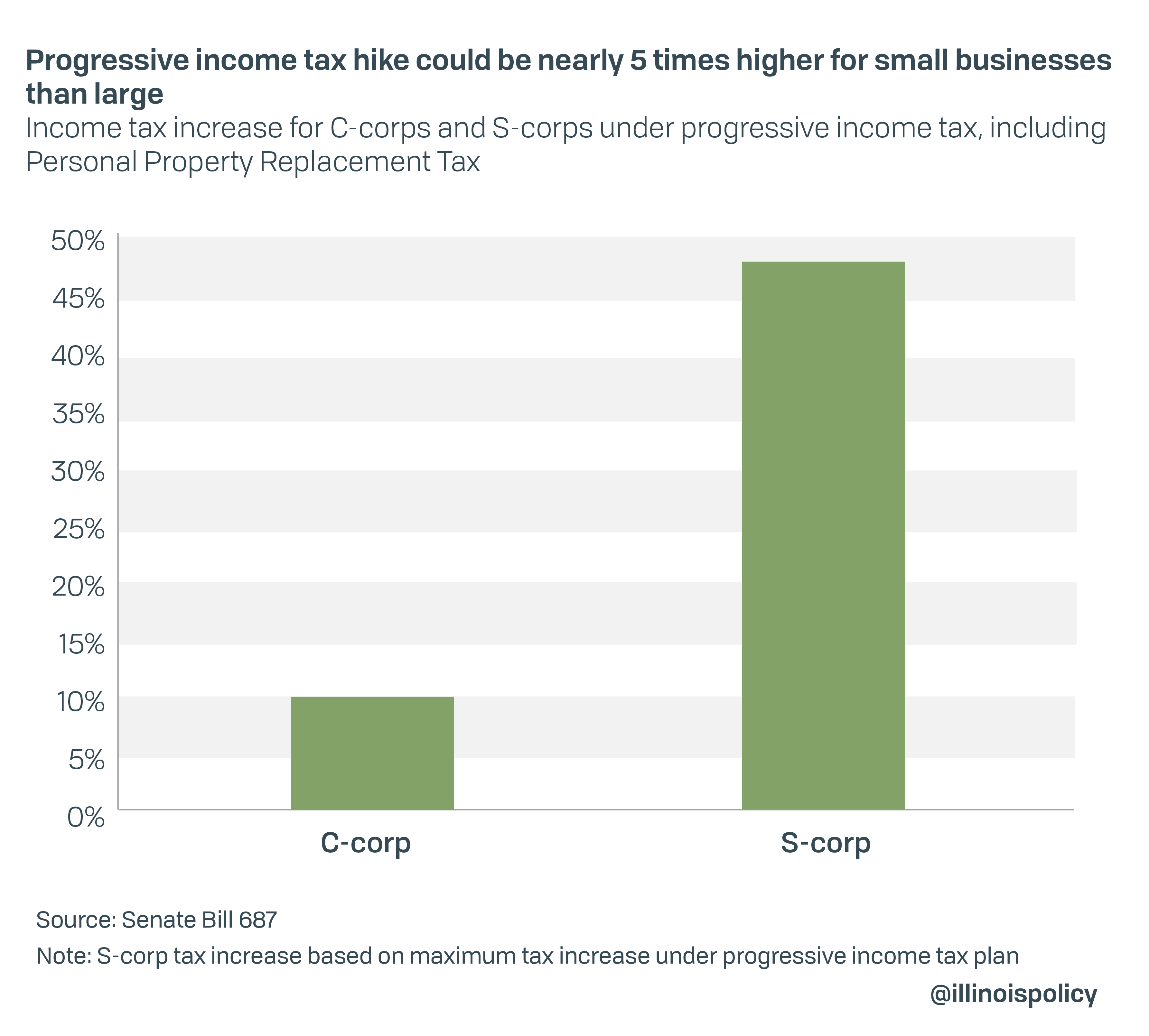

The introductory rates attached to the amendment would raise taxes as much as 47% on more than 100,000 small business owners organized as “pass-through” entities such as partnerships or S-corporations. Small businesses are responsible for 60% of net job creation in Illinois since the Great Recession. Additionally, the initial rates would raise Illinois’ corporate tax rate, paid by small businesses organized as C-corporations, to the nation’s second highest.

Such large tax increases would devastate many small business owners just as they start to recover after struggling to stay open during the COVID-19 pandemic and related government shutdowns.

4. “Only those making more than $250,000 a year will see a tax increase”

4. “Only those making more than $250,000 a year will see a tax increase”

The amendment itself does not set income tax rates, but lawmakers passed a bill that would take effect if voters approve the amendment. It sets initial progressive tax rates starting Jan. 1, 2021. However, lawmakers would have the ability to change these rates at any time and however they see fit with a simple majority vote.

