Will County board approves new $12M gas tax atop doubled state tax

Will County became the first county to use new taxing authority under Illinois Gov. J.B. Pritzker’s capital plan, adding a new countywide gas tax of 4 cents per gallon atop state and local gas taxes.

Drivers filling up in Will County will soon lose a small advantage they’ve long held over most other Chicago collar counties.

On Dec. 19, the Will County board voted to enact a countywide motor fuel tax of 4 cents per gallon, which will take effect Feb. 1, 2020. Currently, Will and Lake are the only counties that do not add their own gas taxes among the Chicago metro area’s five collar counties.

Will County is the first to exercise new taxing authority granted to some counties under Gov. J.B. Pritzker’s capital plan, which allows certain counties to double their gas taxes and others without a gas tax to create one. Counties can also peg their gas taxes to the rate of inflation, potentially allowing gas tax rates to automatically increase annually.

The board approved the new tax largely along party lines, with one Democratic board member, Rachel Ventura of Joliet, joining the Republican members in voting against the tax. That resulted in a tie, so Will County Executive Larry Walsh cast the tie-breaking vote in favor of the tax.

Will County Director of Transportation Jeff Ronaldson in August estimated a 4-cent gas tax would generate an extra $12.1 million annually. The new state law gave the county the authority to impose up to 8 cents a gallon, which would have taken $24.25 million a year from drivers.

Ventura said while she agreed with an excise tax on gasoline in principle, she would not support it without the promise of property tax relief.

“My goal in taxation would be to ensure that Will County homeowners experience a decrease in their property tax and the burden of paying for road maintenance is shifted to those frequent users of the roadways,” Ventura told the Daily Southtown.

In a Dec. 5 committee hearing on the gas tax, Republicans in opposition argued the county already will receive an extra $6.2 million from the doubled state gas tax, as well as $23 million in state money for road projects during the next six years. Will County also receives $9.2 million a year from motor fuel taxes.

Democrats said the money is needed for infrastructure that will boost economic development and help the county grow.

Drivers will pay the new gas tax on top of the layers of gas taxes they already pay at the state and local levels. Joliet, the Will County seat, imposes its own 1-cent-per-gallon tax on gasoline, for example. That’s on top of the state’s newly doubled 38-cent gas tax and the federal government’s 18-cent rate

There’s more: Illinois is one of only a handful of states that applies state and local sales taxes to gas, which means taxes on taxes because it is charged on other per gallon taxes and fees. For perspective, the combined sales tax rate between Joliet and the statecomes out to 8%.

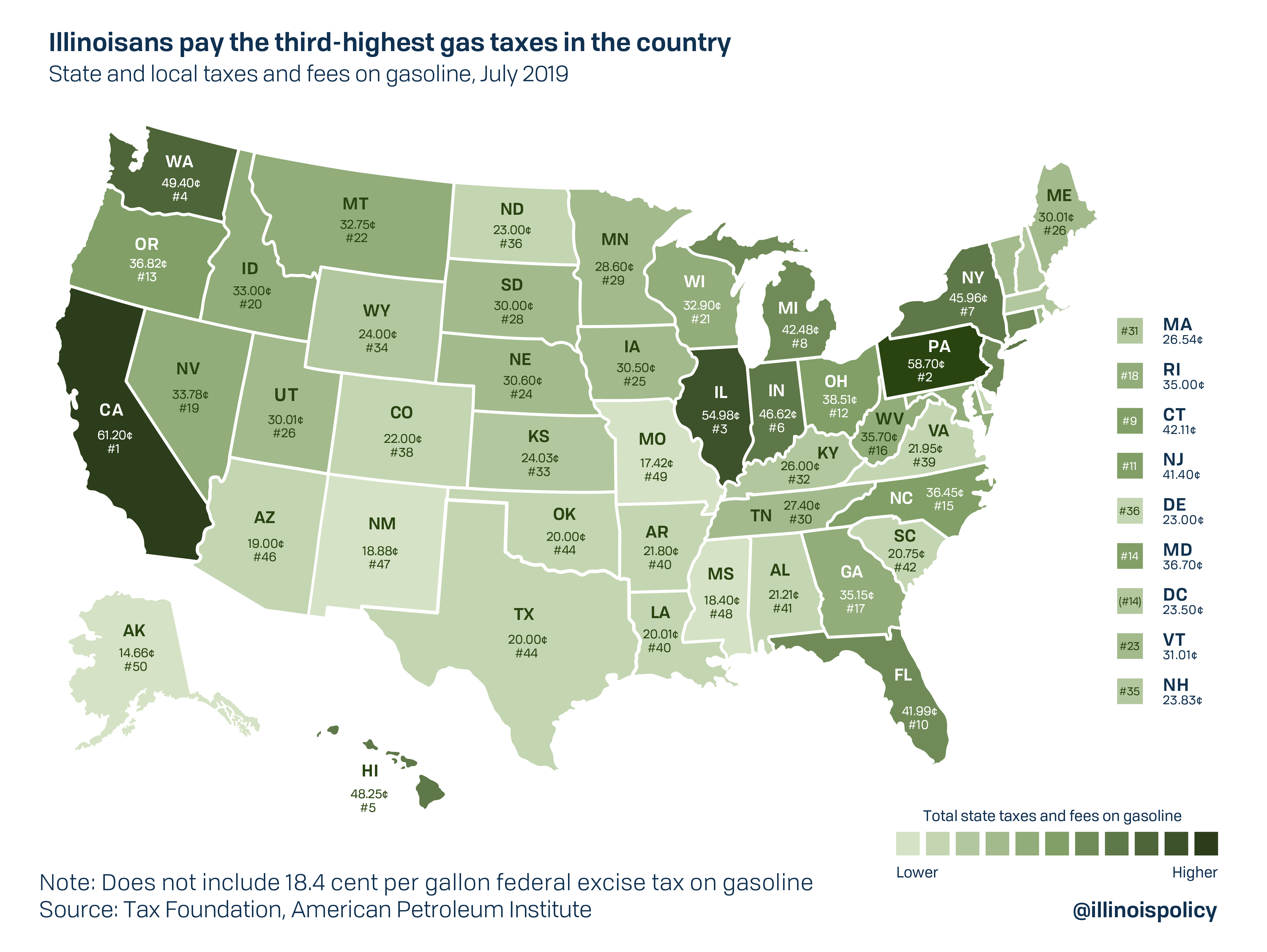

Gov. J.B. Pritzker’s $45 billion capital plan, which doubled the state’s gas tax to 38 cents from 19 cents per gallon, brought Illinois’ total gas tax burden to third- from 10th-highest in the nation. Because nearly two-thirds of Illinois’ population resides in the collar counties, additional gas tax hikes by county governments could push Illinois’ overall average gas tax burden above No. 3.

According to an Illinois Policy Institute analysis, drivers on average will pay an extra $100 per year for the state gas tax hike. Statewide, drivers will pay $1.2 billion a year.

Before the vote, DuPage, Kane and McHenry were the only counties that imposed a countywide gas tax, each at 4 cents per gallon. However, under Pritzker’s capital plan, those counties can double their gas tax.

The new law would allow Lake to create its own gas tax of up to 8 cents per gallon.