Local government workers in Rock Island County take home 6-figure pensions

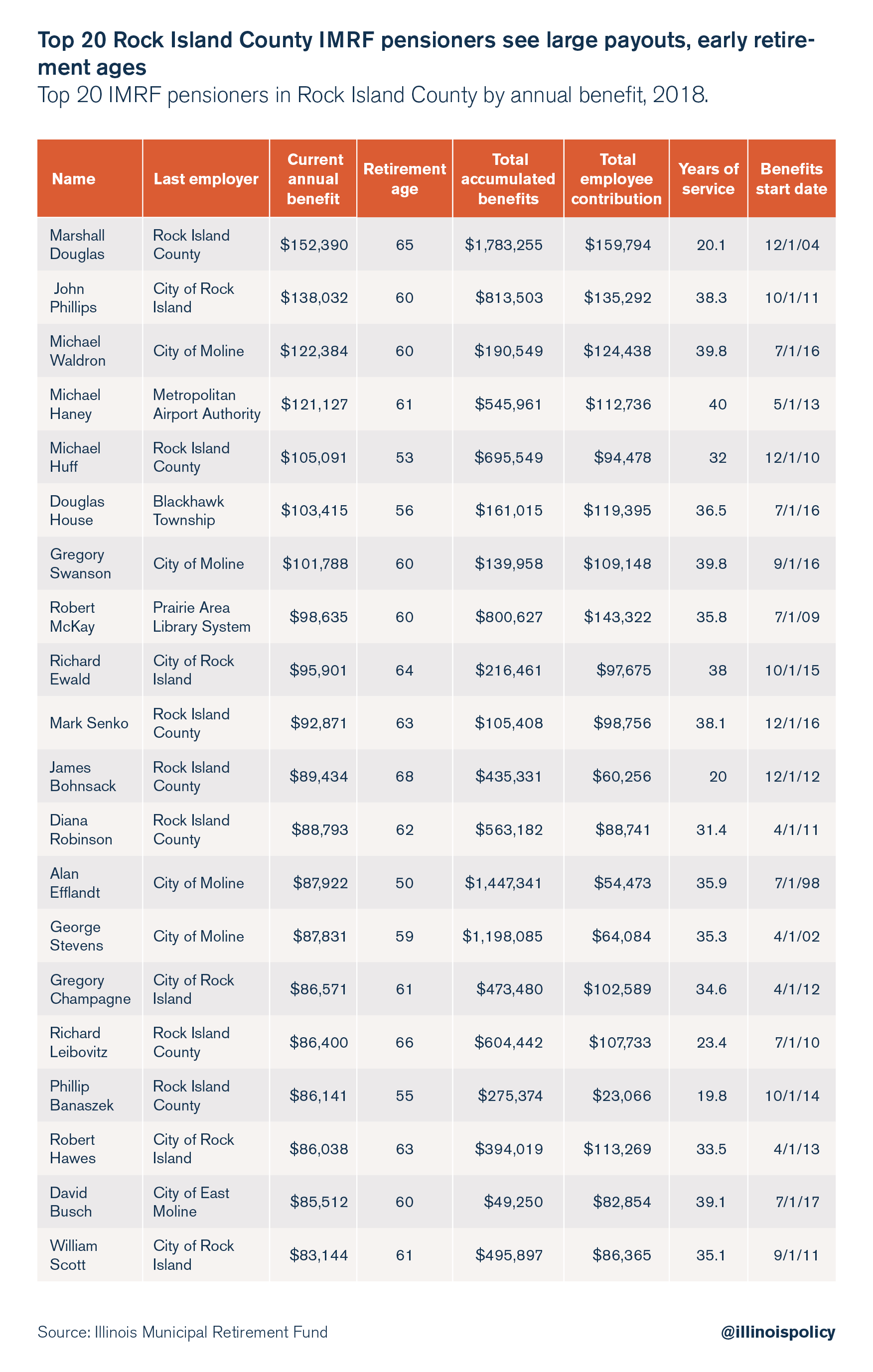

Seven former local officials across Rock Island County are taking home pensions in excess of $100,000 a year. And nearly a dozen have already collected $1 million over the course of their retirements.

Residents on the Illinois side of the Quad Cities divide are on the hook for retirement benefits most could only dream of, while paying high property tax bills that are all too real.

Documents from the Illinois Municipal Retirement Fund, or IMRF, show the largest pension payouts for local government employees across Rock Island County, excluding most teachers and school administrators, as well as police and fire personnel.

Among the top 20 IMRF pensioners, seven receive more than $100,000 each year in pension payments. And nine employees see a larger pension payment in a single year than they contributed to the system over the course of their entire careers.

Government employees are not to blame for IMRF’s unaffordable retirement benefits, which include a 3 percent automatic benefit increase each year. But these benefits do illustrate a divide between local taxpayer incomes and pension promises. The median household income in Rock Island County is just over $50,200. Among local IMRF retirees, 140 receive an annual pension exceeding that amount, with an average retirement age of 57. Eleven have collected over $1 million over the course of their retirements.

IMRF is often touted as the model for how to run a defined-benefit pension plan in Illinois, because local governments are required to prioritize its funding over everything else. But that doesn’t mean the system is fair. Taxpayers contribute far more to IMRF retirements than employees themselves. And those retirement benefits have grown beyond local governments’ ability to pay while maintaining core services.

Just look at public safety pensions in the cities of Rock Island and Moline, for example. In Rock Island, police and fire pension funds have 40 cents and 32 cents, respectively, for every dollar needed to pay future pension benefits. Despite taxpayers having paid $3.3 million more toward these funds in 2016 than in 2006, the funds’ fiscal health actually declined over the decade, according to reports from the Illinois Department of Insurance. The same story has played out in Moline as well. Annual taxpayer contributions to Moline’s police and fire pension funds increased 212 percent and 222 percent, respectively, from 2006 to 2016, while funding ratios fell.

As Rock Island County struggles to attract and retain residents, local leaders need the tools to provide quality local services that give families a bang for their property tax buck. Excessive pension payouts are a prime example of local government waste that does little to improve home values and diverts resources from essential spending.

In order to protect core services, retirees and property taxpayers, state lawmakers must reduce the cost of pensions. In the short term, that means instituting 401(k)-style retirement plans for new workers. In the long term, it means amending the Illinois Constitution to allow for changes to future, unearned retirement benefits for current government workers.