4 reasons Illinois Republicans should ditch the tax talk

Polling shows that Illinoisans are overwhelmingly opposed to an income tax hike, and Illinois’ poor economic growth combined with wealth out-migration mean billions in tax hikes will only inflict further damage on a struggling state.

Illinois Democrats, led by House Speaker Mike Madigan, have worked to convince Republicans the state needs higher taxes. And some Republicans seem open to taking the bait. But raising taxes is bad policy, and bad politics. Lawmakers should stop talking taxes and instead focus on a balanced budget without tax increases.

Find out how much the tax hikes will cost you

Plus additional Corporate Income tax per household: $98

That's an increase of as much as $0

family size above

Illinoisans don’t want taxes, even after two years of a painful budget impasse. And there are good reasons for that – an income tax hike would be deeply unfair to Illinoisans who are seeing barely any income growth. Illinois’ economic growth is terrible, and would get worse under higher taxes. The 2011 income tax hike didn’t improve the state’s finances; it just enabled politicians to put off necessary reforms, and drove income-earning power out of the state.

Illinois politicians should listen to what their constituents want and take a hard look at what Illinois’ economy needs. Here are four reasons Republican lawmakers should reject a tax hike and deliver a balanced budget with substantive economic reforms.

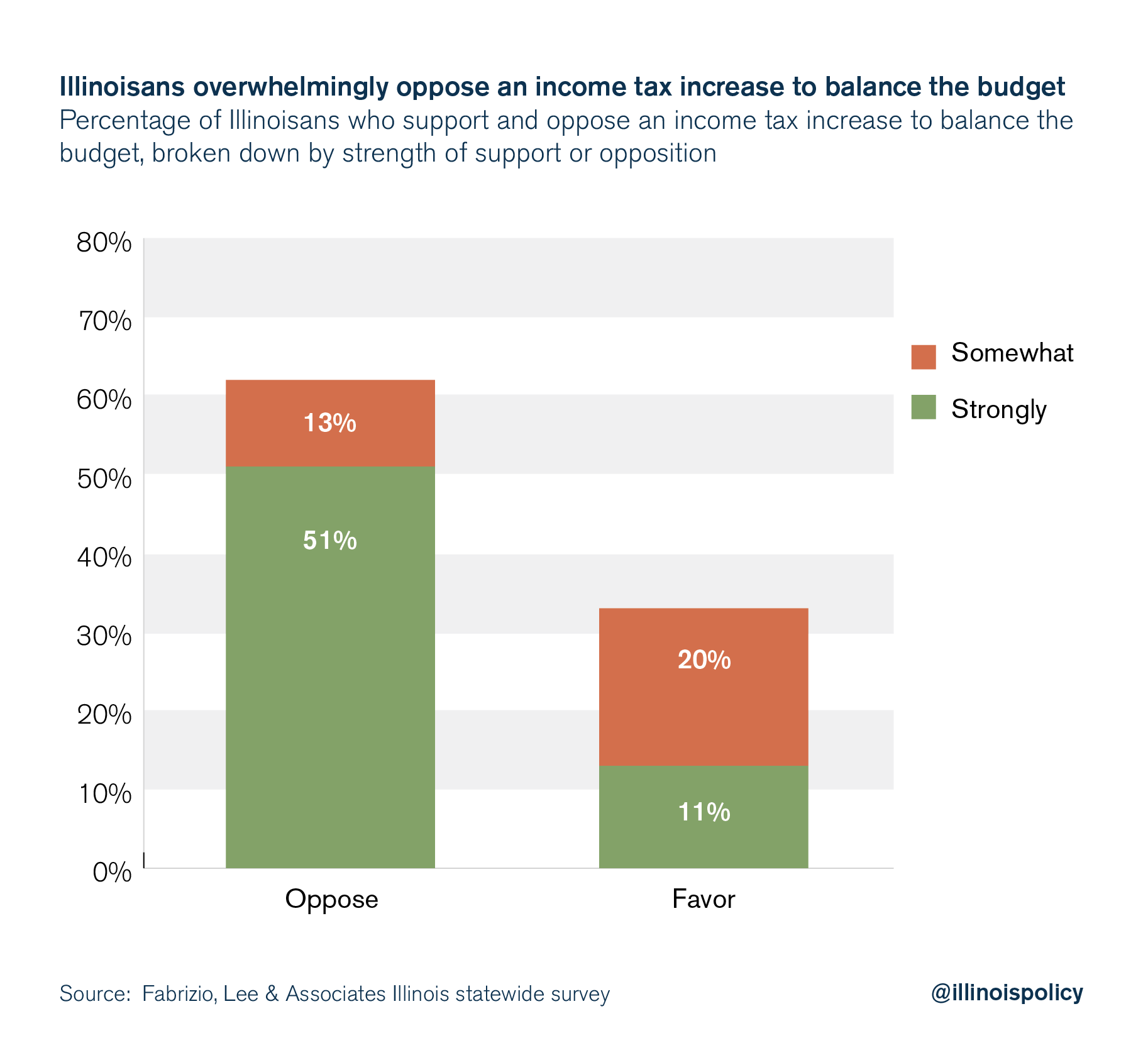

- The people don’t want more taxes. Illinoisans overwhelmingly oppose raising the state income tax to balance the budget, according to a May 23 poll of likely Illinois voters. Even after two years of a painful budget impasse, 64 percent of Illinoisans surveyed oppose raising the income tax to balance the budget, while only 31 percent of respondents support raising the income tax. Of the 64 percent opposition to an income tax hike, 51 percent of Illinoisans strongly oppose an income tax increase while 13 percent somewhat oppose it. Meanwhile, only 11 percent of Illinoisans strongly support an income tax increase to balance the budget, while 20 percent of Illinoisans somewhat support an income tax increase.

A tax hike to balance the budget is a political loser. That’s why Democrats in the General Assembly want Republicans to provide them cover.

A tax hike to balance the budget is a political loser. That’s why Democrats in the General Assembly want Republicans to provide them cover.

