Illinoisans work 119 days to pay for government

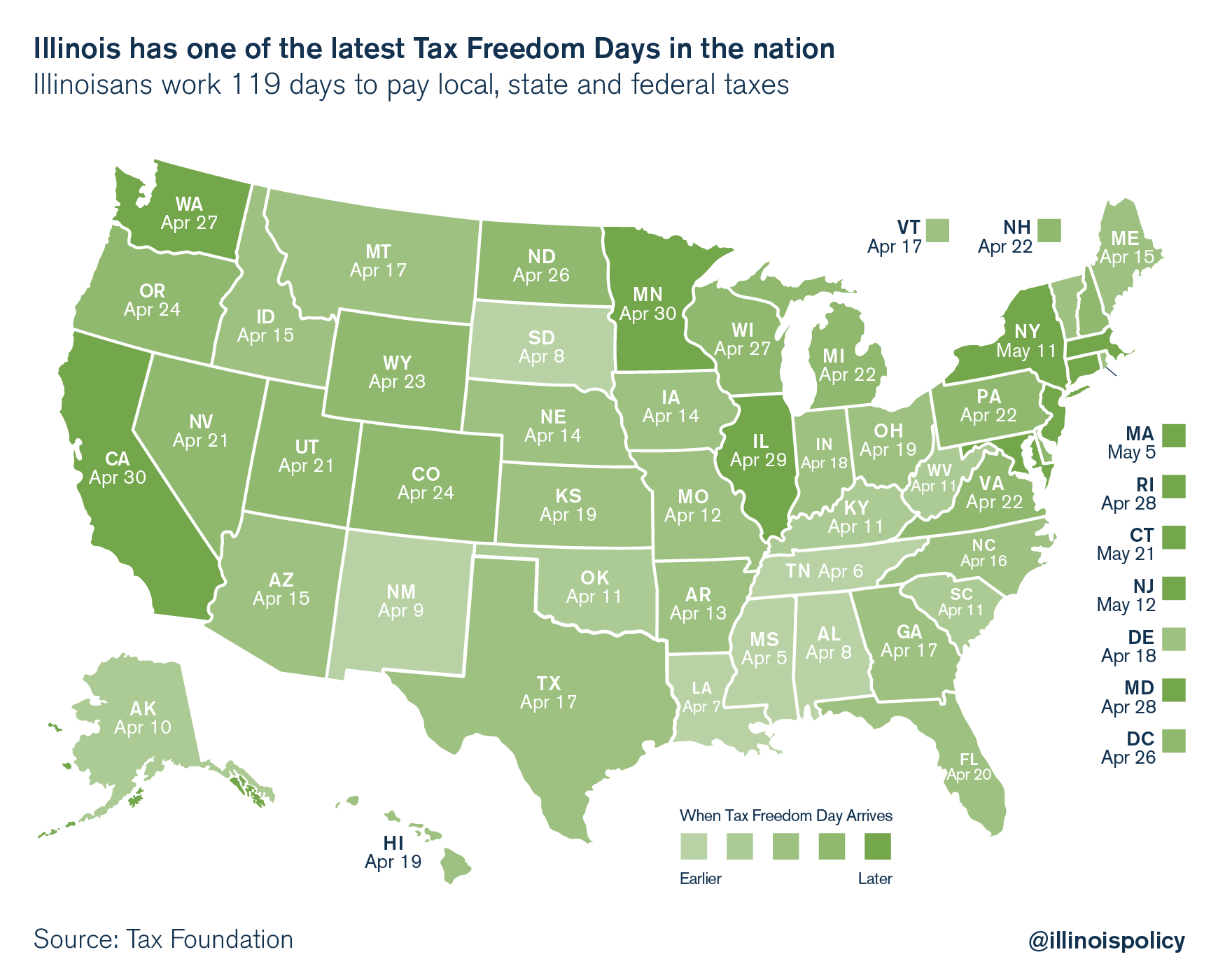

Illinoisans must work from Jan. 1 until April 29 to pay the taxes they owe to federal, state and local governments.

Illinoisans have to work 119 days before they get to keep any of their hard-earned money, according to the nonpartisan Tax Foundation, which on April 6 released its annual “Tax Freedom Day” report for all 50 states, plus Washington, D.C.

The Tax Foundation’s annual report calculates how long taxpayers must work to pay all the taxes they owe for the year.

If Illinoisans were to pay the government up-front all the federal, state and local taxes they owe for 2016, they’d have to work for the government until April 29, or 33 percent of the year, before getting to keep any of the money they earn. That’s five days longer than the national average and nine days longer than the average taxpayer in a Midwestern state.

