DuPage County residents pay some of the nation’s highest property tax rates

As property tax bills hit DuPage County mailboxes, residents are reminded that Illinois needs pension reform, not higher taxes.

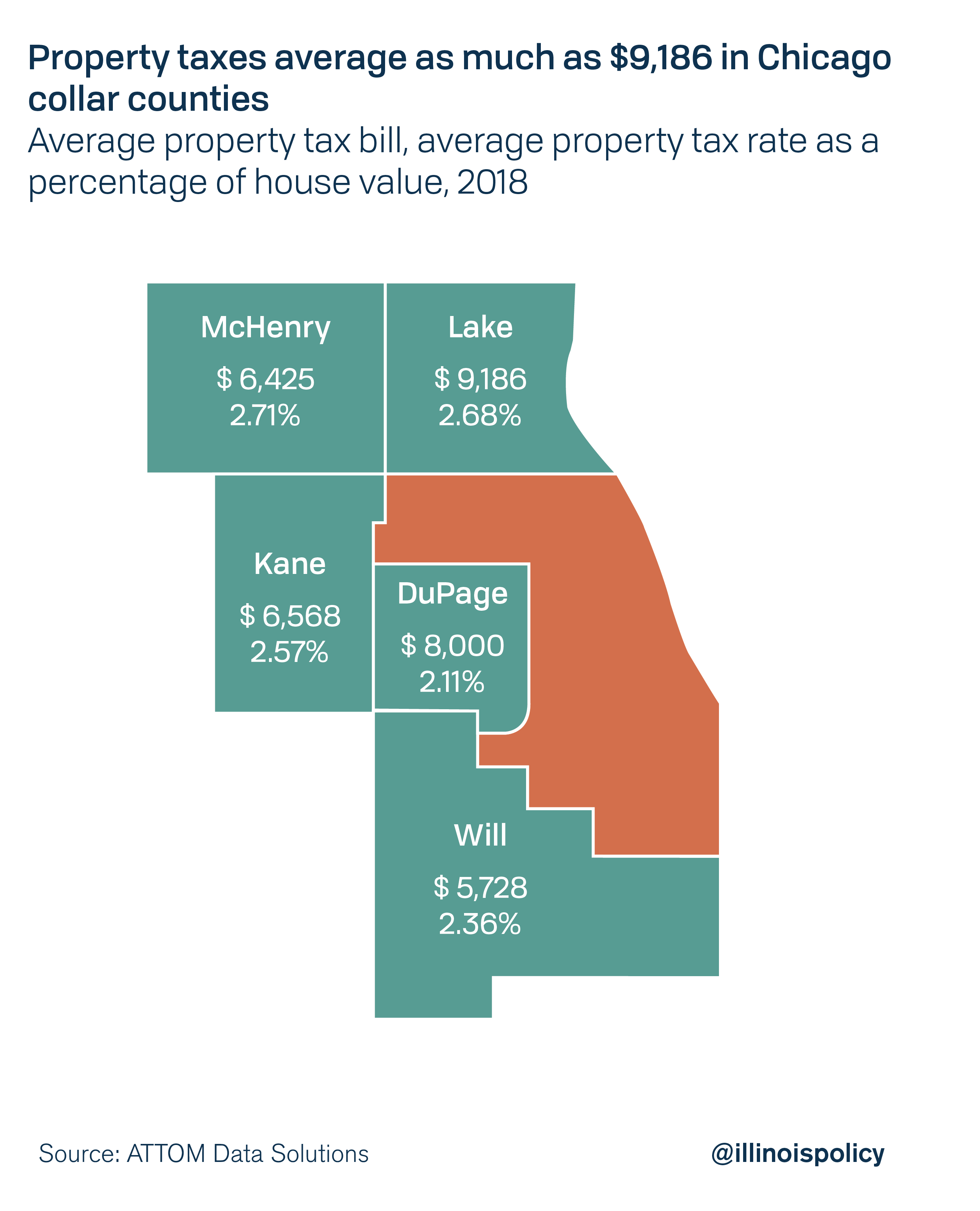

DuPage County homeowners are finding unpleasant deliveries in their mailboxes, as property tax bills averaging $8,000 arrive.

The average household in DuPage County last year paid 2.11% of the value of their single-family home in property taxes, or $8,000, according to ATTOM Data Solutions. That rate is nearly double the national average of 1.16% of home value in 2018.

Between 1996 and 2016, DuPage County residents saw property taxes rise 40% faster than inflation, or an increase of $859 per person when adjusted for inflation. While residents assume property tax hikes pay for public services, the reality is property taxes pay for pensions.

DuPage County taxpayers see 86 cents of every $1 taxed for municipal police go to pensions, and 59 cents of every $1 taxed for fire services go to pensions. Growing pension obligations crowd out services and tie the hands of local governments during the budget process.

Illinois Gov. J.B. Pritzker is trying to convince state lawmakers to ask Illinois voters for a constitutional amendment allowing for a progressive income tax. Supporters claim the “fair tax” will be a magic solution to the financial woes plaguing the state. However, without serious pension reform, any progressive tax proposal will be consumed by pension costs and inevitably lead to tax hikes on all Illinoisans.

But Illinois voters in key state House districts oppose Pritzker’s plan.

In Democratic state Rep. Terra Costa Howard’s district – which covers Lombard, Glen Ellyn, and part of Wheaton – residents dislike Pritzker’s plan. Voters in the district view Pritzker unfavorably, 35% to 32%. They oppose his plan to change to a progressive tax 38% to 29% – regardless of whether they have heard of his proposal. Given brief descriptions of both flat and progressive income taxes, voters said they would vote against changing to a progressive income tax, 44% to 42%. To amend the state constitution, 60% of the voters must approve the proposed amendment.

Pritzker’s proposed progressive tax rates fall short of their $3.4 billion revenue target by at least $1 billion, according to an Illinois Policy Institute analysis. While Pritzker hinged many of his promises on increasing revenue from a progressive tax, a new ad from Think Big Illinois – a group which counts Pritzker among their major donors – walks back the promise of tax relief for 97% of Illinoisans to only claim taxes will not be raised on them.

Moreover, Pritzker told WLS-TV, Channel 7, in Chicago he couldn’t guarantee his tax plan won’t raise taxes later on those making less than $250,000 a year.

“As you know, we currently live in a system in which the taxes can be changed at any moment so there’s certainly no guarantees, but what I will tell you is that I am fighting for the plan that I put forward,” he said April 23.

Illinoisans know that dumping the Illinois Constitution’s flat tax protection for Pritzker’s false promise of property tax relief is a bad deal. In order to fund his promises, Pritzker would need to adopt rates that hike taxes by up to $3,500 on the typical middle-income family – a move that could cost 286,000 jobs.

Absent constitutional pension reform, Illinois’ pension obligations are on track to consume over half of state revenues, crowding out vital services and leaving taxpayers facing further tax hikes. The Illinois Constitution doesn’t need an amendment to remove protection of the flat income tax. Instead, Illinois needs to amend the state constitution to protect already earned pension benefits, while allowing for changes to future, unearned accruals.

For DuPage County homeowners who are set to receive a reminder they face one of the highest effective property tax rates, a progressive tax would depress job growth, accelerate population loss and leave fewer working families to share the property tax burden. With no guarantee that middle-class residents won’t face a state income tax increase, the only guarantee is of higher taxes and more people moving away.

Residents should contact their lawmakers and ask them to vote against the progressive tax amendment. Illinois needs pension reform, not higher taxes.