Shrinking communities bode ill for Illinois’ economy

More than three-quarters Illinois communities lost population over the year, and nearly all of the state’s major metro areas are lagging the nation on key economic indicators.

Illinois’ people problem didn’t get any better last year, and it’s affecting communities of all sizes, according to the latest estimates from the U.S. Census Bureau.

With a declining population, Illinoisans can expect to see declining investment and job creation. And without jobs they can expect to see economic output stall as well.

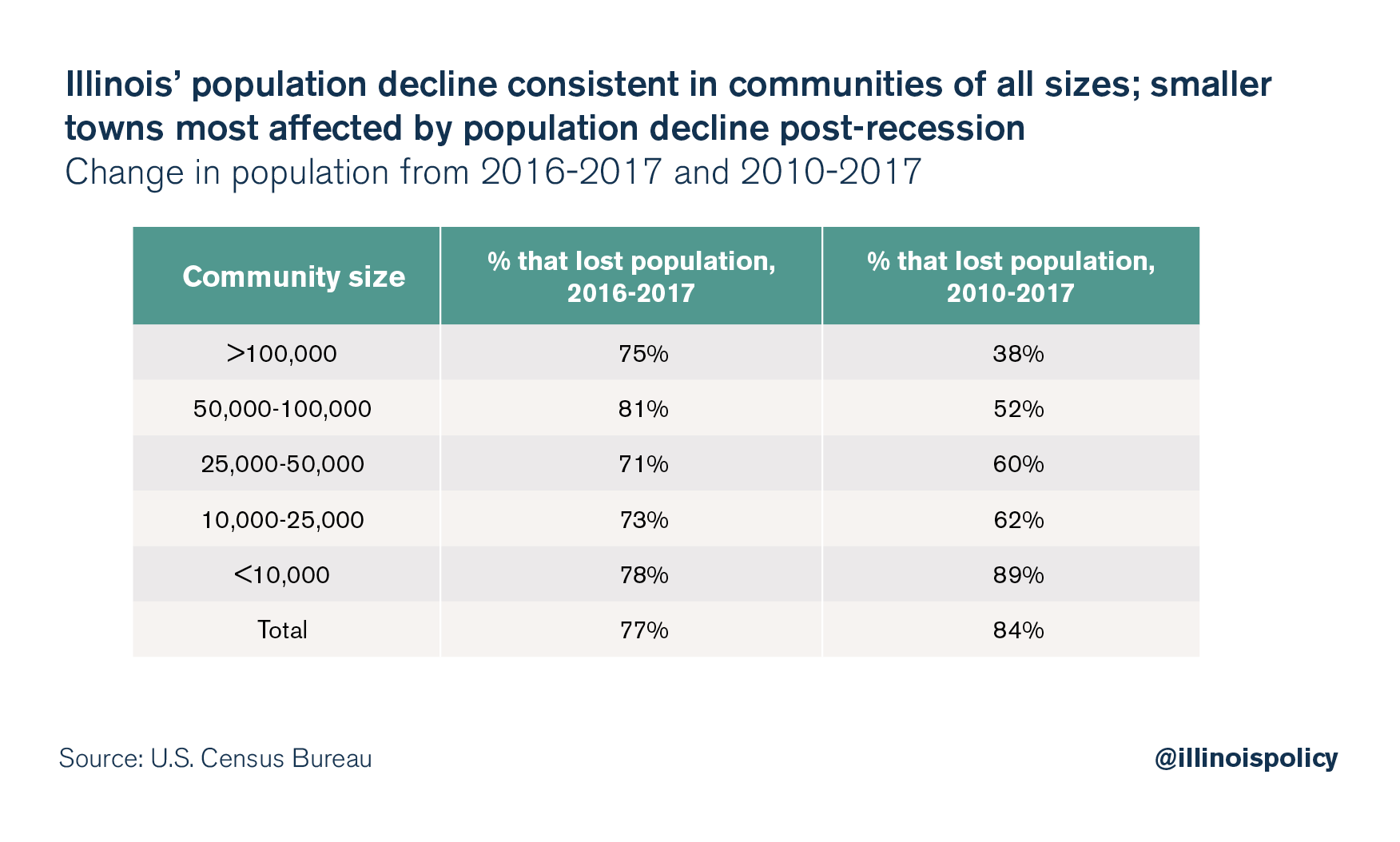

From July 2016 to July 2017, 998 (77 percent) of localities in Illinois saw their population decline, with large cities and small villages most likely to experience population decline.

