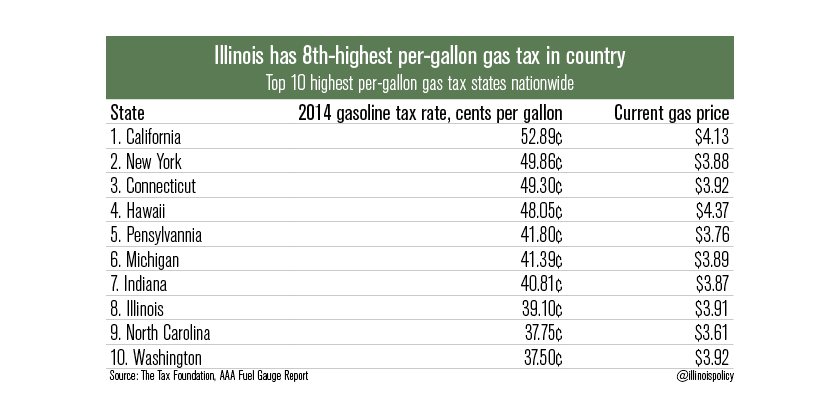

Illinois per-gallon gas taxes are 8th highest in nation

Illinois drivers pay, on average, $0.39 per gallon in state gas taxes. That amount adds up quickly. A driver purchasing 15 gallons of gas in Illinois shells out about $6 extra in state taxes, on top of the price of the gasoline itself. Illinois’ per-gallon gas tax is the eighth highest in the country, according...

Illinois drivers pay, on average, $0.39 per gallon in state gas taxes.

That amount adds up quickly. A driver purchasing 15 gallons of gas in Illinois shells out about $6 extra in state taxes, on top of the price of the gasoline itself.

Illinois’ per-gallon gas tax is the eighth highest in the country, according to research from the American Petroleum Institute.

The state’s gas taxes are multilayered. Illinois’ environmental gas tax comes in at $0.01 and its excise tax is $0.19. But the state also tacks on a sales tax.

Unlike the motor fuel taxes — which are a fixed amount per gallon — the sales tax is set as a percentage rate.

But drivers don’t always realize just how much the state is taking from them at the pump. These taxes don’t show up on your receipt — they’re hidden by being built into the price per gallon advertised along the roadways.