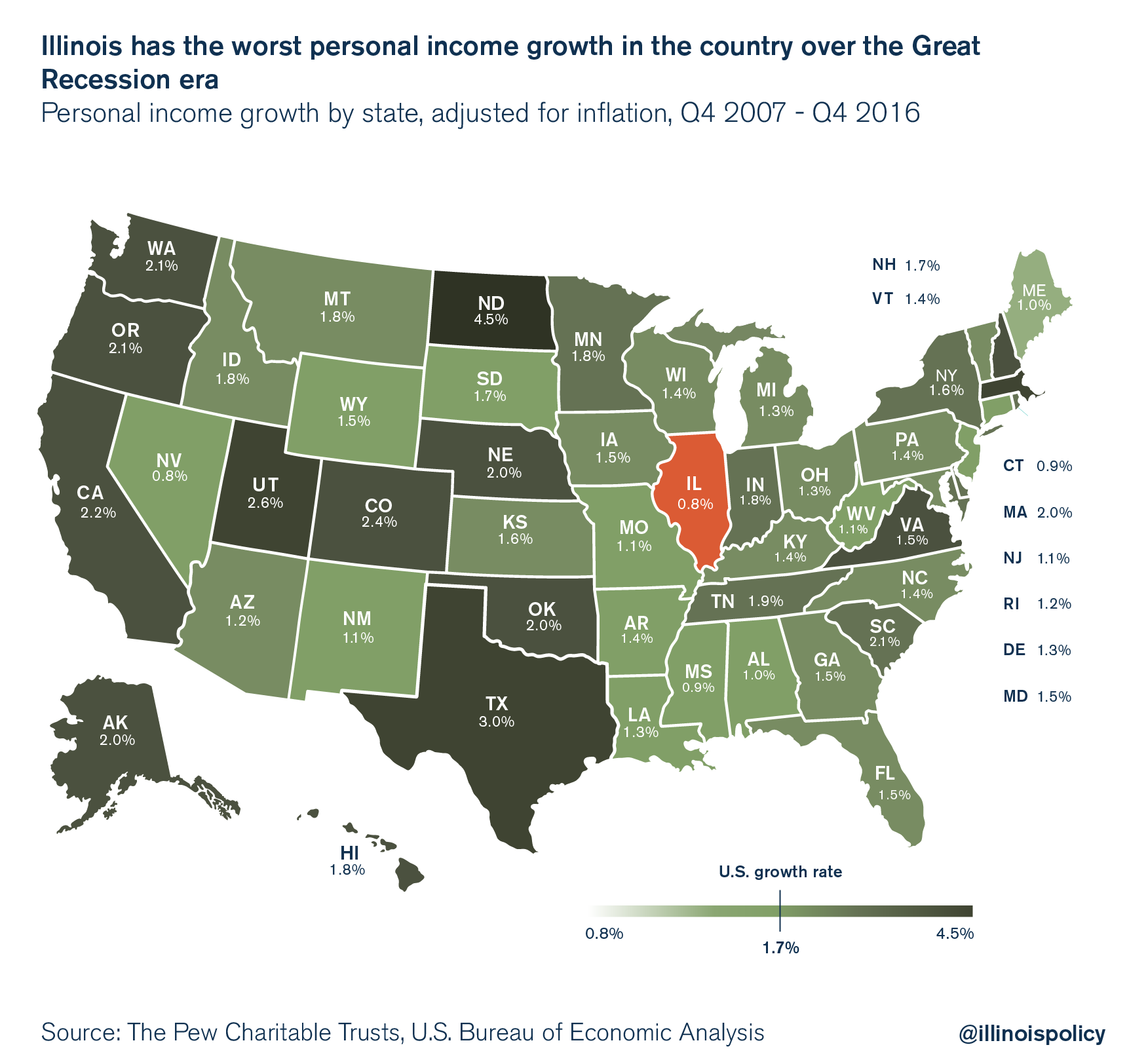

- It’s unfair to hike Illinoisans’ taxes. Illinoisans have the worst personal income growth in the United States over the Great Recession era. Income has grown by only 0.8 percent per year in Illinois. If there’s any state population that should be spared an income tax increase, it’s Illinois’.