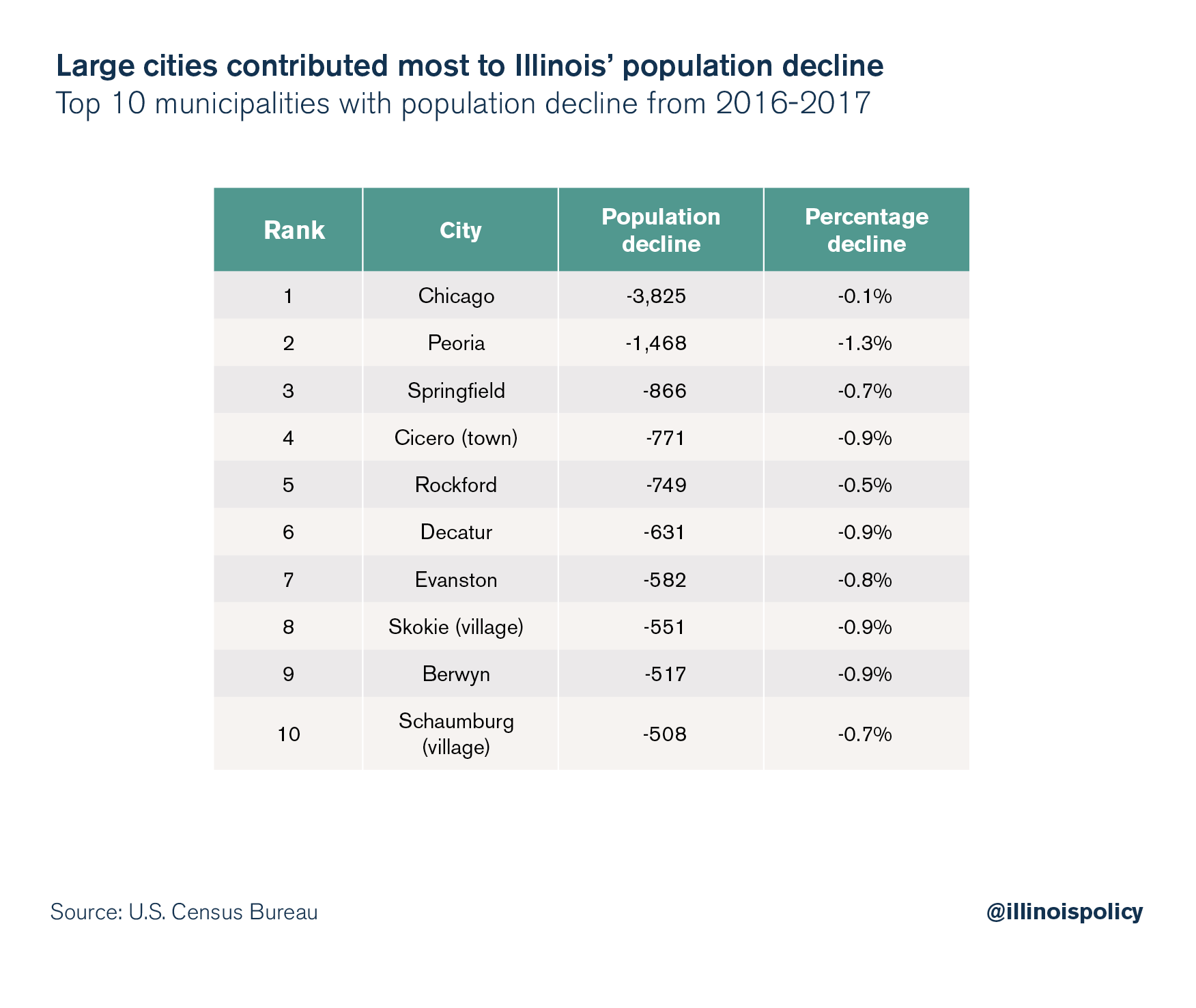

Here are the areas that saw the largest decline in population in raw terms:

