Want a job? Move to a state that doesn’t tax work

Do high taxes help or hinder a state? The Fiscal Policy Center at Voices for Illinois Children thinks high taxes are a good thing. The group released a study recently claiming that states that levy high personal income taxes outperform states that don’t tax income at all. They use their study as a justification for...

Do high taxes help or hinder a state?

The Fiscal Policy Center at Voices for Illinois Children thinks high taxes are a good thing. The group released a study recently claiming that states that levy high personal income taxes outperform states that don’t tax income at all. They use their study as a justification for raising taxes on already tax-beleaguered Illinoisans.

But this study doesn’t change facts: States with no income taxes have outperformed in terms of jobs and growth.

The logic is basic, and the facts back it up. A tax on income is a tax on work. And if you want less of something, you should tax it. If you want more of something, you shouldn’t tax it.

So the logic follows: If you want jobs, don’t tax work.

Seven states in the U.S. do not have income taxes. That means these states don’t levy a tax on corporate income, personal income or investment income.

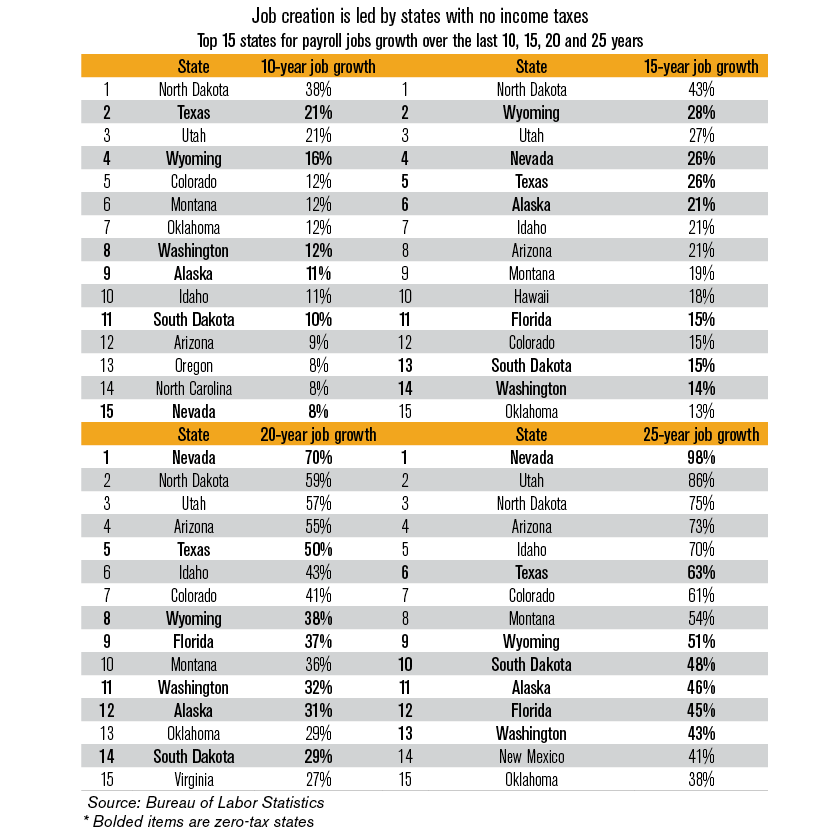

In terms of growing payroll jobs, these no income tax states dominate. Six of these states rank in the top 15 nationally for growing payroll jobs over the past 10 years. If we look back at payroll jobs growth over the past 15-25 years, the states that don’t tax income do even better on jobs growth, with all of them placing in the top 15 for the longer-term periods.

The Fiscal Policy Center seeks to partially diminish the facts of the matter by saying that migratory trends play into this.

Of course migration plays into it. When people vote with their feet to leave high-tax states and move to low-tax states, the low-tax states benefit in terms of population and growth.

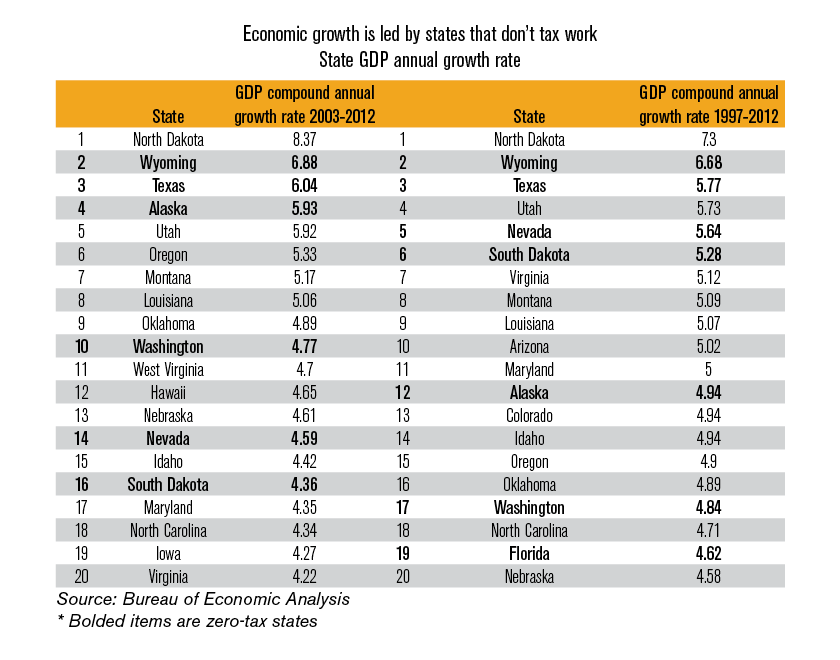

It’s not just in growing jobs that no-income-tax states dominate. They also dominate in growing economic output, going back as far as Bureau of Economic Analysis data can take us.

How about the high-tax states that Fiscal Policy Center claims “outperform” states with no income tax? They are Oregon, New York, Maryland, Vermont, California, Hawaii, New Jersey, Maine and Ohio. These high-tax states are nearly nonexistent in the above jobs and growth rankings.

That’s because most of the top spots are held by other low tax states.

Illinois is persistently plagued by joblessness.

For more jobs and growth, the solution is clear: Lower and then phase out the tax on work. Illinois must eliminate its income tax.