Top 10 reasons Illinois should reject a state-based health-insurance exchange

By Naomi Lopez Bauman

Download Report

Top 10 reasons Illinois should reject a state-based health-insurance exchange

By Naomi Lopez Bauman

Download Report

Introduction

Despite the fact that half of the state-based ObamaCare health-insurance exchanges that have been established are already failing, some state lawmakers and health-care advocates in Illinois continue to push the idea that a state-based exchange is important for Illinois. Not only is a state-based ObamaCare exchange not required by federal law, but it also contains many drawbacks for Illinois consumers and taxpayers.

States have three options for ObamaCare health insurance exchanges:

- Federal exchange. States taking no action would default to the federal health-insurance exchange. States have no role or responsibilities in exchange operations or financing.

- Partnership, or hybrid, exchange. States would be responsible for certain and limited exchange functions.

- State-based exchange. States would obtain federal support for establishing a state-based exchange, assuming operational and financial responsibility. States would be required to comply with federal rules and guidelines governing state-based exchanges.

At present, Illinois has a partnership exchange.

In October 2012, Gov. Pat Quinn sent a letter of intent to participate in a partnership exchange. He also expressed his intention to pass legislation establishing a state-based exchange in Illinois. That is why Illinoisans should know about and publicly debate the evidence from states across the country that have already adopted this approach. Some states are finding out the hard way that a state-based ObamaCare exchange is very costly and difficult to implement. In fact, some are actually abandoning their state-based exchanges and returning to the default federal exchange.

Instead of chasing schemes that fail to address actual problems of health care access and affordability, lawmakers should abandon the state-based exchange approach. And if they are so insistent that this is an essential path for Illinois, they should be willing to voluntarily forgo their taxpayer-subsidized health insurance and voluntarily enroll in the health insurance exchange. After all, shouldn’t they be willing to live under the same set of rules that they would impose the rest of us?

The Top 10

1. Illinois has not demonstrated an ability to effectively manage its existing responsibilities.

Illinois state government is already facing numerous governing challenges. The idea that a complex and high-stakes project should be added to its current portfolio is not only ill-conceived, it is irresponsible.

Recent examples include mismanagement of federal Medicaid funds as revealed in a federal audit. The Inspector General’s report revealed that the state of Illinois took more than $900 million of federal funds that it was entitled to, but could not repay the federal government in a timely manner because the funds had been spent elsewhere.

Get Covered Illinois, Illinois’ statewide ObamaCare promotion campaign aimed at getting more residents to enroll in the exchange, was the subject of investigative reports by AP and Crain’s calling into question the use and billing practices of federal grants for promoting and marketing the new law.The state’s ability to competently manage a new, complex and large-scale project is not realistic based on the state’s track record.

2. A state-based ObamaCare exchange presents more opportunities for cronyism and mismanagement

While many lawmakers might be overwhelmed by the allure of the federal dollars that go hand in hand with a state-based ObamaCare exchange, they should look to Oregon as a cautionary tale.

The state of Oregon received $303 million to establish a state-based ObamaCare exchange, but failed to enroll a single person through its online portal. According to media reports, the project is now the subject of multiple federal investigations by the likes of the Federal Bureau of Investigations, the U.S. Government Accounting Office and the U.S. House Oversight Committee.

3. A state-based ObamaCare exchange comes with an annual $100 million price tag

Not only is a state-based ObamaCare exchange not required under the Affordable Care Act, or ACA, but the cost to Illinois taxpayers could also easily reach $100 million annually, according to the state government’s own estimate. While the federal government does provide funding for establishing the exchange, states are responsible for operating and maintenance costs.

When Massachusetts was forced to scrap major parts of its state-based ObamaCare exchange, there were additional costs incurred to temporarily provide health-insurance coverage. The state had to temporarily enroll its exchange applicants in Medicaid. That “temporary” cost came in at $10 million per month.

4. State-based ObamaCare exchange costs could increase in the future

Operating costs for the state-based ObamaCare exchanges will be paid solely by the state. Costs associated with the operation of the state-based exchange will likely increase in the same way that other government costs increase over time: increases in labor costs, staff additions, increased exchange enrollment and technology-related costs.

5. A state-based ObamaCare exchange would squeeze out spending in other areas

Every dollar spent on operating and maintaining a state-based ObamaCare exchange is money that is not being spent on providing actual health-care coverage or patient care. It is also money that cannot be spent on other state priorities or money that Illinois taxpayers could have kept in their own wallets to meet their families’ needs and priorities. Since the state pays nothing to the use the federal ObamaCare portal, this is money that will squeeze out spending in other areas.