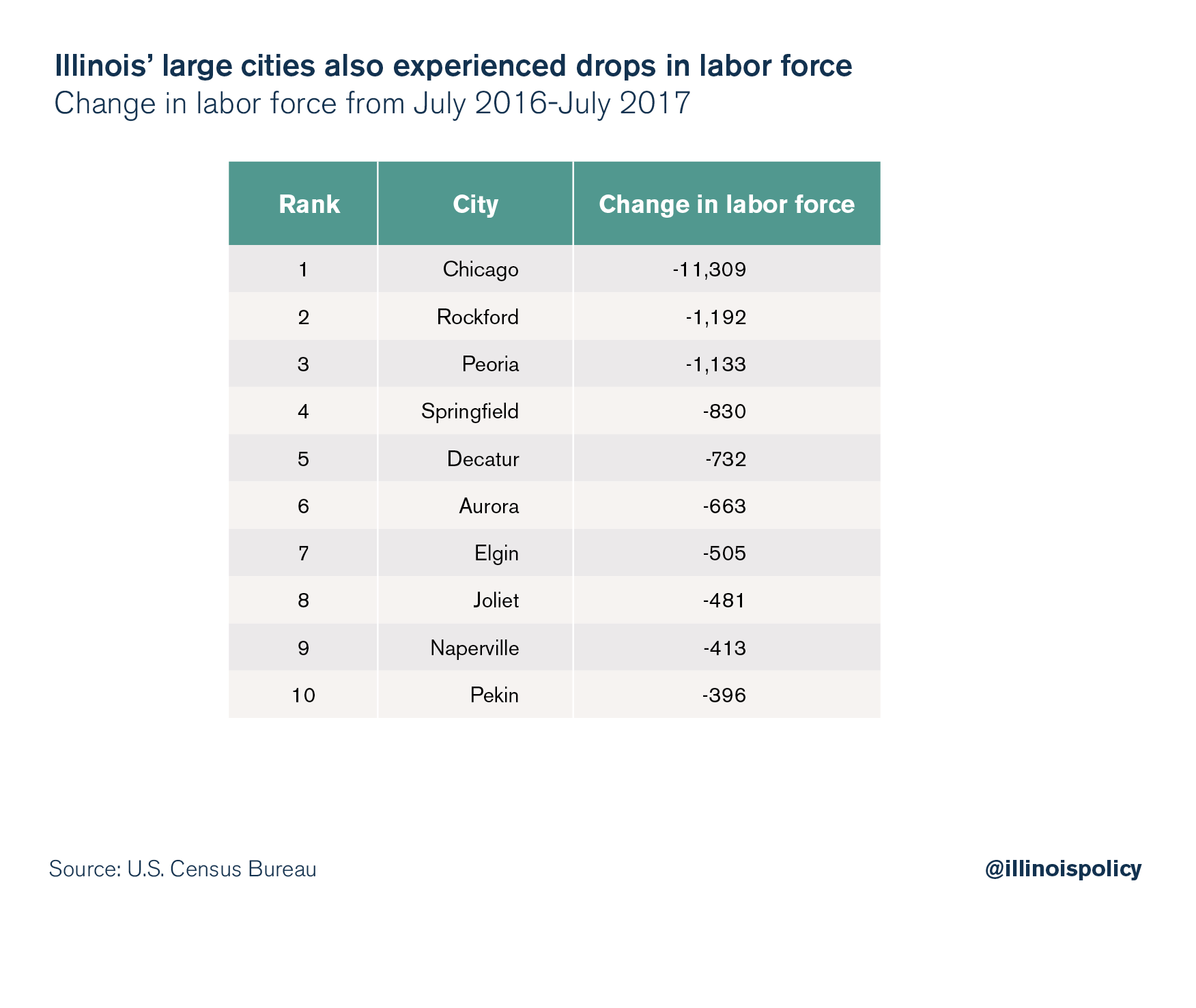

Population decline has dovetailed with a stagnant or shrinking labor force in many Illinois communities. Of localities with 25,000 residents or more, only 11 out of 102 saw their labor force increase in Illinois. Here are the communities that experienced the largest declines in their local labor force from July 2016 to July 2017, in raw terms:

