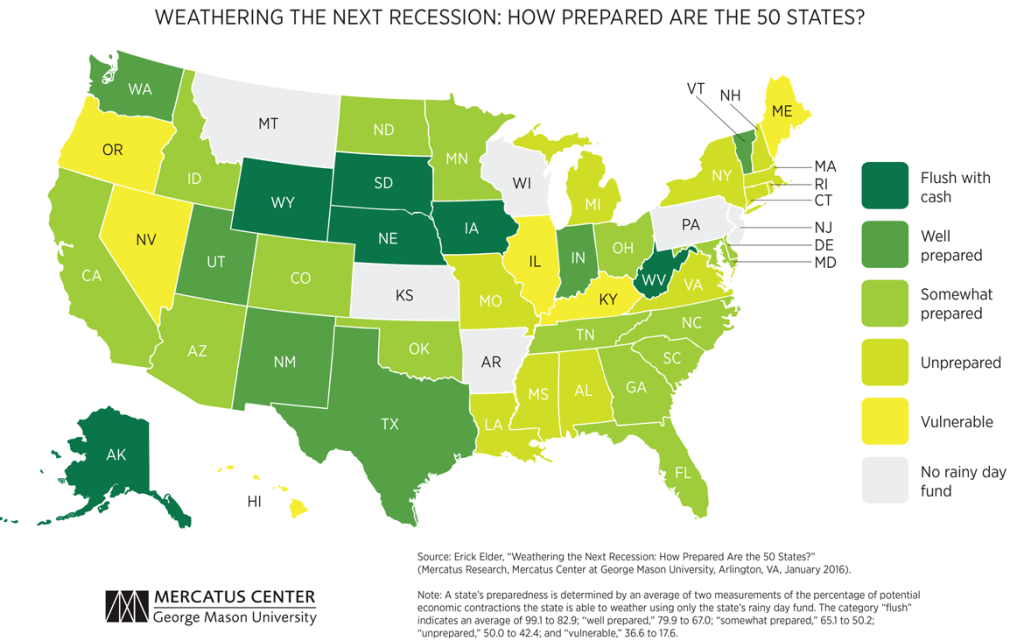

Illinois is unprepared for the next recession

Sky-high debt and a meager rainy day fund make Illinois the second-least prepared state in the U.S. for its capacity to weather a recession.

With the stock markets having their worst-ever start to a year, fears of a China slowdown, and oil prices collapsing, the U.S. is facing a real risk that its economy will enter the next recession.

That’s not good news for Illinoisans, who are already struggling in a state with the nation’s worst post-recession jobs recovery, a collapsing manufacturing base and an increasing dependence on food stamps.

How prepared is Illinois for the next recession?

A January 2016 Mercatus Center study answered this precise question. Not surprisingly, Illinois, with more than $8 billion in unpaid bills and no budget – meaning a potential $4 billion budget shortfall – ranked as the second-least prepared state in the country. (Illinois finished ahead of only Arkansas, which has a one-of-a-kind contingent budgeting process that leaves it with no budget surplus and no rainy day fund.)

In the study, the Mercatus authors “rank[ed] each state’s readiness for an economic downturn based on the size of its rainy day savings fund and budget surplus.” The study “calculated how much revenue each state would be likely to lose in mild, moderate, and severe recessions, based on the state’s unique past experiences during economic booms and busts.”

But Illinois’ problems run more deeply than the amount of liquidity it has on hand to weather a new storm.

Another Mercatus study from 2015 “ranked each US state’s financial health based on short- and long-term debt and other key fiscal obligations, including unfunded pensions and health care benefits.” In that study Illinois ranked dead last among the states at No. 50:

Bottom Five States

Illinois, New Jersey, Massachusetts, Connecticut, and New York rank in the bottom five states, largely owing to low amounts of cash on hand and large debt obligations.

High deficits and debt obligations in the forms of unfunded pensions and health care benefits continue to drive each state into fiscal peril. Each holds tens, if not hundreds, of billions of dollars in unfunded liabilities—constituting a significant risk to taxpayers in both the short and the long term.

Illinois’ massive debt and its nation’s-worst credit rating mean that without structural spending and economic reforms, the state will be left with only two solutions to its problems: cuts in services and higher taxes. Both will force even more people to leave Illinois in search of opportunities elsewhere.

Gov. Bruce Rauner is right to oppose a budget that perpetuates the same failed policies of the past 15 years, which drove the state to this point in the first place. Illinois needs jobs and economic growth, not higher taxes and more debt.

Without reforms, it’s hard to imagine just how poorly Illinoisans will fare if the global economies do tank.