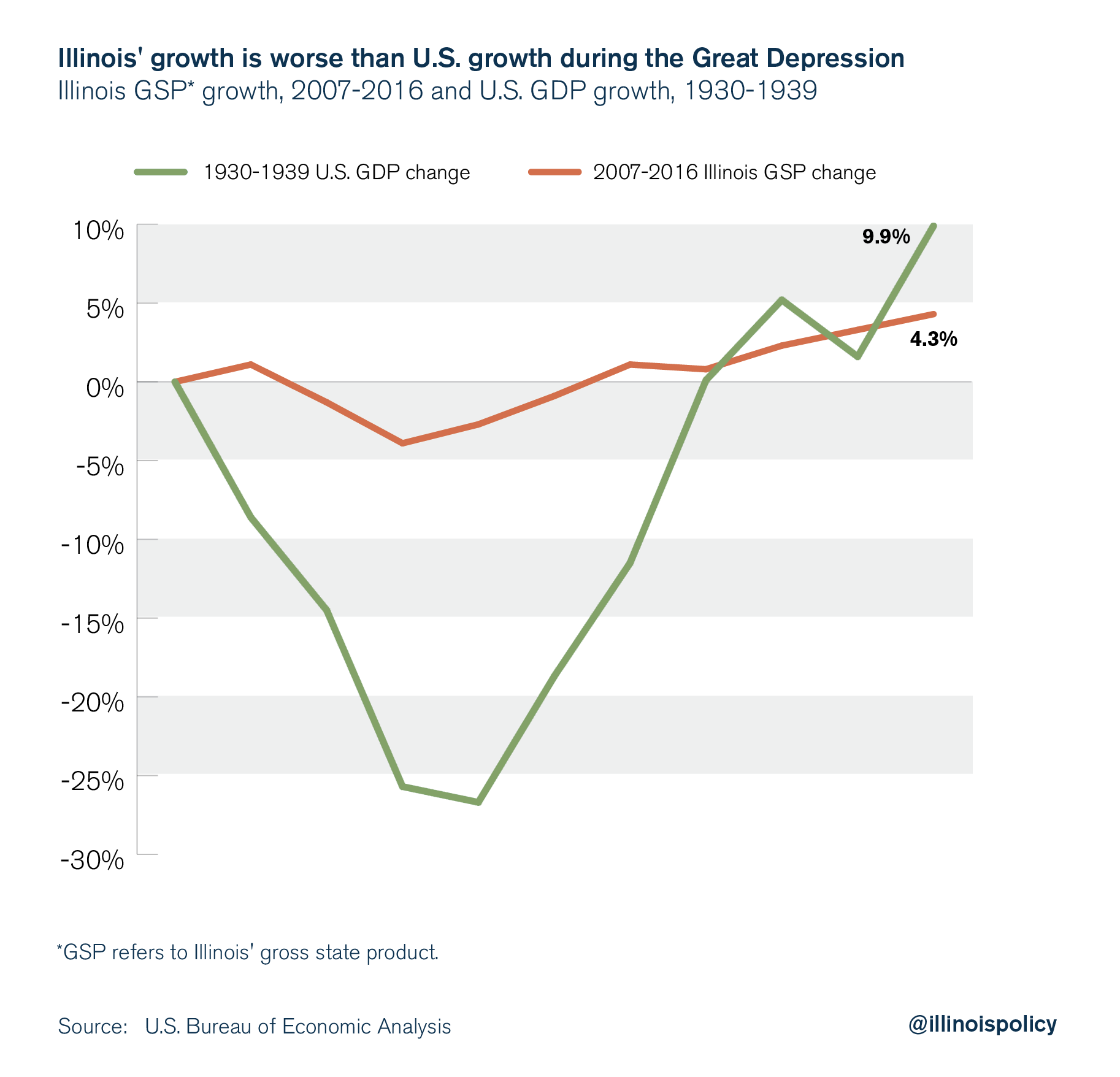

- Illinois’ economy is too weak for a tax hike. Illinois is growing like it’s the Great Depression, only worse. In fact, Illinois’ economic growth from 2007-2016 was weaker than the economic growth during the weakest period of America’s Great Depression, from 1930-1939.

Weak economic growth has resulted in Illinois having the nation’s highest black unemployment rate and second-highest youth unemployment rate. Illinois still has 160,000 fewer people working compared with before the Great Recession, the worst record of any state. Illinois has the worst recovery of manufacturing jobs in the Midwest, and the worst recovery of single-family housing starts in the U.S. Finally, the Land of Lincoln still has fewer jobs than in the year 2000.Illinois’ economic weakness is a long-term problem. Another tax hike will make it worse.

Weak economic growth has resulted in Illinois having the nation’s highest black unemployment rate and second-highest youth unemployment rate. Illinois still has 160,000 fewer people working compared with before the Great Recession, the worst record of any state. Illinois has the worst recovery of manufacturing jobs in the Midwest, and the worst recovery of single-family housing starts in the U.S. Finally, the Land of Lincoln still has fewer jobs than in the year 2000.Illinois’ economic weakness is a long-term problem. Another tax hike will make it worse.