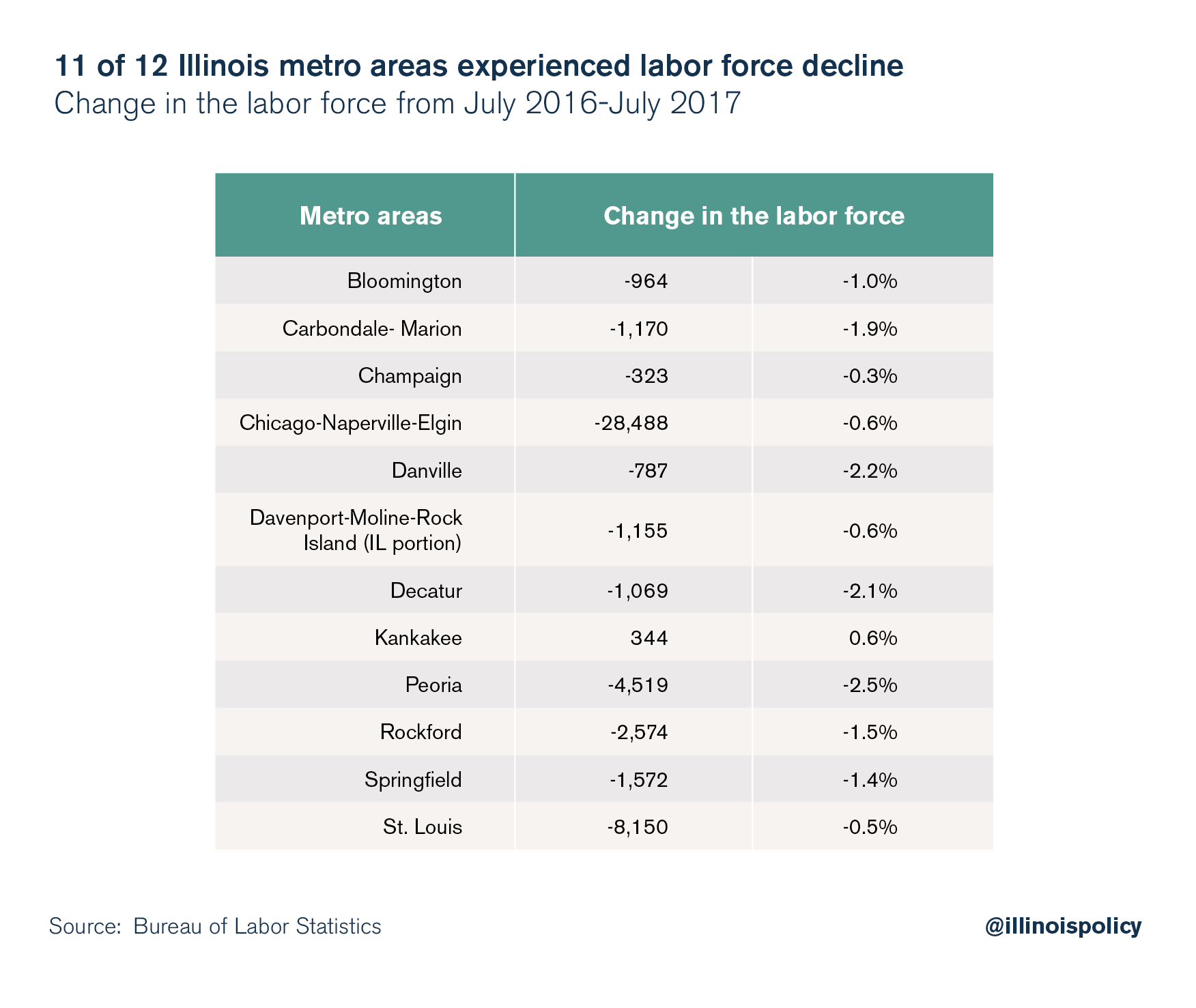

Among Illinois’ 12 “metropolitan areas,” 11 also saw their labor force decline.

What causes population decline?

A population decline can be caused by: 1) mortality rates exceeding birth rates or 2) outmigration exceeding the flow of new residents that move into an area.

In Illinois, the number of births exceeds the number of deaths. That means the state’s population should be growing. However, Illinois has experienced four consecutive years of declining population, which has been driven by more people moving out of the state than moving in.

Why do people move?

Economic research generally notes a strong link between economic conditions and migration flows – in other words, differences in labor market conditions and in other economic factors across regions are drivers of migration (Kennan and Walker 2011).

The push-pull theory of migration predicts that outmigrating individuals will be relatively advantaged compared to their nonmigrating peers at their origin location, which serves to push them toward migration. Conversely, migrants are relatively disadvantaged when compared with individuals at their destination location, and the advantages of the destination pull them to migrate. Thus, individuals migrate to achieve improved conditions.