Progressive tax powers make it easier to hike taxes by giving lawmakers the ability to tax different income groups differently. That would allow lawmakers to divide and conquer taxpayers, rather than facing the political backlash from raising everyone’s taxes all at once. A flat tax was written into the Illinois Constitution in 1970 to give taxpayers that recourse, and they used it after lawmakers in 2017 passed the largest tax increase in the state’s history.

The $3 billion in additional annual tax revenue the first set of rates is now projected to raise is down from a projected $3.4 billion before the COVID recession. That is a pittance next to Illinois’ $224 billion debt burdenand $6 billion budget deficit. Pensions alone will eat just under $11 billion of the fiscal year 2022 budget. If voters grant Springfield politicians the ability to select groups of taxpayers, the middle class would likely be next in the crosshairs for revenue-hungry politicians.

One of the “against” arguments in the guide puts it this way: “Because they refuse to control spending or pass major reforms, the Legislature will just continue to raise taxes on everyone in Illinois, and middle-class families will be their next target.”

Illinois politicians have a long track record of breaking their promises on taxes, including making “temporary” tax hikes permanent or using the money for purposes other than what they said they would.

5. “The federal government and most states use the graduated tax system…”

While both the federal government and 32 states allow for progressive tax powers, the maximum tax rate affects the middle class in half those states, or people earning around Illinois’ median family income of $79,168.

The progressive tax guide relies on a misleading emotional appeal Pritzker has used in the past, saying “Working people and essential workers like nurses, first responders, and grocery store clerks should not pay the same tax rate as the wealthy.” But in 18 of the 32 states the pamphlet says have the same “graduated tax system proposed in this amendment,” working people would be left paying the same top rate as billionaires such as Pritzker.

This claim also lumps together states such as California, which has 10 tax rates ranging from 1% to 13.3% on income over $1 million, with states such as Alabama, where the tax system works much more like Illinois’ flat tax. Alabama has just three separate tax brackets and rates, with the maximum 5% rate affecting all income above just $3,000 for single filers or $6,000 for joint filers.

The lack of full context around this misleading argument is especially troublesome because it is actually repeated in the neutral explanation of the amendment that will appear on the ballot.

6. “A graduated tax system would lower [tax burdens for middle- and lower-income earners]”

As discussed previously, the initial tax rates attached to the amendment offer only negligible income tax relief that has already been more than wiped out by the 20 taxes and fees hiked in 2019. Moreover, the progressive tax will likely be used as a Trojan horse for higher taxes on the middle class.

One of the pamphlet’s arguments against the progressive tax says:

“The proposed amendment would give the Legislature unlimited new authority to increase income tax rates on any group of taxpayers at will, including low-income and middle-income families and small business owners. There would be no limit on the number of tax brackets that could be created and no limit on how high tax rates could be increased on individual taxpayers. In addition, this proposed change will pave the way for a tax on retirement income.”

