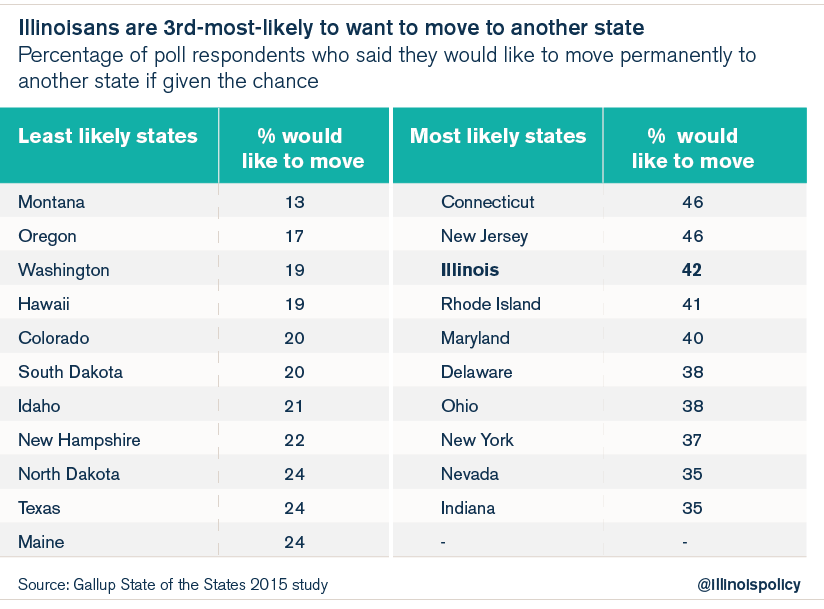

42% of Illinoisans would like to move to another state, Gallup poll shows

A recent Gallup poll found residents in states with higher tax burdens are more likely to want to move. Illinoisans are the third-most-likely to say they would prefer to move permanently to another state.

Illinoisans are more likely to want to pull up stakes and head to another state than residents anywhere else, aside from Connecticut and New Jersey, according to a recent Gallup poll.

Survey-takers asked respondents, “Ideally, if you had the opportunity, would you like to move permanently to another state, or would you prefer to continue living in this state?” The poll showed that residents in states with the highest aggregated tax burden, which includes income, property and sales taxes, were significantly more likely to want to move than were residents of states with lower taxes. On average, 31 to 36 percent of survey participants in the highest-taxing two quintiles of states would like to move to a different state if opportunity allowed, while only 26 percent of respondents in the lowest-taxing three quintiles said they would like to move.

Residents of Illinois, which ranked in the second-highest-taxing quintile according to the study, answered “yes” to the survey question in even higher numbers than most residents in the highest-taxing quintile of states. Forty-two percent of Illinoisans would move if given the chance, whereas only 36 percent of residents in even higher-taxing states would like to move. By contrast, only 13 percent of residents of Montana, which occupies the lowest-taxing tier, want to leave their state permanently.

The article warns:

“States with growing populations typically have strong advantages, which include growing economies and a larger tax base. Gallup data indicate that states with the highest state tax burden may be vulnerable to migration out of the state, putting them in jeopardy of missing out on some of these advantages.”

Illinoisans are unfortunately all too familiar with out-migration and low growth due to the state’s high taxes. The Land of Lincoln already loses one resident every five minutes on net to out-migration. Between July 2014 and July 2015, the state’s worst year yet for out-migration, Illinois lost 105,000 more people to other states than it gained, according to U.S. Census Bureau data.

A study by the nonpartisan Tax Foundation released Jan. 20 showed Illinoisans bore the fifth-highest state and local tax burden among residents in the 50 states in fiscal year 2012, behind only Connecticut, New Jersey, New York and Wisconsin.

Part of what drove that Tax Foundation ranking was the increased income-tax burden Illinois taxpayers shouldered under the 2011 income-tax hike, which boosted individual tax rates to 5 percent from 3 percent, and increased corporate tax rates to 9.5 percent from 7.3 percent. For the four-year duration of the tax hike, Illinois had a net loss of over 300,000 residents and $15.1 billion in annual adjusted gross income. This out-migration of residents and their taxable income cost the state $2.5 billion in annual state and local taxes for that period.

For years, Illinoisans have suffered under the second-highest residential property taxes in the U.S., behind only New Jersey. Since 1990, residential property taxes in the state have grown 3.3 times faster than median household income. And Illinois’ No. 2 property-tax ranking does not even take into account the $588 million property-tax hike Chicago City Council passed in October 2015, the highest property-tax hike in modern Chicago history.

In addition to high property taxes, Illinoisans pay the fourth-highest wireless taxes in the country, according to data from the nonpartisan Tax Foundation.

And Illinois’ gas taxes are also high. Although the raw price of gasoline in Illinois is low now, the state and local taxes levied on gasoline gave Illinois the ninth-highest gas-tax rate as of July 2015, according to the Tax Foundation. Gas taxes in Chicago are even higher, due to numerous layers of county and city taxes on top of the state taxes, driving taxes on a gallon of gasoline bought in the Windy City to 50 percent of the raw price of the fuel.

Illinois has a 6.25 percent sales tax, too, although Chicago, which adds municipal and county taxes on top of that, now levies a 10.25 percent tax on goods purchased in the city, making it the highest sales tax of any major city in the U.S.

How long will Illinois politicians continue to ignore the fact that high taxes drive the residents who pay those taxes away to other states? Illinois must lower its tax burden to keep its residents, and the businesses that provide employment opportunities, in the state.