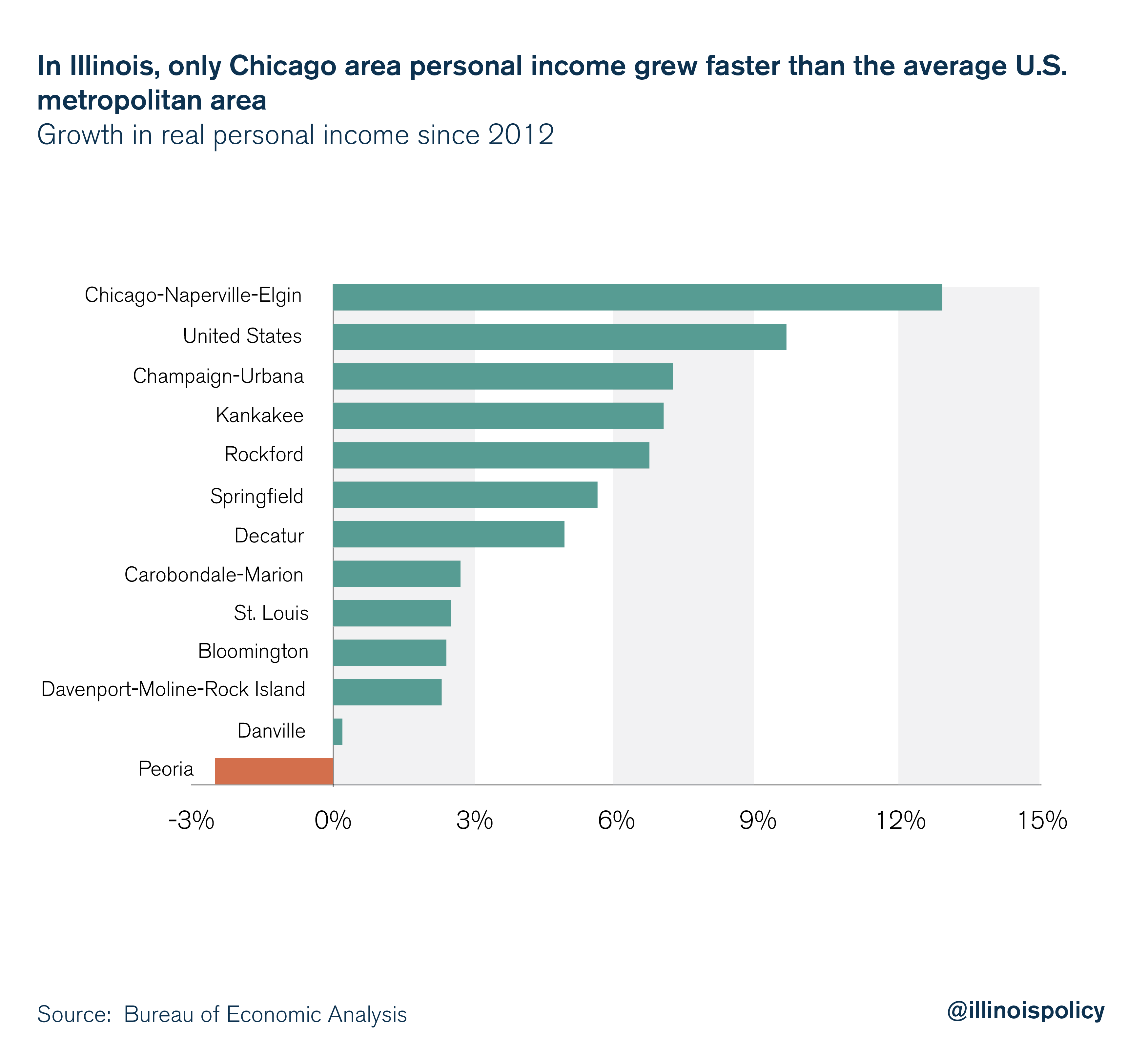

Unfortunately, except for Chicago, all of Illinois’ metro areas have seen slower income growth than the average U.S. metro area from 2012 to 2016 (the most recently available data).

Although regional differentials in wages and wage growth are correlated with migration (Barro and Sala-I-Martin 1992; Kennan and Walker 2011) labor migration is three times as responsive to unemployment as it is to wages (Blanchard and Katz 1992). Previous research using various measures of economic conditions generally finds a positive relationship between economically advantaged locations and in-migration, and both the most common measure of economic conditions and the measure with one of the strongest relationships to migration is the unemployment rate.

Unfortunately, those who are unemployed in Illinois typically find themselves unemployed four weeks (33 percent) longer than unemployed workers in the rest of the nation, according to government data. The difference in Illinois’ unemployment duration relative to the rest of the nation is also greater than in previous economic expansions, helping to explain why other states offer even greater opportunities.

