Poll: Illinois voters in key House districts oppose Pritzker’s income tax plan

Polling of likely voters shows why some Democratic Illinois House members could regret voting for the governor’s graduated income tax.

Illinois Gov. J.B. Pritzker’s prized constitutional amendment is moving in Springfield, but new polling shows why Illinois House members should stop it.

The Senate Executive Committee on April 10 passed Senate Joint Resolution Constitutional Amendment 1 – which would eliminate Illinois’ flat tax protection, allow lawmakers to pass new types of income taxes and open the door for the nation’s highest corporate income tax.

But likely voters in House districts held by Democrats aren’t buying what Pritzker is selling.

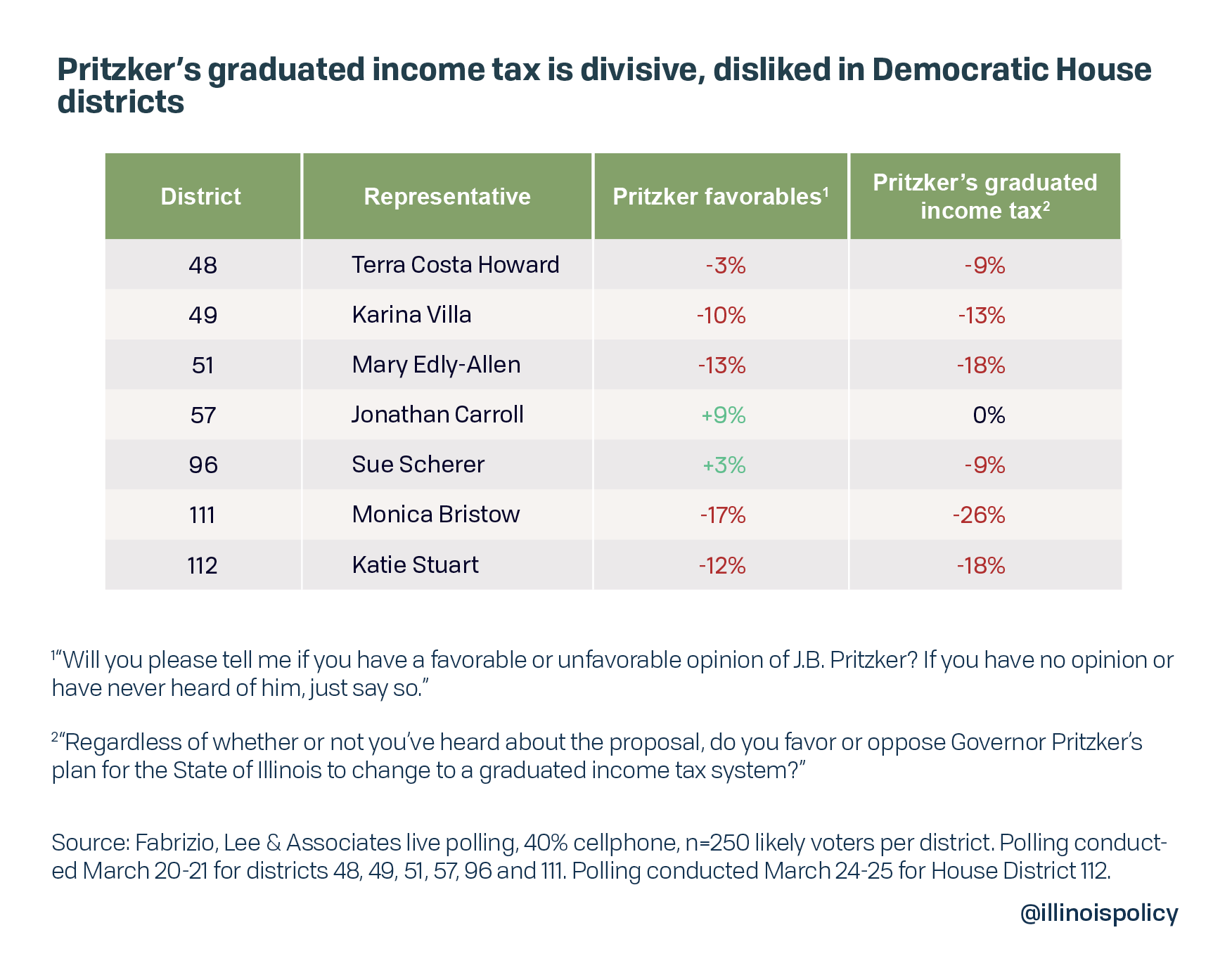

In each of the seven districts polled – held by state Reps. Terra Costa Howard, D-Glen Ellyn; Karina Villa, D-West Chicago; Mary Edly-Allen, D-Libertyville; Jonathan Carroll, D-Northbrook; Sue Scherer, D-Decatur; Monica Bristow, D-Alton; and Katie Stuart, D-Edwardsville – likely voters were opposed or split on Pritzker’s “plan for the state of Illinois to change to a graduated income tax system.”

Notably, respondents who said they were aware of Pritzker’s tax plan were more likely to oppose a constitutional amendment allowing for a graduated income tax.

A nonprofit funded by Pritzker is buying TV ads throughout the state promoting the governor’s plan, which he dubbed the “fair tax.”

Illinoisans know trading the Illinois Constitution’s flat tax protection for Pritzker’s illusory promise of tax relief is a bad deal. Ultimately, Illinois’ spending and debt habits mean Pritzker’s plan will be a bridge to higher taxes for the middle class.

That’s why state lawmakers should reject the governor’s false choice between a progressive income tax hike, a flat tax hike and massive spending reductions. The Illinois Policy Institute’s Budget Solutions 2020 plan offers a bipartisan five-year plan that would balance the state budget while reducing debt and allowing for tax reductions.

Full polling details: House District 48 (topline, crosstabs), House District 49 (topline, crosstabs), House District 51 (topline, crosstabs), House District 57 (topline, crosstabs), House District 96 (topline, crosstabs), House District 111 (topline, crosstabs), House District 112 (topline, crosstabs).