6 reforms to end Illinois’ perpetual budget crisis

Illinois needs a combination of constitutional and statutory changes to put and keep the state on sound fiscal footing and allow it to pay its providers and better prepare for emergencies.

A state budget agreement in Illinois won’t do anything to put an end to the fiscal games that go on year after year. Any financially responsible budget deal must also include the fiscal reforms needed to put an end to unbalanced budgets, and the uncertainty that taxpayers and service providers are forced to endure.

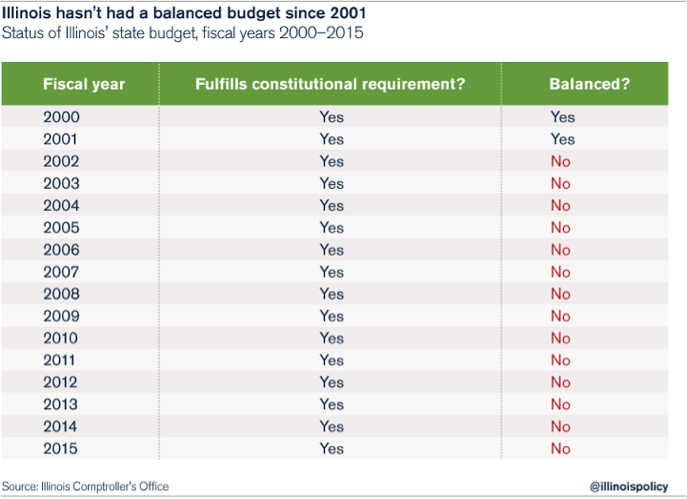

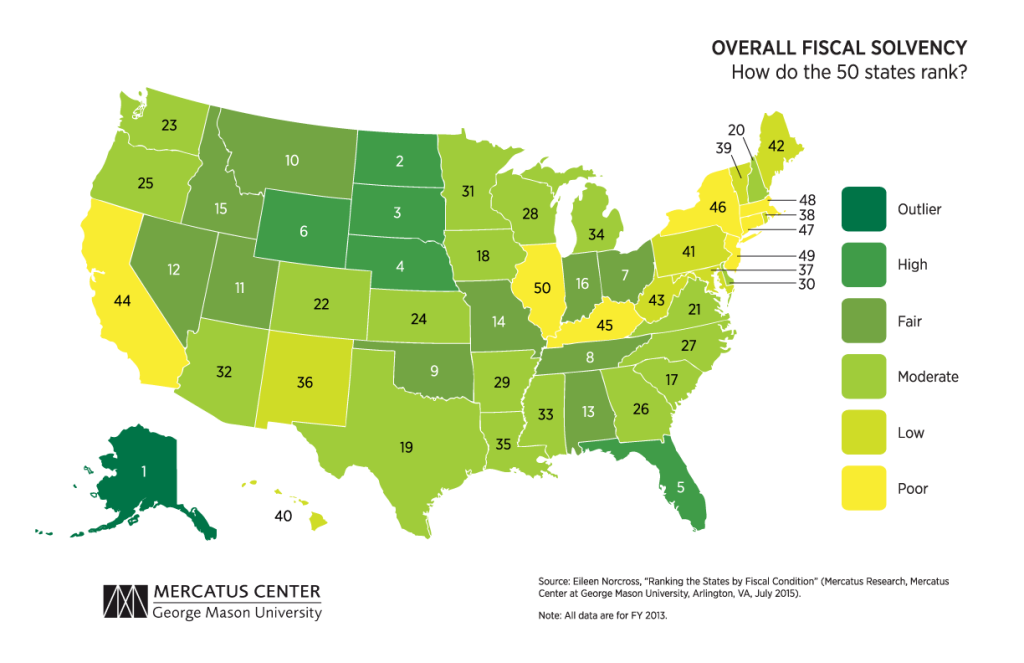

Illinois hasn’t had a balanced budget since 2001. Politicians’ lack of discipline has left Illinois with the worst credit rating of any state in the country, a $4 billion budget shortfall and more than $7 billion in unpaid bills. The Mercatus Center at George Mason University currently ranks Illinois 50th in the nation for fiscal solvency, a measure for how well (or poorly) a state can meet its spending obligations.