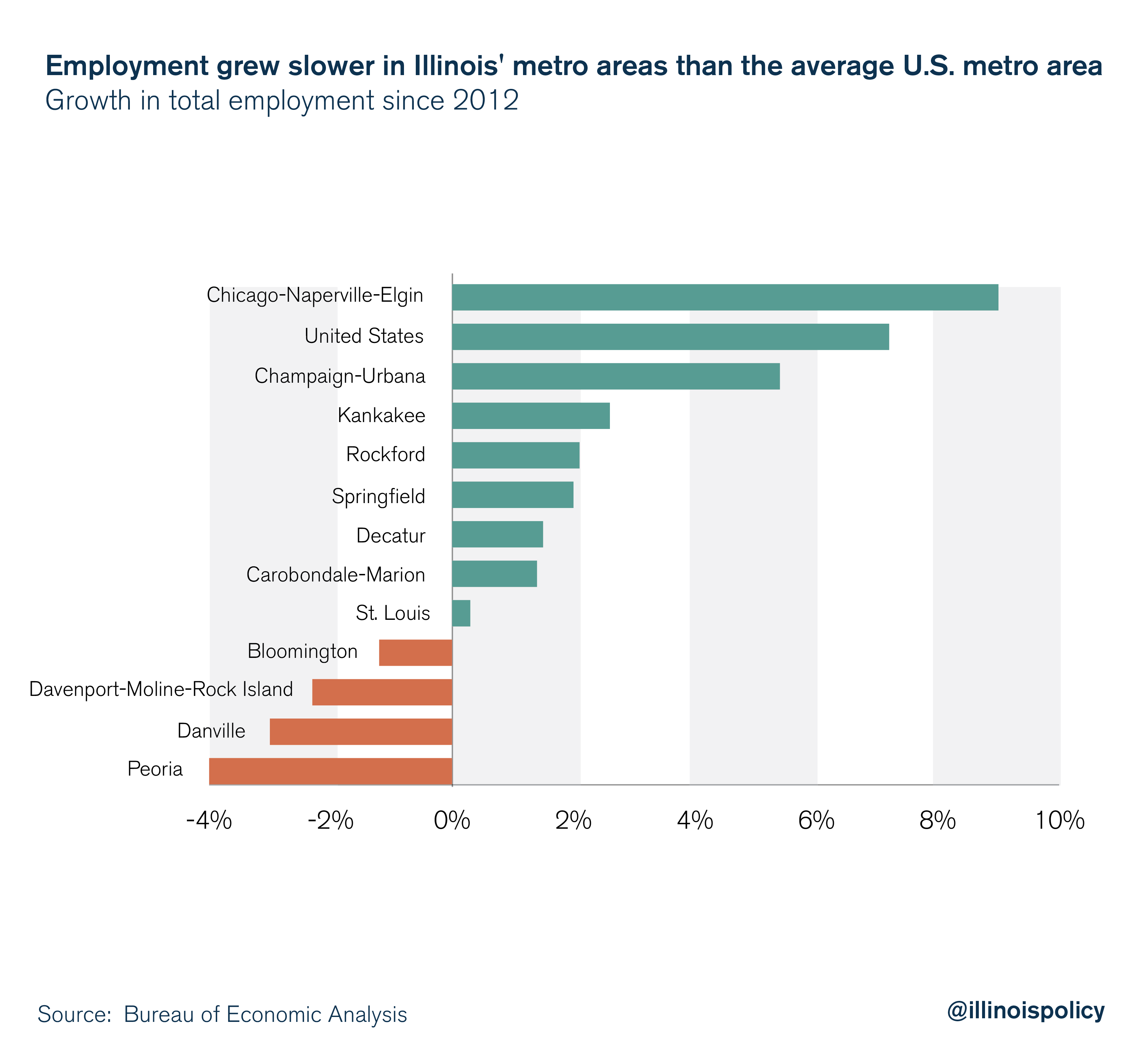

Fewer opportunities within the state can partially explain why employment growth in Illinois’ metro areas outside of Chicago also fails to stack up. Every Illinois metro area except for Chicago has seen employment grow slower than the average U.S. metropolitan area from 2012 to 2016.

Illinois’ sluggish recovery from the Great Recession is abundantly clear. While the entire U.S. economy saw relatively slow jobs growth, Illinois’ economy has been hindered even further by poor public policy. Two record tax hikes, two years of budget impasse, one of the worst property tax burdens in the nation and one of the worst public pensions crises in the nation have completely eroded the confidence of investors and residents of the state.

For the last decade, Illinois state government spending has grown 25 percent faster than personal income for Illinoisans. To finance the massive increases in spending, Illinois has seen two of the largest income taxes in state history since the end of the Great Recession. The tax hikes immediately stunted Illinois’ recovery, but effects of the tax hikes are still being felt, having cost the economy thousands of jobs and billions of dollars.

Making matters even worse, in exchange for higher taxes, Illinoisans are still left on the hook for a backlog of unpaid bills and ever-growing pension liabilities. This means that more and more taxpayer money is being diverted from the delivery of services that raise worker productivity and boost home values.

What’s happening in the fastest-growing cities?