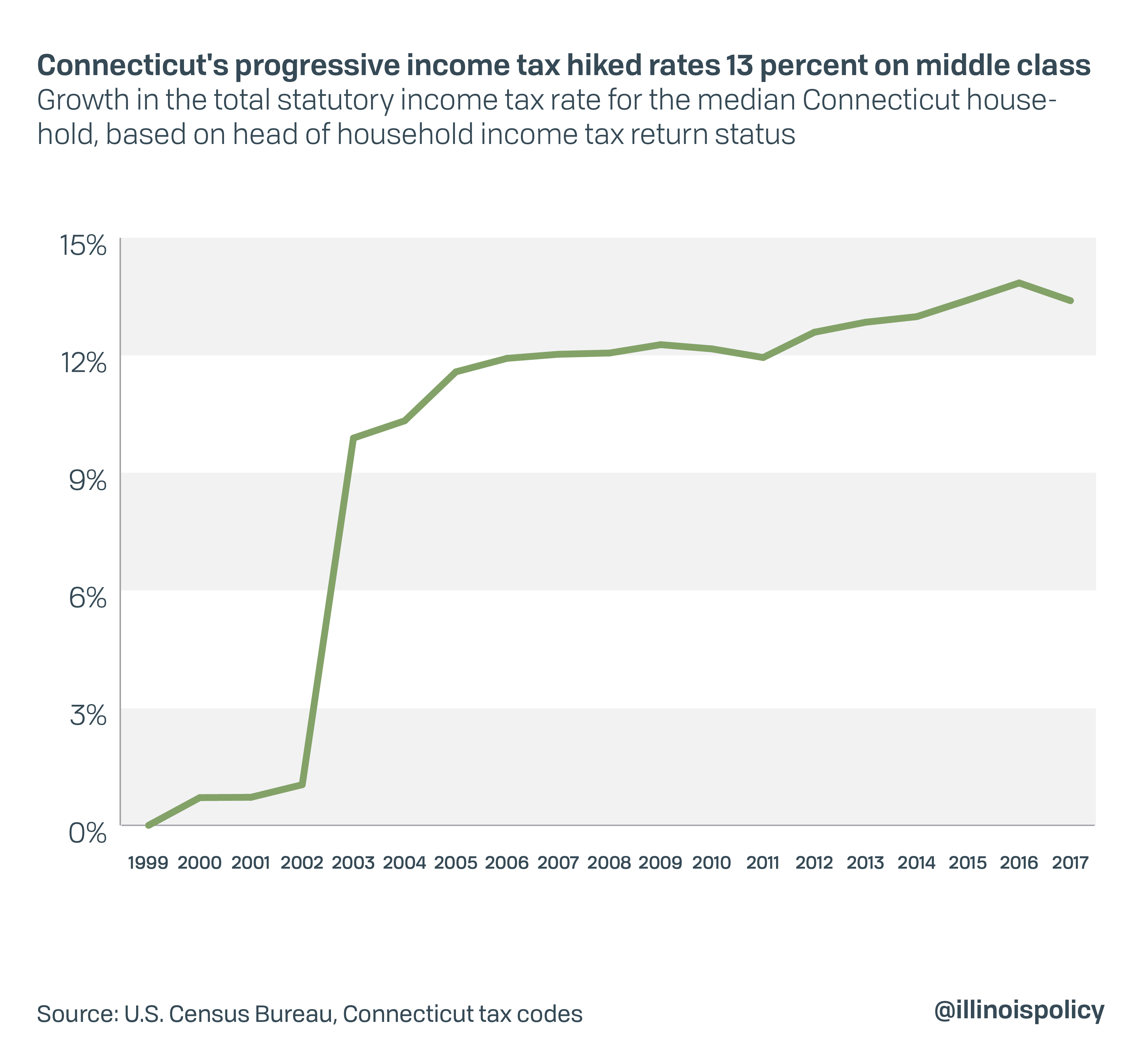

This is accurate. The last state to adopt a progressive income tax, Connecticut in 1996, saw middle class income taxes jump 13% in the years that followed.

Progressive tax supporters have also admitted that the progressive income tax paves the way to taxing retirement income in Illinois for the first time, eliminating a rare advantage in an otherwise uncompetitive tax code that has helped Illinois retain its senior residents. As mentioned, all 32 states with a progressive tax also tax retirement income.

Research from the Illinois Policy Institute has found that if Pritzker attempted to fully finance his campaign promises for higher spending, the progressive income tax would cost the typical Illinois family $3,500 more in taxes.

7. Additional revenue from the tax hike will “address Illinois’ budget deficit and fund critical programs”

After the 2017 income tax hike, Illinois’ total tax burden is already at least the sixth highest in the nation. But despite regular tax increases and record revenues, the state has not balanced a budget in 20 years.

Illinois has a spending problem, not a revenue problem. Most of the overspending is for pensions. Inflation-adjusted pension spending has increased more than 500% since 2000, causing spending on other core government services to fall by nearly one-third during the past 20 years.

Illinois will not be able to fix its infamous pension crisis or achieve a truly balanced budget without a constitutional amendment that allows for pension reform. An amendment to hike taxes cannot fix the problem.