Fortunately Illinois can learn from the many states that have implemented to keep their budget processes disciplined. The following six reforms would drive Illinois toward sustainable, balanced budgets:

Constitutional changes

- A stronger balanced budget requirement

According to the National Conference of State Legislatures, 43 states including Illinois require a governor’s proposed budget to be balanced, 40 states require the state legislature to pass balanced budgets, and 37 ensure that budget deficits cannot be pushed off into the next year.

Illinois’ constitutional requirement for a balanced budget, however, is full of loopholes and has become meaningless. The state hasn’t had a balanced budget in more than a decade because it allows any budget shortfall to be pushed forward into the next year.

That trend hasn’t stopped. In 2014, the General Assembly passed and Gov. Pat Quinn signed a budget they admitted was billions of dollars out of balance. And again, in 2015, the General Assembly passed and sent to Gov. Bruce Rauner another budget that was $4 billion out of balance. Rauner vetoed that budget.

- Biennial budgets

Nineteen states, including Indiana, Kentucky, Minnesota, Ohio and Wisconsin, pass a state budget every two years instead of every year. In addition to eliminating the potential for protracted budget fights every year, this timeframe would allow lawmakers to pass budgets in nonelection years, which would minimize delays for political purposes.

Importantly, governors and legislatures have more time to focus on policy reforms, which are often instrumental to long-term solvency, in nonbudget years. Several states with two-year budgets have AAA credit ratings, and they tend to outperform other states economically and to be more fiscally stable.

- Reasonable pension protection

Some state constitutions protect government employees’ already-earned pension benefits. Illinois courts have ruled that the state’s constitution not only protects already-earned pension benefits, but also those that government workers have not yet earned. That carries a high price tag for taxpayers and squeezes out spending for core government programs and services.

Illinois should amend its constitution so it can reform government workers’ unearned retirement benefits going forward. In the meantime, the General Assembly can pass several reforms that would help reduce the impact of the state’s pension crises.

Statutory changes

- Professional revenue and spending assumptions

Illinois’ constitutional balanced-budget language gives the General Assembly the ability to make revenue and spending assumptions, which essentially allows politicians to make unrealistic or inaccurate assumptions about how much money the state will have to spend. Those tricks were in clear view when legislators passed a 2015 budget they conceded was out of balance the day it was signed. The 2016 budget that Rauner vetoed did not even balance on paper.

Other states prevent midyear deficits with official revenue- and expenditure-estimating conferences. Conferences consist of economists and budget professionals from the executive and legislative branches, with the advice of external experts and national economic forecasts. The governor and legislature are required to use official estimates for revenues and spending programs, as well as official estimates for proposed spending reforms and revenue changes.

- Ending bill backlogs and building a rainy day fund

Illinois should enact a budget-stabilization mechanism that serves to pay down any unpaid bills and to create a rainy day fund. Such a mechanism would require the General Assembly to set aside a portion of any revenues over and above expected revenues for use to pay down the state bill backlog.

After eliminating the backlog, the state would dedicate half of above-trend revenues to a rainy day fund. The state could only make withdrawals from the fund in fiscal or health and safety emergencies.

- End mid- and late-year budget fights and uncertainty for providers

Other states’ laws give the governor authority to declare fiscal emergencies in the event of unforeseen lower revenue or higher expenditures. Even official estimating conferences may not foresee national economic crises, such as 9/11, or natural disasters.

In some states, the governor can adjust the budget’s spending plan in order to fix a mid-year problem without legislative approval if the legislature is out of session. In other states, the governor can send the legislature a plan to address a fiscal emergency through expenditure reductions or use of the rainy day fund. In these cases, a joint committee of the legislature must be given a defined period of time to make changes to the proposal or it becomes law.