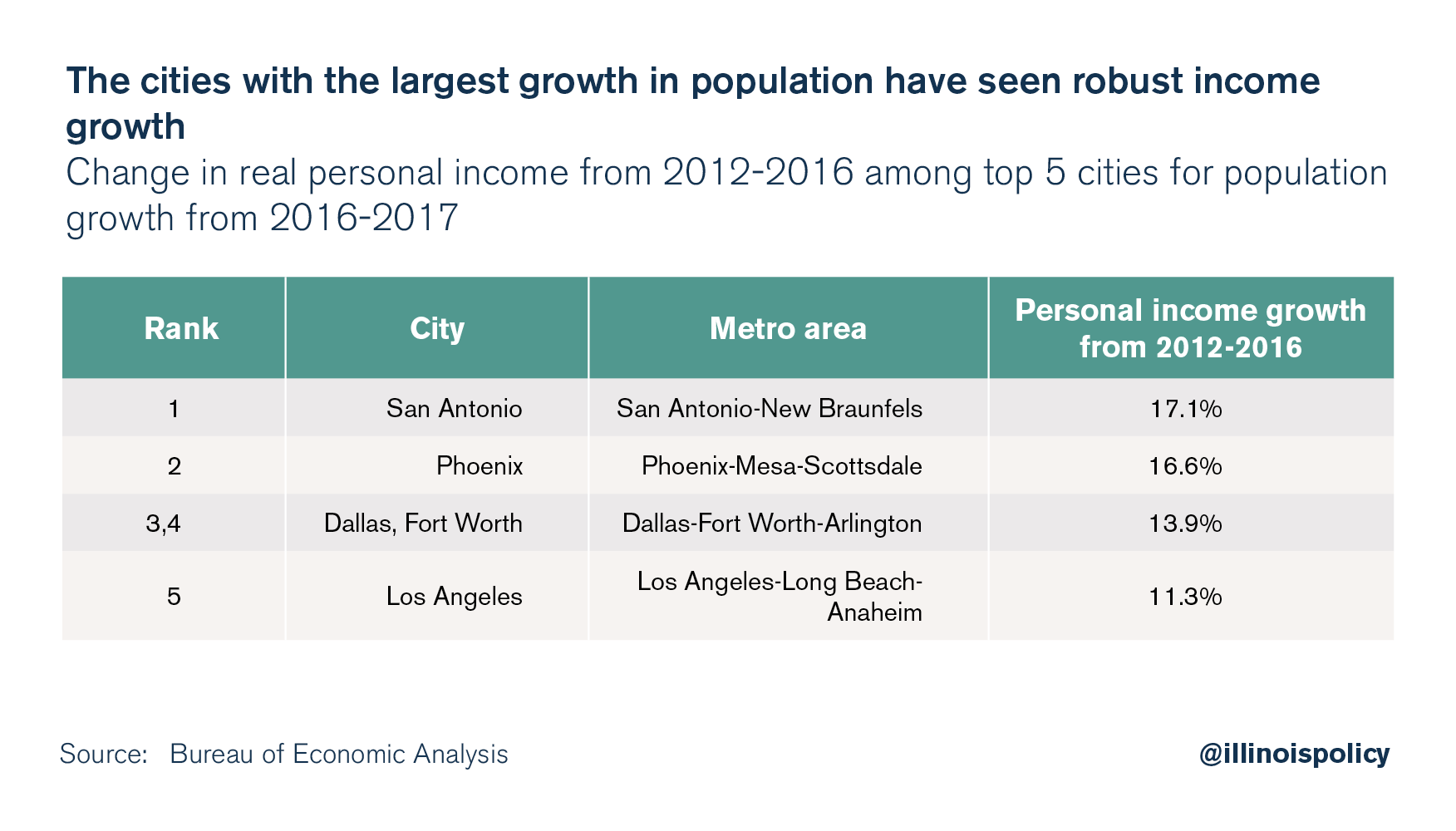

The fastest growing cities in the United States are having a much different experience compared with Illinois’ metro areas. Instead of lagging the nation, these areas are experiencing robust growth in income.

