Typical Illinois family would see a tax hike under nearby states’ progressive tax rates

As examples of the type of progressive tax plan he would like to see in Illinois, J.B. Pritzker pointed to other Midwestern states. But imposing those income tax rates would raise taxes on the median Illinois family.

Democratic gubernatorial candidate J.B. Pritzker’s calls for a progressive tax in Illinois have been short on specifics. But a recent radio interview could give Illinoisans some insight into what they could expect.

During a recent radio interview with WJBC-AM 1230, Pritzker said:

“You can look at almost every state in the Midwest, from Minnesota, Wisconsin, Iowa, Missouri, you know, everybody’s got a progressive income tax, and if you look at all of those systems, I think that’s a reasonable way to at least look at how it works.”

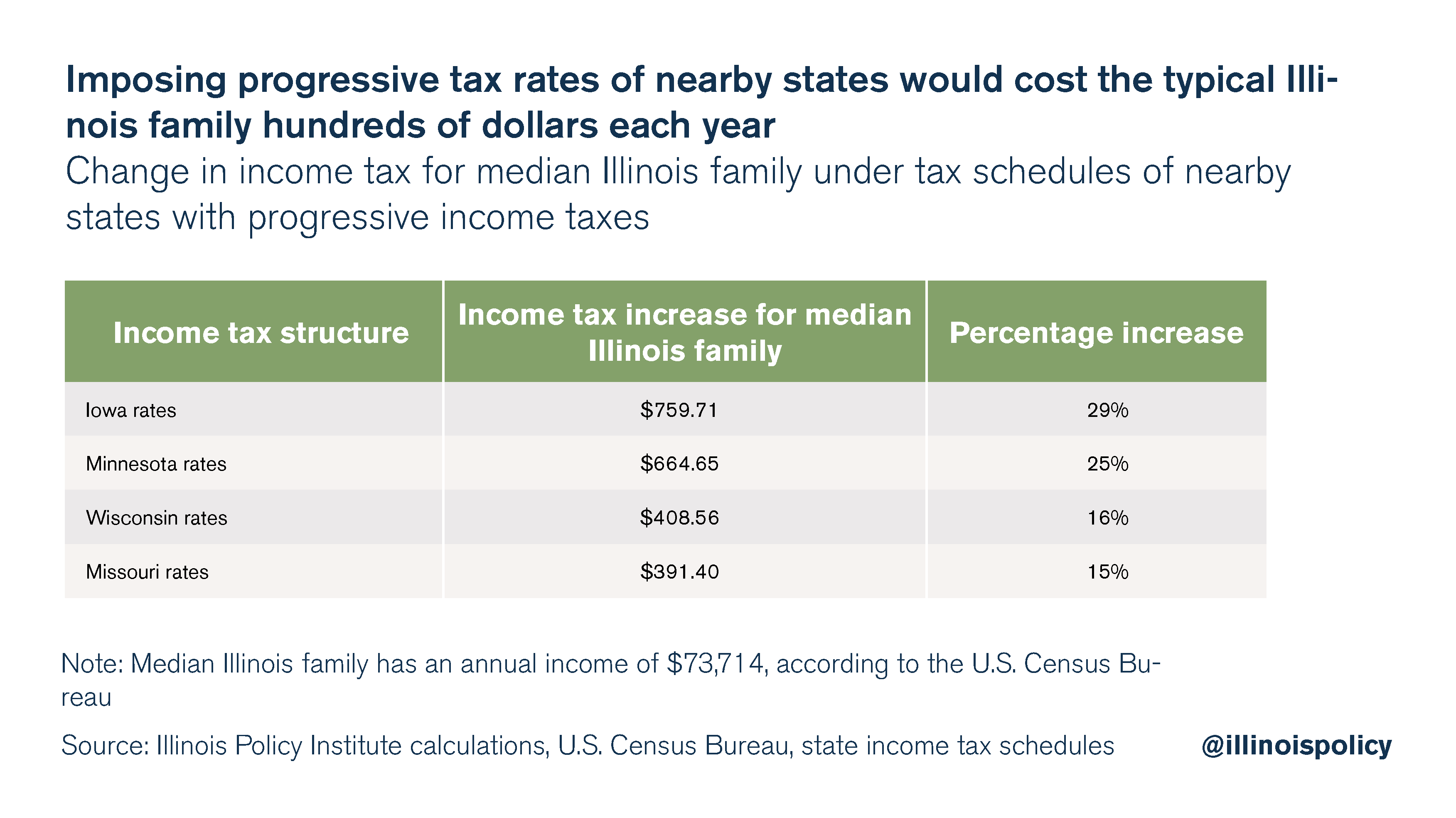

But bringing the tax rates of those states to Illinois means the median family in the Land of Lincoln would see a tax hike of up to 29 percent, or $759.

If Illinois adopted Missouri’s tax schedule, the median Illinois family – with an annual income of $73,714, according to the U.S. Census Bureau – would see a 15 percent increase in their tax bill, amounting to an additional $390 each year. And that’s the best-case scenario.

With Wisconsin’s income tax rates, the median Illinois family would pay $408 more each year, a 16 percent increase. Under the Minnesota rates, the median family would pay $664 more each year, or 25 percent more than what they currently pay. And under the Iowa tax schedule, the median Illinois family would pay a whopping $759 more in income taxes each year.

Calls to copy the progressive income tax structures of nearby states reveal the true cost of scrapping Illinois’ flat income tax: heavy tax hikes on middle-class families.

But Illinoisans simply can’t afford another tax increase. Just last year the General Assembly passed a 32 percent tax hike, which will inflict further damage on Illinois’ already weak economy.

Instead of hiking taxes yet again, the state needs to learn to do what taxpayers do every day: spend within their means.

Illinois should reject these burdensome progressive tax proposals and instead seek to rein in the exploding growth of state spending by capping appropriations to what taxpayers can afford.

Topics on this page

Sign the petition

Stop the progressive income tax

Sign the petition today to tell your lawmaker to oppose the progressive income tax.

Learn More >