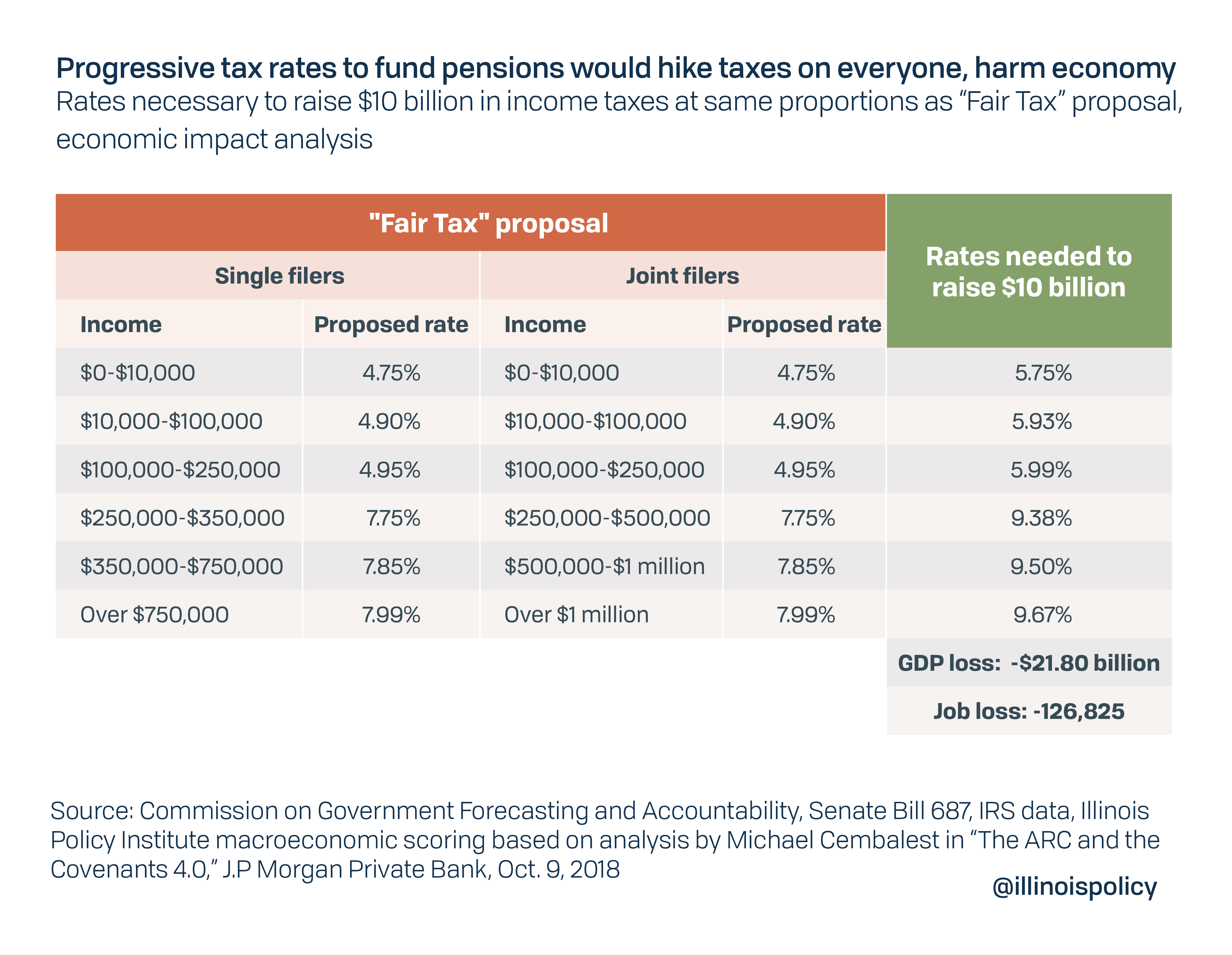

A progressive tax hike that would actually raise enough money to pay off the pension debt, using the same bracket proportions as Pritzker’s initial rates, would have to raise taxes on all taxpayers by around 21%. A tax hike of that size would cost the state economy nearly 127,000 jobs and $21.8 billion in economic output.

8. The amendment would help the economy “after the COVID-19 pandemic”

Perhaps the most bizarre and inaccurate claim made in favor of the progressive income tax is that it would help the state recover from the COVID-19 recession.

Economist are in near-unanimous agreement that hiking taxes during or just after a recession impedes economic recovery and can extend downturns. In 2009, then-President Barack Obama agreed with a questioner who raised this point, saying “[The questioner’s] economics are right. You don’t raise taxes in a recession.”

A pamphlet argument against the progressive tax nicely summarizes why asking taxpayers to pay more when they’re struggling most is so harmful:

“The COVID-19 pandemic caused layoffs, unemployment, bankruptcies, and closures. As small businesses and local employers struggle to rebuild, this is the worst possible time to impose huge new tax increases. Even before the COVID-19 crisis, many residents and businesses were leaving the state because of the high tax burden. If the Amendment passes, it would be the last straw for thousands of small businesses, causing more jobs to leave the state, and making Illinois lose out on investments to rebuild our economy. This would mean fewer jobs and less opportunity for Illinois families.”

Research from the Illinois Policy Institute has found the tax hike under Pritzker’s initial rates would kill 56,000 jobs.

Conclusion: Voters deserve accurate information ahead of important votes

Proponents of the progressive tax have long used misleading claims to push their agenda. But official government documents, mailed at taxpayer expense, and ballot explanations that are supposed to be neutral, should be free of factual errors and claims lacking important context.

Eliminating Illinois’ flat tax will not make its tax system fairer or substantially cut taxes for overtaxed businesses and working families. It offers just a $6 break to low-income Illinoisans who already pay $1,800 in state and local taxes – a higher share of their income than residents of all but two states. The progressive tax also cannot fix Illinois’ failing finances or improve its weak economy.

If voters approve the amendment Nov. 3, they will be accepting an immediate tax hike that would kill jobs and crush small businesses. Worse, they would be granting new taxing power to Springfield that would almost certainly end in even higher taxes on the middle class.

Those harms are not neutral, but they are certainly facts.