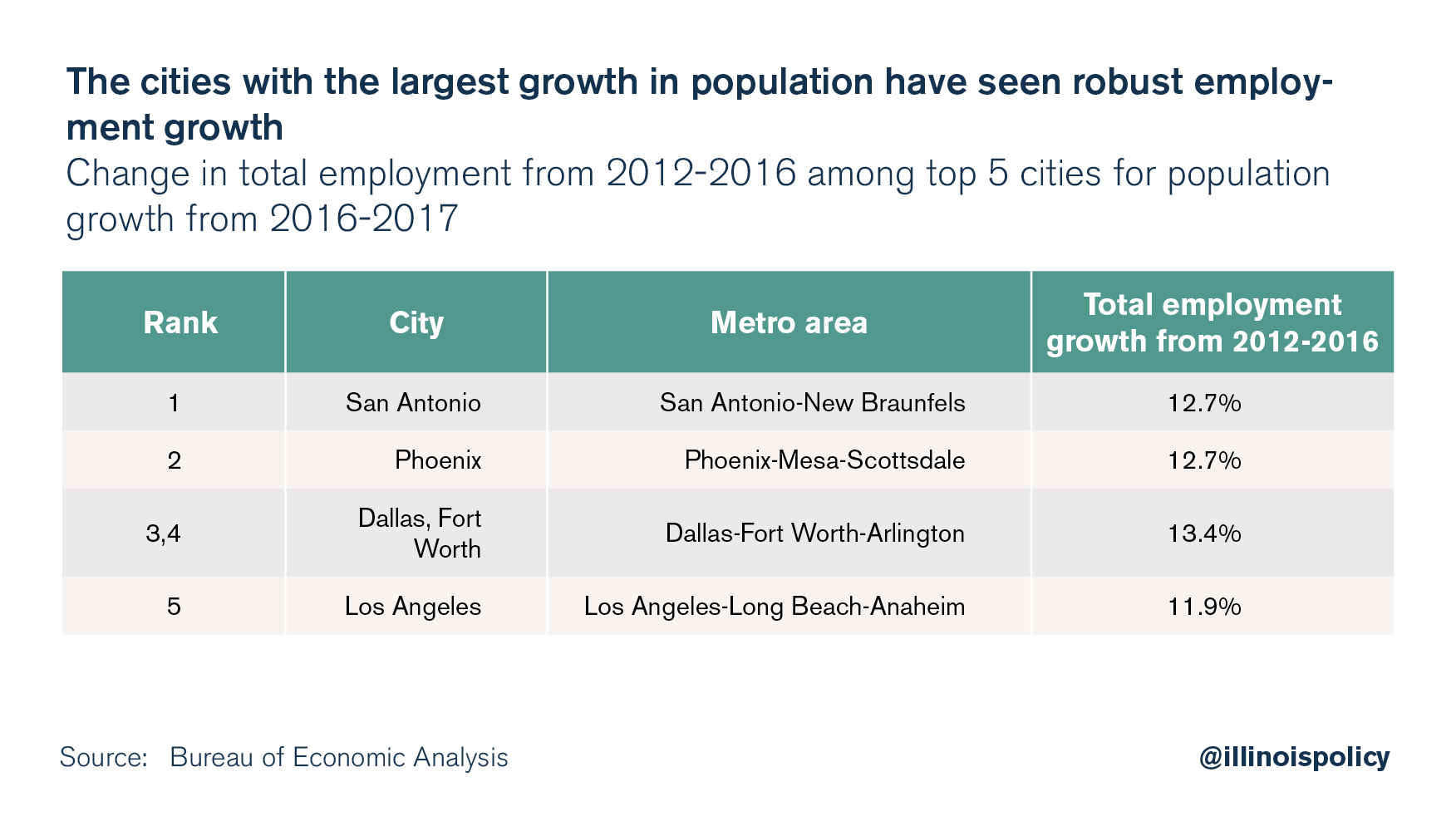

All of these areas have seen robust employment growth as well, in contrast with Illinois’ metro areas.

The future of Illinois’ economy

In the wake of the 2017 income tax hikes, 2018 will likely prove to be another year of slow employment growth coupled with a declining population.

Improving Illinois’ labor market will require sound fiscal and labor policies that assure businesses and employees that market activity will not continue to be penalized with higher taxes each year. Instead of continuously hiking taxes, state lawmakers need to free Illinoisans from their enormous tax burden. A lower tax burden would stimulate investment and job creation, making the state a more attractive place for families and businesses to plant roots.

However, the only way to get lower taxes is to rein in government spending at the state and local levels. A spending cap could provide certainty about future government spending and help lawmakers avoid tax hikes to balance the budget.

Unfortunately, lawmakers have been more concerned about adopting a progressive income tax that would open the door for tax hikes on Illinois’ shrinking middle class – one proposal would cost the state 34,500 jobs and $5.5 billion in economic activity in the first year alone.

If lawmakers voluntarily adopted spending cap amendments that have already garnered bipartisan support, the state could pass a balanced budget that doesn’t hike taxes and provides a long-term path toward relief. The stability granted from the spending cap would go a long way toward restoring confidence in Illinois and reversing the persistent declining population trend.