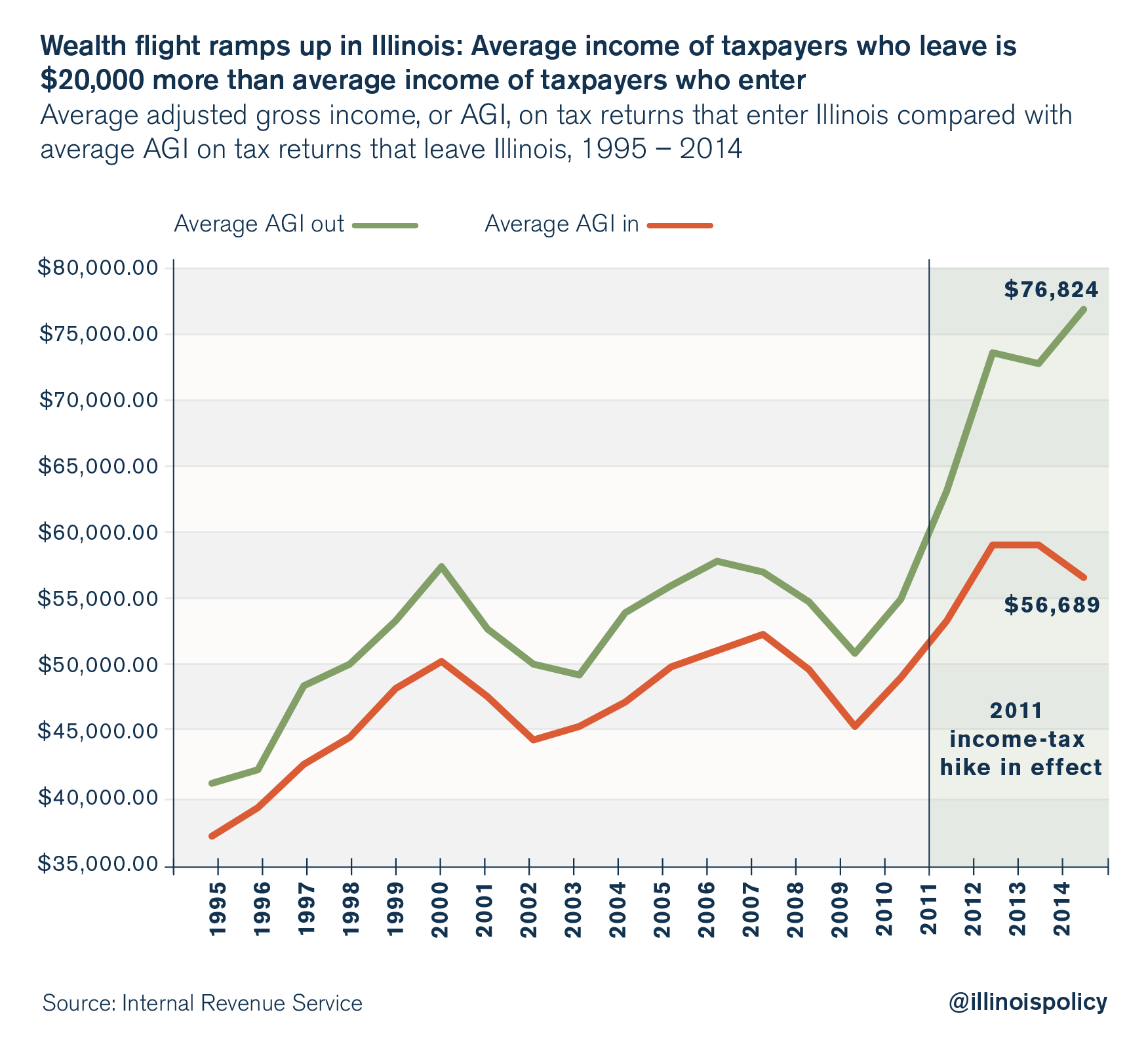

- The last tax hike triggered wealth flight. The 2011-2014 tax hike triggered a significant flight of income-earning power from the state. Illinois lost more than $14 billion of annual adjusted gross income during the four years of the tax increase.The average income of a taxpayer leaving Illinois rose to $77,000 per year, compared with an average income of $57,000 for taxpayers entering Illinois. This income-earning differential – people leaving making $20,000 more than people entering – is the largest of any state.

The fallout from Illinois’ feckless governance continues. From July 2015 – July 2016, Illinois lost 114,000 people on net to other states, the equivalent of losing the entire city of Peoria in a year.

The fallout from Illinois’ feckless governance continues. From July 2015 – July 2016, Illinois lost 114,000 people on net to other states, the equivalent of losing the entire city of Peoria in a year.

Tax hikes have been tried in Illinois before. They’ve inevitably failed because they don’t fix the core problems of too much debt and too much spending. In fact, they allow such reckless behavior to continue.

Taxpayers need to put Illinois’ government on a diet, not the other way around.

Lawmakers should set out their spending priorities for the amount of money that’s currently flowing into state coffers. Items that are low on the list should be cut. If that requires changes in the law or to the Illinois Constitution, so be it. A budget crisis is an appropriate time to make big reforms.

Another income tax hike is bad policy and bad politics. It’s time for lawmakers to stop talking taxes and get to work on the reforms that will turn the state around.