6. Almost half of state-based ObamaCare exchanges are already failing

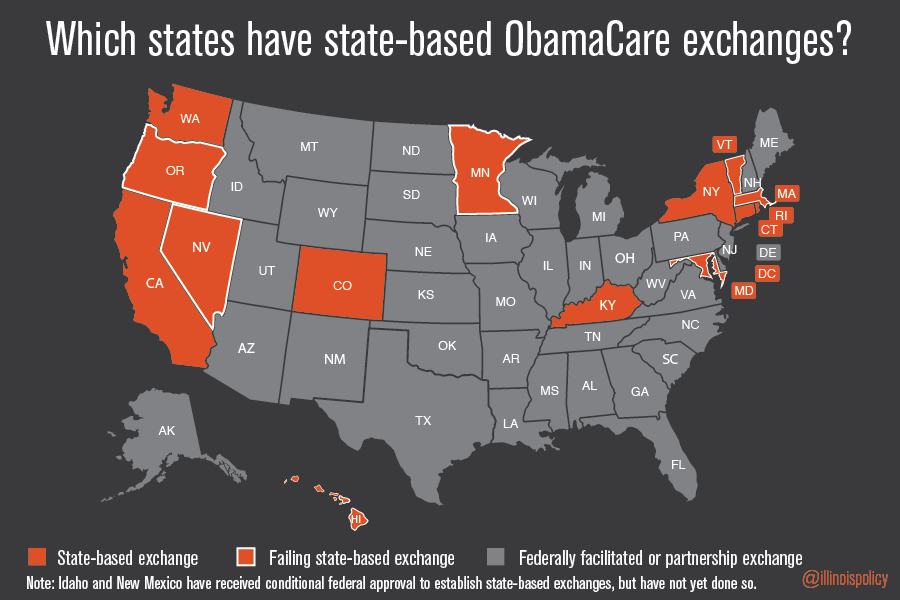

To date, 14 states and the District of Columbia have launched state-based health-insurance exchanges. But seven of those exchanges – just under half – have either collapsed, and are now inoperable, or are now on the brink of failure.

These seven state-based ObamaCarec exchanges – in Oregon, Maryland, Massachusetts, Nevada, Minnesota, Vermont and Hawaii – received a combined total of more than $1.27 billion to set up shop. There should be no question that these states’ experiences should serve as a cautionary tale to Illinois.

7. Illinois is not required to set up a state-based ObamaCare exchange

There is no legal requirement for any state to establish a state-based ObamaCare exchange. While states have the option to do so, there is no penalty or fine for not doing so. In fact, the vast majority of states have wisely not established a state-based exchange.

8. State-based ObamaCare exchange could trigger Internal Revenue Service penalties

Legal challenges to the ACA on the basis that Internal Revenue Service subsidies cannot flow into states that did not establish state-based ObamaCare exchanges are working their way through the federal courts. An important implication of these challenges is that, if the plaintiffs in these cases were to ultimately prevail in these cases, the IRS would not have the ability to subject approximately 16,000 Illinois employers (employing 3.8 million Illinoisans) and 455,000 Illinois individuals to IRS penalties under the ACA.

9. A state-based ObamaCare exchange would not give any real control to the state

Rather than giving states flexibility and control over their own state-based ObamaCare exchanges, the federal government is merely peddling the illusion of control. The reality is that the federal government will retain full control over key insurance regulation decisions that had been, prior to health care overhaul, under the purview of the state Insurance Commissioner and legislature.

Under the new law, the federal government is the arbiter of what insurance coverage can be offered on the ObamaCare exchanges. By mandating a set of minimum essential benefits and retaining control over community and guaranteed issue, the state does not recoup any of the control it has already lost to new federal regulations and rules.

10. If lawmakers so ardently support a state-based exchange, why haven’t they gone first?

If a state-based exchange is such a great idea for Illinois, lawmakers should publicly pledge to enroll in the ObamaCare exchange, forgoing their current and future taxpayer-subsidized health-insurance coverage. Many continue to advocate a state-based ObamaCare exchange, in direct conflict with the available evidence of its risks. If they want to further entrench the ACA into the state of Illinois, they should be willing to lead by example.

For 2014, lawmakers who are enrolled in the Illinois State Employees’ Group Insurance Program will pay between $119 and $144 per month for their own coverage, depending on the coverage they choose if they receive no other outside income. The highest possible rate under any plan is $211. Under Illinois’ state-federal partnership exchange, the absolute lowest-cost premium for a 50-year-old individual in the state starts at $193.79 and the rates, depending on coverage level, can exceed $650 per month.

That is why any lawmaker who embraces this misguided proposal to further expand the health-insurance overhaul’s reach into Illinois should agree to live under the same set of rules. They should forgo their generous taxpayer-funded health insurance benefits and voluntarily enter the same state-based ObamaCare exchange that they are proposing.

Conclusion

Fourteen states and the District of Columbia have been operating state-based health insurance exchanges under the ACA. Based on the experiences of many of these states, Illinois’ state lawmakers and taxpayers should immediately and permanently abandon any proposal to establish a state-based health insurance exchange in Illinois.