Hundreds of local officials in DuPage have salaries over $100,000

Residents of DuPage County pay some of the highest property taxes in the state - and the country. As taxpayers feel the pinch, compensation remains generous for many local officials - some have even enjoyed a boost.

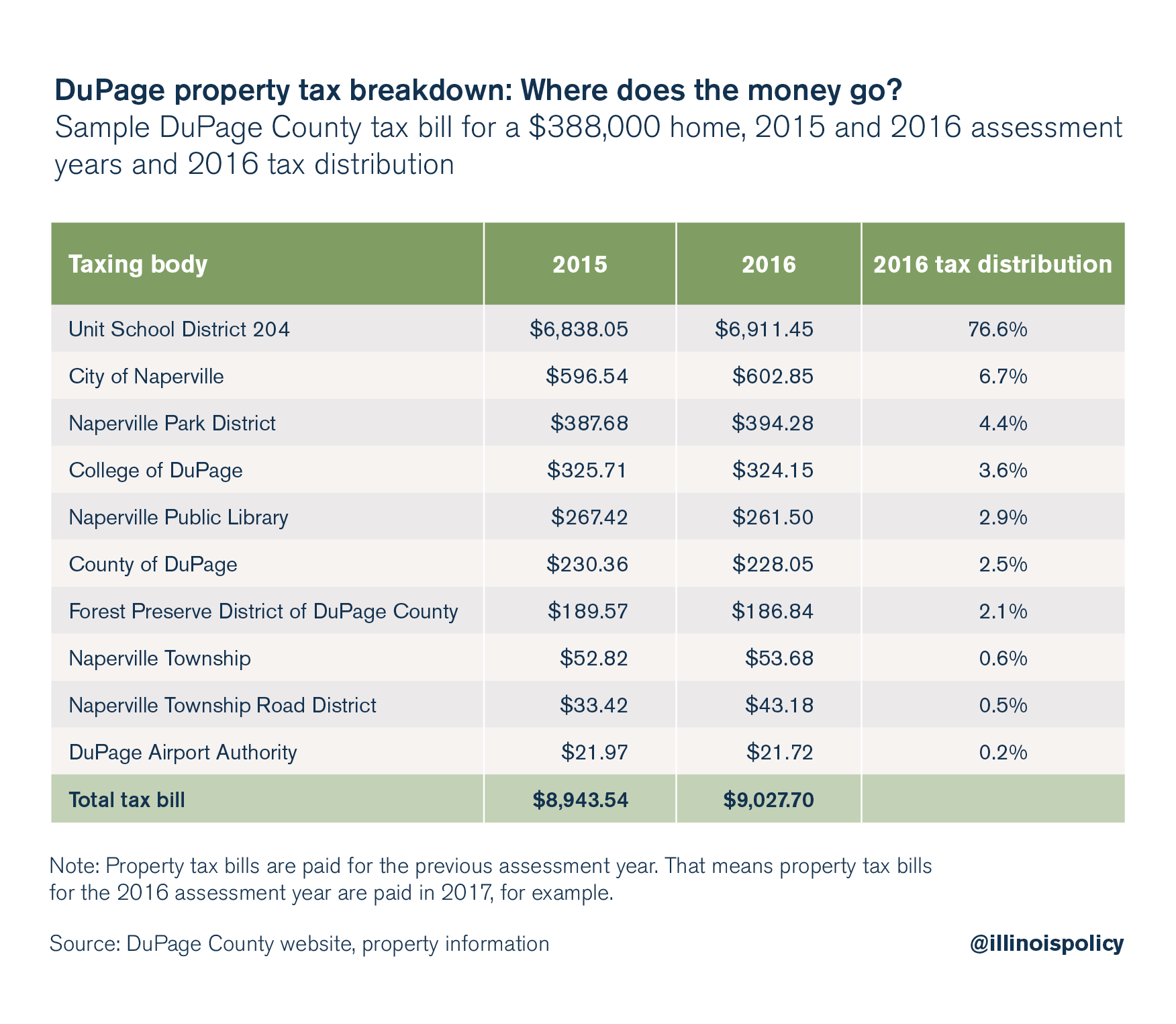

DuPage County billed residents for $2.74 billion in property taxes for tax year 2016.

Although it’s the county that issues the bills and collects taxes, the vast majority of property tax revenue goes to other local taxing bodies, such as school districts, municipalities and park districts.

This includes salaries and benefits for employees of those local units of government. The Naperville Sun pointed out that a 3 percent raise has resulted in a 2018 base salary of just over $207,000 for Ray McGury, the executive director of the Naperville Park District. McGury will also continue to get $7,200 in car allowance and $10,000 in deferred compensation for 2018, benefits he’s received since 2015, according to the Sun.

Apart from benefits and allowances, McGury’s base salary for 2018 will be the highest among park directors in the area, the Naperville Sun reports.

But McGury is far from alone. Property-tax payers are funding a number of six-figure salaries across the county.

Six-figure salaries

According to OpenTheBooks.com, a government watchdog organization, five other Naperville Park District employees were also receiving pay of more than $100,000, as of 2016. And the park district isn’t the only taxing body in DuPage that finds room for six-figure salaries, generous benefits and automatic wage increases.

The city of Naperville also spends significant sums on employee compensation. Its current list of 894 employees shows 154 of them take home a base salary of $100,000 or more. And many more end up earning at least $100,000 when overtime is factored in. A 2016 report by the Naperville Sun showed 310 Naperville employees earned at least $100,000 in 2015.

The Better Government Association, or BGA, another watchdog group, lists 12 workers employed by the DuPage County Forest Preserve receiving salaries in excess of $100,000, as of data year 2016. The BGA’s payroll database lists 89 DuPage County employees who earned more than $100,000 for that data year.

DuPage County taxpayers’ burden

The 2016 property tax bill for a median-valued home in Naperville, located in DuPage County, totaled just over $9,000. Of that amount, 76.6 percent, or $6,911, of property taxes paid went toward Unit School District 204. The city of Naperville accounted for 6.7 percent, or $602, of the total amount billed, and the Naperville Park District came in third, accounting for 4.4 percent, or $394, of the $9,000 bill.

Residents of Chicago’s collar counties, including DuPage County, pay the highest property taxes in the state.

Overtaxed Illinoisans have been fleeing the state, which has resulted in population shrinkage. But outmigration isn’t just a broad, state-level concern – it affects localities, too. And DuPage County is no exception. Between 2015 and 2016 alone, the county saw its population shrink by nearly 2,500 people, according to the U.S. Census Bureau.

Illinoisans have watched their property tax bills grow six times faster than household incomes. This pattern simply isn’t sustainable for most households. And no less sustainable is the pattern driving up property taxes: skyrocketing costs of government. These costs include growing liabilities to public-sector employee pensions and duplicative public services.

Notably, DuPage County has taken some worthwhile cost-saving steps, including local consolidation efforts. But public officials will have to pursue bolder reforms in order to provide taxpayers the financial relief they desperately need. Illinoisans should put pressure on lawmakers to minimize the state’s influence over the spending obligations of local governments. Until lawmakers sufficiently rein in costs, they’ll continue to lean harder on the backs of taxpayers.