Lincolnwood: Tax hike for police pensions, but firefighter pensions not an issue

Missing from the discussion on Lincolnwood’s pension crisis is talk of the unfunded liability for the village’s firefighter pension fund. That’s because this fund has no unfunded liability – Lincolnwood privatized their fire protection services 25 years ago.

Lincolnwood, Illinois – a community of 13,000 residents north of Chicago – just tacked on an additional 2 cents per gallon gas tax to help pay for the village’s quickly growing police pension costs.

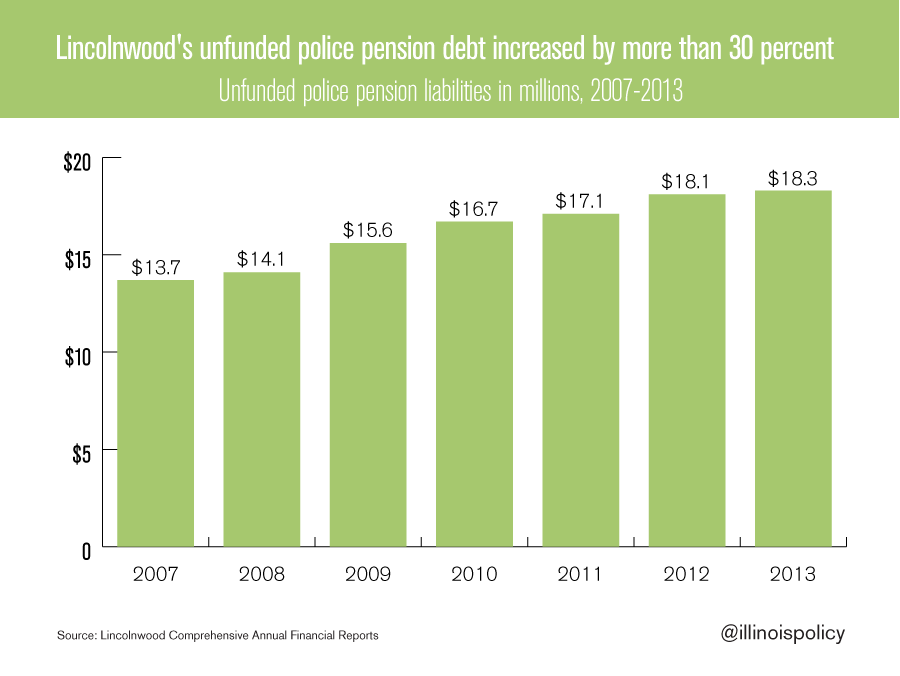

The village’s annual pension contribution to its police pension fund has increased by nearly 70 percent, to $1.45 million in 2013 from $866,000 in 2007. Despite this massive increase in payments, the village’s unfunded police pension debt still increased by more than 30 percent during that same time period.

The problem is Lincolnwood has little control over these increasing costs because the state generally calls the shots when it comes to local pensions. The state sets the benefit levels – retirement ages, cost-of-living adjustments and benefit formulas – with no regard to whether the local budget or taxpayers can afford them.

Missing from the discussion on Lincolnwood’s pension crisis is talk of the unfunded liability for the village’s firefighter pension fund. That’s because this fund has no unfunded liability.

The village of Lincolnwood switched to a private provider of fire protection services in 1990. There were a number of benefits from making this switch – one of which was that having a private provider of fire protection services eliminates the requirement to fund new pension debt going forward, because salaries and benefits for firefighters are handled entirely by the private provider.

Lincolnwood’s pension problems would likely be worse than they are today had the village not made this decision. Morton Grove, a community five miles north of Lincolnwood, has only half the money it’s supposed to have in its firefighter pension fund today to pay for future benefits.

Unfortunately, switching to a private provider of fire services is one of the only things local governments can do to reform their retirement costs in Illinois.

Illinois’ top-down, cookie-cutter approach to police, fire and municipal pension funds completely disregards the fact that each community in Illinois is different. Each local government has a different tax base, different levels of services, different values and generally different ways of operating.

Switching to a private provider of fire services isn’t the silver bullet for all of the local pension crises in Illinois. But it is an option. And it’s working for Lincolnwood.

State government in Illinois should give local governments more options restructure their local retirement systems in a way that best meets the needs of their budget, taxpayers and public employees. That means ending state control over local pension systems.

Image credit: stavos