Voice support for property-tax freeze

SB 1046 would allow taxpayers to take back control over skyrocketing property taxes.

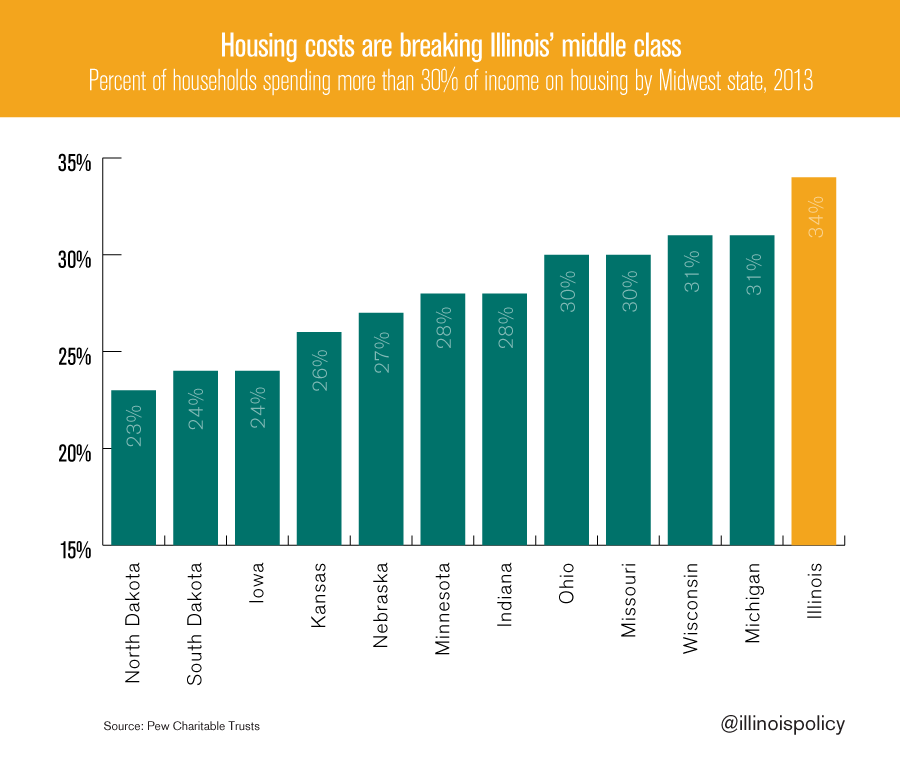

Illinois has the second-highest property taxes in the nation.

But a new proposal Illinois politicians are considering today would give local taxpayers the ability to freeze their property taxes.

Under an amendment to Senate Bill 1046, starting in property-tax year 2016 (payable in 2017), property-tax extensions from all local taxing districts would be frozen at the amount of the 2015 extension.

Only by a vote from taxpayers would a local governing body be able to earn additional taxing authority.

Property taxes are one of the most painful taxes Illinoisans face. This money funds a multitude of local government agencies, such as municipalities, schools, park districts, libraries, mosquito abatement districts, townships, counties and more.

With 6,968 local governments, Illinois has more than 2,000 more local government agencies than any other state. Pennsylvania comes in second with 4,905.

That’s a lot of government to fund – and it just keeps getting more expensive. Property taxes on the average Illinois home total $3,939, the second-highest sum in the U.S., and only $32 below New Jersey, the nation’s worst offender. That puts Illinois’ property-tax burden at more than two and a half times that of Indiana, and more than double Missouri’s.

Illinoisans can’t keep paying more in property taxes – families must be able to feel secure in affording their homes. SB 1046 would allow taxpayers to take back control over skyrocketing property taxes.

Take control of your property tax bill. Click here to support a property-tax freeze.

Instructions for supporting SB 1046: Property Tax Freeze:

Step 1: Click here

Step 2: Complete Section I (“Firm/Business or Agency” type in “individual”; in “title” type in “citizen lobbyist”)

Step 3: Complete Section II (“Persons, groups firms represented in this appearance” type in “self”)

Step 4: In the Section III description, click the pull-down menu that reads “Original Bill” and choose “SFA1,” then choose “proponent”

Step 5: In Section IV, choose “Record of Appearance Only”

Step 6: Type in the encryption code

Step 7: Check “I agree” and click “create slip”