At a time when massive budget deficits threaten to cut into funding for classrooms, Illinois cannot continue to give away subsidies to a select few districts that benefit from the complex structure of the state’s education-finance formula.

Some school districts take advantage of loopholes in Illinois’ education formula, called the General State Aid, or GSA, formula, to appear less wealthy, thereby receiving more means-based state aid than they otherwise would.

Districts do this by underreporting their true local property wealth when applying for means-based support from the state. Due to loopholes in the GSA formula – one for property tax-capped districts and another for districts that operate in tax increment financing, or TIF, districts – school districts are able to underreport their property wealth and receive more education funding.

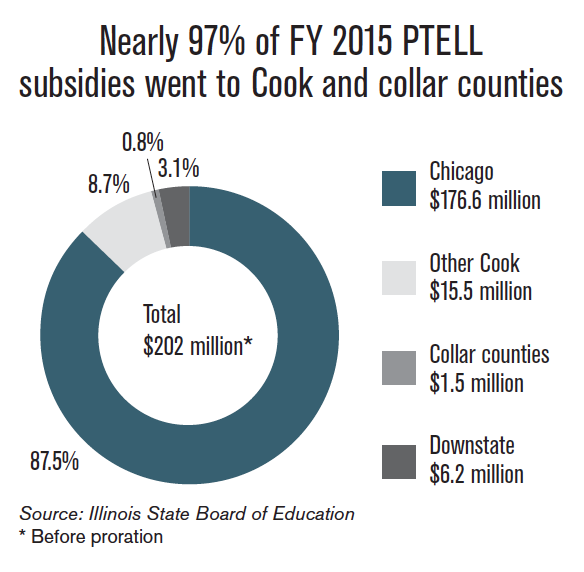

The extra money the state sends to school districts in tax-capped jurisdictions is often referred to as a Property Tax Extension Limitation Law, or PTELL, subsidy. These subsidies totaled approximately $200 million in 2014. At their highest point in 2008, PTELL subsides totaled more than $800 million.

Most school districts that receive the PTELL subsidies are located near

Cook County. Ten districts received more than 96 percent of the $200 million in PTELL subsidies in 2014, with the majority located in Cook County and its collar counties. Only 3 percent went to downstate school districts.

The city of Chicago is the biggest recipient of PTELL subsidies, receiving more than $175 million in extra GSA funds in 2015. It received nearly $500 million in PTELL subsidies in 2008, when property values were much higher in the years before the Great Recession.

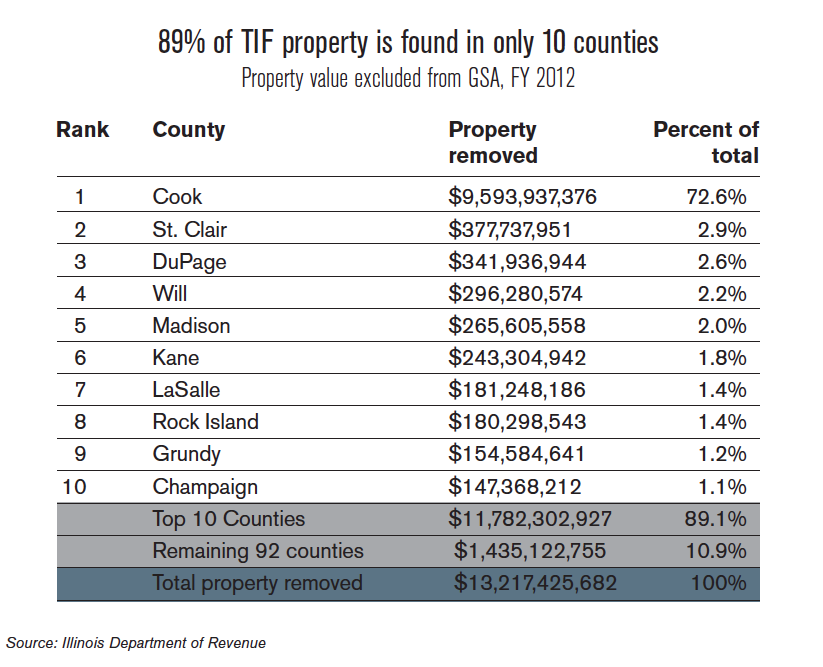

Similar to the PTELL loophole, much of the underreported property wealth by school districts in TIF jurisdictions is located in a small group of counties. In 2012, the latest year data are available, 89 percent of this underreported property from the TIF loophole was located within just 10 counties, with the vast majority in Cook County.

Chicago is the biggest beneficiary of the TIF loophole. The city is allowed to exclude more than $7 billion in taxable property from its needs-based funding application to the state, allowing the city to receive an additional $175 million in GSA funds.

There is no accurate way to calculate the total subsidies granted to non-Chicago school districts, as there is no entity that tracks, by school district, the amount of underreported property values due to TIF districts.