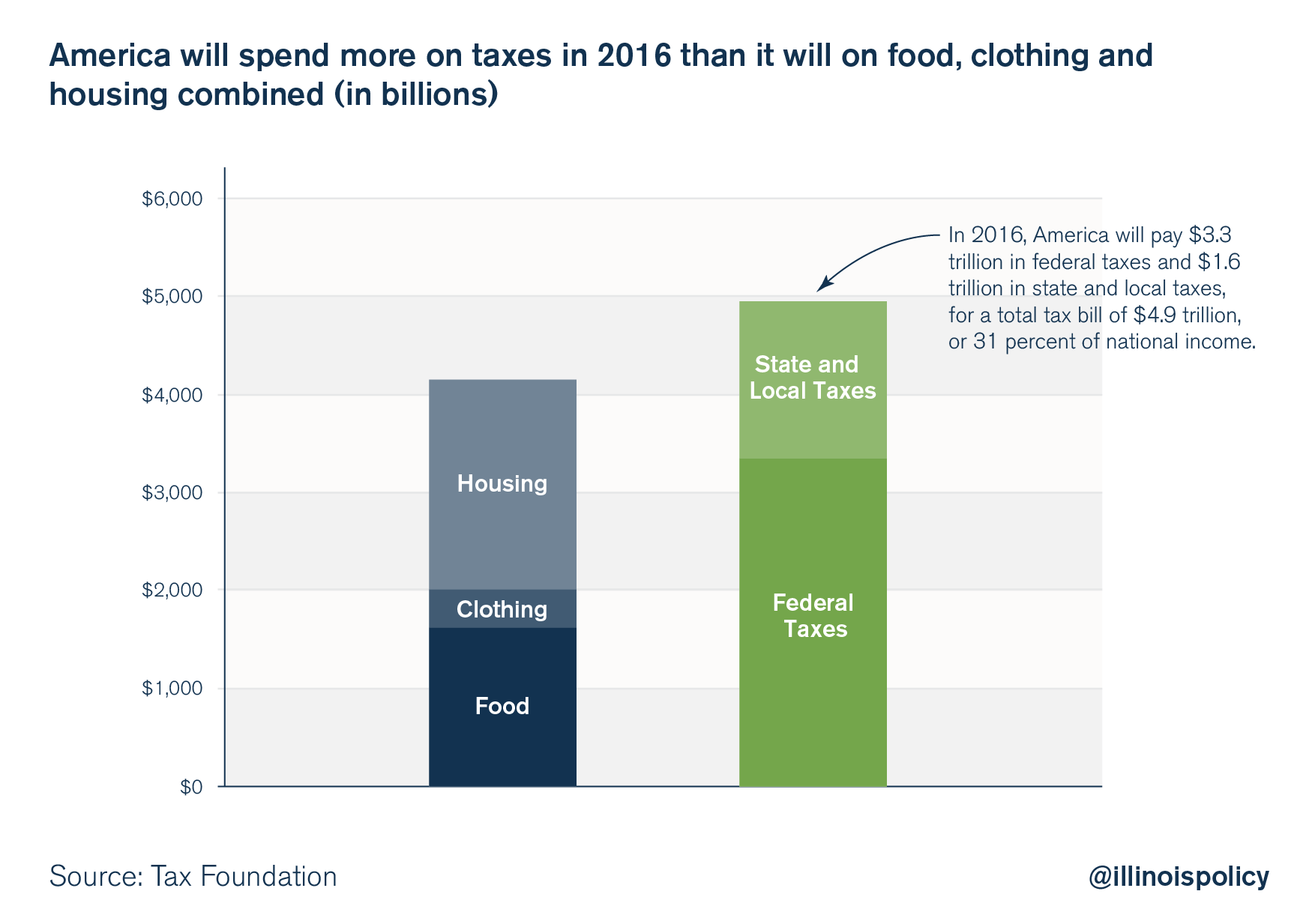

Americans on the whole will work 46 days to pay their federal, state and local individual income-tax bills, according to the report. They will spend 26 days working to satisfy their payroll tax obligations, and another 15 days to pay sales and excise taxes. Corporate income taxes cost Americans nine days’ pay, and property taxes, 11 days. Estate and inheritance taxes, customs duties and other taxes take another seven days to pay off.

The Tax Foundation reports that the average American pays more in taxes than on food, clothing and housing combined.

According to the state-specific Tax Foundation calculations, Illinois’ Tax Freedom Day is April 29. While deflating enough on its face, the real story lies in the comparison with other states.

Illinois ranks 44th in the nation, meaning 43 other states have an earlier Tax Freedom Day than the Land of Lincoln. Compared with the Midwest average, Illinois residents will work nine days longer just to pay taxes.

And it seems matters will only get worse.

The Chicago-based Metropolitan Planning Council recently unveiled an aggressive plan for infrastructure improvements backed by a 30-cents-per-gallon hike in motor fuel taxes – which would push Illinois’ gas taxes to the highest in the nation. In a separate plan, Cook County Commissioner Richard Boykin proposed a 4-cents-per-gallon hike on motor fuel taxes. And on the heels of Chicago’s largest property-tax hike in modern history, comes a proposed $200 million property-tax hike dedicated solely to teacher pensions.

Illinois’ policy leaders need to better understand and think about the overall tax burden before making piecemeal decisions on individual issues such as motor fuel and property taxes.

After all, if government is supposed to work for the people, why are taxpayers spending so much time working for government?